Central banks stay bullish on bullion in January

4 March, 2025

- Central banks reported 18t of net purchases at the start of 2025

- Emerging market central banks remain at the forefront of net buying, with Uzbekistan, China and Kazakhstan the top three buyers

- Poland and India also continue to accumulate gold reserves 2025 – both central banks added 3t to their respective reserves in January.

Central banks continued their strong interest for gold in January with reported net purchases of 18t. The sustained buying highlights the strategic importance of gold in official reserves, particularly as central banks navigate heightened geopolitical risks.

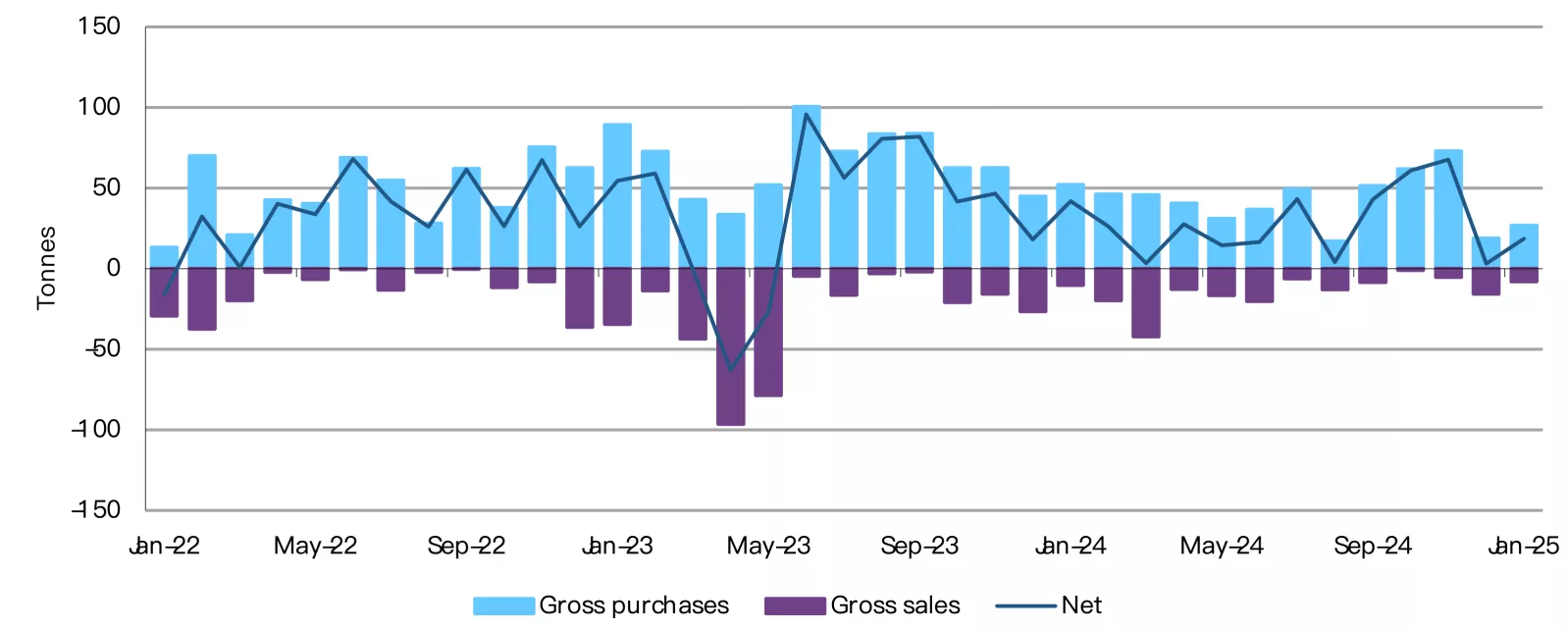

Chart 1: Official gold reserves rose by a further 18t in January

Monthly reported central bank activity, tonnes*

*Data to 31 January 2025, where available. Note: chart includes only purchases/sales of a tonne or more.

Source: IMF IFS, Respective Central Banks, World Gold Council

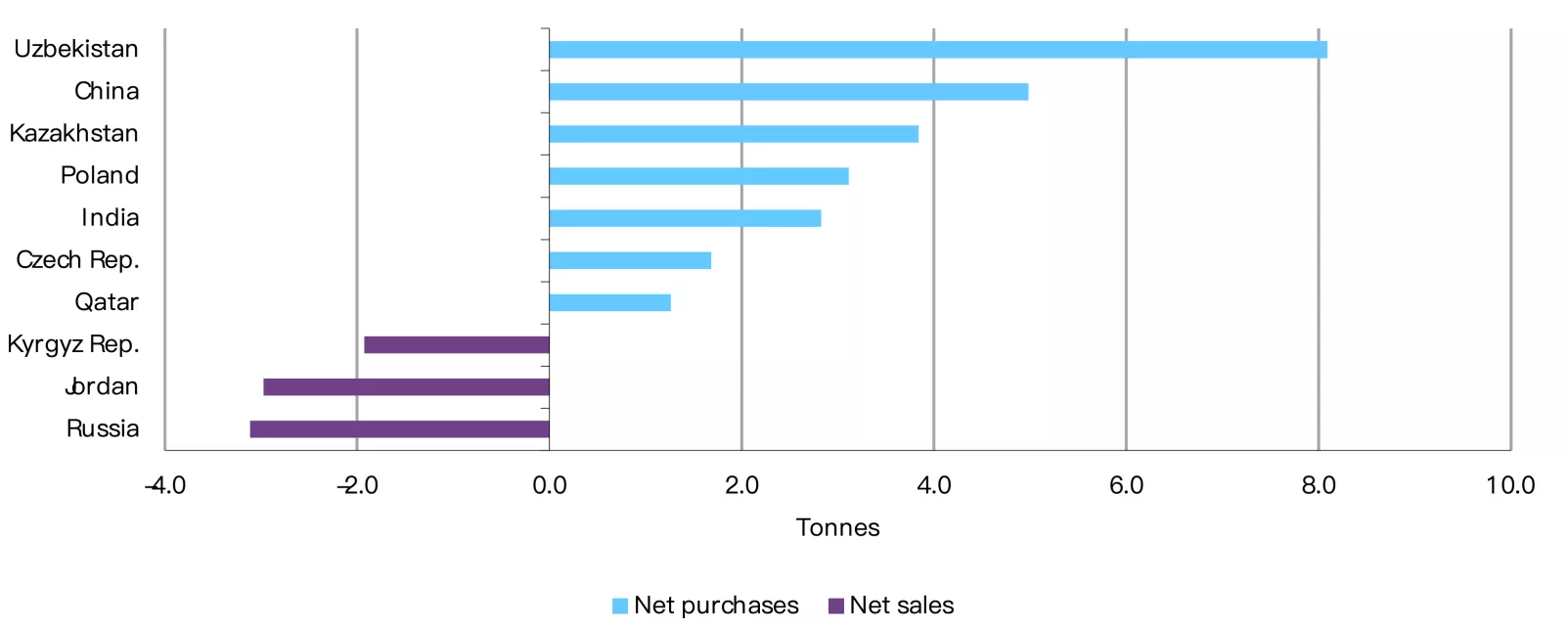

- The Central Bank of Uzbekistan reported 8t net purchases in January, with its gold holdings totalling 391t or 82% of its reserves.

- Sustained appetite at the People’s Bank of China (PBoC), with the central bank reporting its third consecutive month of net buying, adding 5t in January. The PBoC’s gold holdings rose to 2,285t, or 6% of total reserves, at the end of January.

- The National Bank of Kazakhstan (NBK) added 4t of gold to its reserves. At a press briefing on 17 January 2025, NBK Chairman Timur Suleimenov said that the central bank has “been discussing transitioning to monetary neutrality in gold purchases”, with the aim of boosting international reserves and “protect[ing] the economy from external shocks.” The NBK was reported to begin sale of US dollars as part of “mirroring operations related to gold purchases.” Gold holdings for Kazakhstan stood at 288t, which is 55% of its total reserves.

- The National Bank of Poland (3t), the Reserve Bank of India (3t) and the Czech National Bank (2t) and the Qatar Central Bank (1t) continued their net buying into 2025.

- Notable sellers for the month include the Central Bank of Russia and the Central Bank of Jordan, which both sold 3t respectively, and the National Bank of the Kyrgyz Republic which sold 2t.

Chart 2: Central banks appetite for gold resumes in January 2025

Y-t-d central bank net purchases and sales*

*Data to 31 January 2025, where available. Note: chart includes only purchases/sales of a tonne or more.

Source: IMF IFS, Respective Central Banks, World Gold Council

In our recently published 2024 Gold Demand Trends, we noted that central banks continue to play a pivotal role in global gold demand, with their purchasing patterns influenced by both economic and geopolitical shifts. The shift from armed conflict to broader economic tensions has reinforced their net buying trend especially apparent since 2022. Many central banks appear to have strategically leveraged temporary price pullbacks as buying opportunities, while sales have remained limited and largely tactical during price rallies.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.