Today, we released a report on gold and commodities, covering key themes including:

- Why gold is not a typical commodity

- Why gold is under-represented in commodity indices (ranging from 3% to 12%) despite its clear differentiating benefits

- Why gold is the most effective commodity investment

Standing apart from the commodities complex, gold is a differentiated asset because it has historically benefited from six key characteristics:

1. Better long-term, risk-adjusted returns than other commodities and broad-based commodity indices.

2. More effective diversification than other commodities, particularly in market downturns, with no meaningful correlation to oil over time.

3. Better performance than other commodities in low inflation periods.

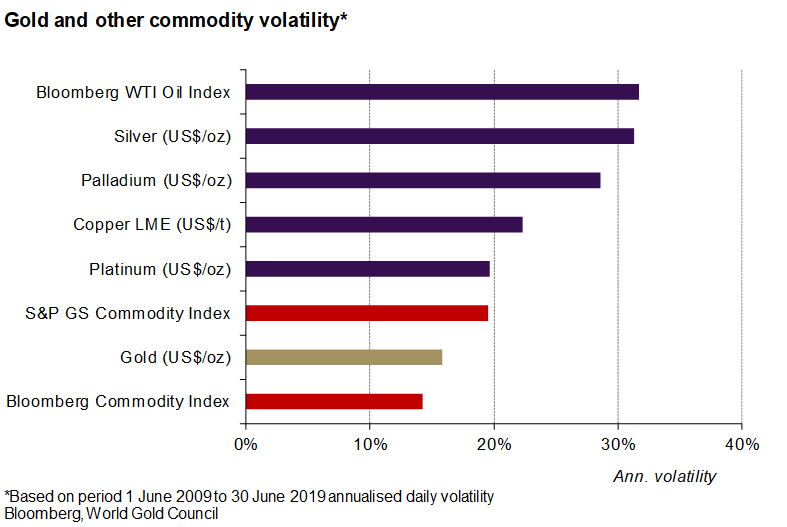

4. Lower volatility than most single commodities and similar volatility to broad-based commodity indices.

5. Proven store of value as commodity values fell sharply against gold following the end of the gold standard.

Ultimately, while commodities can be a relevant tactical asset, a strategic gold allocation of 2%-10% can supplement or replace a broad-based commodities investment alone and may offer more widespread benefits and better risk-adjusted returns.