Ever upwards for AISC, but distinct regional variations are emerging

7 March, 2025

When considering the factors driving up gold miners’ all-in sustaining costs (AISC), Q3’24 was a busy period.

The gold price climbed steadily upwards, trading above US$2,600/oz by quarter end. AISC also continued to rise, up 4% q/q and 9% y/y, to US$1,456/oz, the highest point in our data series back to Q1’10. Lower production, compounded by higher royalty payments and increased sustaining capital expenditures, all helped to drive up AISC. On a regional basis, some differences began to emerge. Africa, Oceania and South America realised the most notable increases, but in North America the rate of growth was much lower, highlighting a mixed scenario for the quarter.

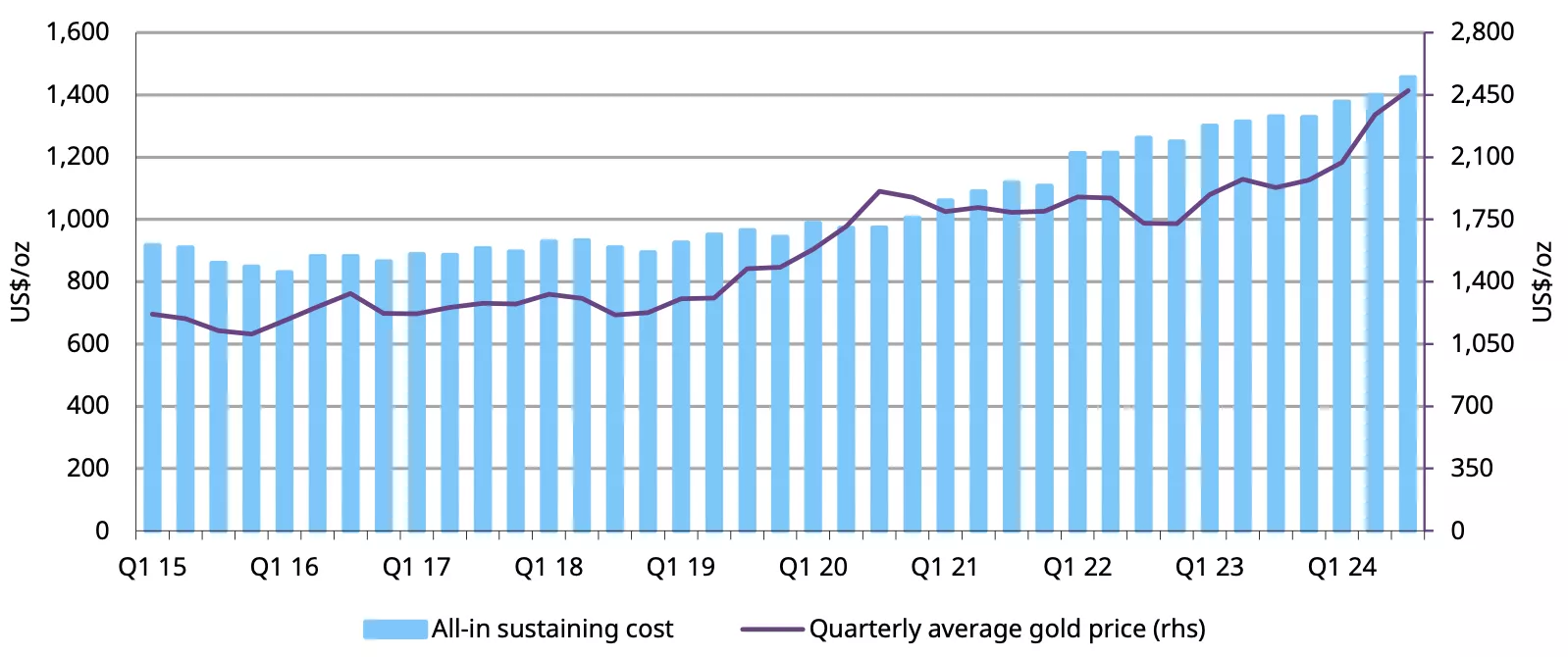

Chart 1: AISC continues to rise as the gold price climbs higher

Quarterly gold price vs. AISC*

*Data as of September 2024.

Source: Bloomberg, ICE Benchmark Administration, Metals Focus Gold Mines Cost Service

In recent decades, as the gold price has strengthened, so too has gold producers’ AISC. Rising prices means marginal, lower grade ore becomes economic. They also lead to higher royalties and mining tax payments as revenues and profits increase. Improving producer margins provide the financial headroom for companies to invest in the recapitalisation of assets and progress mine developments, which can lead to higher sustaining capital expenditure. This occurred in Q3’24 as the global average royalties and mining tax unit cost rose to US$90/oz, up 5% q/q and a significant 31% y/y. The estimated global sustaining capital expenditure unit cost also increased, albeit more modestly, by 3% q/q to US$303/oz. However, on a year-on-year basis, the increase was a substantial 50%.

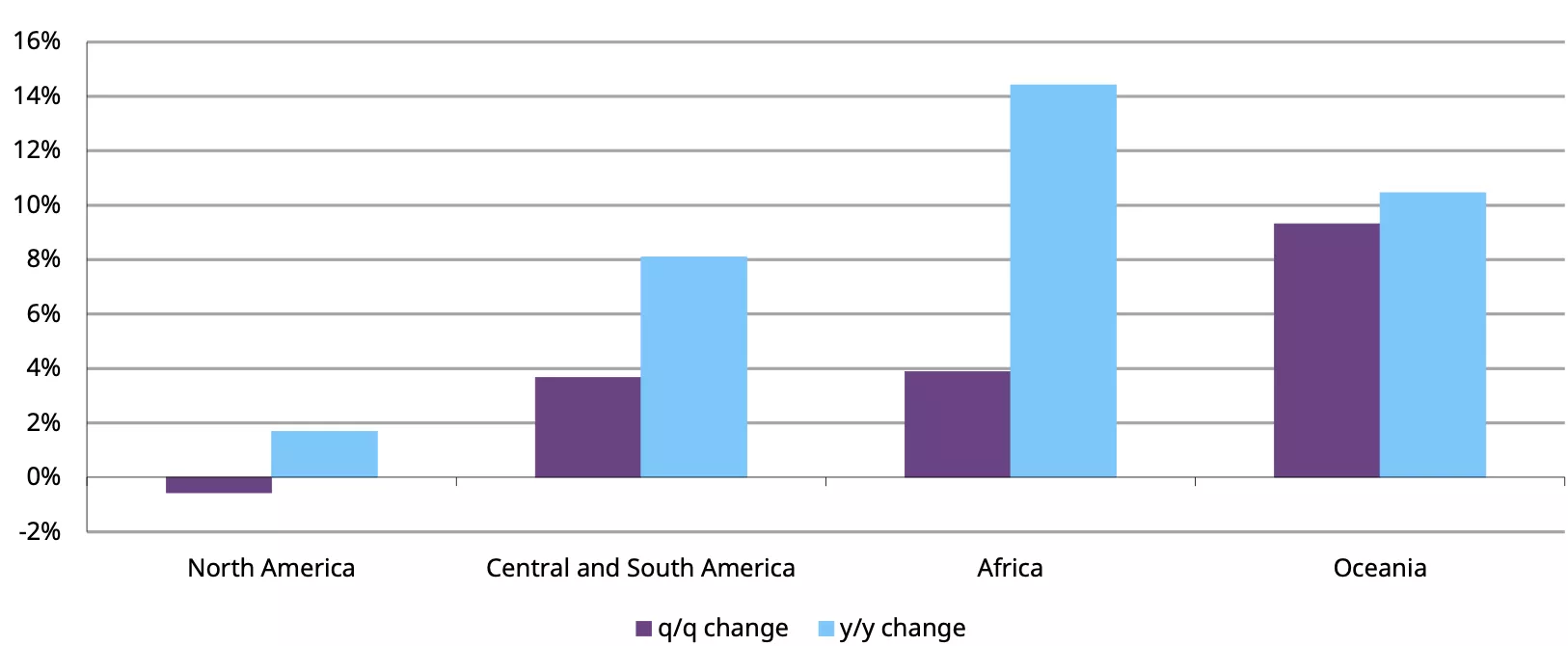

The regional average AISC for Africa in Q3’24 was US$1,532/oz, up 4% q/q and 14% y/y. The key driver was lower production as numerous operations faced challenges or processed lower grade ore during the quarter. In Mali, Allied Gold’s Sadiola operation was suspended early in Q3’24 while the company awaited permits for the Korali-Sud orebody. In Ghana, at AngloGold Ashanti’s Iduapriem, output dropped as recovered grades fell due to delays in drilling and flooding in the C1 pit. In contrast, Newmont reported higher mill throughput and grade at Ahafo in Ghana and production resumed at Sibanye-Stillwaters’ Beatrix operation in South Africa following back-break incidents in H1’24.

In Oceania, the regional average AISC rose 10% q/q and 15% y/y to US$1,464/oz, affected by higher sustaining capital expenditure and lower production at some operations. In Papua New Guinea, both Barrick’s Porgera and Newmont’s Lihir mines reported an increase in AISC. At Porgera, the ramp-up to commercial production is ongoing while at Lihir, the Phase 14A expansion and associated wall construction continues. In Australia, some operations recorded lower production. Northern Star reported lower supply from its flagship KCGM operation as the East Wall remediation was prioritised and planned maintenance was undertaken at the processing plant.

Chart 2: Distinct regional variations in AISC are evident

Percentage change in AISC*

*Data as of September 2024.

Source: Metals Focus Gold Mines Cost Service

The Q3’24 regional average AISC for South America increased by 6% q/q and 14% y/y to US$1,197/oz. Production was lower at some mines, affected by ongoing project work and the weather. For example, access to high grade areas was restricted at AngloGold Ashanti’s Serra Grande mine in Brazil due to the ongoing reclamation of the decline and at Pan American Silver’s Minera Florida mine in Chile as a result of heavy rainfall. In contrast, in Peru, injection leaching at Newmont’s Yanacocha improved gold production lowering costs by 8% q/q.

Over in North America, Q3’24 heralded mixed fortunes for operations. The regional average AISC remained virtually flat quarter-on-quarter at US$1,508/oz and rose by a minimal 2% y/y. Overall, production for the region increased, but it was varied. In Canada, Agnico Eagle reported record throughput at Meliadine following the commissioning of the Phase 2 mill expansion, but, in contrast, at Detour Lake, higher throughput, lower grades and increased royalty payments increased production costs. Meanwhile, in the US, at Cortez, part of the Nevada Gold Mines complex, the joint venture between Barrick and Newmont, lower underground grades, in addition to a higher refractory ore content increased processing costs and subsequently the AISC.

With the Q4’24 reporting period in full swing initial indications are that these variations have continued. A quick glance at the top three producers shows that on a quarterly basis Barrick and Newmont have reported lower AISC, but Agnico Eagle’s is higher. All three companies have reported a year-on-year rise in their full year AISC.

While the continual rise in AISC may be of concern, it is important to note that 97% of primary gold production in Q3’24 was profitable. Furthermore, rising costs at a time of near record gold prices is not unusual. The mixed reporting observed in Q3’24 is, perhaps, an indication that the tide is beginning to turn.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.