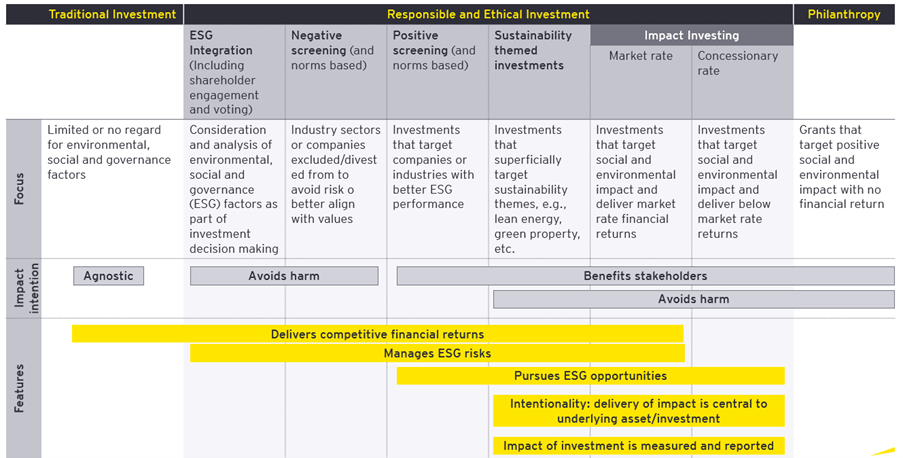

Globally, there’s an increasing shift of funds towards responsible and ethical investments, with 98% of institutional investors already screening environment, social and governance (ESG) performance when making investment decisions. A barrier for mining and metals companies is that, by definition, they are unlikely to be considered a mainstream impact investment. With this growing movement towards impact investing, EY and the World Gold Council recently co-hosted a webinar to discuss whether gold mining companies have the attributes of an impact investment, and what they could do better or differently to fit the description.

Panellists Catherine Raw, Evy Hambro, James Bevan and Matt Bell, along with moderator David Harquail, shared the view that it’s currently hard for the industry to claim to be an impact investment. That said, its contribution to local economies and communities can be an accelerant for change if done the right way. One welcomed approach from the investor community includes the World Gold Council’s Responsible Gold Mining Principles, which offers shared expectations of improved standards.

There’s no doubt the sector recognizes that engagement with stakeholders and communities is critical to help build a better tomorrow — and secure the capital needed to drive transformation in the recovery of COVID-19 and beyond. In fact, license to operate (LTO) was ranked number one for the third consecutive year in the EY Top 10 business risks and opportunities report. Now, gold companies must act purposefully in order to build a strong LTO, effectively disclose metrics and maintain on investors’ radars.

What barriers stand in the way of being seen as a responsible investment choice?

Forty-four percent of webinar participants said the sector has a brand perception problem. While gold mining companies may be making significant investments in stakeholder and community relations, the positive momentum is often lost due to gaps in disclosures, evolving investor expectations and heterogeneous nature of the sector. A big challenge for companies is that most investors and ESG ratings agencies consider mining to be one homogenous industry — often not distinguishing between thermal coal and gold, for example. This means that poor performance from one operator can have ramifications throughout the sector, regardless of commodity.

Another barrier webinar participants identified — the ability to measure and demonstrate value — resonated with Catherine who said communicating coherently to investors is a challenge particularly when there are multiple, sometimes duplicative reporting standards to follow. She noted that at Barrick Gold Corporation, they have produced a dashboard providing key metrics and scores to simplify achievements for investors.

Evy agreed that there needs to be a more effective way to show the investing world — and the world more broadly — what the sector really does. Recognizing that most investors and analysts tend to focus on the negative measurements within ESG, he asked whether there could be an ESG “balance sheet” to provide a full picture view and facts that highlight not just the negatives, but the positives as well. In addition, Evy suggested the need for standardized ESG metrics so that investors can have a level playing field upon which to assess how companies are performing across companies and sectors.

Catherine highlighted that the industry was slow to recognize the need to create standards, and hence many have been initiated through not-for-profit and industry associations. The aggregation of the standards was viewed very positively by the miners on our panel, who want alignment and simplification of the different standards. On the other hand, sophisticated investors understand that ESG ratings agencies are competitors and will have different viewpoints as to what they consider important.

If it maximizes ESG outcomes, how could the gold sector be viewed by investors?

We asked participants how far they thought the gold sector could go. The result was encouraging, with almost 40% saying they see the gold sector becoming a positively screened investment option, and a further 25% thinking it could be a sustainable investment of choice. It is clear that the sector needs to continue to evolve a platform to allow gold to distinguish itself.

As more Assets under Management are directed to companies that can deliver both a “market return” as well as demonstrate an “impact return,” there are countless opportunities for gold mining companies to step up and secure a piece of the pie. To do so, the sector needs to remain laser focused on building energy efficiency, a strong commitment to social values and exercising good governance. By focusing on ESG factors and finding ways to effectively communicate their positive impact, gold companies will be well positioned to build LTO and capture lasting investor attention.

To view the webinar on-demand, click here.

At EY, we’re keen to hear your thoughts and comments to continue the dialogue. For more information, please visit www.ey.com/en_ca/mining-metals.