- Gold was higher by 4% last week (XAU +3.9%, LBMA +3.9%), as US/China trade negotiations hit a snag, the US dollar fell, and rates continued to fall. Gold prices are at all-time highs in over 20 countries, having rallied 8% in the past month and 17% this year in US dollars.

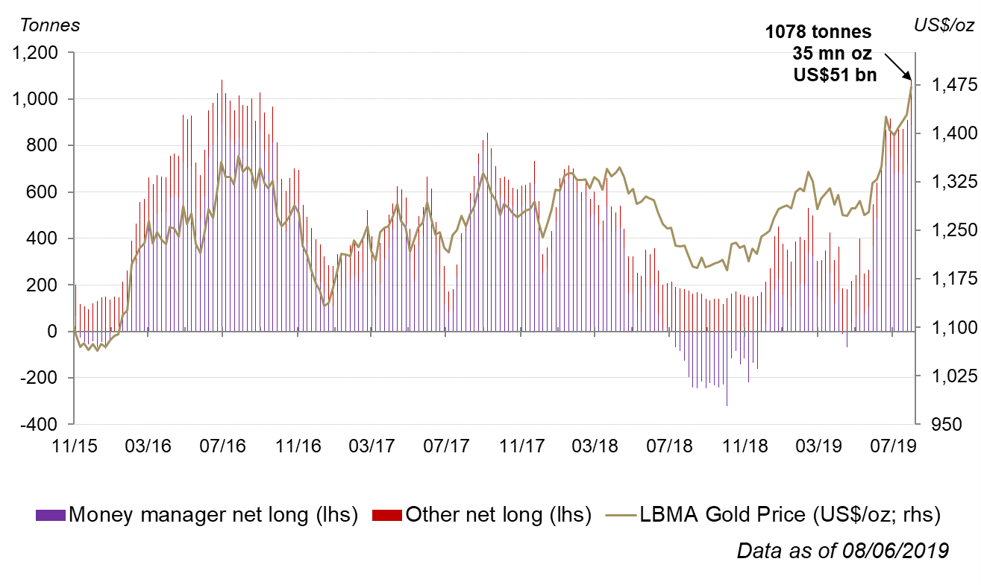

COMEX net longs near all-time highs as gold is at all-time highs in many currencies

12 August, 2019

- COMEX net longs are near all-time highs and are long 1,078 tonnes. When net positions are at extreme levels, short or long (as they are now), this can precede a reversal in the price, although not necessarily immediately.

COMEX Net Longs

Source: CFTC, Bloomberg

- Gold trading volumes are well above short- and long-term averages at $213bn a day this month. That is 87% above the 2018 average. The Shanghai Futures Exchange volume continues to increase significantly, with daily volumes at $21bn, well above the ytd average of $7.0bn.

- There is over $3tn worth of gold futures option open interest at the $1,500 strike over the next two months which is many multiples above traditional amounts. Some of this probably has to do with the psychological level of $1,500, but this could act as a magnet for prices, so gold could hover around that level.

- Overall, there were $1.7bn worth of inflows globally last week across all regions. There have been $2.5bn of inflows so far in August also spread across the regions. Year-to-date flows surpassed $10bn last week as assets in global gold-backed ETFs have grown 8% this year, with inflows split between North America and Europe.

- Lower rates continue to help the opportunity cost of holding gold. US bond markets are currently pricing in the probability of a 50bp cut of 28% and a 72% probability of a 25bp cut for the next meeting, despite previous statements by Fed Chairman Powell that signaled a wait and see approach. In all, the US 2/10 curve has moved into single digits, flirting with inversion.

Fed rate cut probabilities in September

Source: Bloomberg