Indian gold import duties reduced to the lowest level in over a decade

26 July, 2024

- Gold import duty was cut by more than half in the most recent Union Budget

- Long-term capital gains tax on gold was adjusted down and the holding period decreased

- Profits on gold ETFs and mutual funds will no longer be taxed at the short-term capital gains rate if held for at least 12 months

- Despite some potential short-term disruptions, we expect the combined effects of these changes to add at least 50t to gold demand in H2 2024.

Union Budget 2024-25: key highlights

The 2024-25 Union Budget unveiled several pro-gold policy measures, that are expected to have broad ranging implications for the local gold markets, supporting the industry's reform and fostering organised growth.

Taxes relating to the physical and financial gold markets have been rationalised. The new measures include:

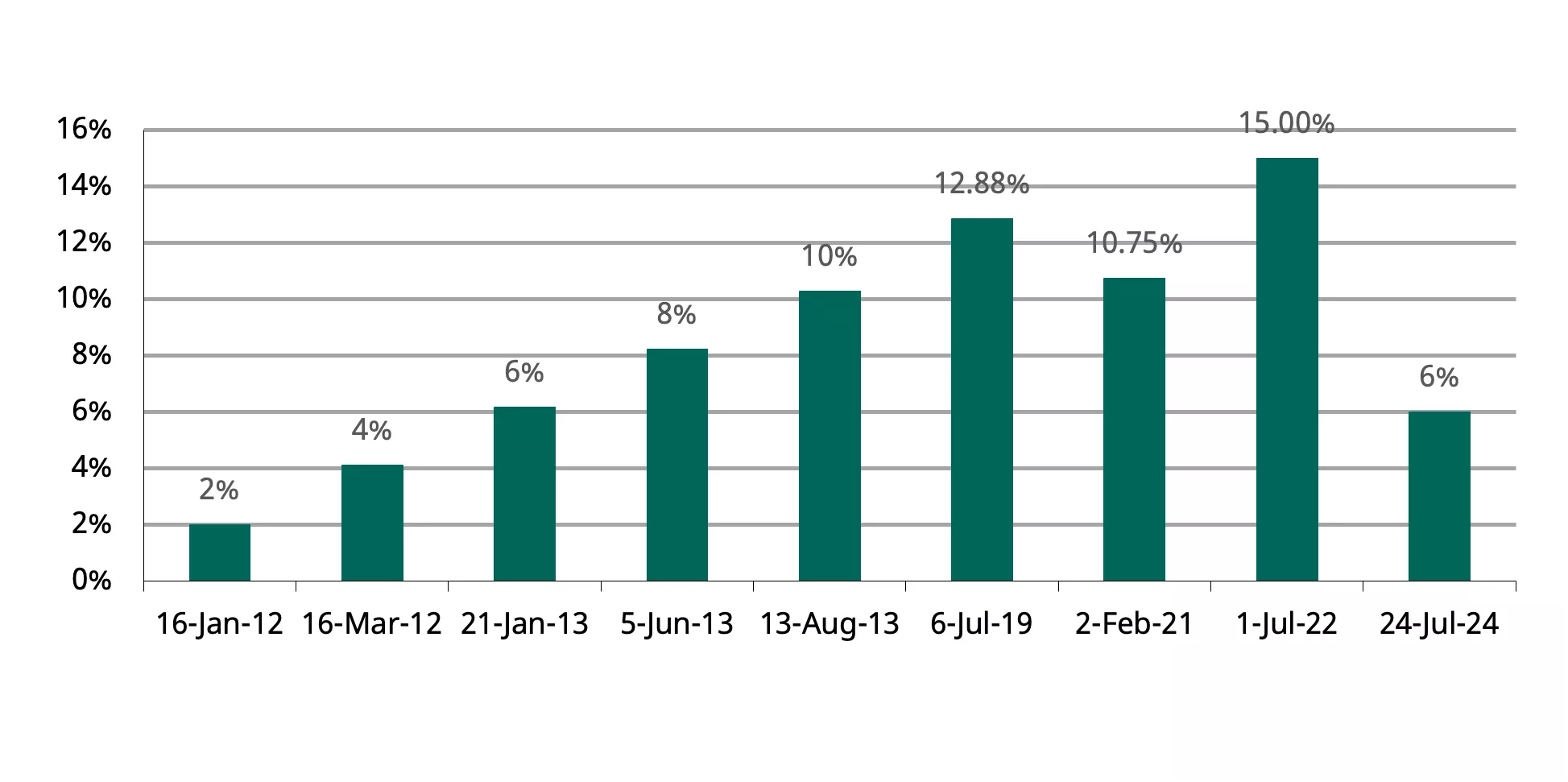

- A significant cut of 9% in import duty on gold and gold doré. Total customs duty1 on gold was lowered from 15% to 6% and that on gold doré has been reduced to 5.35% from 14.35%.2 This is the sharpest reduction on record and the lowest since June 2013. Prior to the Budget announcement, gold import duties had been above 10% for almost 11 years (Chart 1). These changes in customs duty are effective from 24 July 2024.

- Reduction in rate and holding period for long-term capital gains on gold. The holding period for taxation of long-term capital gains on gold has been reduced from 36 months to 24 months. The rate of long-term capital gain has also been reduced from 20% with indexation3 to 12.5% without indexation. This proposal is applicable with effect from 23 July 2024.

- Recategorisation of gold ETFs and mutual funds.4 The definition of “Specified Mutual Funds” has been amended to exclude gold ETFs and gold mutual funds and include only debt and money market securities. In the 2023-24 Union Budget, gold ETFs and gold mutual funds were considered as “Specified Mutual Funds” and gains were taxed as short-term capital gains at the applicable slab-rate,5 regardless of the holding period. Consequent to the amendment, gold ETFs/mutual funds will be treated as any other long-term asset if held for a specified period. Furthermore, the specified period for long term capital gains has reduced from 36 months to 12 months for listed securities and to 24 months for unlisted securities. Given that gold ETFs/mutual funds are listed, they will be considered as long term if held for more than 12 months and therefore taxed at the lower rate of 12.5%. Unlisted gold mutual funds will be considered as long-term investment if held for more than 24 months and will be taxed at the lower rate of 12.5%. The Union Budget states that the amendment is to be brought into effect from 1 April 2026. This has been interpreted by the industry as referring to the “assessment year” 2026-27.6

Chart 1: Significant cuts in customs duty on gold

% of customs duty on gold

Implications for the gold market

These measures are likely to have broad-ranging implications for the stakeholders in the gold industry. More details will emerge once the dust settles but there are some initial observations

- The reported surge in gold smuggling into the country,7 through both new and established routes is likely to be dented. The customs duty reduction will make gold imports via unofficial channels less (or even non) profitable.

- Imports of platinum alloy from the UAE (which may contain more than 80% gold) have surged in recent months. This has contributed to gold prices in the domestic markets trading at a discount to international prices. The reduction in platinum duty, may lead to a decline in the import of platinum alloy as the duty differential under the UAE-India Comprehensive Economic Partnership Agreement (CEPA) becomes less appealing.8

- The reduction in duty will also bring down the landed cost of gold.9 This will likely improve the competitiveness of the domestic gold industry and would also help free up working capital for exporters.

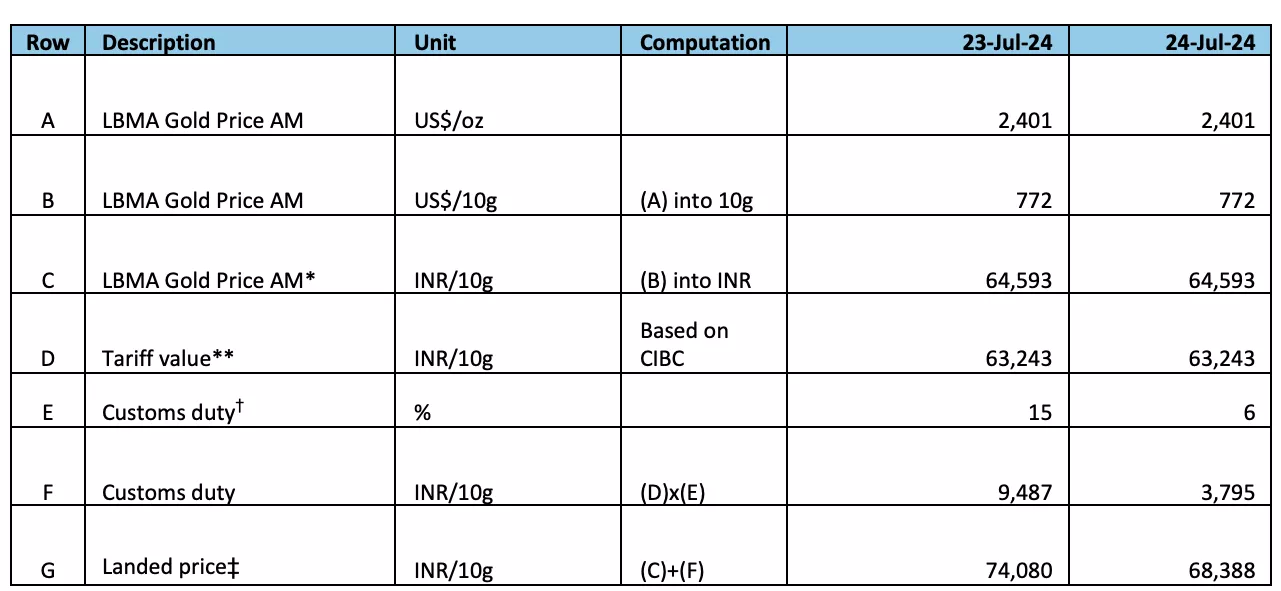

- The government expects the duty cuts to boost gold jewellery production and thereby employment in this labour-intensive sector. In absolute terms the 9% cut in customs duty, keeping the international gold price, exchange rate and tariff values10 constant, should translate into a cost reduction of 7.7% (Table 1).

- Bullion dealers, manufacturers and retailers may, however, experience a partial loss on inventory. Market estimates put the inventory held by jewellers at around 400t, some of which would have been bought at price levels higher than the post-Budget announcement price. However, such losses are expected to be recovered over one or two quarters aided by the anticipated increase in consumer demand in response to lower prices.

- The more recent loans issued against gold provided by banks and non-banking financial companies (NBFCs) will likely be impacted given the drop in value of collateral. With the rise in gold prices y-t-d, there has been a notable increase in the loans against gold provided by banks and NBFCs,11 as borrowers have opted to pledge their gold for their funding needs instead of selling outright.

Table 1: Calculation of landed cost of gold following customs duty cut from 15% to 6% (all else being constant)

* Based on LBMA price and daily RBI reference rate for USD/INR.

** Based on Central Board of Indirect Taxes and Customs (CBIC) tariff and exchange rate published values.

† Customs or import duty applicable on tariff value

‡ LBMA price and import tax (tariff value * customs duty)

Source: Bloomberg, CBIC, World Gold Council

Implications for gold demand

The reduction in customs duty has the potential to measurably increase demand both during the upcoming buying season (between August and December) and over the longer term. In the past, when the import duty was raised in 2012, it created headwinds for jewelry demand but its effect was even more noticeable in the bar and coin market. Our econometric model (see India’s Gold Market: Reform and growth, pp.128-132) suggests that Indian consumer demand – the sum of jewellery and bar and coin demand – could see an additional 50t or more in the second half of 2024 through a combination of an initial boost in consumer appetite given the more attractive price as well as a longer-term effect as local prices aligns more closely with the international price.

Anecdotal reports also suggest that the revised definition of “Specified Mutual Funds” which excludes gold ETFs from debt and money market securities is likely to improve flows into gold ETFs. It is anticipated that the reduction in duty and the shortening of the long-term investment qualifying time period will make the investment landscape for gold-ETFs more equitable and attractive. This will likely give further impetus to flows into these funds which have been witnessing steady net inflow since April 2013.

Overall, while there may be some short-term mitigating factors such as the price paid for existing inventories, or the still elevated gold price, we believe that the reduction in customs duty combined with the more beneficial long-term capital gains treatment for gold funds, could be an important catalyst for long term Indian gold demand.

Initial market reaction

The Indian domestic price fell 7%12 post the Union Budget, reflecting the lower duty. Similarly, the net asset value (NAV) of gold ETFs dropped by 6.5%-8.9%.

Anecdotal reports suggest a significant increase in foot traffic at retail jewellery shops, and there has been a reported increase in the local gold price premium. By way of comparison domestic prices have been trading at a discount to international prices for the previous five months.

Footnotes

1Basic customs duty was reduced from 10% to 5% and Agriculture and Infrastructure Cess (AIDC) cut from 5% to 1%.

2The customs duty on silver too has been reduced by the same amount and that of platinum has been cut from 15.4% to 6.4%.

3Indexation is used to adjust purchase prices of asset for inflation before calculating the tax liability on its capital gains.

4Memorandum explaining the provisions in the finance bill, 2024, Government of India.

5Based on taxable income, different tax rates called slab rates are applied.

6The assessment year of 2026-27 would make this applicable for capital gains for 2025-26.

7Gold dust in diapers, secret land routes, high-seas drops — what's behind gold smuggling surge in India, The Print, 19 July 2024.

8Under the UAE- India Comprehensive Economic Partnership Agreement (CEPA), the import duty on platinum alloy is 5%.

9Landed cost includes the tax and carry cost over the international prices.

10The tariff value on gold and the foreign exchange value is notified by the Central Board of Indirect Taxes & Customs on a fortnightly basis.

11For example, RBI data shows a 30% growth y/y as of May 2024.

12As of 25 July 2024