India gold market update: Rally and demand realignment

17 April, 2025

Highlights

- Gold’s price rally builds and exceeds key levels, with domestic price gains of 23% y-t-d

- High prices reshape consumer buying patterns

- March sees the first net outflow from gold ETFs in 10 months - India diverges from the global trend

- The RBI adopts a measured buying pace, even as the strategic importance of gold reserves intensifies

- Corporate retail jewellery sector logs strong growth from January to March

- March sees a sharp recovery in gold imports.

Looking ahead

- Seasonal and wedding related purchases may support gold demand this month and next. Investor interest is likely to strengthen as gold’s appeal as a safe-haven asset and portfolio diversifier heightens amid global economic uncertainties and financial market volatility.

Gold extends rally and breaks new thresholds

Gold has continued its impressive rally, repeatedly setting new record highs across major currencies and recently surpassing the threshold of US$3,200/oz.1 A weaker USD and heightened geopolitical risk – including tariff-led fear and uncertainty – have been key drivers of gold’s performance. Alongside this, strong gold ETF buying across most regions has been propelling gold higher.

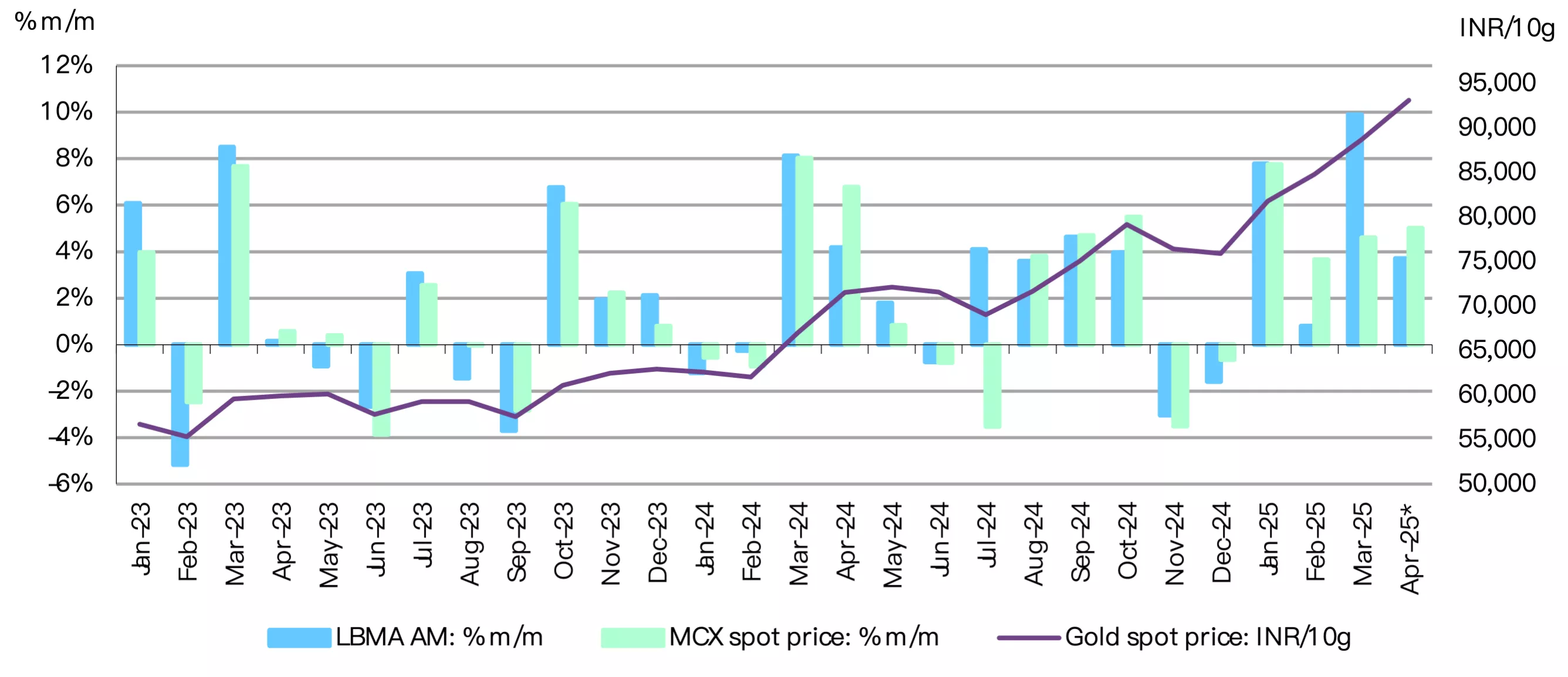

Chart 1: Golden surge continues

Monthly LBMA Price AM and domestic spot price changes and movement*

*Based on the LBMA Gold Price PM in USD and MCX spot gold price.

Source: Bloomberg, World Gold Council

So far in 20252 the LBMA gold price PM in USD has climbed by US$621/oz or 24%, to US$3,230/oz, with over 14% of this increase occurring since March. The Indian domestic spot gold prices3 have mirrored this trend, rising 23% y-t-d to INR93,217/10g. For much of the past four months domestic prices have traded at a discount to international benchmarks (after adjusting for exchange rate and taxes),4 primarily due to subdued jewellery demand amid elevated prices. While domestic prices briefly moved into a slight premium in early April, the average discount has widened significantly – from US$12/oz in mid-March to over US$30/oz on 11 April.5

Gold buyers turn selective

Gold's steep climb and ongoing volatility are keeping many consumers on the sidelines, with demand for jewellery continuing to be limited to need based purchases, particularly for weddings. There has been a noticeable shift in consumer behaviour in response to soaring prices, with more buyers opting to trade in old jewellery for new: anecdotal reports suggest that 40–45% of purchases now involve some form of exchange.

While festive buying has continued, it remains modest and localised, often tied to specific regions and communities. At the same time, the investment appeal of gold is gaining prominence. Anecdotal reports suggest that demand for bars and coins has been resilient, even at high price levels.

The trend of festival and wedding related purchases is likely to persist, supported by the safe-haven appeal of gold. But this may not offset the drop in discretionary purchases. Amid broader financial market turmoil and uncertainty, gold's role as a store of value is becoming more pronounced, reflecting a shift in consumer behaviour from consumption-driven purchases to wealth preservation.

Stronger quarter for corporate retail jewellers

Earnings reports from leading jewellery retailers6 for January-March quarter point to a strong performance, with average revenue growth up 25–35% y/y. This was largely fuelled by wedding related demand, festive buying, and a noticeable consumer shift toward gold – both as an adornment and a store of value.

While high gold prices tempered demand at the lower price points, the premium segments remained fairly resilient. Average transaction values reportedly rose by 15% to 20% y/y. Also, there was an uptick in old gold exchanges, which contributed to overall sales volumes. Corporate retailers7 continued their aggressive store expansion strategy, adding 10 to 30 new outlets during the quarter and reinforcing the growing presence of organised players in the jewellery sector.

These large retailers remain upbeat about the outlook for the April-June quarter. Early indicators of advance bookings for regional festivals such as Akshaya Tritiya – a key period for gold purchases – point to strong consumer sentiment. Further underlining this bullish outlook, leading retailers plan to open between 150 and 200 new showrooms over the next 12 months, setting the stage for continued gains in market share and deeper penetration across regions.

Streak snaps: gold ETFs see outflows

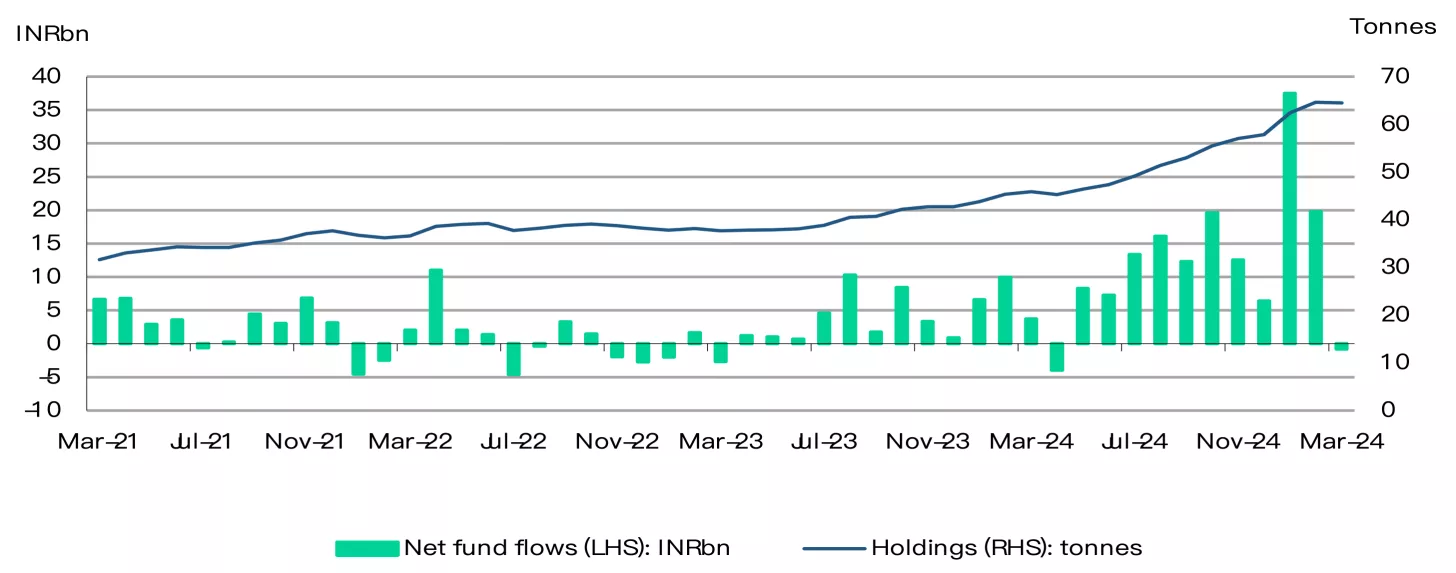

In a divergence from the global trend, Indian gold ETFs recorded modest net outflows in March, following ten consecutive months of sustained, strong inflows. Anecdotal evidence suggests that the pullback likely reflects profit-taking amid a record rally in gold prices, alongside portfolio rebalancing. Despite the outflows, assets under management (AUM) climbed to a record high, driven by the surge in gold prices, while investor participation continued to grow as new accounts were added.

According to the Association of Mutual Funds in India (AMFI), gold ETFs recorded net outflows of INR0.8bn (~US$8.9mn) in March, the first monthly outflow since April 2024. This is lower than our initial estimates, which were based on preliminary data.8 Despite these outflows, cumulative assets under management (AUM) of gold ETFs rose to INR589bn (~US$6.8bn), up 6% m/m and 89% y/y thanks to the gold price increase. Gold ETFs now account for 0.9% of total mutual fund AUM, up from 0.6% a year ago. The collective gold holdings of the 20 gold ETFs stood at 64.5t, down 0.1t from a month ago. However, strong inflows during the preceding two months added 6.7t to the collective holding in Q1 2025, the highest quarterly addition on record.

Investor interest in this asset class continues to grow with 0.13mn new investor accounts (or folios) added during the month, bringing the total number of gold ETF investor accounts to a record 7mn. In the last twelve months 1.9mn folios were added to gold ETFs.

Chart 2: Gold ETFs hit pause on inflows

Monthly gold ETF fund flows in INRbn, and total holdings in tonnes*

*As of end March 2025.

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

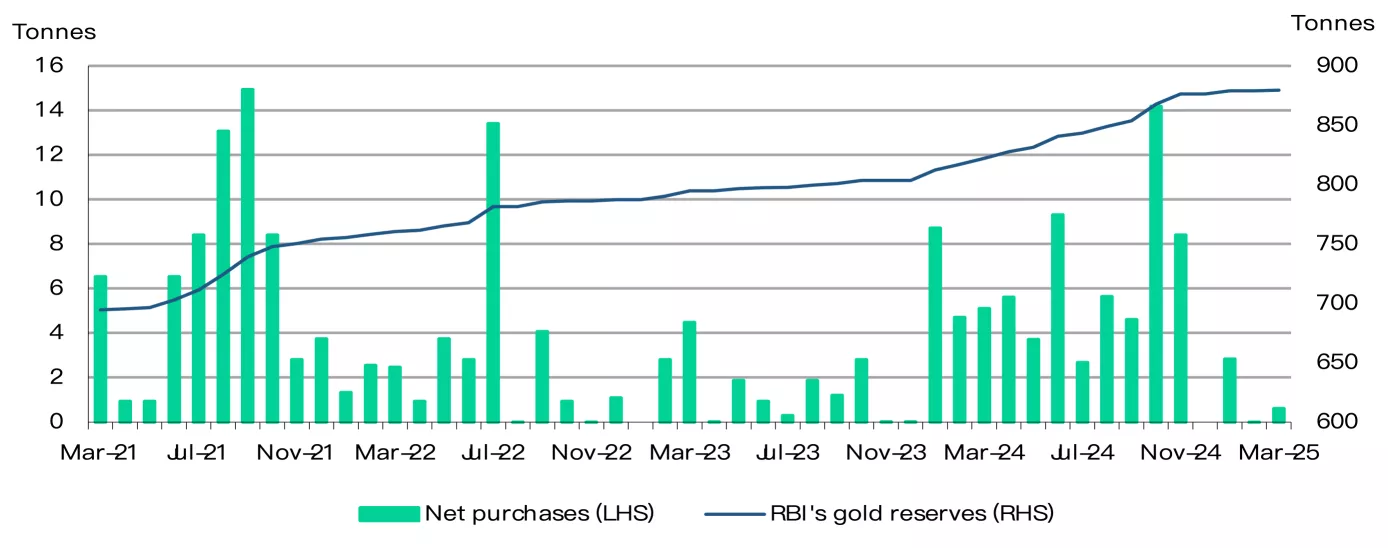

RBI moderates gold buying but gold’s role in reserves strengthens

The RBI added a modest 0.6t of gold to its reserves in March, resuming purchases after a pause in February, according to our estimates based on the central bank’s weekly forex reserve data. This brings the RBI’s total gold holdings to 879.6t, or 11.7% of its total foreign exchange reserves – the highest level both in quantum and share.

Over the past year, gold’s share in the RBI’s forex reserves has risen nearly 4%, reflecting a net addition of 57.5t to its holdings. Yet recent trends suggest a moderation in the central bank’s gold buying. After consistently purchasing an average of 6.6t per month from January to November 2024, the RBI took a breather in December and February. And in January and March its purchases were notably below the previous monthly average.

This recent pattern in gold purchases may suggest a more measured approach from the RBI, although it underscores gold's rising strategic importance in India’s reserves management.

Chart 3: RBI’s gold accumulation slows

RBI’s monthly net purchase and reserves, tonnes *

*As of 4 April 2025.

Source: RBI, World Gold Council

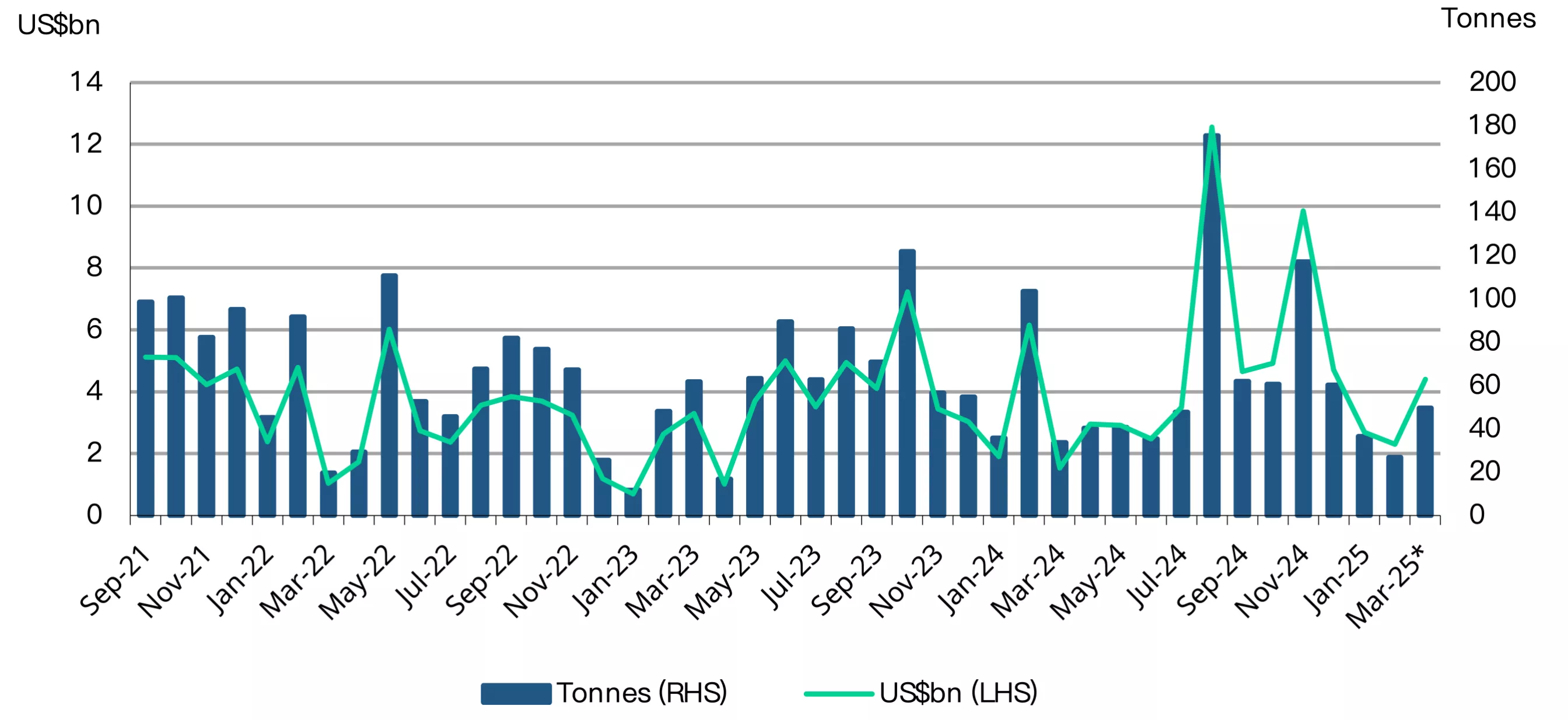

Turnaround in imports

Despite record high prices, gold imports rebounded sharply in March after two consecutive months of decline. According to data from the Ministry of Commerce, imports climbed to US$4.4bn – nearly double the previous month's figure and significantly higher than the US$1.53bn recorded a year earlier. While still below the average monthly imports of US$7.3bn set between August and December 2024, the sharp uptick suggests a resurgence in demand and underscores a continued interest in gold, even at elevated prices. Based on our estimates, import volumes for the month were in the range of 47t to 52t.

The latest data from the Ministry of Commerce has revised gold imports for 2024 – from 724t to 812t – mainly due to revisions in import figures for the period from July to October.

Chart 4: Gold imports see strongest uptick in three months

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1On 11 April,2025.

2As of 11 April 2025.

3MCX spot gold price.

4The premium/discount of local gold prices is based on the LBMA Gold Price AM adjusted for import taxes and exchange rate, which is also referred to as the ‘landed price’.

5Based on NCDEX data as 11 April 2025.

6Kalyan Jewellers India Pvt Ltd,, Titian Company Ltd, and Senco Gold Ltd.

7Comprises Kalyan Jewellers India Pvt Ltd,, Titian Company Ltd, and Senco Gold Ltd.

8Our initial estimate based on partial information available at the time was outflows of US$51mn.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.