You asked, we answered: Is the threat of US tariffs moving the gold market?

27 February, 2025

Key highlights

- The gold market has seen a significant rise in COMEX gold inventories, along with a widening of the spread between futures and spot prices, sparked by tariff uncertainty

- This, combined with reports of falling inventories in London, has fuelled speculation about stability in the gold market

- Events like these have happened before and the market has normalised

- As such, we believe that the disruptions will likely ease… although the current environment of elevated geoeconomic risks could result in intermittent spikes

- Most importantly, despite all the noise, the gold spot market has remained well behaved – and has generally benefited from flight-to-quality flows.

Gold bullion flows West amidst tariff uncertainty

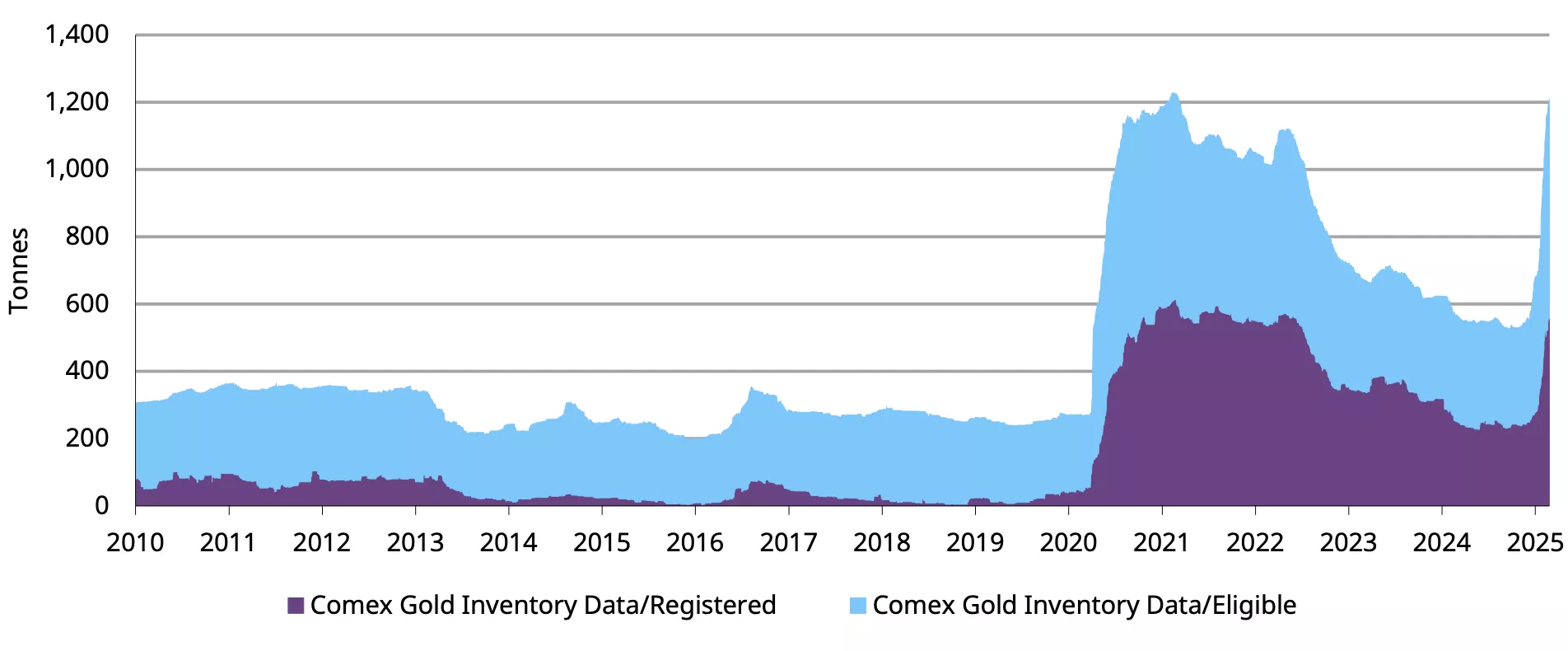

In late 2024 COMEX inventories started to rise as concerns grew that tariffs could impact gold imports.1 This surge of gold imports into the US caught many gold market observers by surprise, as the country is (more or less) self-sufficient in its gold needs, being both a significant producer and a consumer.2 While gold itself hasn’t been directly targeted, speculation and shifting risk management strategies amid concerns of broad-based tariffs have still had a noticeable impact on prices and trading patterns. This trend has continued into early 2025 and, as of date, COMEX registered and eligible inventories have increased by nearly 300t (9mn oz) and more than 500t (17mn oz), respectively (Chart 1).

Chart 1: COMEX gold inventories reach COVID highs

Reported COMEX inventories for registered and eligible gold*

*Data to 24 February 2025. Note: Registered metals are those metals which meet the standards for delivery under the gold, silver, copper, or aluminium futures contracts and for which a receipt from an exchange-approved depository or warehouse has been issued. Eligible metals are those which meet the delivery standards as stated in the rules for which no receipt from an exchange-approved warehouse has been issued.

Source: Bloomberg, World Gold Council

By way of context, short-term speculators and some investors often hold large net-long gold futures positions on the COMEX futures market, while banks and other financial institutions short these futures contracts as counterparties. But these financial institutions are generally not short gold; instead, they run long over-the-counter (OTC) positions to hedge their futures shorts. And because physical gold is more often found in the London OTC market – as a large trading hub and often a cheaper location in which to vault gold – financial institutions typically prefer to hold these hedges in London, knowing that they can quickly – in normal market times – ship gold to the US when there is a need. In recent months, many traders have chosen to pre-empt the threat of tariffs by moving gold to the US, thus avoiding the possibility that they may have to pay higher charges.

Alongside the increase in inventories, the price of COMEX gold futures contracts – and their spread to spot gold traded in London – also rose, with traders factoring in potential tariff-related costs. For example, the spread between the COMEX active gold futures contract and gold spot reached as much as US$40/oz to US$50/oz (140-180 bps), significantly above the US$13/oz (60 bps) average from the past two years.3

Now…this is not new. COMEX inventories – and the differential between futures and spot prices – have risen before, most notably at the onset of the COVID pandemic.

The main question from investors, amidst reports of falling inventories, is: can gold’s largest OTC trading hub, London, cope with the market disruption? We can look at past examples for guidance and analyse all the currently available data to offer an informed opinion – considering, of course, the heightened level of uncertainty all financial markets are experiencing in the current environment.

London inventories have fallen… but not as much as some think

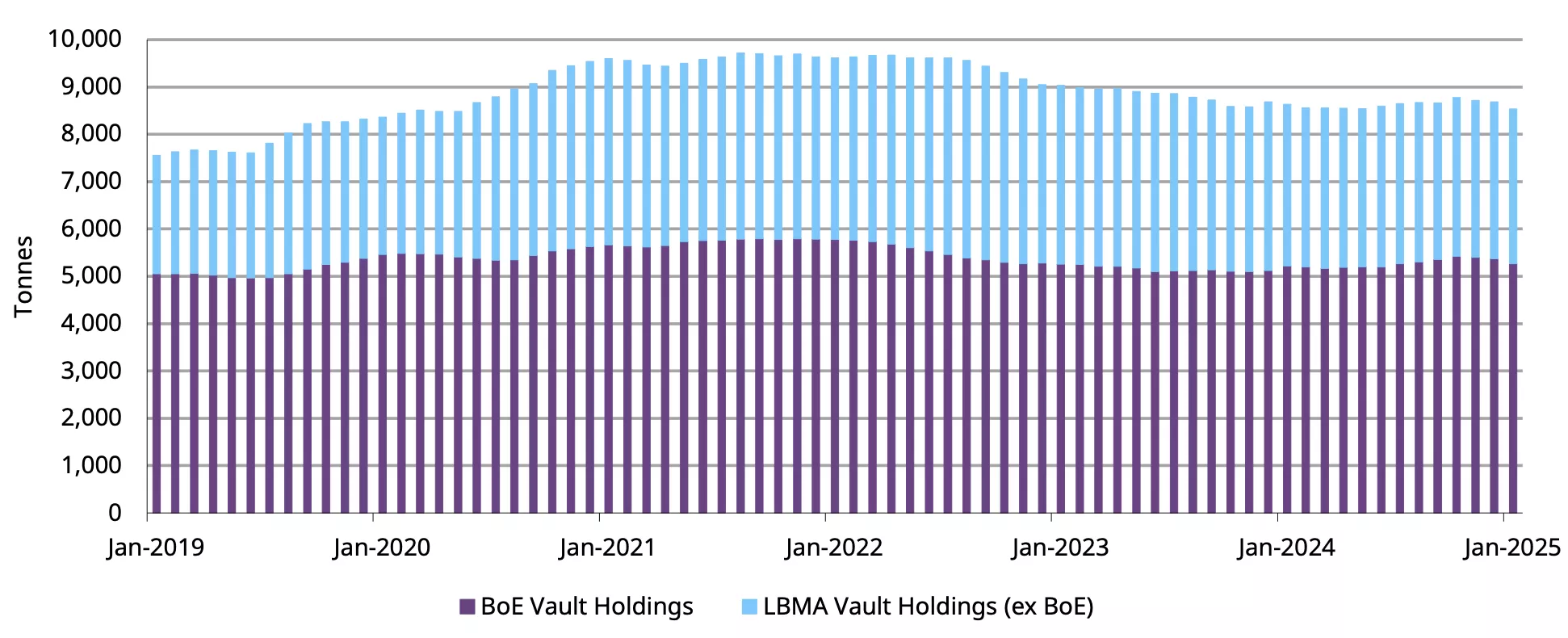

As COMEX inventories rose during COVID, London inventories fell. And both eventually normalised. At present, total LBMA reported inventories stand at approx. 8,500t (Chart 2), out of which approx. 5,200t are held at the Bank of England (BoE). And while there are reports of queues to retrieve gold, it is important to note that BoE operates differently from commercial vaults – longer wait times create a perception of scarcity that is more likely explained by logistics.4

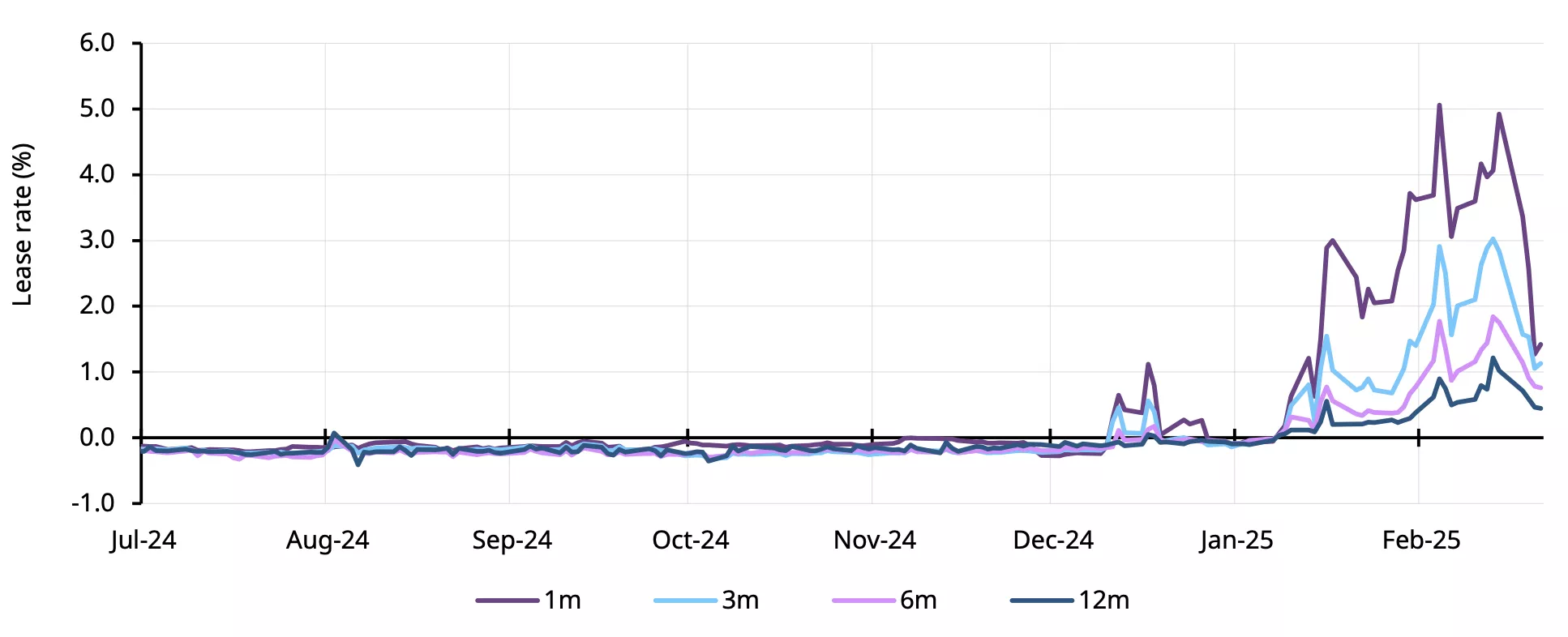

Another consequence has been an increase in gold’s lending rate. A calculation based on overnight borrowing rates and gold swap rates, as a proxy, suggests that one-month lease rates reached as high as 5% during January, reflecting ‘tightness’ in the London gold market (Chart 3).

Chart 2: Gold vaulted in London has dropped but remains above its 2020 level

Estimated gold stock in London, tonnes*

*Data to 31 January 2025.

Source: Bank of England, London Bullion Market Association, World Gold Council

Gold’s diverse sources of supply can promote normalisation

Trade data from the Census Bureau suggests that a good portion of gold flowing into the US comes from Switzerland. In turn, some of this gold could have originated in the UK as it needs to be refined from Good Delivery (~400 oz) bars into 1 kg bars – the weight accepted for delivery into COMEX futures.5 Other sources of gold include Canada, Latin America, Australia and, to a lesser degree, Hong Kong. And then there’s gold from domestic mine production – the US being the fifth largest producer globally – which can be refined locally.

Of course, gold flowing into the US from around the world may limit the amount of gold going into other markets, including London, but we believe that the impact should be temporary. This is especially true as gold has multiple sources of supply – mine production and recycling – spread around the world, reducing the reliance on imported gold to meet local demand in the medium term.

A few signs of normality are starting to emerge: the buildup of COMEX inventories has slowed; the spread differential between gold futures and spot prices is falling,6 and the bid-ask spread for gold ETFs – many of which vault their gold in London – remain well behaved.7 In addition, the lease rates also seems to be cooling down, with data suggesting it is now closer to 1% and well below January’s record high (Chart 3).

While part of gold’s strong price performance could be attributed to momentum, our analysis suggests that it has been supported by flight-to-quality flows amid increased financial market volatility driven by geoeconomic and geopolitical concerns.8

Chart 3: Gold lease rates have cooled after reaching record highs

Indicative gold lease rates*

*Data to 21 February 2025. Indicative lease rates estimated by subtracting the gold swap rate from the Secured Overnight Financing Rate (SOFR) forwards for various tenors.

Source: Bloomberg, World Gold Council

In summary

Gold has not been a direct target of tariffs, but market reactions to trade uncertainty has driven a significant shift in trading behaviour and impacted the gold price. The movement of gold from London to the US, rising COMEX premiums and concerns over availability were largely the result of risk management decisions rather than true supply issues.

Now that COMEX inventories appear to be well-stocked and the backlog of withdrawals from the BoE continues to be cleared, these disruptions should ease over the coming weeks. However, this period serves as a stark reminder that even indirect trade policy concerns can send ripples through global financial markets.

This may not be the last time we see temporary distortions in the gold market. The signs are, however, that the depth and liquidity of the gold market is able to absorb – over time – most of these shocks.

Footnotes

1See: Unearthed: Gold price soars amid tariff concerns | Post by Unearthed Podcast | Gold Focus blog | World Gold Council

2Trade data from US Census Bureau and our demand/supply estimates imply that the US often alternates between being a net importer or a net exporter, suggesting that the market over the long-term is largely in balance.

3As of 25 February 2025. Estimate based on the difference between the rolling COMEX futures active contract and spot gold price (XAU).

4The Bank of England holds gold on behalf of many central banks and offers gold accounts to commercial banks that conduct business with central banks. See: StoneX Bullion, How much gold is kept in the Bank of England? October 2024. But the bank does not have the staff levels to be able to respond quickly to a sudden increase in demand for gold movements. As Dave Ramsden, Deputy Governor for Markets and Banking at the Bank of England said at a press conference in February, “If you were coming in new to us, you might have to wait a bit longer because all the existing slots are booked up. But this is a very orderly process. It’s an obvious point, but gold is a physical asset, so there are real logistical constraints and security constraints." See: Bloomberg, BOE says tariffs premium is fueling clamor to withdraw gold, February 2025.

5COMEX gold futures also accepts 100 oz bars for delivery, but these are less common in the market as they have fallen out of use.

6The average difference between the COMEX gold actives futures contract and spot gold price was US$20/oz (70bps) during February.

7For example, based on Bloomberg data as of 24 February, GLD’s average spread in 2025 has widened marginally from its 2024 average, and is below some of the levels seen during COVID, while the average spreads of funds such as GLDM, IAU, SGOL, and IGLN among others have remained unchanged over this period.

8Y-t-d, as of 24 February, gold ETFs have amassed inflows of US$10.3bn, increasing holding by 113t – the strongest two-month period in two years.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.