Gold’s 2024 performance best in 14 years

3 January, 2025

Gold performed exceptionally well in 2024, outperforming all major asset classes and proving to be a strong portfolio diversifier. Over the course of the year the LBMA Gold Price PM set 40 new all-time highs (ATH), the most recent of which was US$2,777.80/oz on 30 October.

Gold rose 25.5% in 2024, likely due to its role as an effective hedge against the heightened geopolitical uncertainty and market volatility experienced this year.

According to our Gold Return Attribution Model, gold’s positive performance was linked to the following key factors:

- Strong central bank and investor demand, which offset declining consumer demand

- Heightened geopolitical risk due to increased conflicts, along with a busy electoral year across the world

- Periods of opportunity costs when markets saw lower yields and a weakening US dollar.

Market consensus expectations suggest a more modest performance for gold in 2025, but with the potential for upside catalysts as the year unfolds. As you prepare for the year ahead, take a look at our 2025 Outlook where we outline potential scenarios and their impact on gold.

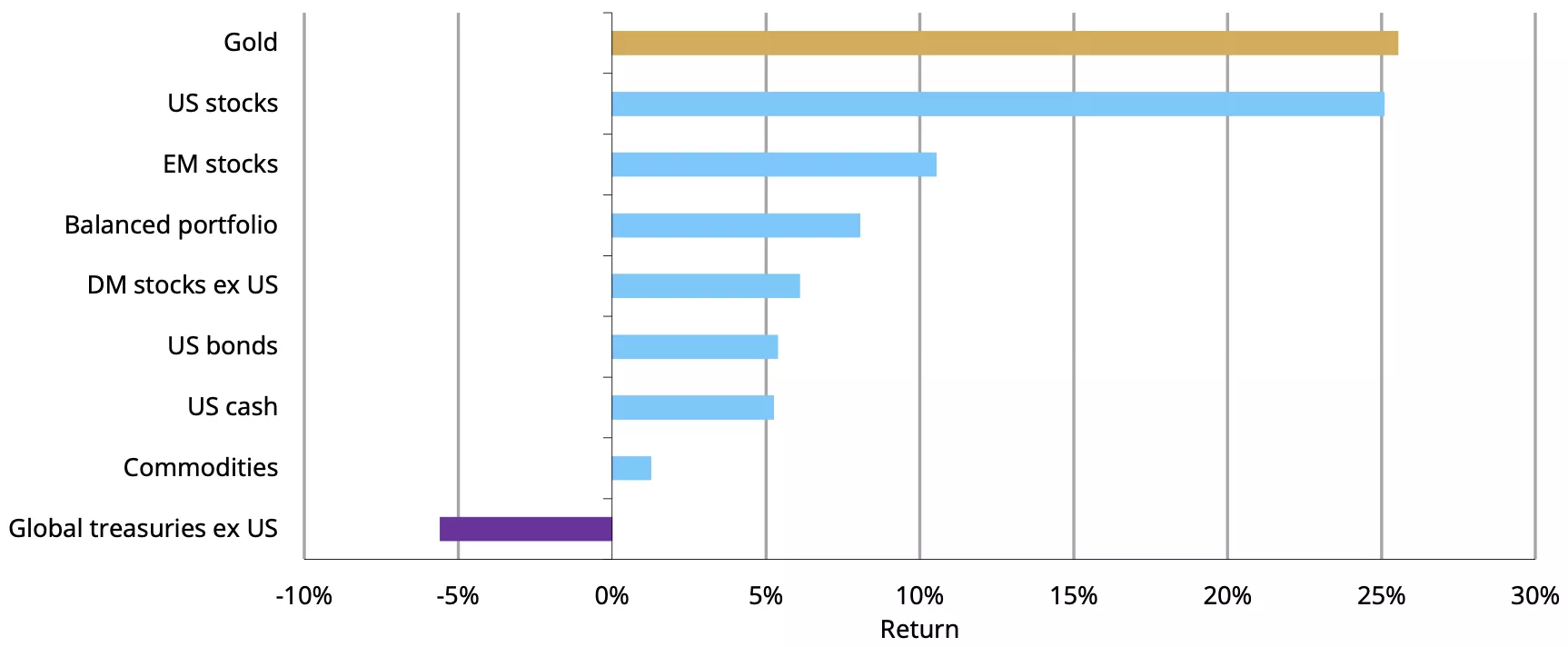

Chart 1: Gold outperformed all major asset classes in 2024

*Data as of 31 December 2024. Indices used Bloomberg Barclays Global Treasury ex US, Bloomberg Barclays US Bond Aggregate, ICE BofA US 3-Month Treasury Bills, New Frontier Global Institutional Portfolio Index, MSCI World ex US Total Return Index, Bloomberg Commodity Total Return Index, MSCI EM Total Return Index, LBMA Gold Price PM (USD/oz), MSCI US Total Return Index.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council