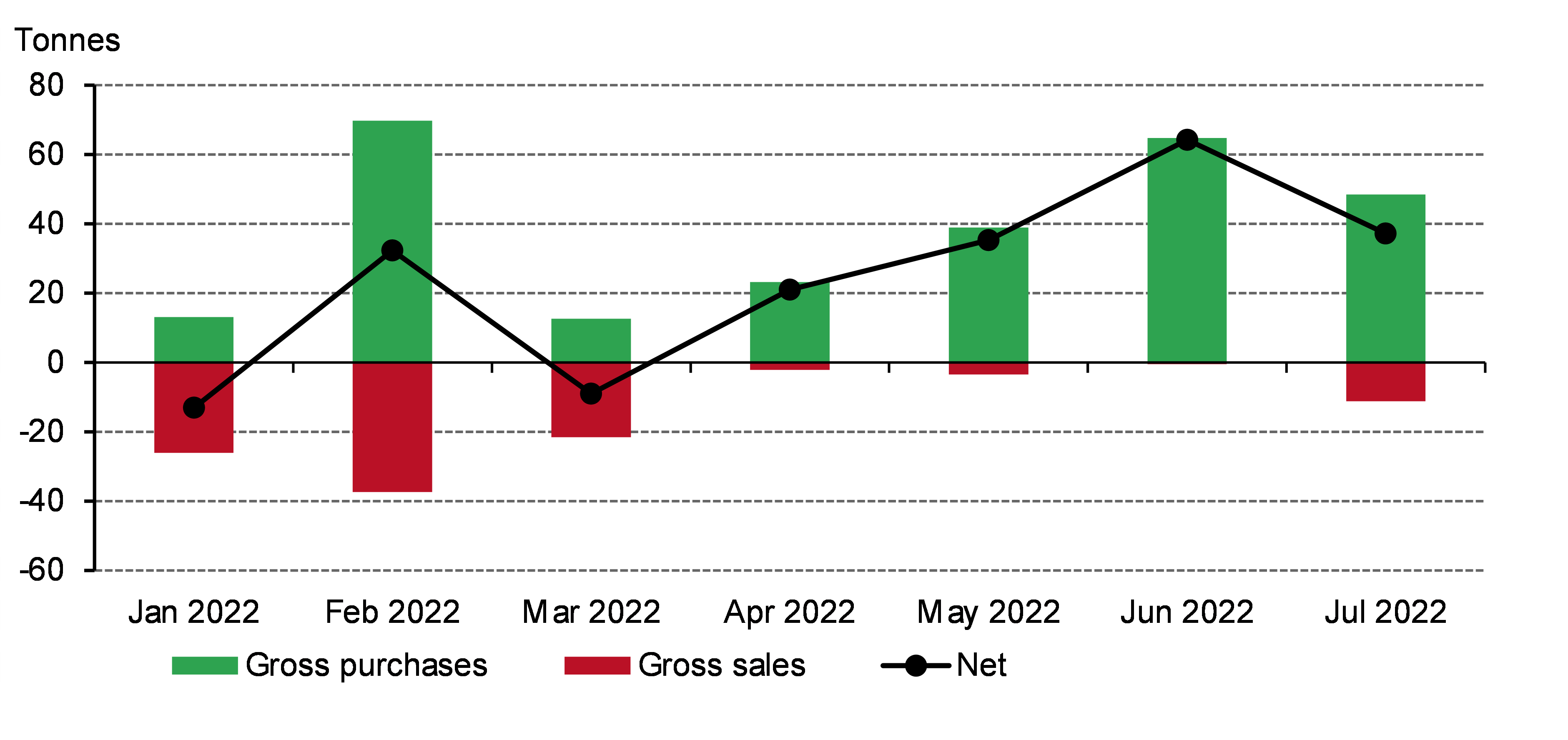

Central bank demand remained robust in July. Global gold reserves increased by 37t (net), below June’s 64t increase. Added to the 270 of net purchases over H1, this pushes YTD central bank demand towards the 300t mark.

Central banks’ appetite for gold continues in July

6 September, 2022

Few central banks were active during the month, but those that were acted with purpose.

- The Qatar Central Bank was the largest buyer, adding 15t of gold to its official reserves in July. This addition appears to be the largest monthly increase on record (back to 1967), although it should be noted that early data is patchy. Its gold reserves now stand at 72t (10% of total reserves), the highest on record in tonnage terms.

- The Reserve Bank of India, a regular buyer, added over 13t tonnes to its gold reserves - the highest monthly purchase since September 2021 (19t). This lifts total gold reserves to 781t, up 27t year-to-date.

- The Central Bank of Türkiye (Turkey) increased official gold reserves by 12t in July. This is broadly in line with the monthly average so far this year, and takes y-t-d net gold purchases to 75t. Total official gold reserves now stand at 469t, a two-year high.

- The Central Bank of Uzbekistan bought a further 9t of gold in July – the same volume as in June. After sales of 25t in Q1, net purchases for the year so far now total 11t. Gold reserves now total 373t (61% of total reserves).

- The National Bank of Kazakhstan was the only notable seller according to official reported data. It sold 11t in July, bringing its y-t-d net sales to just under 30t. Total official gold reserves now amount to 373t, accounting for 64% of total reserves. As reported by Bloomberg, the bank indicated that any further sales would be dependent on market conditions.

In addition to the officially reported data, Reuters reported a 6t fall in gold reserves at the Central Bank of Venezuela during the first half of 2022, to 73t. This change in gold reserves has yet to be reflected in the IMF statistics, with the last available data point from June 2018, but will continue to monitor this for developments and update our data accordingly.