Skip to main content

Liquidity:

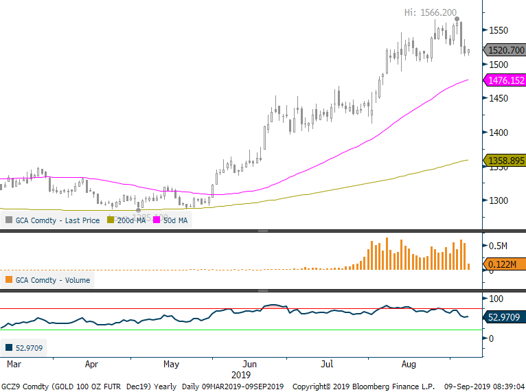

- Trading volumes continued to increase to begin September, 108% above the 2018 average, driven by COMEX and Shanghai Futures Exchange volumes.

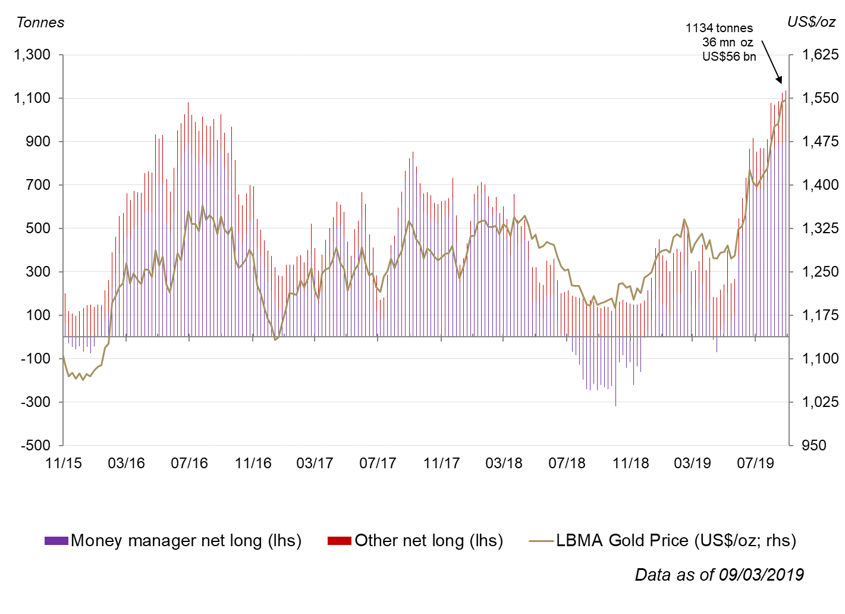

- COMEX net longs inched up to all-time highs for a second week in a row (long 1,134 tonnes).

- Futures open interest continues to move higher at $119bn, driven mostly by COMEX, and is 60% above the 2018 average.

COMEX Net Longs

Source: CFTC, Bloomberg

Gold-backed ETF flows:

- $946mn worth of inflows last week across all regions, primarily in North America and China.

- Year-to-date flows surpassed $15bn or 11% holdings’ growth.

- See our August ETF report we released last Thursday.

Price Behavior:

- Realized volatility spiked last week and 30-day vol is at 17, averaging over a 1% move over the past 30-days, nearly the highest in the past year.

- Gold fell back to the Fibonacci level of $1,520 which could act as support as the price consolidates

使用微信扫一扫登录

[世界黄金协会]