Central bank gold statistics: November 2024

6 January, 2025

Published 6 January 2025.

Central banks continue their great gold grab in November

- Based on available reported data, central banks bought a net 53t in November

- The National Bank of Poland (21t) was the biggest buyer, while the People's Bank of China reported its first addition (5t) since April

- The Monetary Authority of Singapore was the biggest seller during the month, while the Bank of Finland also announced a reduction in its gold reserves.

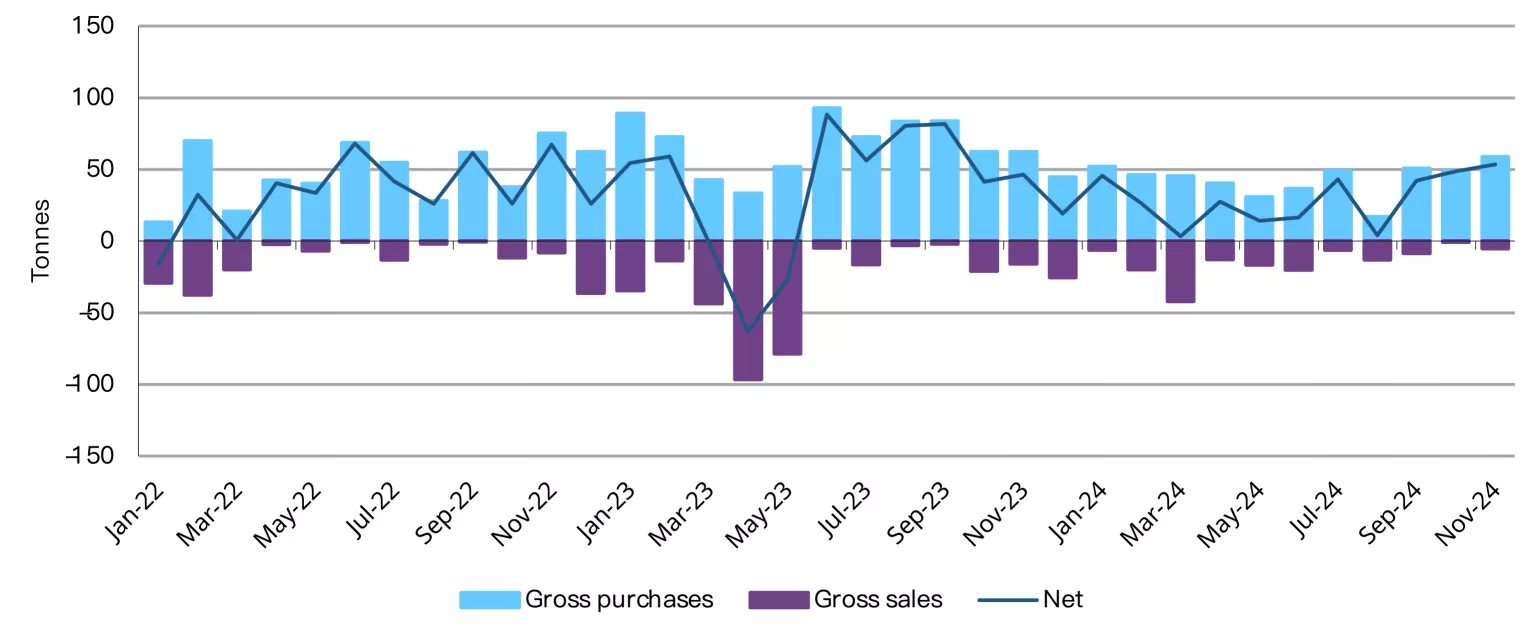

Assessing the final act of 2024, central banks around the world continued to play a leading role in the demand for gold. November represented another solid month of gold buying as central banks collectively added a net 53t to global official holdings based on available reported data. This extends the broader trend observed throughout this year where central banks – mostly those from emerging markets – have remained keen buyers of gold, driven by the need for a stable and secure asset amid global economic uncertainties.

Chart 1: Official gold reserves rose by a further 53t in November

Monthly reported central bank activity, tonnes*

*Data to 30 November 2024 where available.

Source: IMF IFS, respective central banks, World Gold Council

The gold price dip in November, following the US election, may have provided some central banks with added impetus to accumulate. At a country level, much of the buying was limited to those who have been active in recent months:

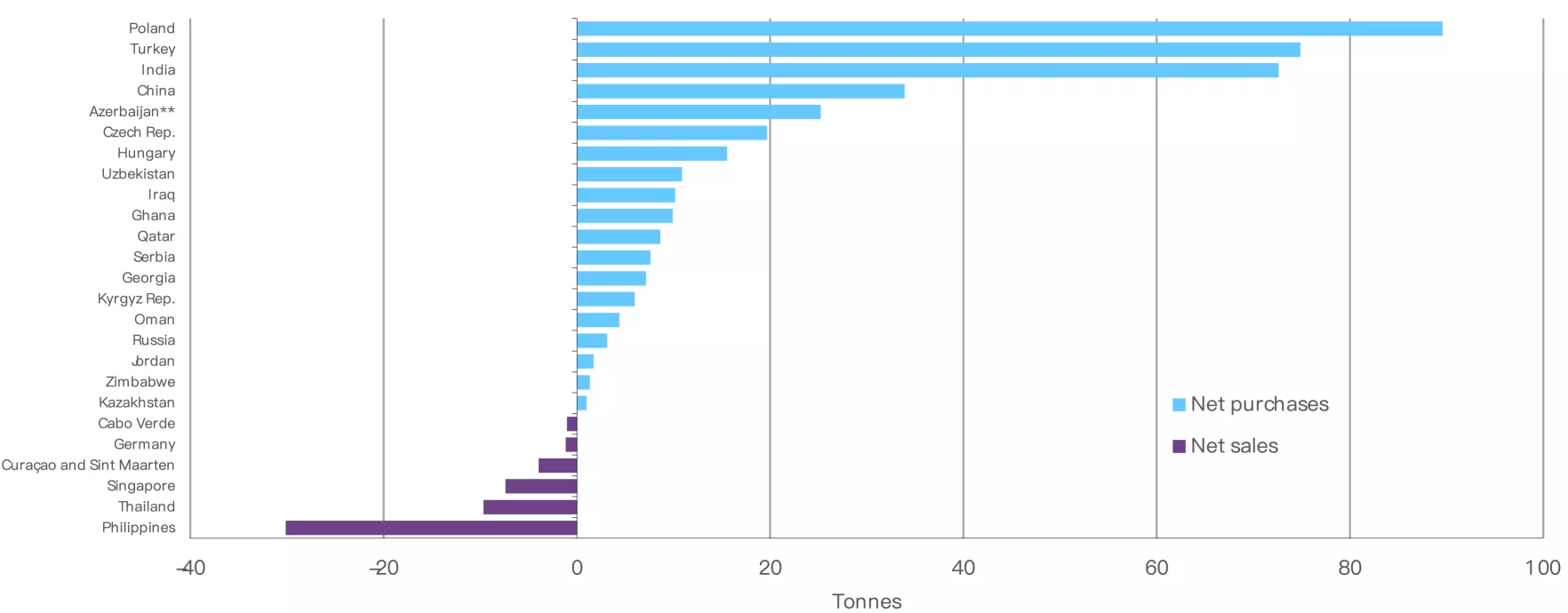

- The National Bank of Poland (NBP) was once again a major buyer. It increased its gold reserves by 21t in November, to 448t. Gold now accounts for almost 18% of its total reserves, just below the previously stated target of 20%.1 This purchase also cemented the NBP’s position as the leading gold buyer on a y-t-d basis (90t)

- Data published by the Central Bank of Uzbekistan shows its gold reserves rose by 9t during the month – the first monthly addition since July. As a result, the bank’s y-t-d net purchases now total 11t and total gold holdings amount to 382t

- The Reserve Bank of India continued its 2024 buying streak, adding a further 8t to its gold reserves in November. This lifts y-t-d buying to 73t and total gold holdings to 876t, maintaining its position as the second largest buyer in 2024 after Poland2

- The National Bank of Kazakhstan increased its gold reserves by 5t, the second successive month of buying. As a result, the bank has flipped to being a net purchaser (1t) y-t-d, with total gold holdings now standing at 295t

- One of the most notable developments during the month was the announcement that the People's Bank of China (PBoC) had resumed gold purchases. After a six-month hiatus, the PBoC added 5t of gold to its reserves, increasing its y-t-d net purchases to 34t and its total reported gold holdings to 2,264t (5% of total reserves)

- Data published by the Central Bank of Jordan shows its gold reserves rose by over 4t in November - the first monthly increase since July. Y-t-d net purchases now total nearly 2t, lifting gold holdings to 73t

- The Central Bank of Turkey increased its gold reserves by 3t during the month. The central bank also entered into reverse swap agreements (gold for lira) with domestic commercial banks to manage liquidity

- Gold reserves held by the Czech National Bank rose by almost 2t in November – the 21st consecutive month of buying. Y-t-d net purchases now total almost 20t, lifting gold holdings to just above 50t

- The Bank of Ghana continued its gold accumulation as part of its domestic gold purchase programme, adding a further 1t in November. Y-t-d net purchases now total almost 10t, lifting total gold holdings to 29t. The bank also launched a Ghana Gold Coin to the public during the month as part of its “efforts to stabilise the economy and promote investment in Ghana’s gold reserves”3

- The Monetary Authority of Singapore was the month’s largest seller, reducing its gold reserves by 5t, bringing y-t-d net sales to 7t and overall gold holdings to 223t.

It was also announced in December that gold reserves at the Bank of Finland had been lowered by 10% to 44t – the sale most likely taking place during that month. The bank noted that: "Exchange rate risk is the most significant of the Bank of Finland’s financial asset risks. Increasing the size of its foreign exchange reserves elevates the Bank’s exchange rate risk considerably, and so the Bank is strengthening its foreign exchange rate provision by selling about 10% of its gold reserves".4This brings the bank’s gold reserves to their lowest level since December 1984.

Chart 2: Net purchases continue to heavily outweigh net sales in 2024

Y-t-d central bank net purchases and sales*

*Data to 30 November 2024 where available. Note: chart includes only purchases/sales of 1t or more. **Represents the gold reserves of the State Oil Fund of Azerbaijan (SOFAZ).

Source: IMF IFS, respective central banks, World Gold Council

Although we await the remaining 2024 data, the broad sustained interest in gold from central banks this year has clearly highlighted the metal’s enduring appeal. With only December data yet to be revealed, central banks will no doubt be substantial net purchasers for the 15th consecutive year. A performance fully deserving of a curtain call.

Don’t forget, our next Gold Demand Trends report will be published on 5 February 2025, in which we will review central bank gold demand for 2024 as a whole.

Footnotes

1tvpworld.com/77461458/poland-to-dramatically-boost-gold-reserves

2Our initial estimate for RBI buying in October (27t) was updated on 17 December 2024 to reflect the correct increase in gold reserves (14t).

3www.modernghana.com/news/1360389/bogs-gold-coin-launched-prices-range-from-gh11.html

4http://www.suomenpankki.fi/en/news-and-topical/press-releases-and-news/releases/2024/bank-of-finland-increases-its-foreign-exchange-reserves

Disclaimer

Copyright and other rights

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

Any references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. All third-party content is the intellectual property of the respective third party and all rights are reserved to such party.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate intellectual property owners, except as specifically provided below.

Use of any statistics in this information is permitted for the purposes of review and commentary in line with fair industry practice, subject to the following pre-conditions: (i) only limited extracts may be used; and (ii) any use must be accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus, Refinitiv GFMS, or other identified third party, as their source.

World Gold Council does not guarantee the accuracy or completeness of any information and does not accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is not a recommendation or an offer for the purchase or sale of gold or any products, services, or securities.

This information contains forward-looking statements which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There is no assurance that any forward-looking statements will be achieved.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither WGC nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.