Highlights:

- Global and domestic gold prices inch down from April peaks as of mid-May; still up 15% y-t-d

- Strong demand during Akshaya Tritiya: price moderation from record levels aided buying and narrowed the discount between domestic and international gold prices

- Sustained gold buying by the RBI, 25t added to reserve since start of year

- April sees gold ETFs withdrawals for the first time in a year

- Gold imports rebound in April, despite the uptick in prices.

Looking ahead:

- Demand is expected to primarily revolve around the festive period, which kicks off in August-September

- Jewellery demand will likely remain subdued following the recent festive period, with purchases largely confined to weddings

- Meanwhile, bar and coin demand is likely to see continued interest.

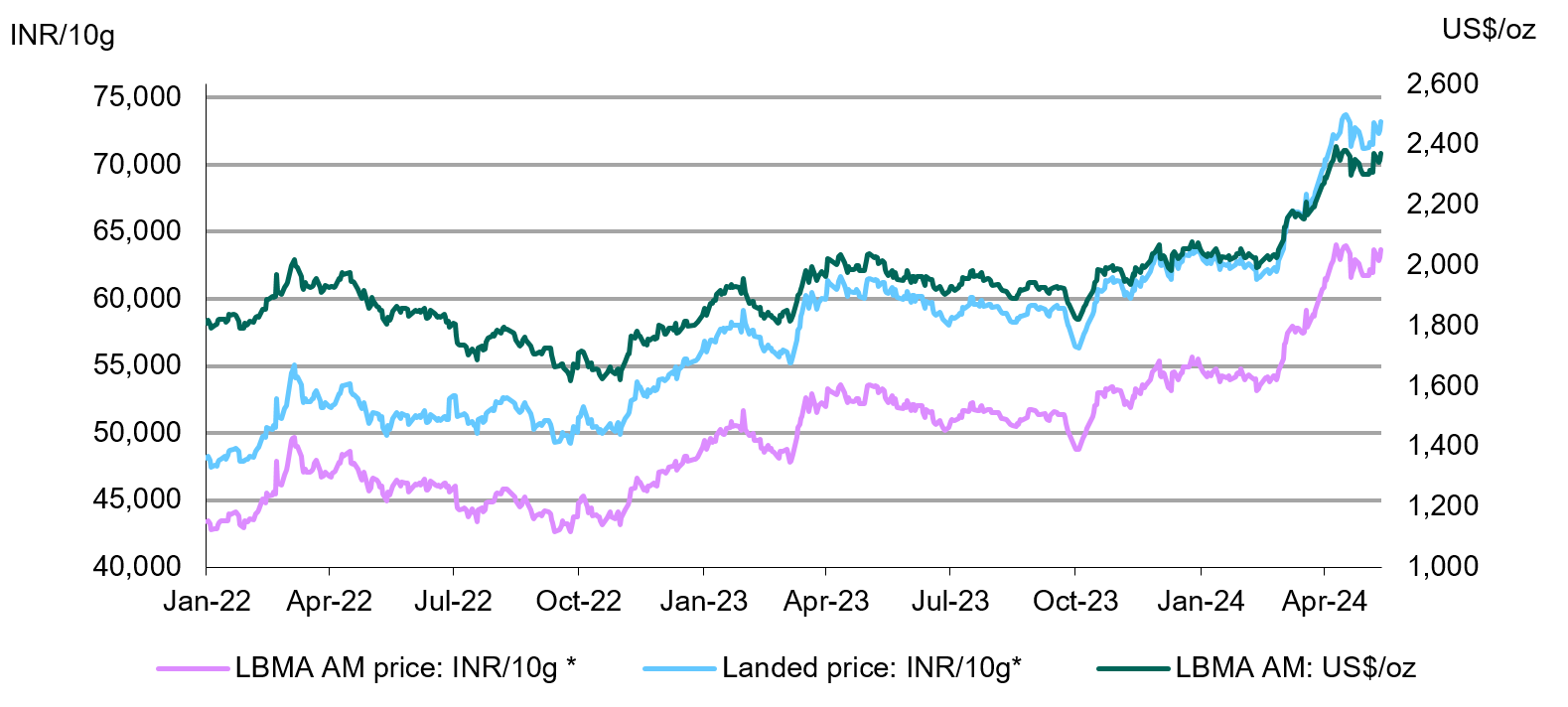

Gold prices pull back modestly after record surge

Gold prices have eased from their peak of mid-April, likely due to profit taking. Nevertheless high gold prices prevailed, ending April up 4% on the back of an 8% rise in March. Since mid-April1 gold prices have moderated 1% and have risen by 15% so far this year, trading at over US$2,350/oz at the time of writing.2 Domestic landed gold prices in India3 have followed the movement of international gold prices owing to the relative stability of the INR vs the US dollar.

Chart 1: Gold prices stay elevated

LBMA Price AM and domestic landed price by month, US$ and INR*

Festival alongside price moderation stimulates demand

After a generally weak March and April, there was a resurgence in gold demand ahead of and around the Akshaya Tritiya festival on 10 May. Considered one of the two most important days for buying gold traditionally, anecdotal evidence suggests that demand exceeded expectations, with strong activity observed in both urban and rural areas; some industry participants even hinting at record buying in value terms. Anecdotal accounts from jewellers and various industry stakeholders suggest that there was significant pre- booking of gold jewellery, bars and coins well before the festival, as consumers took advantage of the moderation in price from its April peak. Additionally, there was notable demand for wedding jewellery - typically heavier pieces - despite the busy wedding season being some months away. Consumers were apparently bringing forward their wedding purchases in anticipation of further price rises in the near future. Demand for bars and coins, particularly among younger age groups, was reportedly robust, reflecting favourable consumer attitudes toward gold as an asset.

Anecdotal reports from jewellers suggest that the value of sales during the festival was appreciably higher compared to the previous year, with healthy volumes. This growth occurred despite the festival lasting longer last year in some regions4 and gold prices being 20% higher, suggesting that consumers likely accepted gold’s higher price and may have a positive view of its trend.

However, the likelihood of the continuation of such demand is low with consumers making purchases around festivals. Overall buying activity is expected to be restrained.

Gold price discount in domestic market narrows

Rising consumer interest was reflected in the reduced discounts on domestic gold prices in relation to international prices. India’s gold price discounts averaged US$3/oz in the first fortnight of May, down from US$10/oz in April.

Chart 2: Smaller discounts on domestic gold prices

NCDEX gold premium/discount relative to the international price

Indian gold ETFs see outflows

After an uninterrupted 12-months of inflows, Indian gold ETFs experienced outflows in April. This is in contrast to the flow of investments into gold ETFs in other major markets during the month notably China and North America. Net outflows from Indian gold ETFs totalled INR3.9bn in April,4 marking a significant shift from the preceding 12-month average inflows of INR4.4bn. This decline could in part be attributed profit taking and a likely shift to other asset classes such as debt and equity-oriented funds. In April, debt mutual funds saw significant inflows amounting to INR1.9trn and equity funds inflows totalled INR189.2bn.

Notwithstanding net outflows, the total assets under management (AUM) as of end April was up 5% from a month earlier and up 43% y/y at INR328bn (US$3.8bn), aided by the surge in gold prices. Moreover, there has been a noteworthy rise in the number of folios5 in gold ETFs, up by 122,920 from the previous month to 5.2mn, reflecting the prevailing investor appetite for gold as a financial asset. Collective holding remained steady at 44.7t, up 19% y/y.

Chart 3: Downturn in ETF flows

Monthly gold ETF fund flows in INRbn and total holdings in tonnes*

RBI enhances its gold stockpile

The RBI is consistently bolstering its gold reserves. According to RBI data and our own estimates, its gold holdings reached a new peak of 828.6 tonnes at the beginning of May.6 After adding 5.6t in April,7 RBI has now made a net acquisition of gold bullion equivalent to 25t since the start of the year. On average, the RBI has been purchasing around 6t of gold per month this year. The central bank's net gold acquisitions in 2024 have already exceeded those of 2023 (16.2t). As of early May, gold comprises 8.5% of total reserves, up from 7.7% at the close of 2023.

The RBI is among major emerging market central banks that have been driving gold purchases in 2024. Having surpassed the whole year purchase of 2023 in the first three months of 2024 itself, the central bank seems to be on track for net gold acquisition reminiscent of levels seen in 2021 (a total of 77.5 tonnes with average monthly buying of 6.5t).

Chart 4: RBI is actively acquiring gold

RBI’s monthly net purchases and reserves, tonnes*

Resurgence in gold imports

Following a significant decline in March, gold imports witnessed a resurgence in April, reaching a value of US$3.1bn, more than twice the amount of the previous month. Import figures for April also marked a three-fold increase from the corresponding period last year. This is despite record high prices during the month and can be attributed to the stocking up in readiness for Akshaya Tritiya.

In volume terms, as per our estimates, gold imports in April likely hovered around 50t, higher than the 34t of gold imports in March and 17t in April23.

Chart 5: Rise in gold imports

Monthly gold imports, tonnes and US$bn*

Footnotes

Based on LBMA AM gold price from 12 April to 15 May 2024.

15 May 2024 LBMA AM gold price.

Landed prices include import tax but exclude GST and are based on the LBMA AM gold price.

The 'muhurat' or the auspicious time to buy gold during Akshaya Tritiya in 2023 was spread over two days and differed across regions.

Based on AMFI monthly report for April.

Folios are unique identification numbers or account numbers assigned to investors by the mutual fund.

As of 3 May 2024.

As of 26 April 2024.