Why bitcoin isn’t the new gold

16 August, 2024

There is no question that the week of August 5th, 2024, will be one to remember. The performance of assets, especially risk assets, raised significant questions and comparisons as investors experienced levels of volatility that we have not seen since the onset of COVID (which is now more than four years ago). Global equities were severely impacted and at their peak, the S&P 500 and NASDAQ were off over four and six percent, respectively, on Monday of that week.

Market events of this nature are a good opportunity to step back and remind ourselves of the fundamentals of each asset class and an opportune time to assess how they performed against our expectations. Did the composition of my portfolio perform as expected during these extreme market conditions?

In that context, there has been an increased level of rhetoric regarding cryptocurrencies and the use of bitcoin as an “inflation hedge” or a store of value. Some even say bitcoin is “digital gold.” Numerous market researchers and journalists are challenging that premise, and concluding this is not the case.

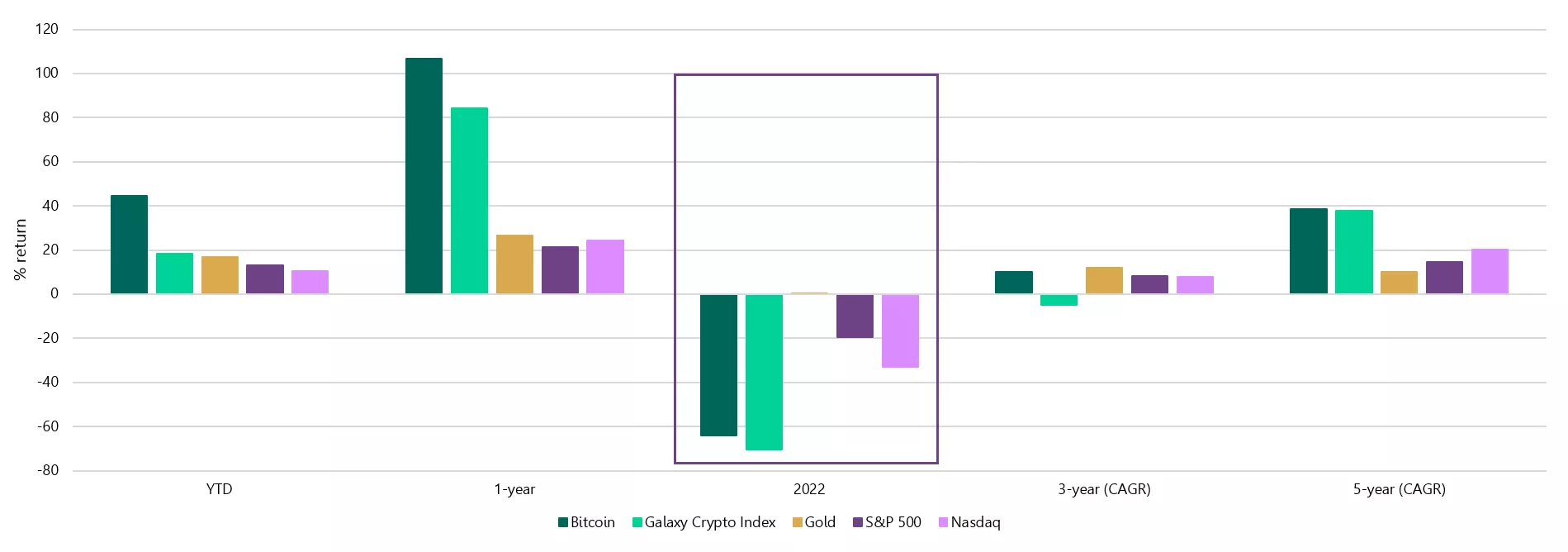

We feel the best way to compare bitcoin and gold is to look at the numbers, starting with returns. Over the past five years, gold and bitcoin have provided strong returns. There is no question that bitcoin has offered significant upside (and sometimes downside) - but at what cost as compared to gold?

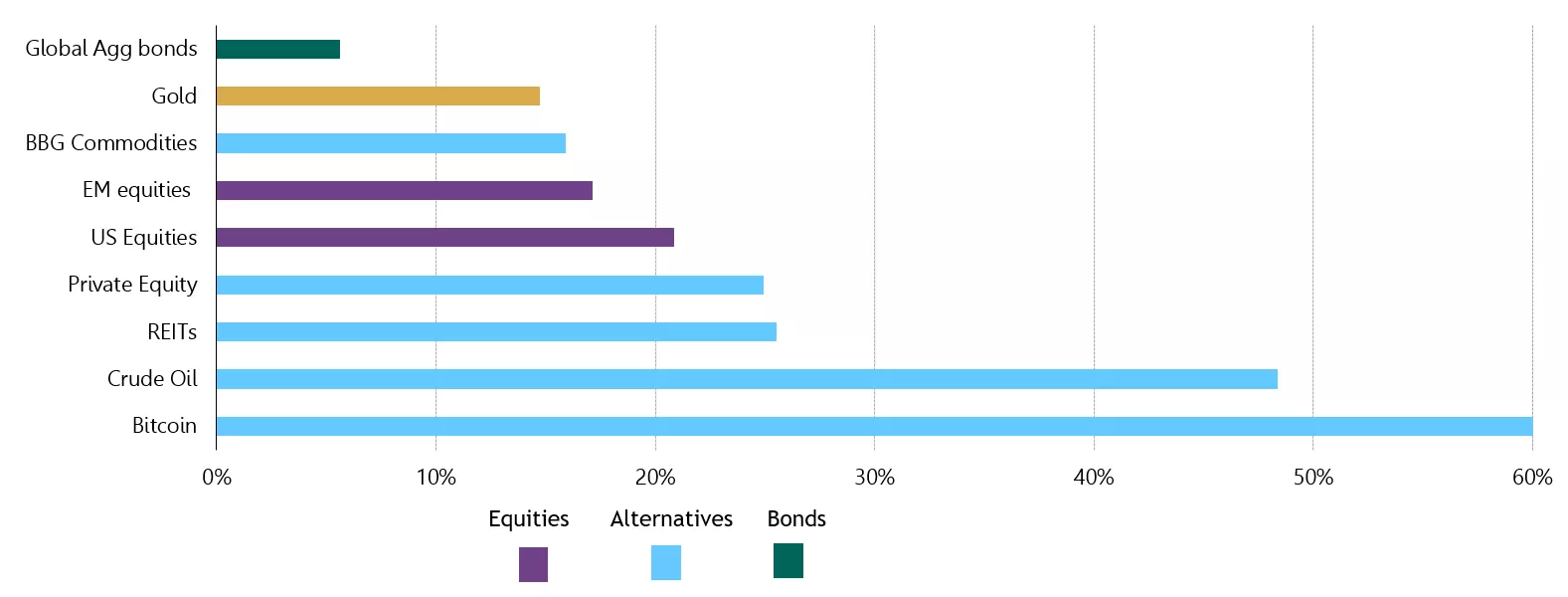

Let’s dig deeper and focus first on volatility. Simply put, gold and bitcoin sit at the opposite ends of the volatility spectrum. On a five-year rolling basis, the data shows a rather clear picture: gold is less volatile.

Gold and major asset 5-year average daily volatility - annualised

Gold has long demonstrated its role as a safe haven asset, which is supported through clear use cases by central banks, long-term investment holdings and global savings, so its volatility is on the lower end of the spectrum of comparative assets. Bitcoin’s strongest use case, as described by the major asset managers, is its position as an indicator of overall blockchain adoption, making its performance and volatility closer to technology stocks.

Year to date results, including the most recent market correction, further confirm that gold and bitcoin have significantly different profiles.

Gold and major asset weekly volatilities across different horizons

*The table is computed based on daily and weekly returns in US dollars between July 2014 and July 2024. Indices used: Bloomberg Global Aggregate Bond Index, MSCI Daily Gross World Index; MSCI Daily Gross EM; MSCI USA Index; LBMA Gold Price PM, Bloomberg Commodity Index, Bloomberg WTI Crude Oil; S&P Listed Private Equity Index; FTSE Nareit Equity REITs Index USD, Bloomberg Bitcoin Spot.

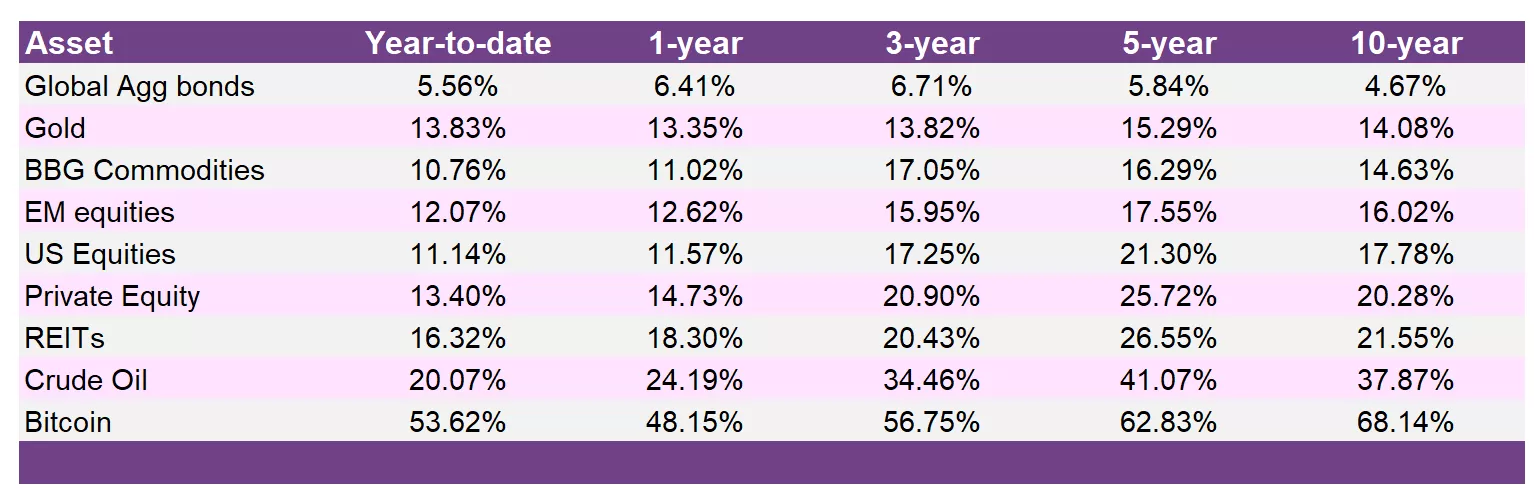

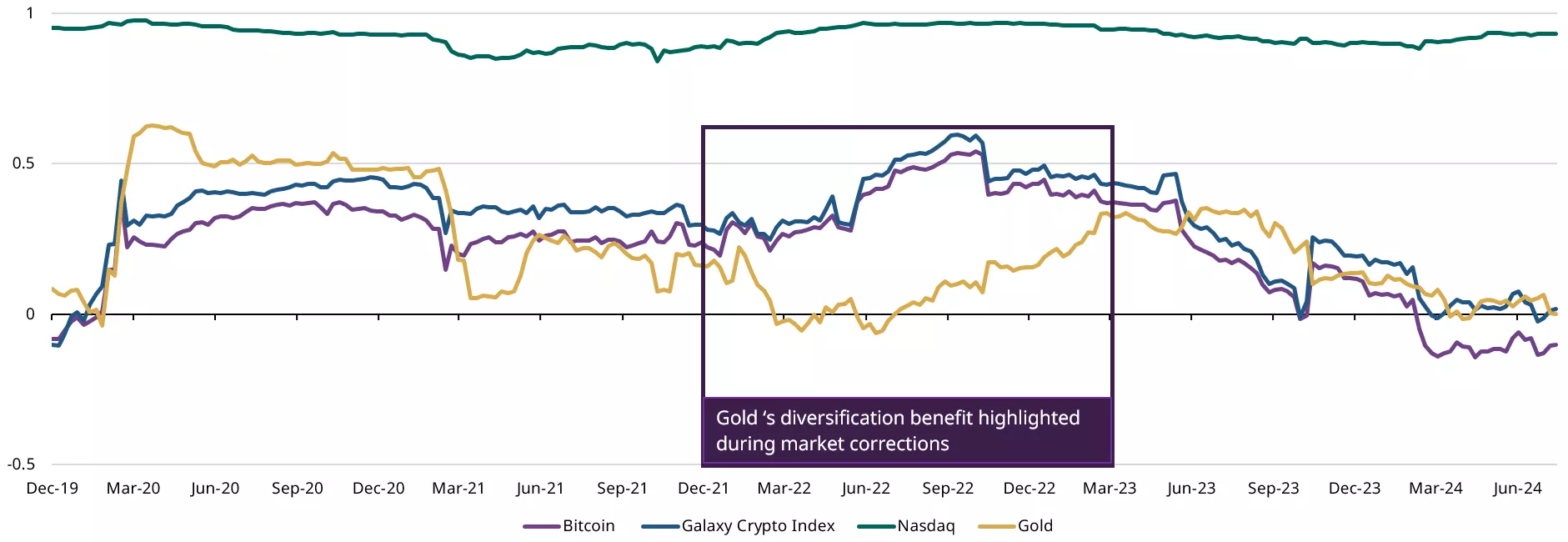

Let’s now look at correlation. Again, the numbers demonstrate that bitcoin and gold have different drivers and in times of increased stress in market conditions, gold provides a unique impact on a diversified portfolio. Looking at data both year to date and averaging over the past five years, gold’s performance provides positive correlation in up markets, and negative correlation in down markets.

Historical correlations to S&P 500

Looking a bit closer at the one-year weekly rolling correlations with the S&P 500, the 2022 Russian invasion of Ukraine provides a market moment that amplifies gold’s role as a safe haven and performance that separates it from bitcoin.

1 -year weekly rolling correlation to S&P 500

This provides further support that gold is accepted on a global scale, without restriction, as a store of value that protects investors from risk.

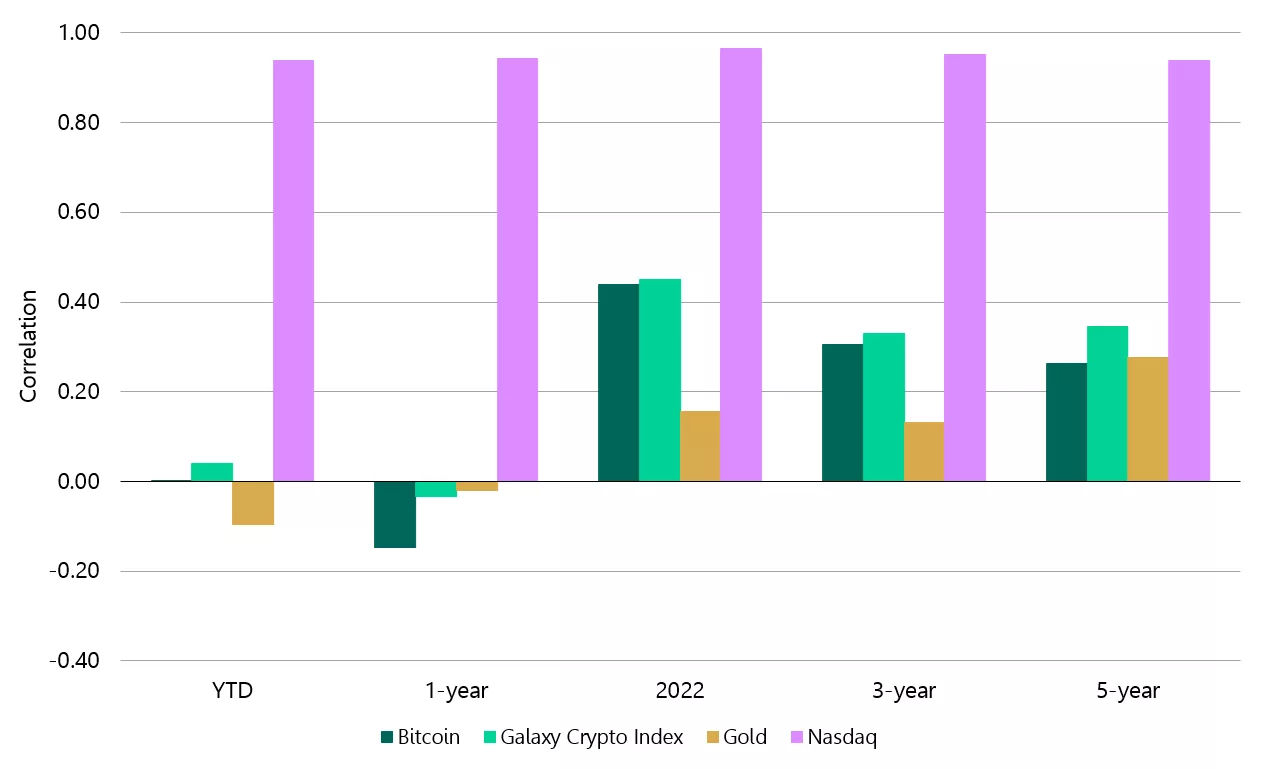

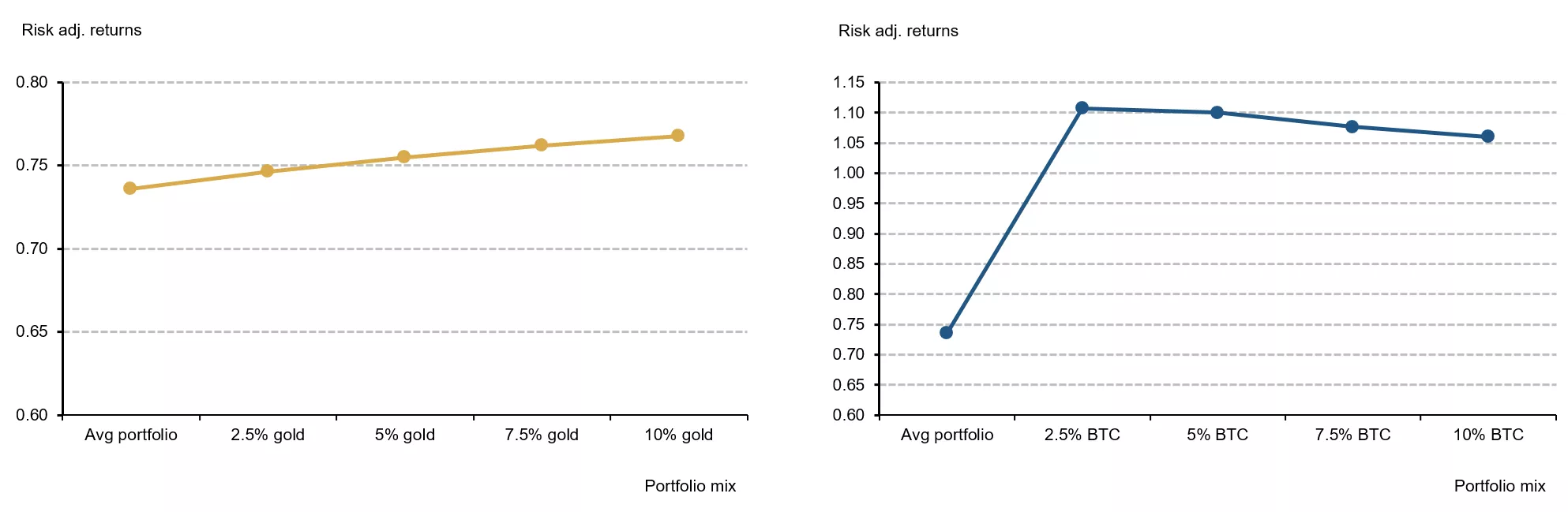

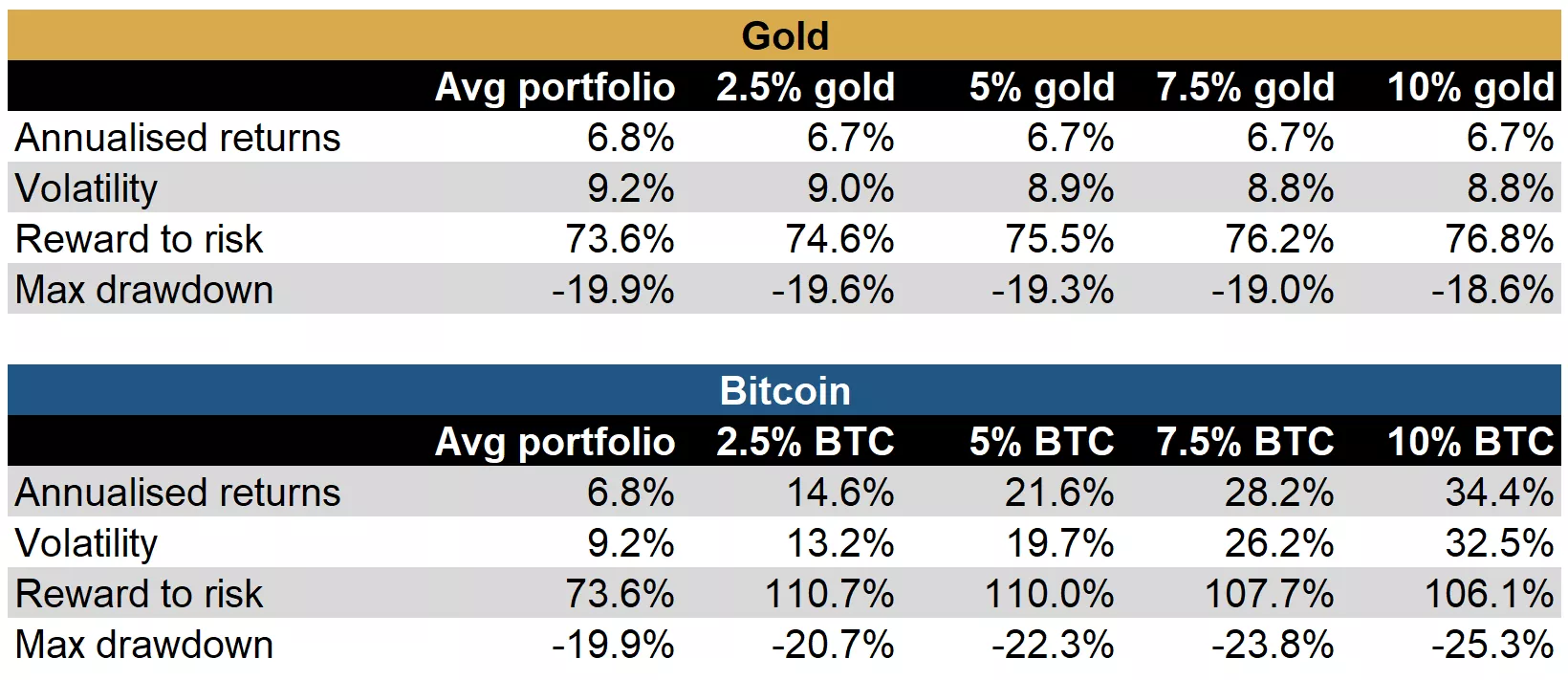

And lastly, let’s examine the returns on a risk adjusted basis using a diversified portfolio to demonstrate the case. We’ve simulated the performance impact on this portfolio by adding an allocation ranging from 2.5% up to 10% and assessed the impact at the varying levels of allocation. It’s clear from our analysis that a gold allocation reduces volatility while providing improved returns and does so consistently even with an increased level of allocation. However, that is not the case for bitcoin. The more you allocate, the higher the risk.

*Based on US dollar performance between 30 July 2010 and 31 July 2024. The hypothetical average portfolio: 50% allocation to equities (40% MSCI World Net Total Return Index, 5% MSCI EM Net Total Return Index, 5% MSCI World Small Cap Net Total Return Index), 40% allocation to fixed income (20% Bloomberg US Treasury Index, 15% Bloomberg US Corporate Bond Index, 5% Bloomberg US Corporate High Yield Total Return Index) and 10% allocation to alternative assets (3.3% FTSE REITs Index, 3.3% HFRI Hedge Fund Index and 3.3% Bloomberg Commodity Index). The allocation to gold and bitcoin comes from proportionally reducing all assets. Risk-adjusted returns are calculated as the annualized return/annualized volatility. See important disclaimers and disclosures at the end of this report.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

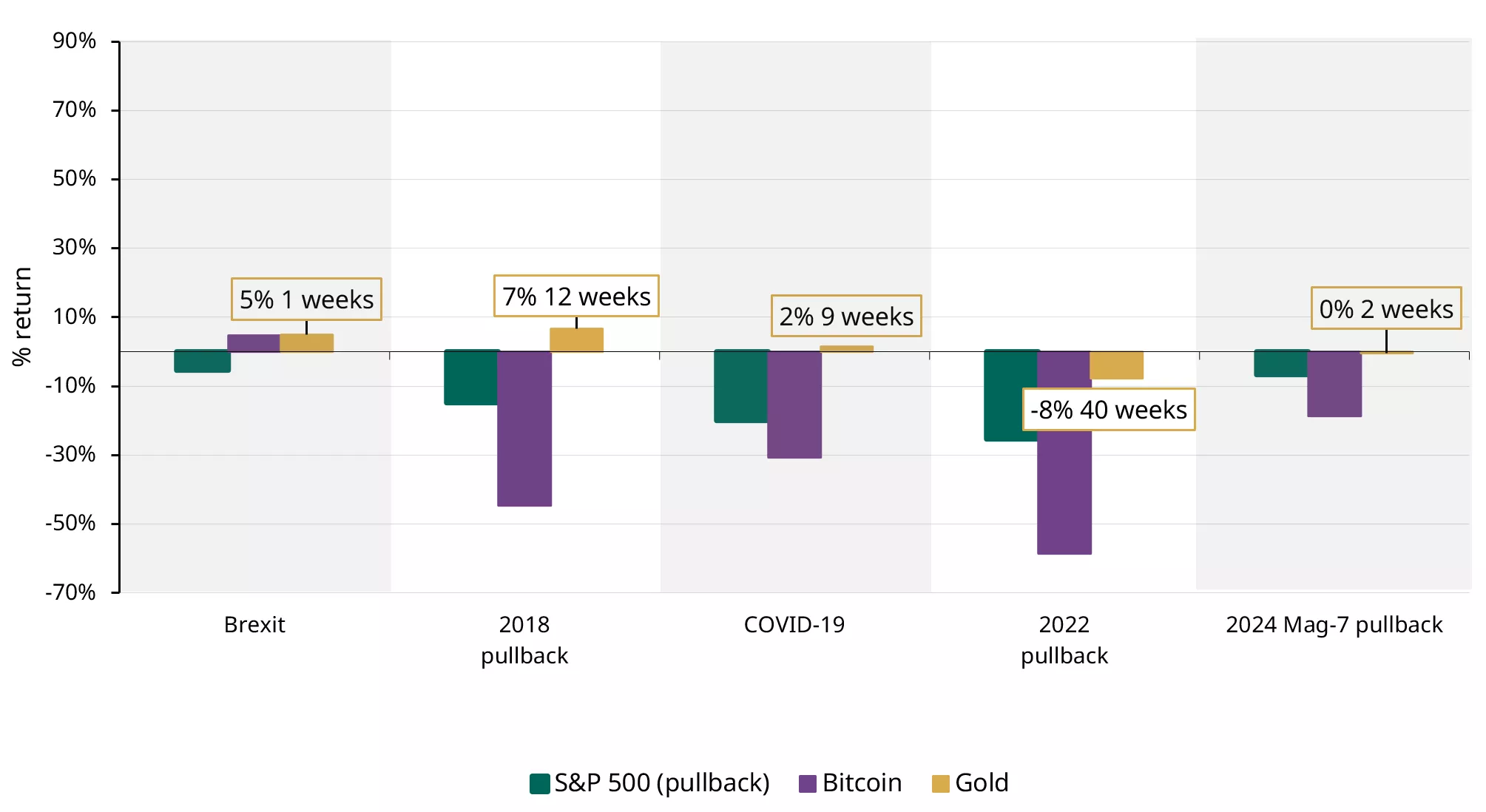

It is critical to remember, and a point amplified during the week of August 5th, that to truly be a safe haven asset, the right kind of performance during significant market drawdowns is key. What you can find is that once established, bitcoin has not demonstrated the same characteristics as gold at those critical moments. When you expect protection against significant market moves, bitcoin tracked risk assets.

*Sources: Bloomberg, World Gold Council.

*As of 09 August 2024. Return computations in US dollars for ‘S&P 500’: S&P 500 Index; ‘Bitcoin’: Bloomberg Bitcoin Index; ‘Gold’: LBMA Gold Price PM. Dates used: Brexit: 23/6/2016 - 27/6/2016; 2018 pullback: 10/2018 - 12/2018; 2020 pullback: 31/1/2020 - 31/3/2020; 2022 pullback: 1/2022 – 10/2022; 2024 Mag-7 pullback: 23/7/2024 – 05/08/2024.

The addition of gold to a portfolio provides demonstrated diversification, while bitcoin doesn’t offer any genuine diversification: the addition of bitcoin is the same as increasing exposure to high-risk equities (such as tech stocks, further supporting the most common use case for bitcoin being a proxy for blockchain adoption).

*Based on US dollar performance between 30 July 2010 and 31 July 2024. The hypothetical average portfolio: 50% allocation to equities (40% MSCI World Net Total Return Index, 5% MSCI EM Net Total Return Index, 5% MSCI World Small Cap Net Total Return Index), 40% allocation to fixed income (20% Bloomberg US Treasury Index, 15% Bloomberg US Corporate Bond Index, 5% Bloomberg US Corporate High Yield Total Return Index) and 10% allocation to alternative assets (3.3% FTSE REITs Index, 3.3% HFRI Hedge Fund Index and 3.3% Bloomberg Commodity Index). The allocation to gold and bitcoin comes from proportionally reducing all assets. Risk-adjusted returns are calculated as the annualized return/annualized volatility. See important disclaimers and disclosures at the end of this report.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Allocating gold to the portfolio provides an increasing level of risk adjusted return at any level of allocation. Holding it for the past decade (rebalancing as required) would have increased the risk adjusted returns and lowered volatility.

Allocating bitcoin to a portfolio and holding it for the past decade (rebalancing) would have increased the risk adjusted return at a certain level, in this case 2.5%. However, beyond that allocation level, the portfolio volatility would have been higher; drawdowns greater; the risk adjusted return would deteriorate.

The data demonstrates that gold and bitcoin are very different investments, each with unique characteristics and risks. While bitcoin may bring certain benefits to a diversified portfolio, the data shows that it is not an equivalent investment to gold or substitute for gold as it adds risk through increased volatility and returns comparable to high-risk equity assets.