UK financial markets have gone into full-blown crisis in the last few weeks. The government’s ‘mini-budget’ announcement on the 23rd September was poorly received by global investors, leading to a sharp spike in UK government bond volatility. One consequence of this was severe dysfunction in the liability-driven investment (LDI) market, forcing the BoE to step in. As this turmoil may prompt pension schemes to reconsider their strategic asset allocations, we look at how gold could have and can play a role in defined benefit (DB) pension schemes.

Where does an LDI strategy fit in a pension scheme structure?

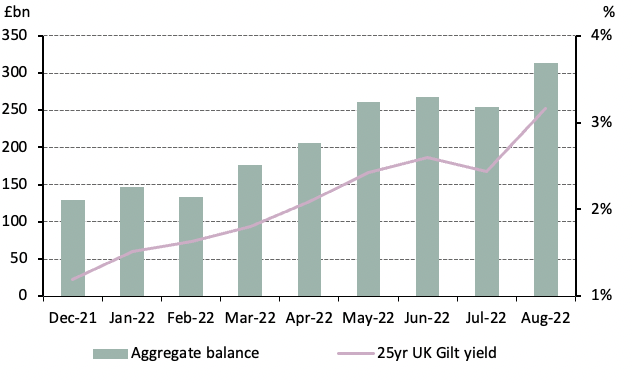

The key objective of a pension scheme is to pay its members the benefits they’re owed as and when they fall due. And for so long as a scheme has a funding deficit, it will need to invest in both growth assets to earn a suitable level of return and assets that move in line with the value of its liabilities. In other words, assets that, like the value of its liabilities, are sensitive to fluctuations in interest rate and inflation i.e. UK gilts and UK inflation-linked bonds (Chart 1).

Chart 1: The value of liabilities are responsive to UK gilt yields

S179 Liabilities using data from the Pension Protection Fund (PPF) and 25yr UK gilt yields

It is however difficult for a scheme to achieve this twin objective of closing a funding deficit and hedging interest rate and inflation risks without introducing leverage. And whilst leverage could be introduced in the growth portfolio, options to do so are typically limited. As a result, leverage has historically been introduced in the matching portfolio through an LDI strategy, enabling the pension scheme to then invest in a wide range of growth assets (equities, high yield, emerging market debt, private assets etc.).

How is LDI collateral managed and what happened between September 23 and 28?

Since the start of 2022, yields on long-dated gilts have increased 2% reaching 3.2% on 31st August. For UK DB schemes not fully hedged, this has provided a welcome tailwind to funding positions by decreasing the present value of liabilities relative to the value of assets. In fact, the Pension Protection Fund (PPF) has recently estimated that aggregate pension funding position has improved by £185bn over that period (Chart 2).

Chart 2: Rising yields provided a welcome tailwind to aggregate pension funding positions

Historical aggregate funding position of schemes in the PPF universe and 25yr UK gilt yield*

Whilst rising interest rates (and falling liabilities) have tended to improve funding positions, they have also resulted in increased collateral calls due to the falling values in LDI assets. To be clear, this is to be expected as the aim of LDI is to mirror the movements in pension scheme liabilities. Against this backdrop, for schemes engaged in leveraged LDI, collateral calls have been frequent in the first 8 months of the year.

And up until September 23, the adjustments to collateral pools fluctuated gradually over time, enabling pension funds to follow their trusted process to source cash - initially from predetermined liquidity positions and then from other assets within the wider portfolio, as deemed appropriate. Realising the latter assets was however not immediate. It sometimes took a few days before the proceeds of any sale could be moved into the LDI portfolio to replenish the collateral pool.

The ‘mini-budget’ heaped more pressure on LDI strategies

With easily realisable assets already running low, the scale and speed of the rise in interest rates triggered by the government’s tax cut announcement on the 23rd September placed enormous strain on the system. 30-year real yields moved up circa 2% in three trading sessions and there was simply not enough time to get the required assets in to the LDI funds to meet the unprecedented margin calls.

It is these margin calls on levered fixed income positions that resulted in disorderly selling. The shortage of immediately available liquidity combined with a feedback loop in the process by which some derivatives position were being cup (to reduce leverage) led to a set of circumstances in which the market was very close to a vicious circle. The events forced the Bank of England to step in by announcing it would buy long-dated UK government bonds to stabilise the market. And although we’ve seen some short term relief in the gilt market, the movements since early October show that these troublesome circumstances remain (Chart 3).

Chart 3: 30-year Real Gilt Yields – recent movements

An opportunity for gold?

Pension funds will always want to manage their investments in a liability-aware manner. But recent UK market moves may prompt them to reconsider how their strategic asset allocations need to evolve. We feel this could present an opportunity for gold.

Indeed, gold’s traditional role as a safe-haven asset means it comes into its own during times of high market uncertainty as witnessed over the last few weeks. Whilst the BoE’s intervention helped to temporarily bring down yields in longer-dated bonds, the gilt market remains under pressure along with other assets typically held by pension funds. Sterling corporate bonds were down over 8% in the 2 weeks following the ‘mini-budget’ while the UK’s domestically focussed FTSE 250 index fell more than 7%. Gold, on the other hand, posted positive returns (Chart 4).

In times of market stress, with a broad range of pension assets falling in value, holding effective diversifiers such as the precious metal can help alleviate pressures. In other words, utilising a gold allocation as a source of liquidity could have reduced the amount of forced-selling in other assets already subject to price pressures, given them more time to recover.

Chart 4: Post mini-budget returns (£) for gold versus UK bonds and UK equities

Moreover, the long-term implication of last week’s events might be that pension schemes reconsider the level of illiquidity in their portfolios. Private debt, private equity or real estate all have some compelling investment characteristics but schemes need to be confident they have sufficient liquid assets in their portfolio and can rebalance quickly across their funds.

In effect, there is now a risk that haircuts will need to be taken to realise illiquid assets. The gold market on the other hand is large, global, and highly liquid. It is also more liquid than several major financial markets, including euro/yen and UK gilts, while trading volumes are like those of US 1-3 year treasuries (Chart 5).

Chart 5: Gold trades more than many other major financial assets

One-year average trading volumes of a number of major assets in £*

The scale and depth of the market mean that it can also comfortably accommodate large, buy-and-hold institutional investors. And in stark contrast to many financial markets, gold’s liquidity does not dry up, even at times of financial stress, making it a compelling addition to a DB portfolio.

Food for thought as pension schemes digest the recent collateral squeeze and reassess their strategic asset allocations...