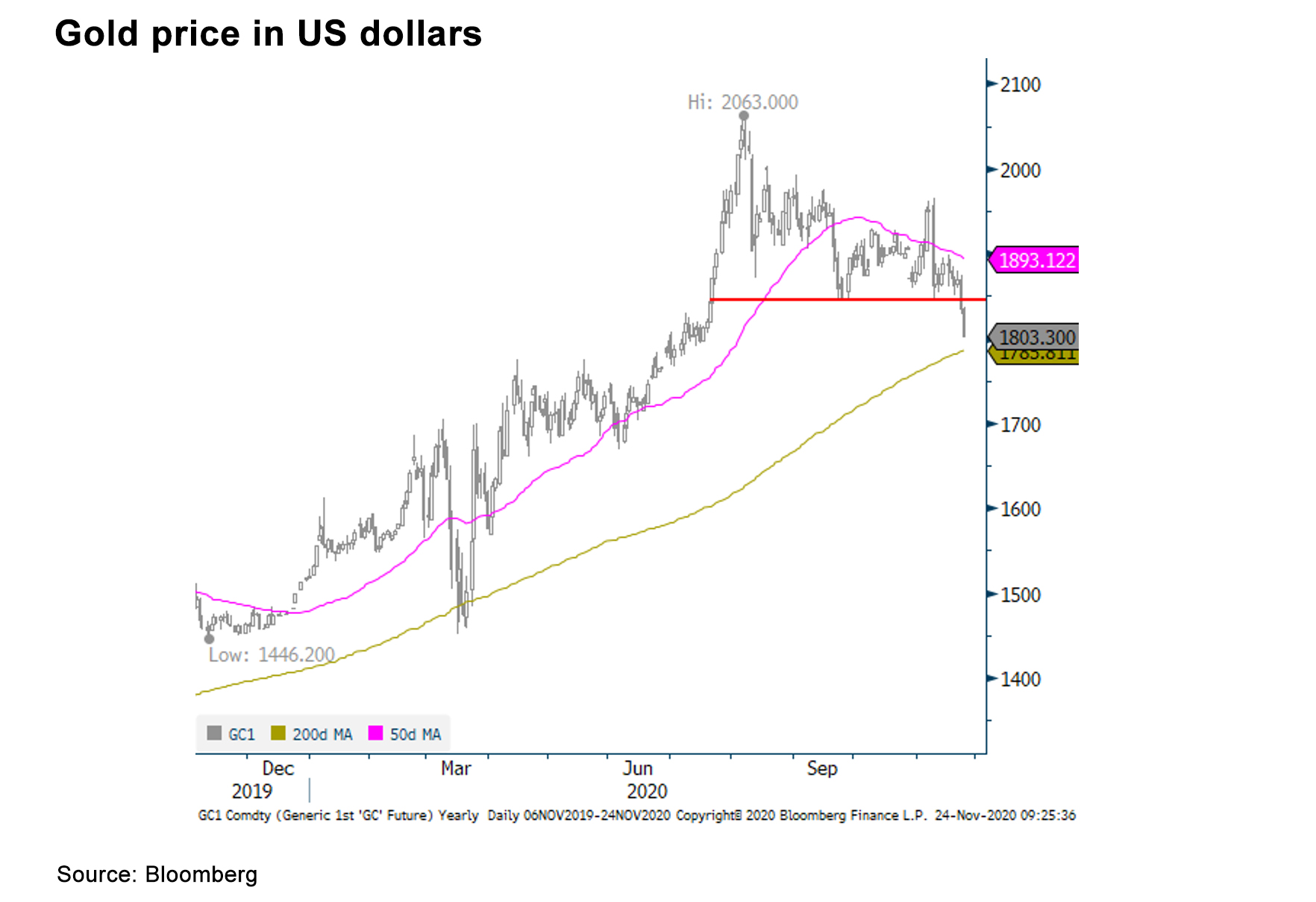

As we’ve discussed recently, a balanced result of the US election (Democratic President and House of Representative; Republican Senate), gave the markets a sense of “status quo”, which propelled risky assets higher and gold lower. This came as investors took profits and the gold price made a technical pause. While gold held important support levels of around US$1,850/oz for the past four months, it broke that level yesterday and has continued lower today, near US$1,800/oz, as the perception of market risks fall.

Gold falls as positive news dominates the markets

24 November, 2020

There are a few reasons for the recent decline in the gold price. First, there have now been three confirmed successful vaccines, with AstraZeneca the latest company to note favourable results. President-elect Biden began announcing his Cabinet and yesterday named Janet Yellen his Treasury Secretary. As Chairperson of the US Federal Reserve, her accommodative policies were positive for risky markets over a large portion of the past decade. And finally, the General Services Administration declared Biden the winner of the Presidential election, and to some surprise, President Trump agreed to have his team transition to the new administration.

While the aforementioned news is negative for gold in the short term, some potential positive catalysts have emerged. While the Janet Yellen announcement is positive for stocks, it ironically should also be positive for gold as it increases the likelihood of lower rates for a longer period. We continue to highlight lower rates as positive for gold as it improves its opportunity cost. Seasonal improvements in gold demand in India and China are also positive for gold. Jewellery sales in China increased during October as its economy continues to improve, and recent data suggest positive consumer activity surrounding Diwali in India.

Gold remains 17% higher on the year, stronger than most major assets. But there is no denying that recent news has been overwhelmingly positive for broader markets and negative for gold prices. However, it could take some time before the vaccines are approved and even longer before they are deployed, and a substantial proportion of the population is vaccinated. Also, there is continued concern about whether enough of the population will take the vaccine to create herd immunity. Vaccines could end the pandemic, but the economic impact will be realized for years to come. And it will likely take additional fiscal and monetary help to fully “cure” the economy, adding additional credence and support for gold demand.