Over the course of this year, I have been fielding an increasing number of questions from US investors and media about owning precious metals, in particular gold, in an individual retirement account (“IRA”). When I did my own independent, online research, I found that the information available on the web can be confusing and, in many ways, misleading if not downright inaccurate. This blog is a very simple and concise summary, for anyone interested in achieving the benefits of gold in their retirement account. Read on for the facts and information that you need to know, and some guidance to assist you along the way.

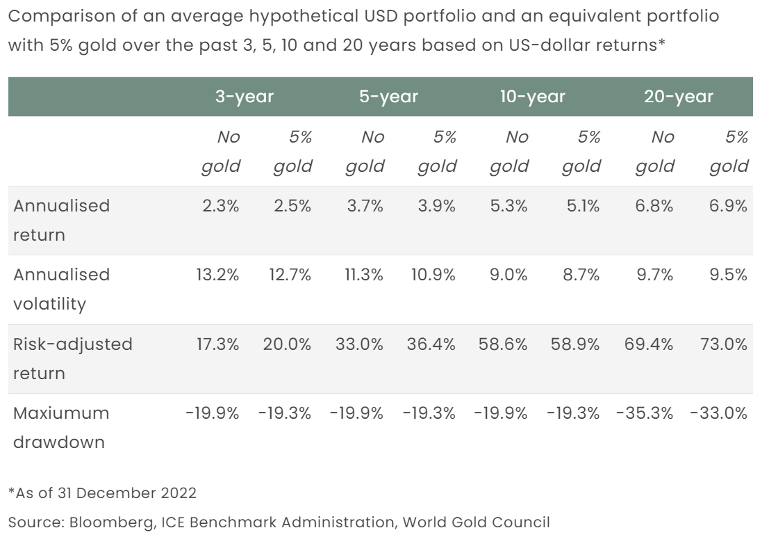

Let’s start with gold as an investment. World Gold Council research shows that most portfolios can benefit from an allocation to gold. As the current market environment continues to prove quite challenging for investors and makes portfolio management difficult, our data suggests a strategic allocation to gold can provide long-term returns and lower overall portfolio volatility.

The favorable effects of a strategic allocation to gold are due to its significant level of liquidity and unique performance behavior, which is driven by both investment and consumer demand. The “dual nature” of gold as both an investment asset and a consumer good makes gold an excellent addition to a diversified portfolio and delivers long-term returns in both good and bad economic environments.

A bit about IRA’s

An IRA is a method of long-term savings that an individual can use, and it offers: the ability to save for the future, a platform for providing returns and the potential for certain tax advantages in the future. As IRAs are long-term by design, they offer an excellent platform for investors to diversify and reap the benefits of an allocation to gold.

For investors, attention to the details is necessary when making the decision to invest in gold using an IRA. To start, there are four typical types of IRA accounts as defined by the IRS:

- traditional IRAs,

- Roth IRAs,

- Simplified Employee Pension (SEP) IRAs,

- and Savings Incentive Match Plan for Employees (SIMPLE) IRAs.

Each has different rules regarding eligibility, taxation, and withdrawals. What is not a defined account type by the IRS is a “precious metal” or “gold” IRA account, and anyone insisting you need this type of account to invest in precious metals could be misrepresenting the facts. There are no such defined terms under the Internal Revenue Code of 1986 (the “Code”). Any investor may make use of open/existing IRA accounts to make your investment. It's worth noting that some organizations might try to use these labels to “brand” their business activity, but it is not a legal structure that is different to the IRS defined accounts. The key is, your existing provider needs to confirm they are set up and ready to accept your investment.

Can I own regulated gold financial instruments in my IRA?

A simple and effective way for investors to access gold in an IRA would be to make use of the large and established physical gold-backed exchange traded funds (“ETF”) market. Section 408(m) of the Code defines what types of collectibles and precious metals can be included in an IRA. In 2004, the IRS clarified through private letter rulings that under this section, the purchase of shares of a gold ETF by the trustee or custodian of an IRA would not be treated as the acquisition of a collectible resulting in a taxable distribution to the IRA owner.

Gold ETFs are liquid, easy to access and track the gold price making them a very sensible and viable investment choice. As physical gold-backed ETFs are technically equity instruments, there are no account or trading restrictions. However, it would be sensible to confirm with your IRA trustee/custodian that you are looking to have the instrument added to your existing IRA and that they are clear on the process to make that investment through the purchase of a gold-backed ETF.

Can I own physical gold in my IRA?

Separately, an investor may choose to make an investment in gold in physical form in their IRA provided the form of physical gold qualifies under section 408(m) of the Code which requires that the gold meet certain criteria (primarily purity and liquidity requirements).

In addition to understanding the types of gold eligible through physical investment, there are other key considerations an investor will need to review before implementing an allocation to physical gold. A critical key point to address straight away is the need for your IRA trustee/custodian to provide the essential platform for investing in the physical market as not all IRA platforms permit this type of access. A client needs to ensure that their IRA trustee/custodian offers access to the appropriate forms of gold, and that they have the means/capabilities to hold the gold in custody. This is a condition that must be met to ensure the investment is in line with the IRS ruling that initially provided for the investment. Once your IRA trustee/custodian confirms that that they can offer you access to precious metals, you can gain access to gold using the various types of IRAs equally (traditional, Roth, etc.).

Once I am clear that I want to own gold and can hold gold, what should I do next?

We recommend to any individual who is interested in adding gold, either using a regulated financial instrument like an ETF or in physical form, that they should start with familiarizing themselves with our Retail Gold Investment Guidance. This framework has been designed to provide investors with five simple steps to follow and various questions to ask before any steps are taken to invest in gold.

If you are being approached by an organization that is unfamiliar to you and experience selling behaviors that include, for example, high pressured sales tactics or directives like “you need a new account, there is no other way”, realize that these are signs that you should slow down and ask more questions. Remember, you are looking at your long-term savings, and no one needs to make a hasty decision and put any of your assets at risk.

If you are pursuing this investment opportunity on your own, once you decide that you are comfortable with adding a gold allocation to your savings, you should contact your investment advisor/IRA administrator to discuss the possible options available to you.

Want to learn more about the gold market? Visit Goldhub.org

Important disclaimers and disclosures

© 2023 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates (collectively, “WGC”) or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus, Refinitiv GFMS or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

WGC does not guarantee the accuracy or completeness of any information nor accepts responsibility for any losses or damages arising directly or indirectly from the use of this information. This information is for educational purposes only and by receiving this information, you agree with its intended purpose.

Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. WGC does not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information contains forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. WGC assumes no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. WGC provides no warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.