Highlights:

- International and domestic gold prices have been scaling unprecedented levels, trading above US$2,300/oz: up 8% in March and up 3.1% in April m-t-d1

- Historic price levels have weighed on jewellery demand but stimulated investment (bar and coin) demand

- The domestic gold price remains at a discount in relation to the international price, although in April discounts have narrowed

- The RBI continues to build its gold reserves, adding 18.5t since the start of 2024 and taking reserves to an all-time high of 822.1t

- Momentum in Indian gold ETFs inflows has waned

- The marked reduction in gold imports during March was likely driven by the price surge and a higher flow of recycled gold.

Looking ahead:

- Elevated prices, fewer weddings and election-related restrictions will likely impact consumer demand

- However, any price stability ahead of Akshaya Tritiya could provide some respite

- At the same time, gold’s continued strong performance this year could encourage investment demand.

Gold prices touch fresh highs

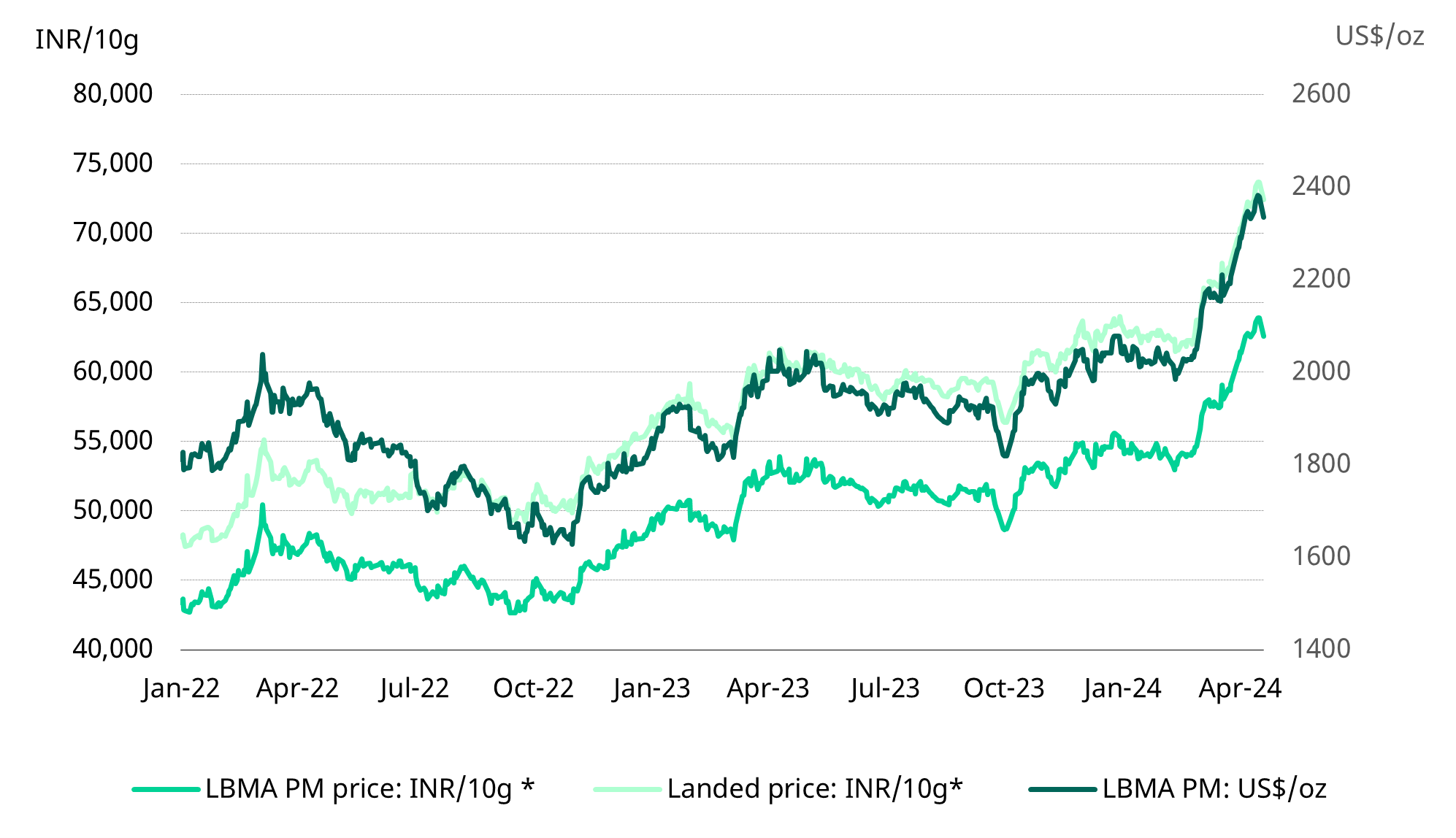

Gold prices have rallied since mid-February to reach unprecedented levels. Prices rose by 3.1% in April2 following an 8% surge in March. At the time of writing,3 gold is trading above US$2,300/oz. Our analysis shows that risk and momentum have been behind the upward move. Domestic landed gold prices in India4 mirrored the increase of international gold price or LBMA Gold price in March (up 8%), owing to the relative stability in the INR. To date in April, however, the domestic landed price has risen by 4% (to INR72403/10g)5 versus 3% in the LBMA Gold Price, due to a depreciation in the INR (0.4%) against the USD.

Chart 1: Gold prices at an all-time high

LBMA price and domestic landed price by month, US$ and INR*

Historic prices stifle demand

The recent speed and magnitude of the gold price rises have been unprecedented. While it took nearly a year for domestic prices to rise from INR50,000/10g to INR60,000/10g, the rise from INR60,000/10g to INR70,000/10g took little more than five months. Anecdotal evidence suggests that the swiftness of the price uptick has affected gold consumption demand, particularly jewellery demand, which makes up around three-quarters of total consumption. Additionally, most jewellery purchases are tied to wedding-related purchases, Also, consumers are awaiting stabilization in prices for fresh purchases and have been resorting to exchanging/selling old jewellery to benefit from windfall gains. Demand is also likely impacted by election-related restrictions and fewer weddings this year (April-May).

At the same time, physical investment demand (bars and coins) has seen an uptick on anticipation of further price increases. Some jewellers and manufacturers have been booking profits by liquidating stock and diverting gains to other investment avenues, but many are facing a liquidity crunch, limiting their ability to add to their inventories.

Demand is unlikely to experience a meaningful uplift over the next couple of months, particularly while general elections take place (April to June), as the movement of gold and cash is closely monitored.6 But some improvement in demand could be expected around the time of Akshaya Tritiya (10 May) if prices stabilise as this is traditionally considered to be an auspicious time to buy gold.

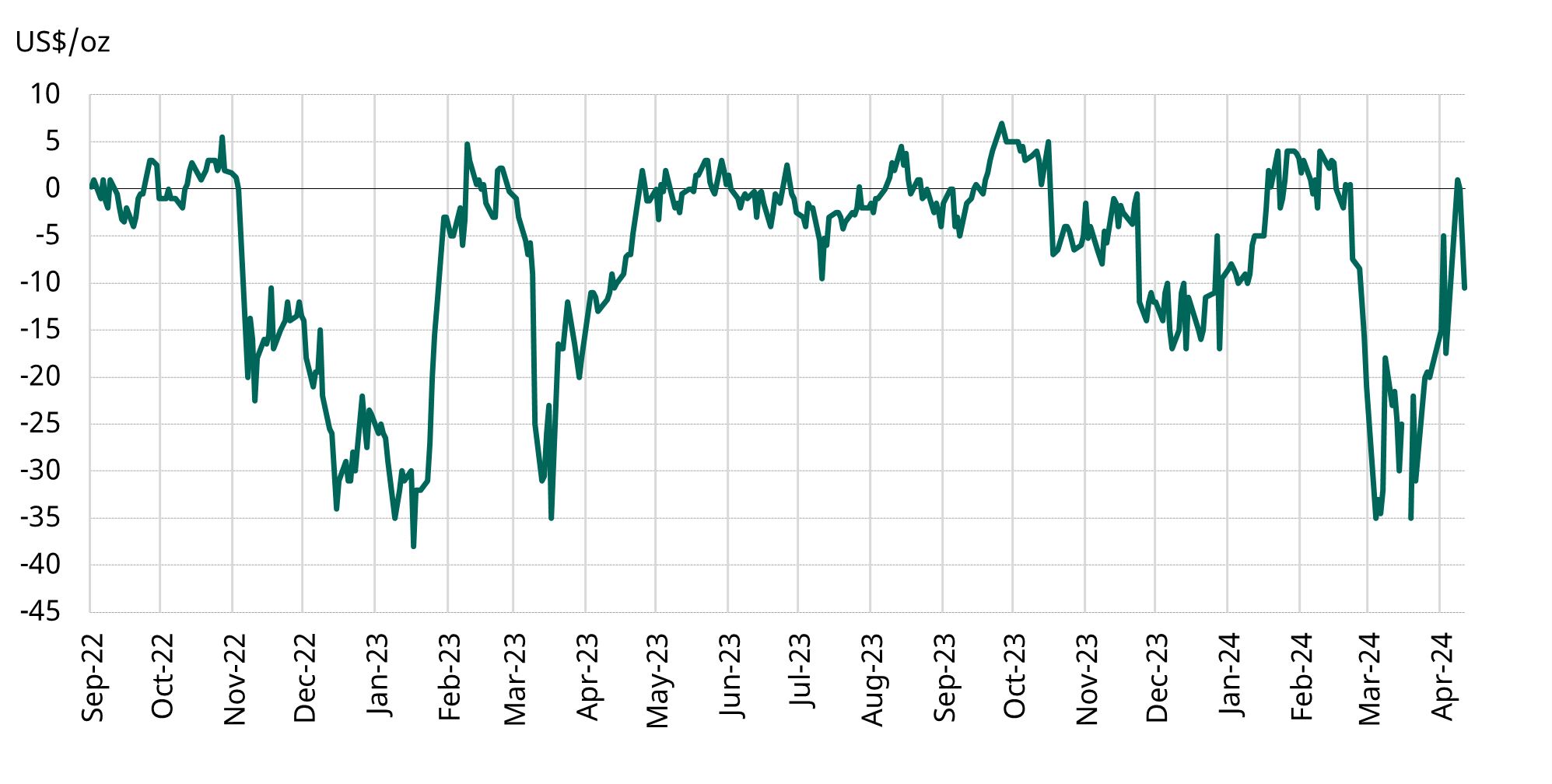

Gold continues to trade at a discount in the domestic market

Despite the sharp drop in gold imports in March, domestic gold prices continue to trade at a discount to international prices in the face of sluggish demand, particularly for jewellery. The increased supply of recycled gold in response to higher prices is likely a further influencing factor. Discounts are, however, narrowing. April7 saw India’s gold price discount averaging US$12/oz, down from US$24/oz in March.

Domestic gold prices often trade at a discount when international gold prices surge. But compared to previous gold price spikes the current domestic price discount is narrower (see Table 1), possibly indicative of pockets of gold demand here.

Chart 2: Domestic gold prices trade at a discount

NCDEX gold premium/discount relative to the international price*

Table 1: Greater discounts witnessed during past price spikes

Domestic gold price discount and percentage change in international gold price

| | Domestic gold price discount*:US$/oz | LBMA AM Fix: Monthly price change (%) |

| Mar-16 | -28.84 | 4.1 |

| Jul-16 | -34.45 | 5.0 |

| Jul-19 | -18.57 | 4.1 |

| Aug-19 | -40.77 | 5.8 |

| Mar-22 | -26.26 | 4.8 |

| Dec-22 | -20.03 | 4.0 |

| Jan-23 | -29.20 | 5.5 |

| Mar-23 | -12.90 | 2.7 |

| Apr-23 | -18.17 | 4.8 |

| Dec-23 | -13.10 | 2.6 |

| Mar-24 | -23.85 | 6.7 |

| Apr-24* | -12.79 | 7.9 |

*Till 22 April

Source: NCDEX, Bloomberg World Gold Council

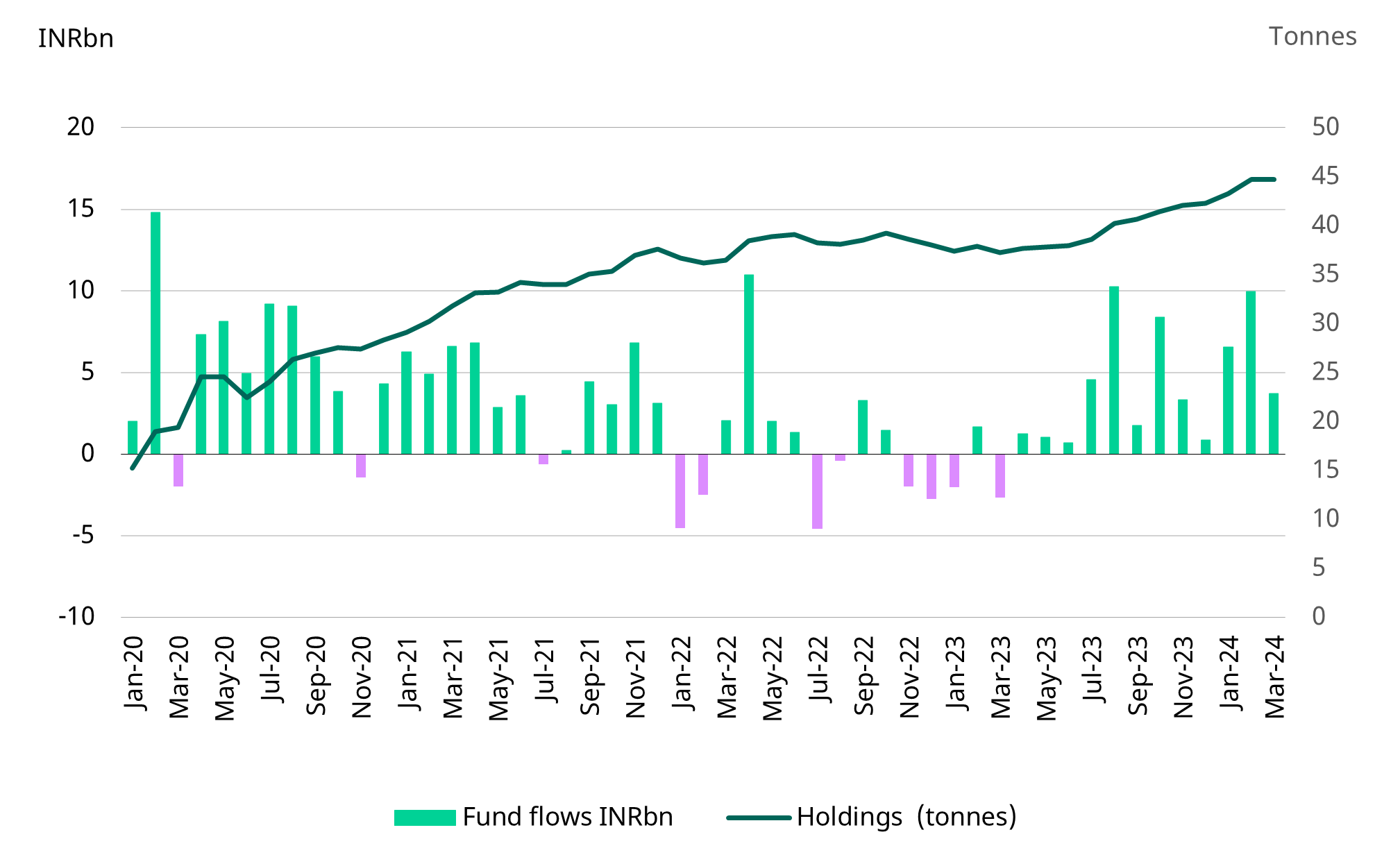

Momentum in Indian gold ETF inflows loses steam

Inflows into Indian gold ETFs weakened in March, Net inflows into the Indian gold ETFs totalled INR3.7bn in March, a significant (62%) drop from the substantial inflows of INR9.8bn in February – a six-month high. This decline could partly be attributed to the quarter- and financial year-end payment requirements of investors. Indian mutual funds as a whole witnessed net outflows in March to the tune of INR1,593bn. Despite lower net inflows, aided by the surge in gold prices, total assets under management (AUM) of gold ETFs at the end of March were up 9% m/m at INR312.2bn. Collective holdings remained steady at 44.7t, although up 20% y/y.

Net fund inflows into Indian gold ETFs for the fiscal year 2023-24 (April–March) totalled INR52.4bn, a significant rise from INR6.5 in FY23 but 24% lower than the record net inflows in 2020-21 (INR69.2bn). The fiscal year 2023-24 has seen an 8% portfolio accretion or additional folios8 created. This increase in folios and fund inflows can be attributed to the rise in gold prices, growing interest in tradable financial products, a significant uptick in capital market investments,9 the pursuit of investment diversification and geopolitical tensions.

Chart 3: ETF inflows slow

Monthly gold ETF fund flows in INRbn and total holdings in tonnes*

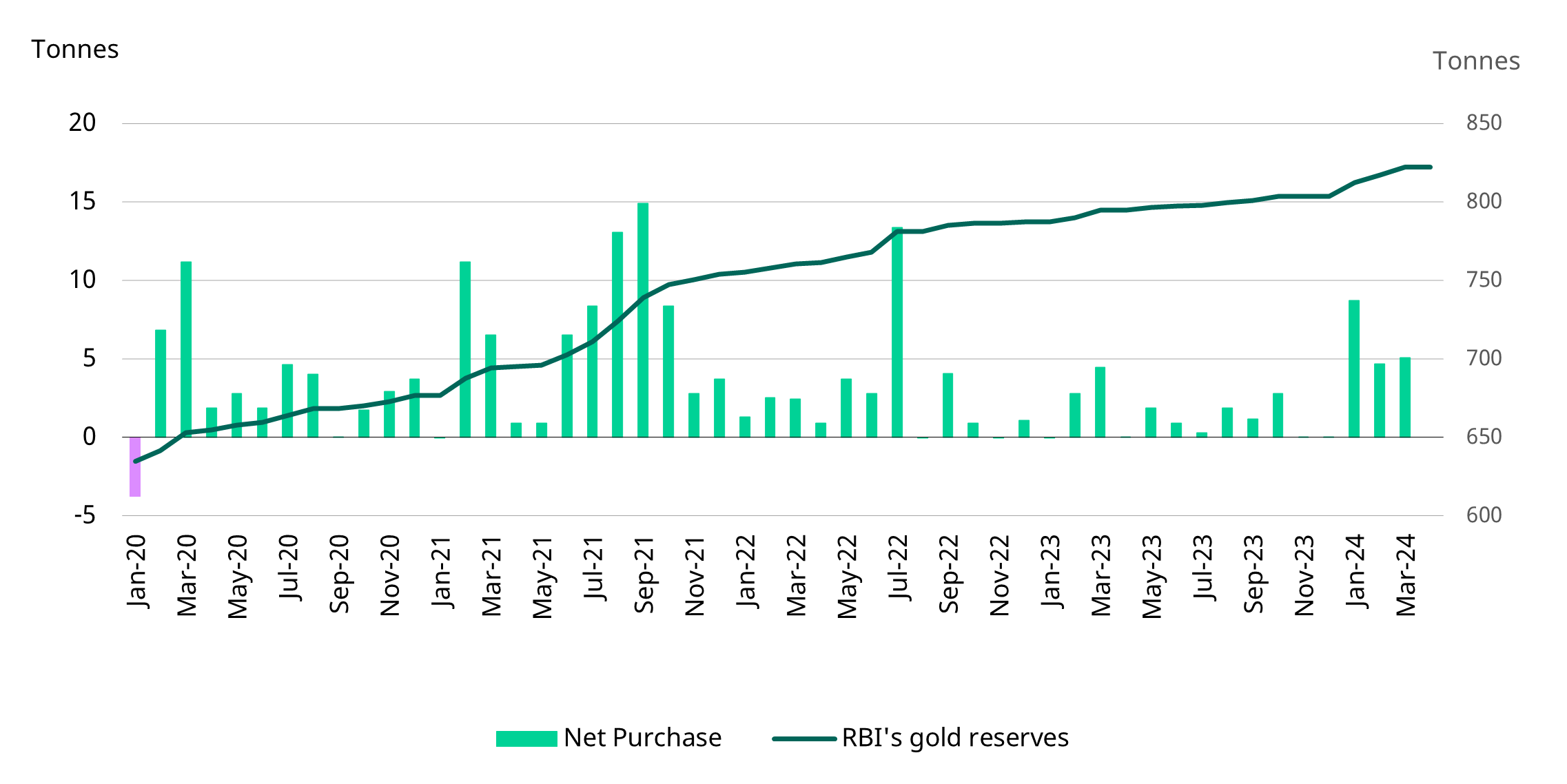

RBI augments its gold holdings

The RBI continues to build its gold reserves at a steady clip. RBI data and our own estimates indicate that its gold holdings rose to a record high of 822.1t by the start of April,10 representing an 18.5t net acquisition since the beginning of the year. The central bank’s net gold buying in 2024 has already surpassed its net purchases in 2023 (16.2t). As of early April, gold’s share of total reserves has risen to 8.4% from 7.7% at the end of 2023.

The RBI is among key central banks that have been driving gold purchases in 2024. This continues the RBI’s trend of adding to its gold reserves and brings its net gold purchases to an annual average of 42t (between 2018 and 2023).

Chart 4: RBI increases its gold holdings

RBI’s monthly net purchases and reserves, tonnes*

Sharp drop in gold imports

After a significant spike in February, gold imports saw a substantial decrease in March. At US$1.5bn, imports stood at a quarter of February’s total (US$6.1bn) and were the lowest in eleven months. This decline can largely be attributed to the record high prices (up 8% m/m). Furthermore, anecdotal evidence suggests that the price surge has spurred the supply of old or recycled gold in the domestic market; together with sluggish jewellery demand the need for fresh imports has lessened.

In volume terms, as per our estimates, gold imports in March likely totalled less than 30t, significantly lower than the 104t imported in February and 62t in March 2023. For the 2023-24 financial year (April 23 to March 24), gold imports saw an annual growth of 30% in value terms and an approximate 15% increase in volume terms. Monthly imports during the year fluctuated, varying between 16.7t and 121.9t (US$1.0-7.2bn). Despite the y/y increase, the volume of imports for the financial year remained below the pre-pandemic five-year average (by 15-17%).

Chart 5: Gold imports plunge

Monthly gold imports, tonnes and US$bn*

Footnotes