Following the recent release of our Gold Demand Trends report for Q3 2020, one of the questions we are being asked frequently is how much influence the US election will have on gold demand and performance.

The simplest answer is that while, understandably, investors are closely following the US election for many reasons, it is just one of the many factors that influence gold at a global level. And specifically with respect to this election cycle any of the possible outcomes – whether a clear win by either Republicans or Democrats, or a contested election – will likely support one or several of the key drivers of gold investment demand.

Let me elaborate.

A historical perspective

Looking back, gold’s performance has not significantly differed based on the party controlling the White House. Since 1971, gold returns were 11% on average per year during Democratic presidencies and 10% during Republican ones1. Similarly, gold returns were only slightly higher in the year following a challenger party’s victory relative to an incumbent party’s victory (7.9% versus 6.5% respectively).2

US gold demand

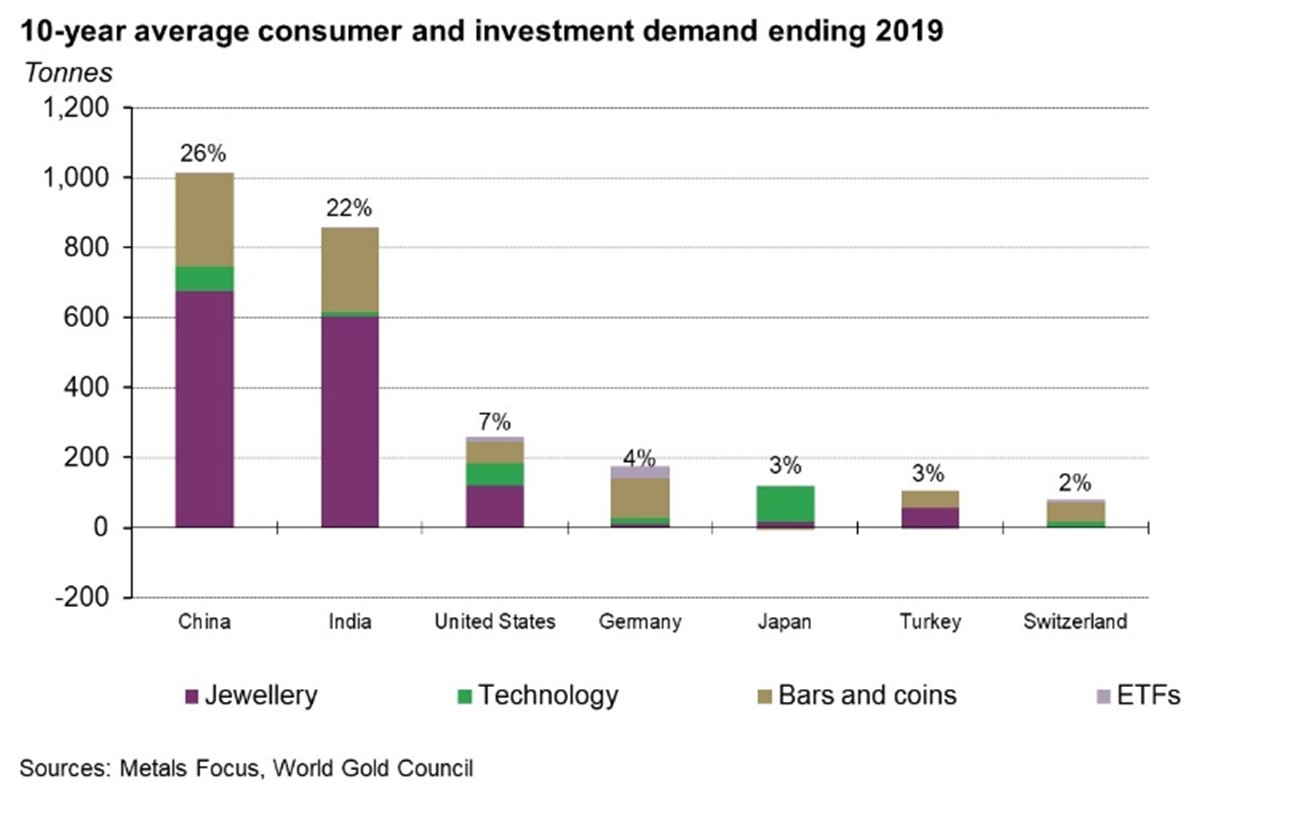

Gold is a global market; it is purchased by consumers and investors around the world for a myriad of reasons, but primarily as a means to preserve capital and diversify risk. The US is the third largest gold consumer market, accounting for approximately 7% of global physical gold demand in the form of jewellery, technology, bar and coin, and ETFs. And while activity in derivatives markets, especially through COMEX, generally represent positioning by US investors, there is still a large portion of physical gold demand that is influenced by global dynamics well beyond the US election.

High risk and low interest rates are not going away any time soon

The stakes are clearly high in this election. The political landscape has been increasingly divisive over the past several years – in the US and abroad – and investors are bracing for a potential period of even greater volatility. Many economists have published views regarding how a Republican or Democrat win might impact various macroeconomic indicators.

In our view, any potential outcome will likely support gold investment demand, albeit for different reasons.

- A Trump win will likely be seen as business friendly and constructive in terms of fiscal policy, supportive of the positive momentum the stock market has enjoyed for most of the past four years. On the flip side, trade tensions may resurface again and monetary policy will likely remain very accommodative for a long time

- A Biden win may create concerns of higher taxes and larger budget deficits, and result in corrections in the stock market, but it could be seen as more conciliatory in terms of trade. In this case we don’t believe that monetary policy will become more restrictive any time soon.

- A contested election or unclear outcome for a period of time, viewed as a concern by many will likely result in a a particularly uncertain period for financial markets.

In sum, the combination of a high-risk, low-rate environment is expected to maintain gold investment demand for the foreseeable future. As such, investors should prepare for ongoing high volatility as market conditions adjust to emerging developments.

Footnotes

1 SSGA, What Impact Do US Politics Have on Gold? October 2020.

2 Ibid.