- Central bank investment objectives rank capital preservation as primary importance;

- Looking back to 1973, gold has preserved its value in real terms both over the entire period and, importantly over different phases of the business cycle--both expansionary and contractionary;

- In comparing the performance of gold relative to other reserve assets, it was the only major asset class to preserve its value in real terms during periods of stagflation;

- Looking ahead to the impact of COVID-19 over the medium term, the possibility of an economy characterised by low levels of growth and upward price pressures has increased because of both the negative impact on demand and investment as well as the higher cost of doing business and supply side disruptions;

- Thus, for those investors focused on capital preservation, gold may be safer by this metric than traditional reserve assets such as government bonds over a medium term horizon.

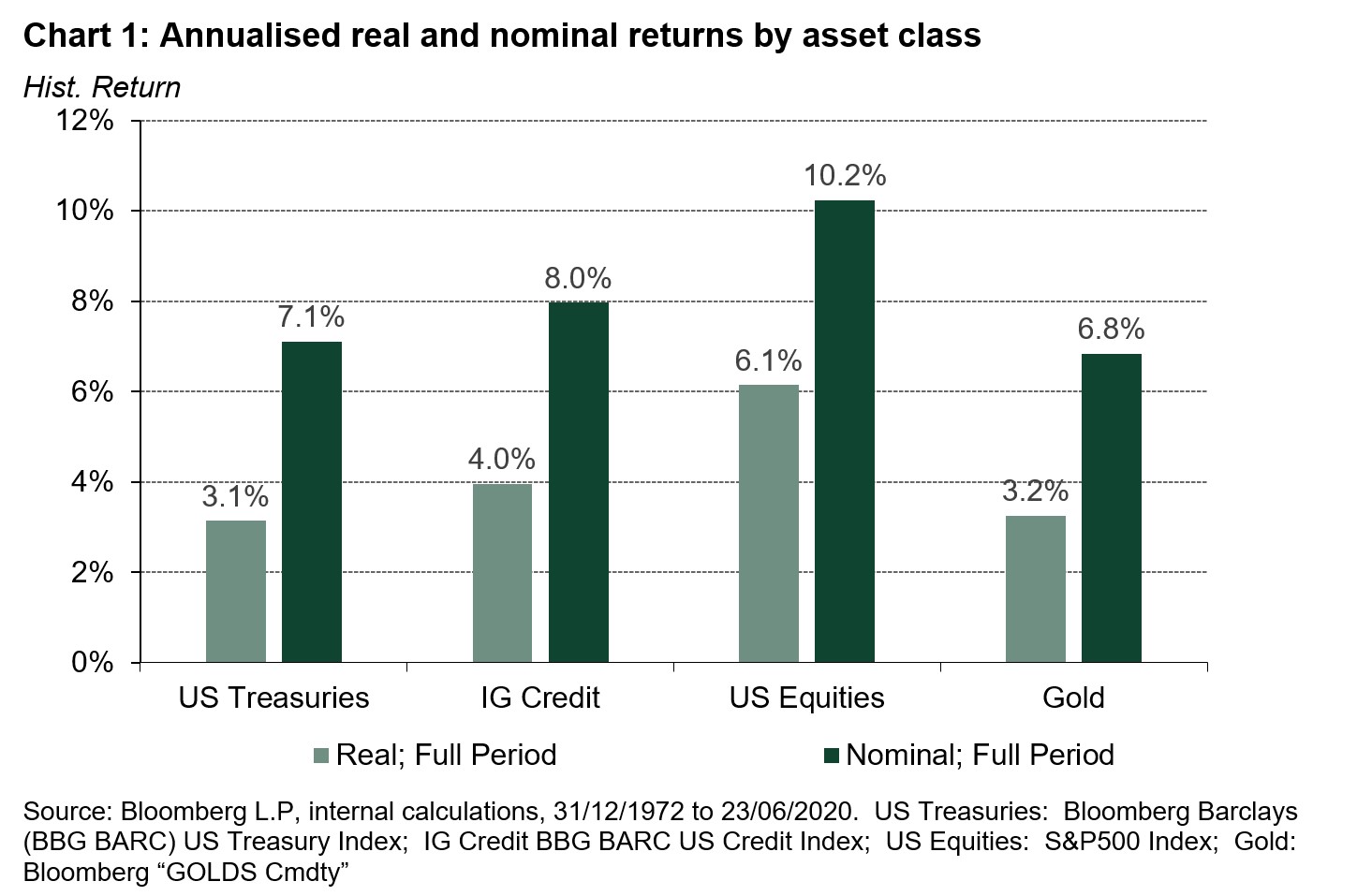

Central bank investment objectives typically rank capital preservation as a top priority. And, the best measure of capital preservation would be the real investment return, or the total return adjusted for price inflation. This gives an indicator of the preservation of purchasing power, which is central banks’ underlying goal in the investment of its foreign currency assets.

When viewed over long periods, gold’s performance with respect to capital preservation is quite similar to governments. As illustrated in Chart 1, both gold and US Treasuries achieved positive real returns of around three percent on an annualised basis over the last half century.

The story is quite different, however, when assessing capital preservation and returns over discrete economic scenarios over the multiple business cycles over the last half century. In comparing gold with traditional reserve assets—mainly US Treasuries—gold performed better in meeting capital preservation objectives during periods of stagflation. During such periods, fixed income returns were eroded by inflation, and equity returns by low economic growth.

The global economy is emerging from the COVID-19 crisis in fundamentally different shape than in the preceding decades where globalisation and strong supply side factors both kept inflation at bay and helped fuel economic growth. Pressures on global trade already existed with the recent increase in tariffs but global supply chains have been further disrupted by COVID-19 and international trade, which plummeted in the Spring of 2020 and is unlikely to revert to previous trend growth. Not only have international political tensions increased, but COVID-19 revealed the risks around dependencies on long supply lines. At a micro-economic level, businesses are beginning to reopen but with a much higher cost structure because of health, distancing and sanitation requirements. These factors may also weigh on productivity and prices. Finally, economic growth is likely to remain subdued due to employment uncertainties and continued distancing/isolation—whether government imposed or self-restricted.

These factors increase the possibility of a stagflation scenario—an outcome nearly unthinkable only six months ago. As investment committees consider alternative economic scenarios, the greater possibility of stagflation would warrant increased attention to the performance of gold to meet real capital preservation investment objectives.