No matter where they are headquartered, market participants in the gold market operate in the leading bullion hubs of the world - Singapore, Shanghai, London and New York. This is no accident. Strong, successful bullion markets rely on, and are supported by, strong, successful commercial banks, offering a full range of bullion banking services.

Bullion banks are and continue to be a key pillar of the market - they build greater trust across the gold value chain, drive efficiency, provide liquidity, promote transparency and support price discovery. The result is that customers can participate in the bullion market with confidence. London and New York have a long history of bullion trading, but the Singapore and Shanghai markets have only emerged in the past 15 years. In 2017, the revenue from global bullion banking operations was estimated to be US$1.5-1.8 billion. India leaves much of this potential on the table.

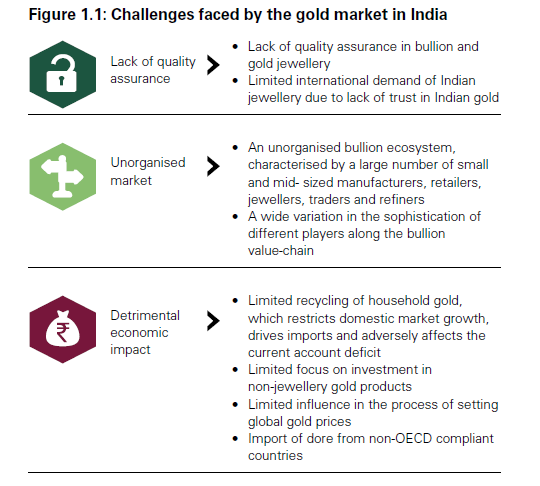

India's gold market is one of the largest in the world, but it lacks organisation, structure and trust. But that is beginning to change with numerous transformational initiatives underway. A robust bullion banking industry could support and accelerate that shift - inspiring trust, bolstering innovation and driving growth.

The timing for bullion banking reforms in India could not be more propitious. The Indian gold spot exchange is expected to launch in the near future, a key moment in the development and formalisation of the domestic gold market. Commercial banks need to be part of that journey, offering a range of bullion banking products and services to customers along the gold value chain and promoting higher value addition.

This report outlines the role that bullion banks play in leading gold centres around the world. It explains how India could develop a thriving bullion banking industry over the coming years to support its overarching economic ambitions, and enable gold to play a role in this journey. The report is based on deep discussions and research with banks, exchanges, refiners, vaulting services and regulators around the world, as well as key stakeholders in India. The insights and recommendations that we make stem directly from these discussions.

Indian commercial banks are ready to embrace bullion as an asset class. India can reap significant benefits, both within its gold market and across the wider economy with a robust bullion banking industry. The stage is set!