Central Bank Gold Statistics: October 2024

4 December, 2024

Published 4 December 2024, updated 17 December 2024.

Central bank gold buying ramps up in October

Turkey, India and Poland lead net buying y-t-d

- Central banks reported 47t of net purchases this month – the highest amount recorded y-t-d1

- The Central Bank of Turkey led the field, adding 17t of gold to its reserves, followed by India and Poland – 14t and 8t respectively

- The National Bank of Kazakhstan recorded its first monthly net buying (4t) after five consecutive months of reducing gold holdings

- Based on currently available IMF data, reported net sales were negligible this month.

The October tally almost doubled that of the 12-month average with the Central Bank of Turkey leading both y-t-d purchases and those reported during the month. Turky added 17t in October, bringing its total gold purchases to 72t y-t-d. Emerging market central banks continued to dominate the market with Poland and India adding 68t and 64t y-t-d to their gold reserves respectively. These three central banks alone account for 70% of total global net purchases reported this year.

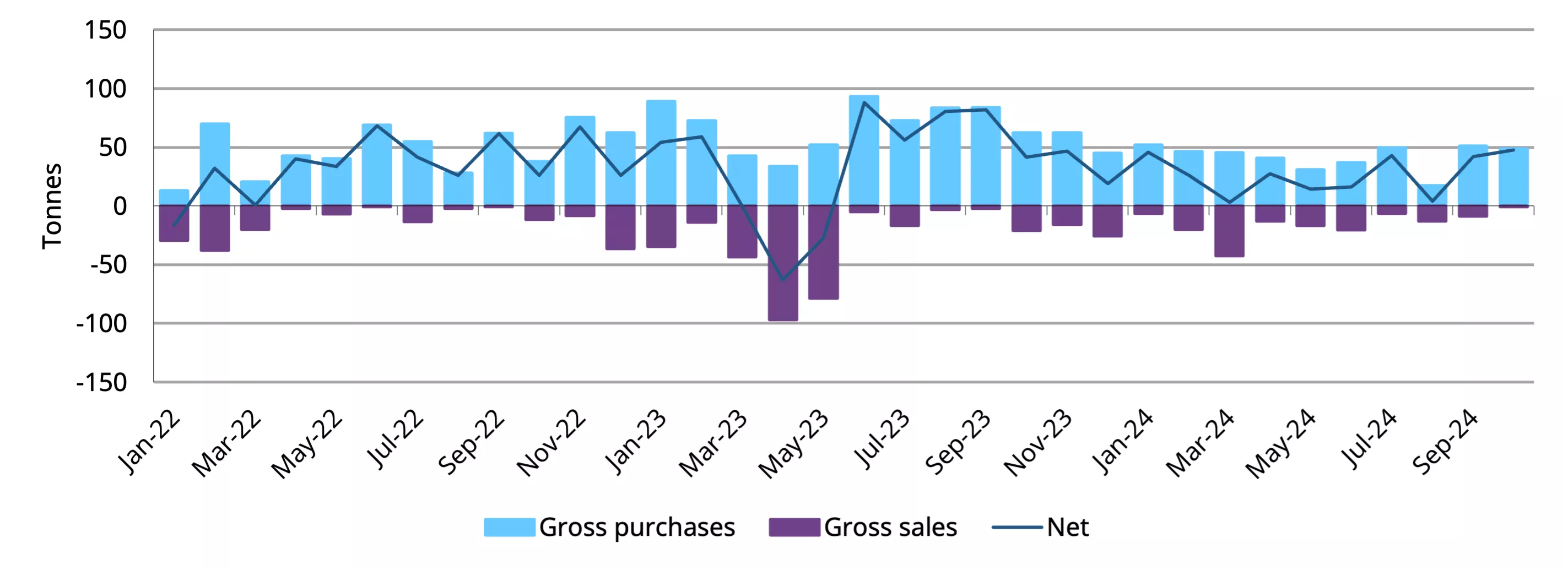

Highest monthly net buying for 2024 recorded in October

Monthly reported central bank activity, tonnes*

*Data to 31 October 2024 where available. Note: chart includes only purchases/sales of 0.5t or more.

Source: IMF IFS, respective central banks, World Gold Council

Other than Turkey, several central banks reported net increases (of a tonne or more) to their gold reserves in October.

- The Reserve Bank of India added 14t – the highest reported monthly figure since October 2021. On a y-t-d basis India has added 64t, representing a four-fold increase on its 2023 activity.

- The National Bank of Poland recorded net buying of 8t during the month, its seventh consecutive month of net buying. On a y-t-d basis, Poland added 69t, making up 17% of its total reserves. The NBP's annual report2 highlights its commitment to accumulating gold, with the central bank targeting a 20% allocation as a percentage of its total official reserve assets

- The National Bank of Kazakhstan added 5t of gold to its reserves after five months of net selling. However, Kazakhstan remains a net seller y-t-d, down 4t in 2024

- The Czech National Bank (CNB) added 2t of gold, making October its 20th consecutive month of net buying. The CNB has accumulated 37t of gold over this period, lifting its total gold reserves to 49t

- Kyrgyzstan added 2t of gold to its reserves, bringing its y-t-d purchases close to 6t and making October the highest reported monthly net buying on record since September 2023

- Data made available by the Bank of Ghana shows that its gold reserves now amount to 28t. The country’s gold reserves have increased steadily since May 2023, when they stood at just under 9t. Ghana added a further 1t during the month.

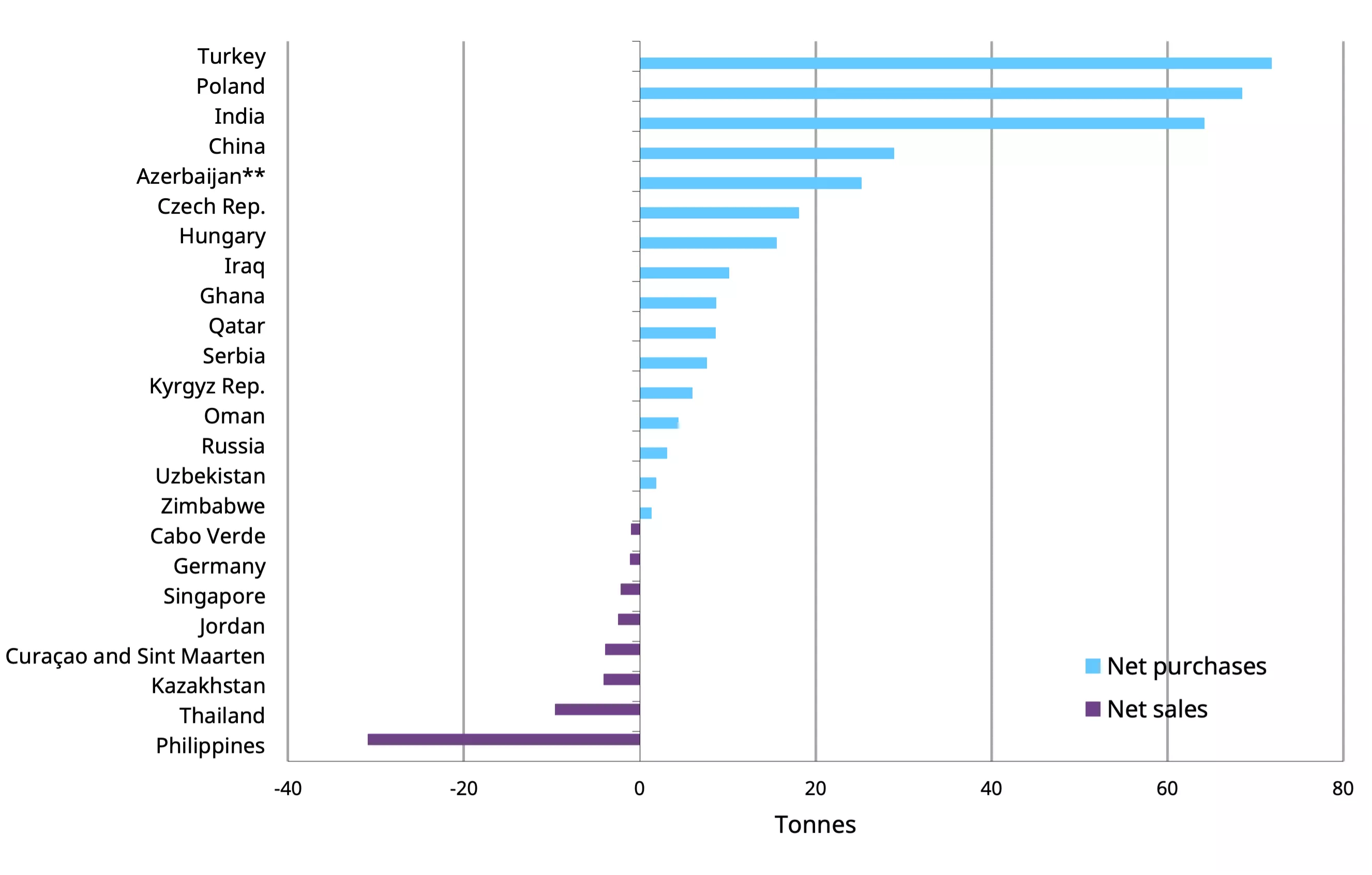

Y-t-d central bank net purchases and sales*

*Data to 31 October 2024 where available. Note: chart includes only purchases/sales of 0.5t or more.

Source: IMF IFS, respective central banks, World Gold Council

Central bank demand remains robust, with y-t-d (reported and unreported) buying reaching 694t by Q3 2024 – comparable to levels seen in 2022. While rising gold prices appear to have inhibited some buying and prompted tactical sales over recent months, October's rebound in reported activity signals continued interest from central banks to accumulate gold within their reserve portfolios. This reaffirms the role gold plays as a strategic asset for central banks to manage risks and diversify reserves.

Footnotes

1Based on reported monthly data from the International Monetary Fund (IMF). This blog was updated on 17 December 2024 to reflect the correct increase in Reserve Bank of India gold reserves (in tonnage terms) in November and year-to-date.

Disclaimer

Copyright and other rights

© 2024 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

Any references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. All third-party content is the intellectual property of the respective third party and all rights are reserved to such party.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate intellectual property owners, except as specifically provided below.

Use of any statistics in this information is permitted for the purposes of review and commentary in line with fair industry practice, subject to the following pre-conditions: (i) only limited extracts may be used; and (ii) any use must be accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus, Refinitiv GFMS, or other identified third party, as their source.

World Gold Council does not guarantee the accuracy or completeness of any information and does not accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is not a recommendation or an offer for the purchase or sale of gold or any products, services, or securities.

This information contains forward-looking statements which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There is no assurance that any forward-looking statements will be achieved.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither WGC nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.