Central Bank Gold Statistics: July 2024

3 September, 2024

Central bank gold demand strengthened in July despite price rise

- Reported net purchases by central banks more than doubled to 37t in July

- The National Bank of Poland was the leading buyer in the month, followed by the Central Bank of Uzbekistan and the Reserve Bank of India (RBI)

- We expect central bank demand for gold to continue in the coming months.

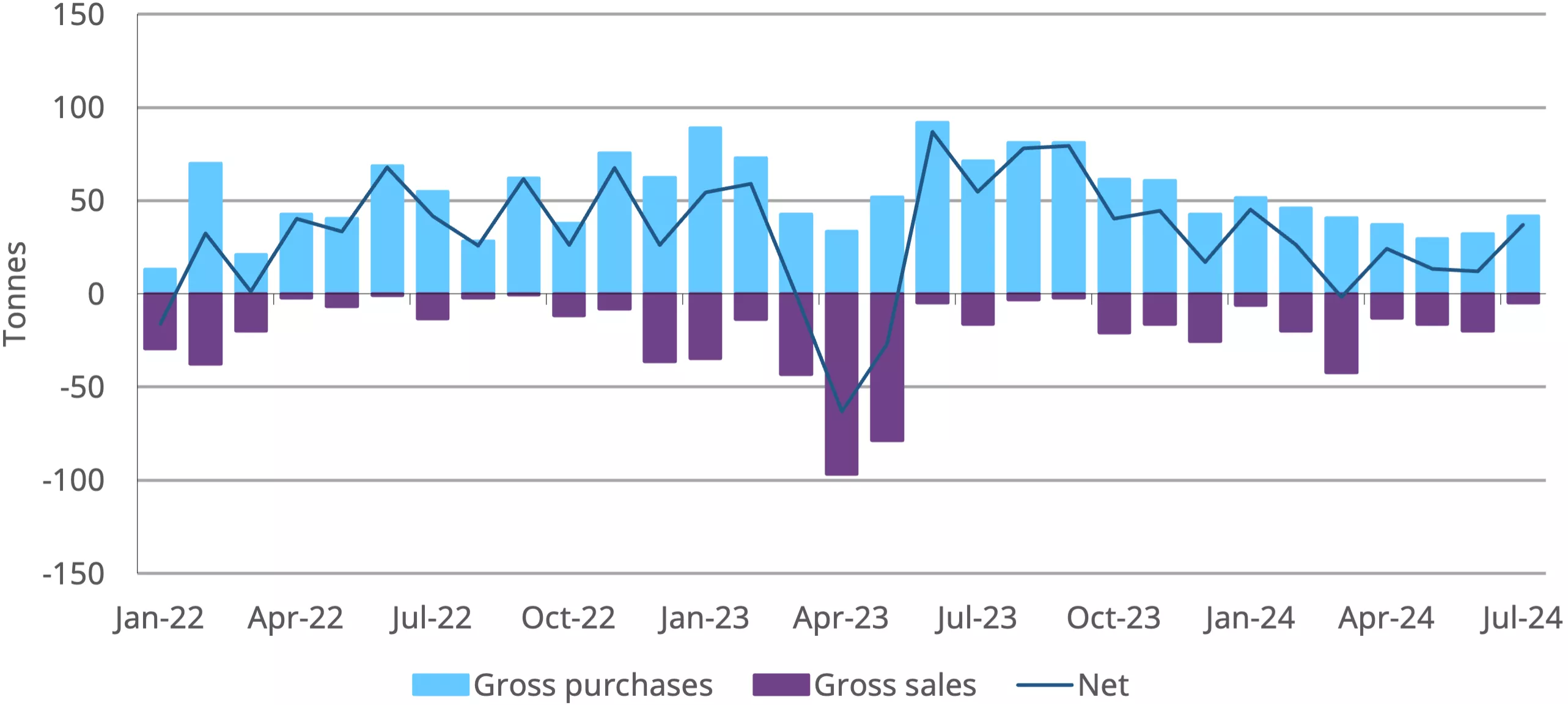

Central banks have shown an ongoing commitment to accumulating gold in recent months. While the overall level of reported demand has cooled as the gold price has continued to rally to new record highs, it has nonetheless remained positive. This commitment continued in July, as global central banks are reported – via the IMF and publicly available data – to have added a net 37t to official reserves. This represents a 206% m/m increase and the highest monthly total since January (45t).

Central bank gold demand picked up in July

Monthly central bank gold demand in tonnes*

*Data as of 31 July 2024 where available.

Source: IMF IFS, respective central banks, World Gold Council

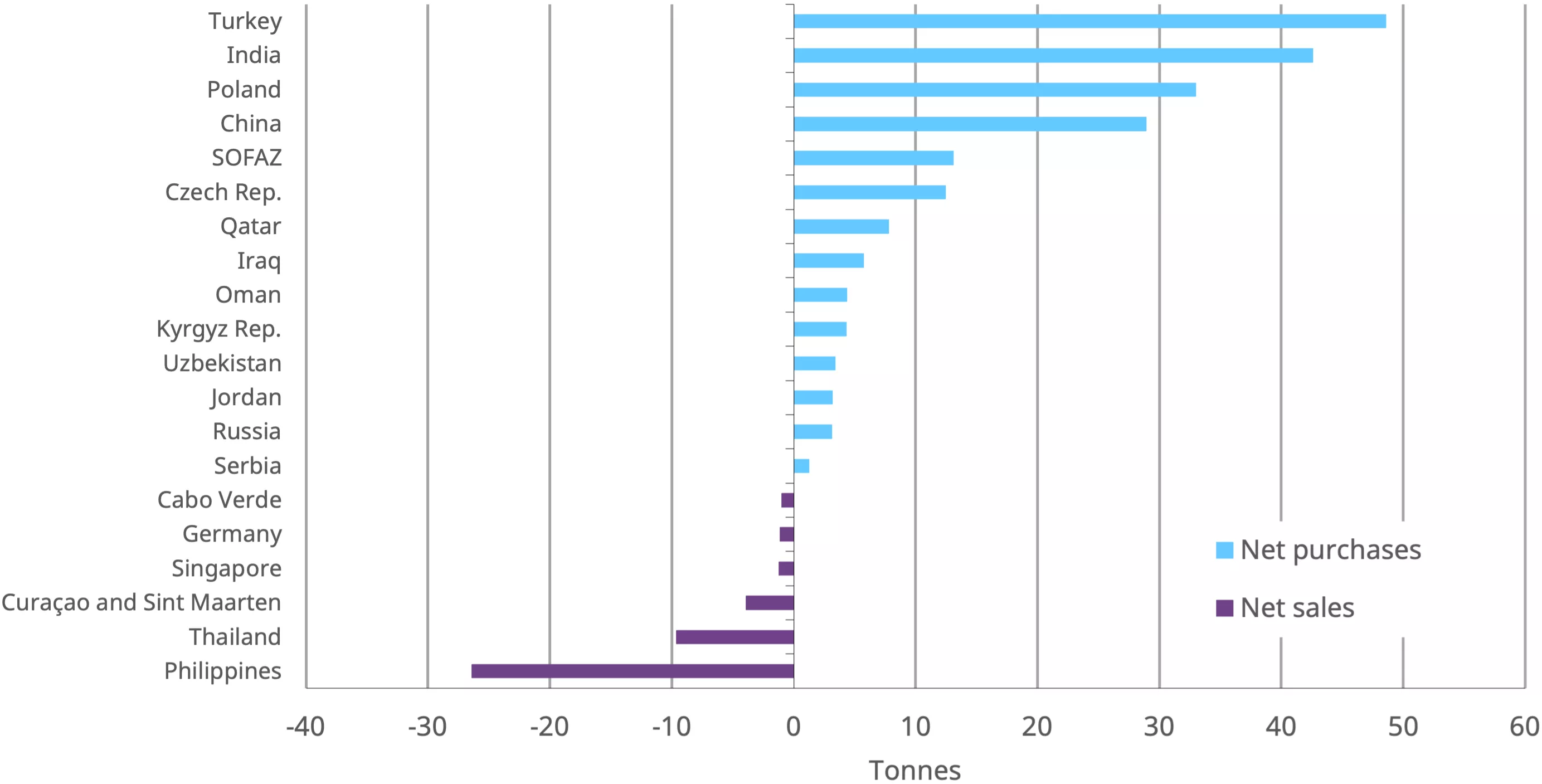

At a country level, activity was limited to those who have been buyers and sellers of late. In total, seven central banks added gold (of a tonne or more) to their reserves in July, while only one central bank reduced its gold holdings.

- The National Bank of Poland was the largest buyer, adding a net 14t, its largest monthly increase since November 2023. This purchase lifted its gold holdings to 392t, or 15% of total reserves. Poland has been on a gold buying spree since April, accumulating 33 tonnes over the last four months

- The Central Bank of Uzbekistan bought 10 tonnes in the month – the second consecutive month of buying – bringing its gold holdings to 375t. July’s purchase has flipped the Central Bank of Uzbekistan from a net seller to a net buyer on a y-t-d basis (+3t)

- Estimates based on weekly data suggest that the Reserve Bank of India’s gold reserves rose by 5t in July, meaning the RBI has now added gold every month so far this year. Y-t-d net purchases of gold total 43t, and have lifted its gold holdings to 846 tonnes

- Central Bank of Jordan (CBJ) gold reserves rose by over 4t in July - the third consecutive month of net purchases. On a y-t-d basis, CBJ gold reserves are now up a net 3 tonnes to 74 tonnes

- Data from the Central Bank of Turkey shows that its official (central bank plus Treasury) gold reserves rose by 4t – with 14 consecutive months of net buying. Its official gold reserves amount to a new record high of 589t, eclipsing the previous record of 587t, set in February 2023

- The Qatar Central Bank lifted gold reserves by 2t. This increases its y-t-d net purchases to 8t, and total gold holdings to 109t

- The Czech National Bank (CNB) increased gold reserves by 2t during the month, lifting its total to 43t. The CNB has now added to its gold reserves for 17 consecutive months, with net purchases totalling over 31t during this period

- Based on available data at the time of publication, the Central Bank of Kazakhstan was the only net seller in July. Its gold reserves fell by 4t, reducing its gold holdings to 295t or 55% of total reserves.

One other noteworthy change relates to the State Oil Fund of Azerbaijan (SOFAZ) – the only sovereign wealth fund in our data set.1 Second quarter results show that its gold holdings rose by 10 tonnes between April and June, representing the biggest quarterly increase in gold holdings since Q2'19 (+23.7 tonnes). Total gold holdings at the end of Q2'24 were 114.9 tonnes, 13t higher than at the end of 2023.

Gold buying continues to heavily outweigh sales this year

Y-t-d central bank gold purchases/sales in tonnes*

*Data as of 31 July 2024 where available.

Source: IMF IFS, respective central banks, World Gold Council

While the gold price rally is very likely having some impact on central bank gold demand this year, the longstanding trend of net buying remains intact. This reinforces the findings from our latest central bank survey, which highlights several reasons (such as gold’s role as a store of value and its performance in times of crisis) why, despite the elevated price, central banks are still keen to accumulate gold. Based on these findings, we continue to be confident in our expectation that more buying is to come.

Footnotes

1Currently, SOFAZ is the sole sovereign wealth fund in our data set as it is the only one we are aware of which publicly discloses its gold holdings.