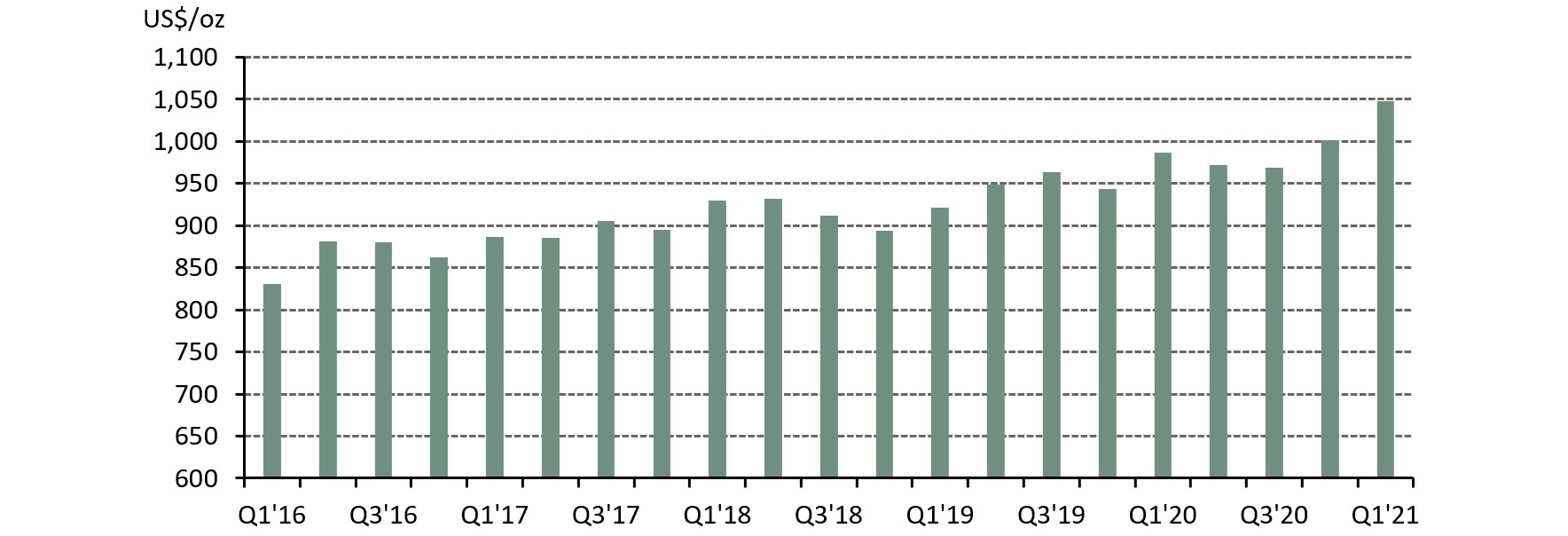

Costs in the gold mining industry increased for the second consecutive quarter in Q1’21, with the global average All-in Sustaining Cost (AISC) up by 5% q-o-q to US$1,048/oz, reaching its highest level since Q2’13. This, combined with a 4% fall in the average quarterly gold price, resulted in a 14% drop in AISC margins (the gold price minus AISC) between Q4’20 and Q1’21. Despite this decline, industry margins remained healthy, with only the top 4% highest cost mines featuring an AISC above the gold price during the quarter.

Gold mining costs continue rising in Q1'21

30 June, 2021

Source: Metals Focus Gold Mine Cost Service

Increased mine site operating costs were the main driver, with Total Cash Costs (TCC) rising by 6% q-o-q to US$769/oz. Some of this q-o-q change was caused by regular seasonal variations in costs in several countries. For example, operating costs during the first quarter are often higher at mines in countries which have harsh winter conditions, such as Canada. Meanwhile, Q1 production and costs in South Africa are usually impacted by the holiday season when many workers take time off, reducing production efficiency.

TCC in South Africa and Canada are often higher in Q1

Source: Metals Focus Gold Mine Cost Service

However, the Q1’21 rise in costs was not just down to seasonal variations. TCC also increased by 4% y-o-y. This y-o-y rise was the result of a number of factors:

- Miners now have additional costs related to COVID-19 which did not exist in Q1’20, such as additional PPE, testing and quarantine procedures.

- Average grades declined by 4% over this period dropping from 1.44 g/t to 1.39 g/t, as lower grade material has become economic to exploit at higher gold prices, putting further upward pressure on unit costs.

- Labour costs in the mining industry are rising. This is being driven by increased demand for skilled workers as metal prices incentivise project development across multiple commodities, combined with COVID-19 travel restrictions limiting the availability of workers and contractors.

With these pressures on costs expected to persist throughout 2021 costs are expected to remain elevated in the coming quarters.