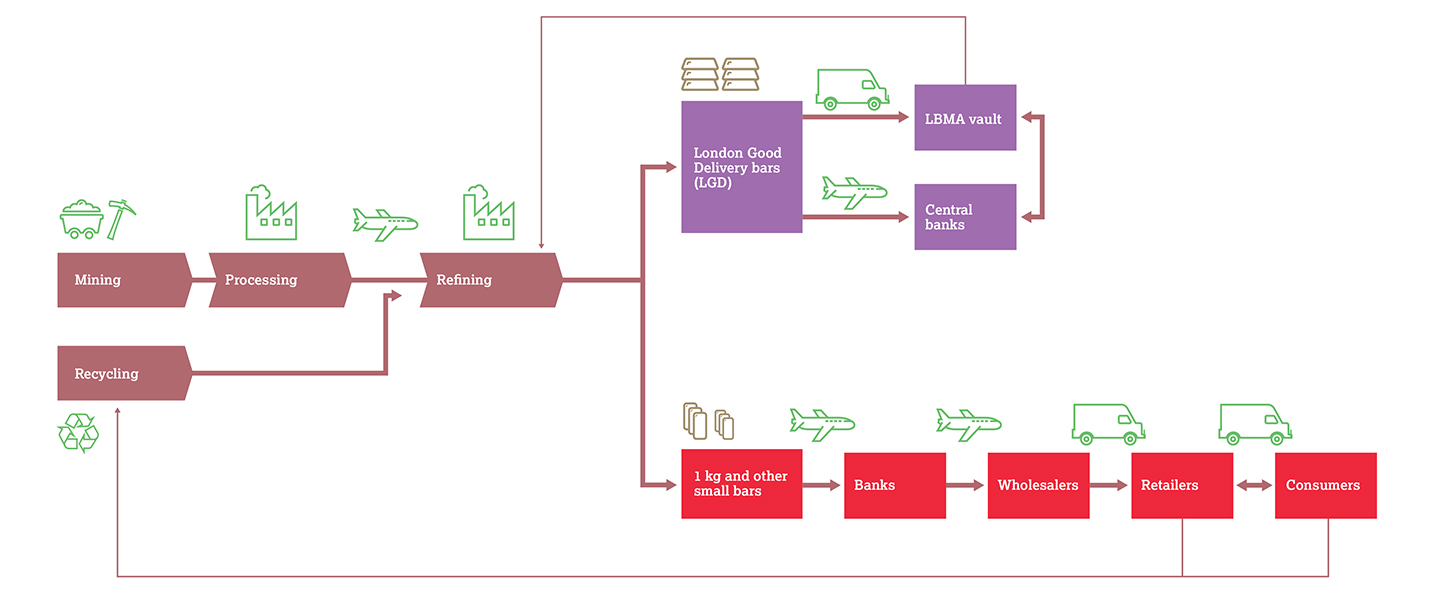

The gold supply chain is truly global. Gold is mined on every continent except Antarctica, refined into bars and coins in numerous countries, and distributed far and wide. This geographical dispersion not only brings stability to the gold market, it is also necessary to satisfy demand.

But the onset and scale of the COVID-19 pandemic has caused unprecedented disruption to various parts of the gold supply chain. In this report, we explore:

How the different components across the supply chain have been affected

- Following national and local government measures aimed at countering the outbreak, total gold production fell 3% y-o-y in Q1, while recycling activity fell 4% y-o-y

- Operations at a small number of refineries and fabricators were also halted during Q1

The impact on the flow of gold through the supply chain

- Stringent travel restrictions – border closures and a reduction in commercial flights – impeded the flow of gold along the chain

How the disruption has affected investment demand

- In the wholesale market the availability and liquidity of LGD bars was relatively unaffected by the supply chain issues

- Supply and logistical issues caused depletion of some dealer inventories of small bars and coins, and left many investors facing long wait times and high premiums

We find that while gold’s supply chain has not escaped unscathed, it has demonstrated resilience in the face of these challenges, highlighting a key strength of the market.