As 2019 comes to an end and 2020 begins, we believe that:

- Financial and geopolitical uncertainty combined with low interest rates will likely continue supporting gold investment demand

- Net gold purchases by central banks will likely remain robust even if they are lower than the record highs seen in recent quarters

- Momentum and speculative positioning may keep gold price volatility high

- Gold price volatility and expectations of weaker economic growth may result in softer consumer demand near term

- But structural economic reforms in India and China will support demand in the long term.

Note: our comprehensive annual Outlook will be published by mid-January 2020.

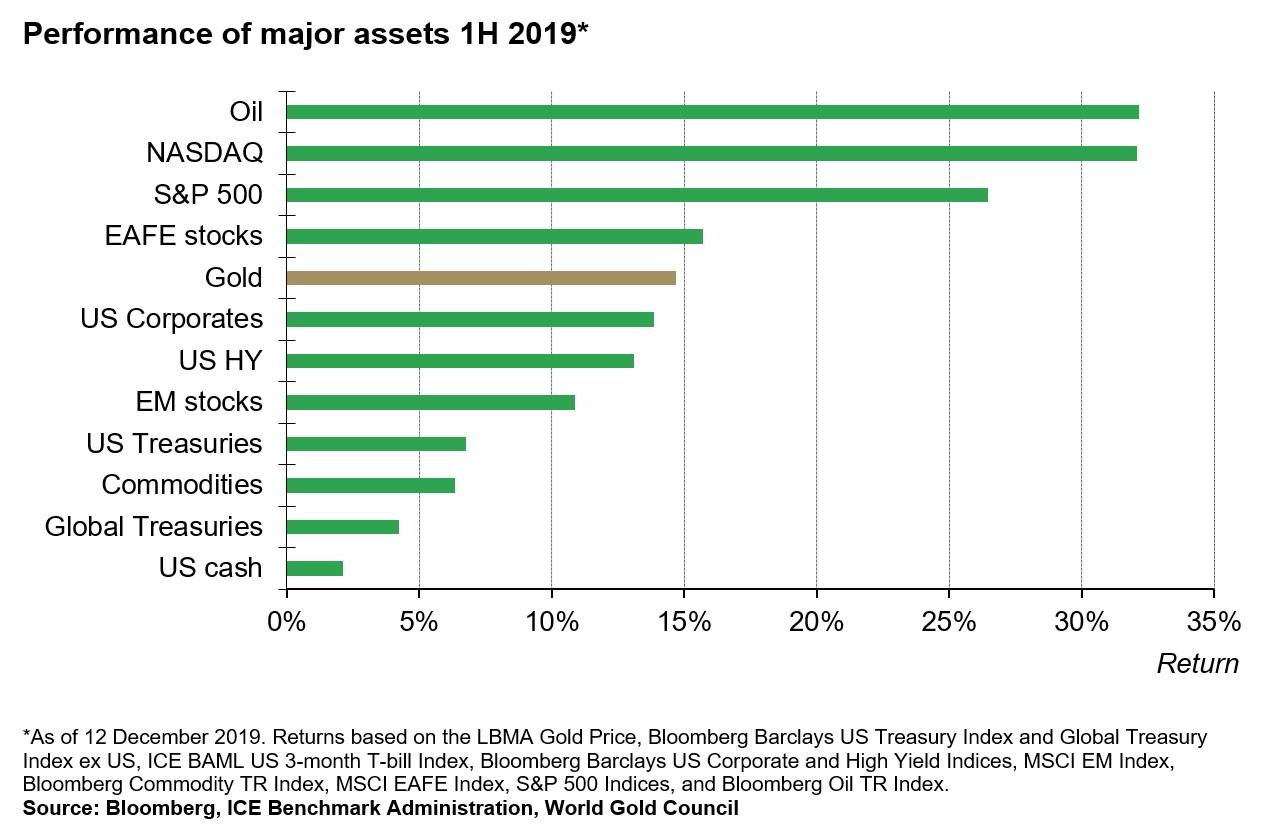

Stocks outperformed in 2019 but investors remained cautious

The year 2019 proved eventful for investors. Stocks, especially in the US, continued to reach record highs but not without major pullbacks at various times during the year as economic and geopolitical risks compounded. At the same time, many central banks – the highest level since the global financial crisis – started cutting rates, expanding or implementing quantitative (or quasi-quantitative) easing and, in some instances, doing both. After having moved well above US$1,500/oz during the third quarter, the gold price was up by almost 15% as of the end of November, as investors looked to balance higher stock prices with an increasingly uncertain environment.

Investors are adding gold to their portfolios

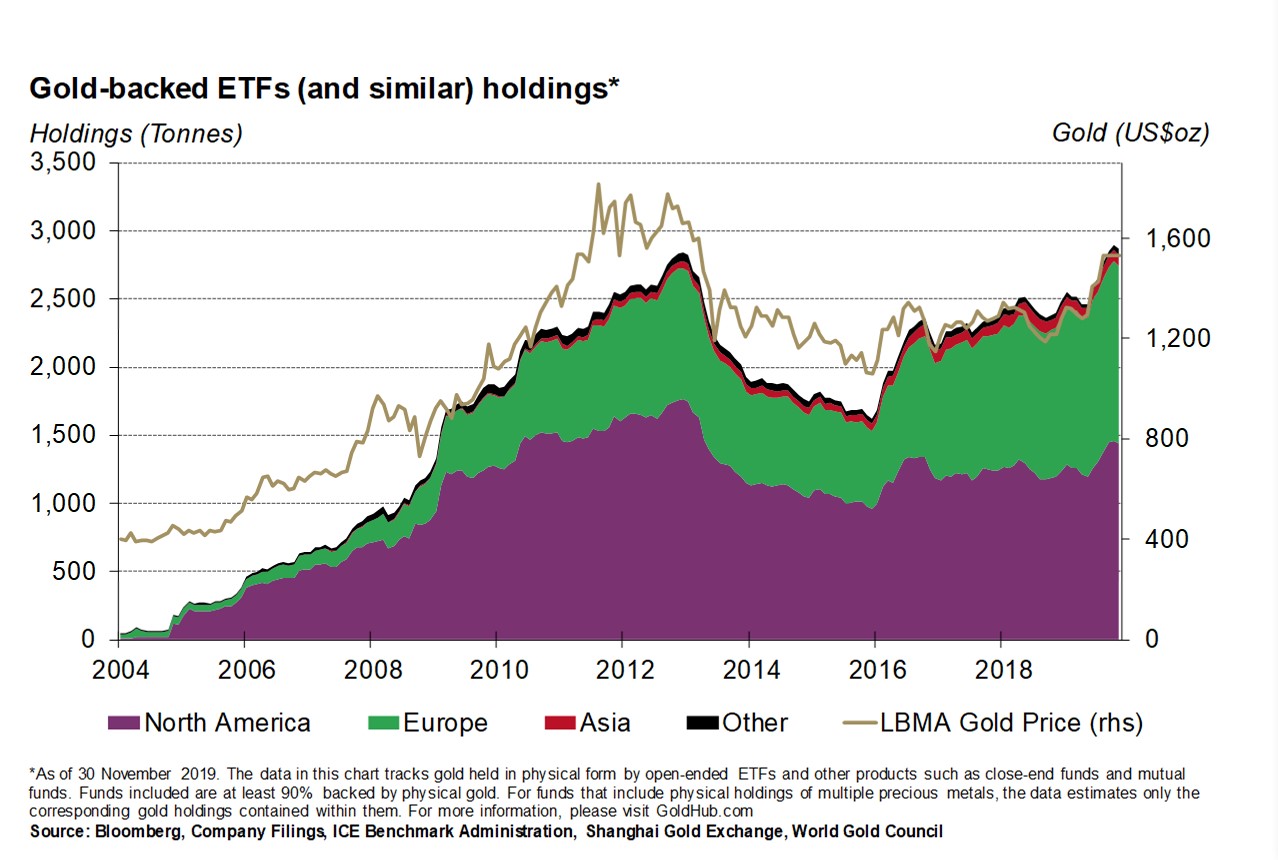

In 2018 central banks bought the most gold ever recorded and these robust purchases have continued, y-t-d, in 2019. Gold-backed ETF holdings also reached all-time highs by October as investors responded to the high-risk, low rate environment.

High risk and low rates in the horizon

As we look ahead to 2020 we believe investors will face an increasing set of geopolitical concerns, while many pre-existing ones will likely be pushed back rather than being resolved. In addition, the very low level of interest rates worldwide will likely keep stock prices high and valuations at extreme levels. Within this context, we believe there are clear reasons for higher levels of safe-haven assets like gold.

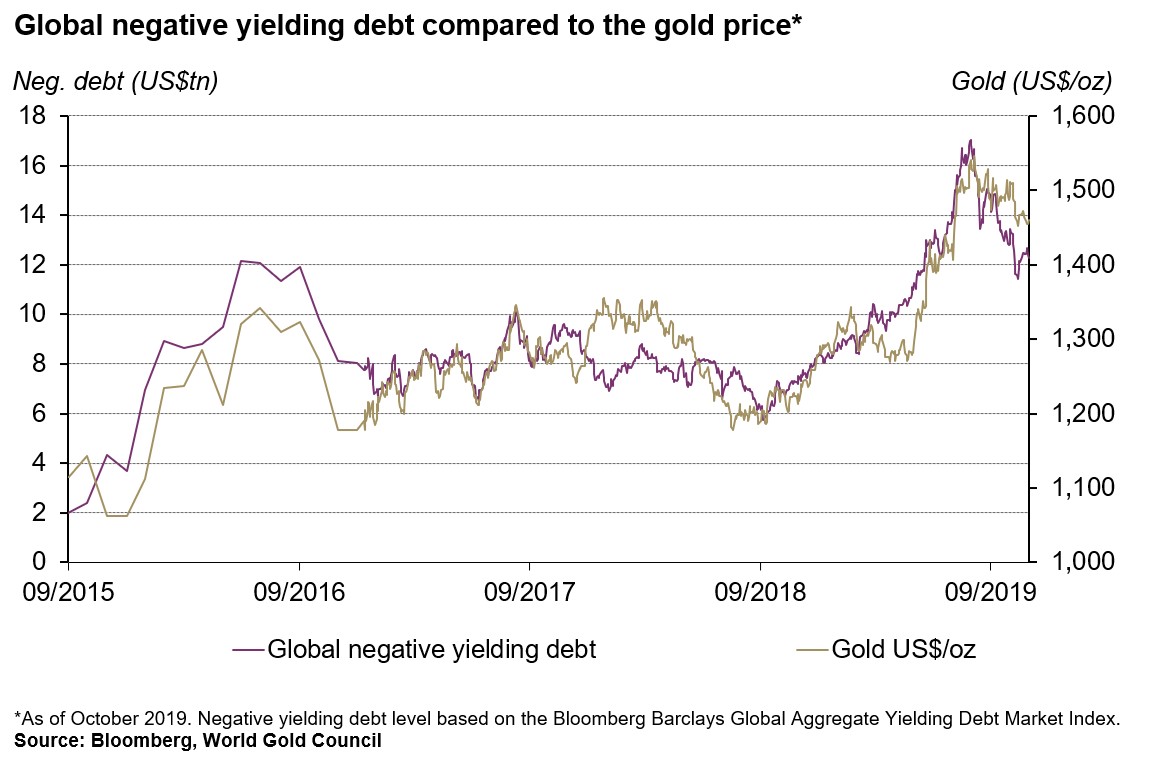

One of the key drivers of gold, especially in the short and medium term, is the opportunity cost of holding gold relative to other assets, such as short-dated bonds. Unlike bonds, gold does not pay interest or dividends because it does not have credit risk. This perceived lack of yield can deter some investors. But in an environment where a quarter of developed market sovereign debt is trading with negative nominal rates and, once adjusted for inflation, a whopping 70% trades with negative real rates, the opportunity cost of gold almost goes away, even providing what can be seen as a positive “cost of carry” relative to sovereign bonds.

Global monetary policy has shifted by 180 degrees. Less than a year ago both Federal Reserve board members and US investors expected interest rates to continue to increase, at the very least through 2019. Instead, after a brief pause, the Fed cut rates three times during 2019 and is expected to cut at least once more in 2020.

Gold has historically performed well in the year following Fed policy shifts from tightening to “on-hold” or “easing” – the environment in which we currently find ourselves. In addition, when real rates have been negative, gold has historically returned twice as much annually as the long-term average, or 15.3%. Even low positive real rates produce higher average returns. Effectively, it has only been in periods with significantly higher real interest rates – an unlikely outcome given the current market conditions – that gold returns have been negative.

This is further supported by the surge in negative real-yielding debt, as evidenced by the strong positive correlation between the amount of debt and price of gold over the past four years. To some degree this illustrates the erosion of confidence in fiat currencies related to monetary intervention.

The low rate environment has also pushed investors to increase the level of risk in their portfolios, either by buying longer term bonds or lower-quality riskier bonds, or simply replacing them with riskier assets like stocks or alternative investments. This environment may make gold more effective than bonds in mitigating stock-market risk, providing portfolio diversification and helping investors achieve their long-term investment objectives.

Soft consumer demand

A by-product of uncertainty in geopolitics – the macro-economy and monetary policy – is likely to be high gold price volatility similar to what the market experienced in the second half of 2018 as investors adjust their expectations and change their positioning, often through levered positions in derivatives markets based on new information.

Higher gold price volatility, combined with expectations of weaker economic growth, may result in softer gold consumer demand near term. But structural economic reforms in India and China will likely support long-term demand.

It’s all connected

Gold demand, supply and, in turn, price performance, respond to four broad sets of drivers:

- Economic expansion: periods of growth are very supportive of jewellery, technology and long-term savings

- Risk and uncertainty: market downturns often boost investment demand for gold as a safe haven

- Opportunity cost: the price of competing assets, such as bonds (through interest rates), currencies and other assets, influence investor attitudes towards gold

- Momentum: capital flows, positioning and price trends can ignite or dampen gold's performance.

In this context we believe that although consumer demand may be soft and speculative activity could amplify price movements, overall it is likely that investment demand will remain robust and central banks will continue their net purchasing trend.