On 25th January 2020, people throughout China will celebrate the start of a new year – the most important festival in the Chinese lunar calendar. This will kick off Year of the Rat and begin another rotation of the twelve zodiac signs. Most people are already in a festive mood, and, as a result, so is China’s gold market.

Rotation of the twelve Chinese zodiac signs

“Something gold” for Chinese New Year

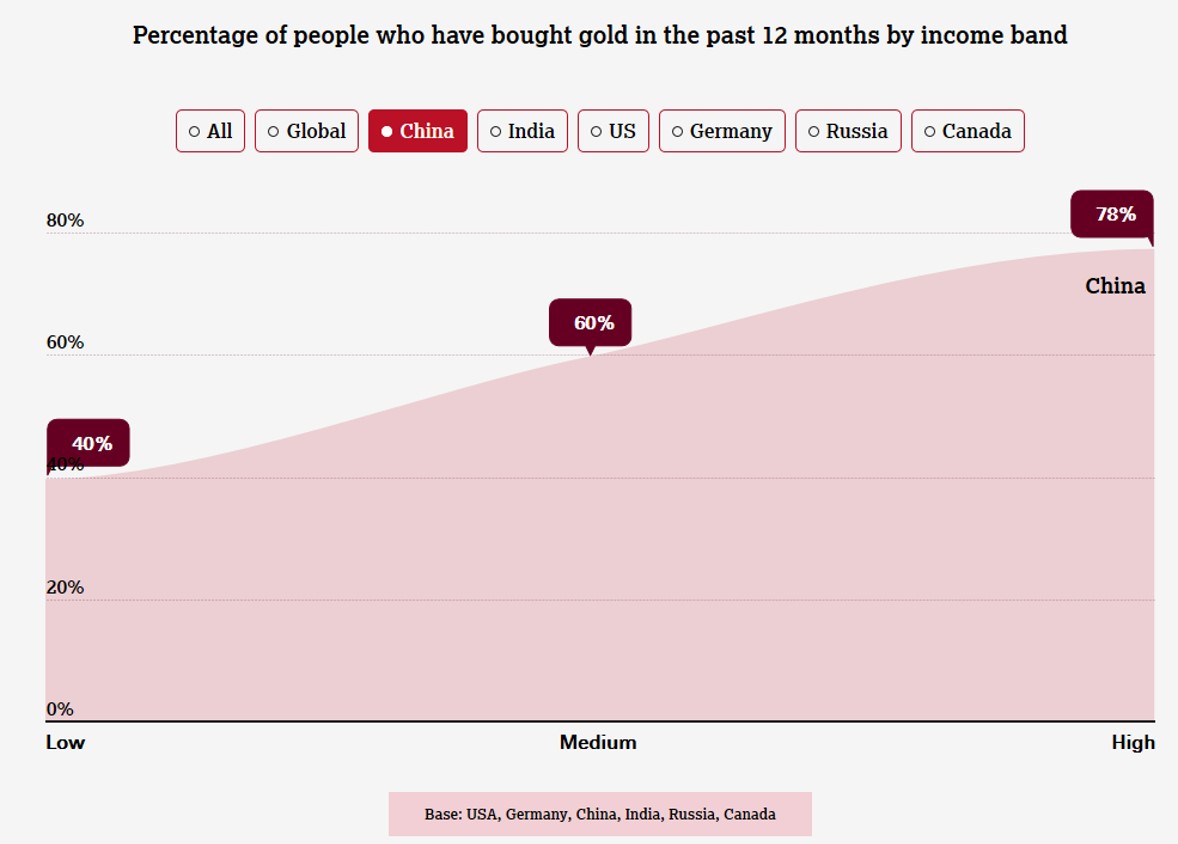

Buying “something gold” is a long-standing new year tradition in China. Firstly, gold has been considered a sign of good luck or fortune for millennia, something significant as many look forward to what the new year will bring. This was in large part down to the fact that gold and its colour represented the supremacy of emperors throughout China’s history. Secondly, driven by year-end bonuses, Chinese consumers’ purchasing power is usually the highest before Lunar New Year. This is supported by our 2019 global consumer research findings, which indicate that higher incomes leads to higher gold consumption.

There is also the convention of gifting during the CNY. For example, after greeting “Gong Xi Fa Cai” (wish you good luck and fortune) on Chinese New Year’s Day, seniors usually hand out red envelopes which contain money or other valuable gifts such as gold to juniors.

Consequently, the month before Lunar New Year, which is also known as Spring Festival, is often the busiest gold buying season as more consumers choose to purchase gold products to bring others and themselves good luck. And it has been an important tradition for hundreds of millions of drifters in many cities to bring home good luck after one year’s painstaking work.

Our 2019 global consumer research results also highlight such an emotional attachment to gold: on average, over 70% of fashion and lifestyle consumers across all generations in China feel that gold can bring good luck versus 57% globally.

I bought mouse-themed gold products for good luck in 2020, Year of the Rat1

Samples of mouse-themed gold jewellery products

Source: Batar Group

Higher physical gold demand before Chinese New Year

Led by such tradition, December – approximately one month before the CNY – has been a better month for gold retailers historically.2 According to the National Bureau of Statistics, monthly retail gold sales, including gold bars, coins and jewellery, have on average been highest in December every year during the past two decades.3

Note: average monthly data between Jan 1998 and Dec 2019 in USD.

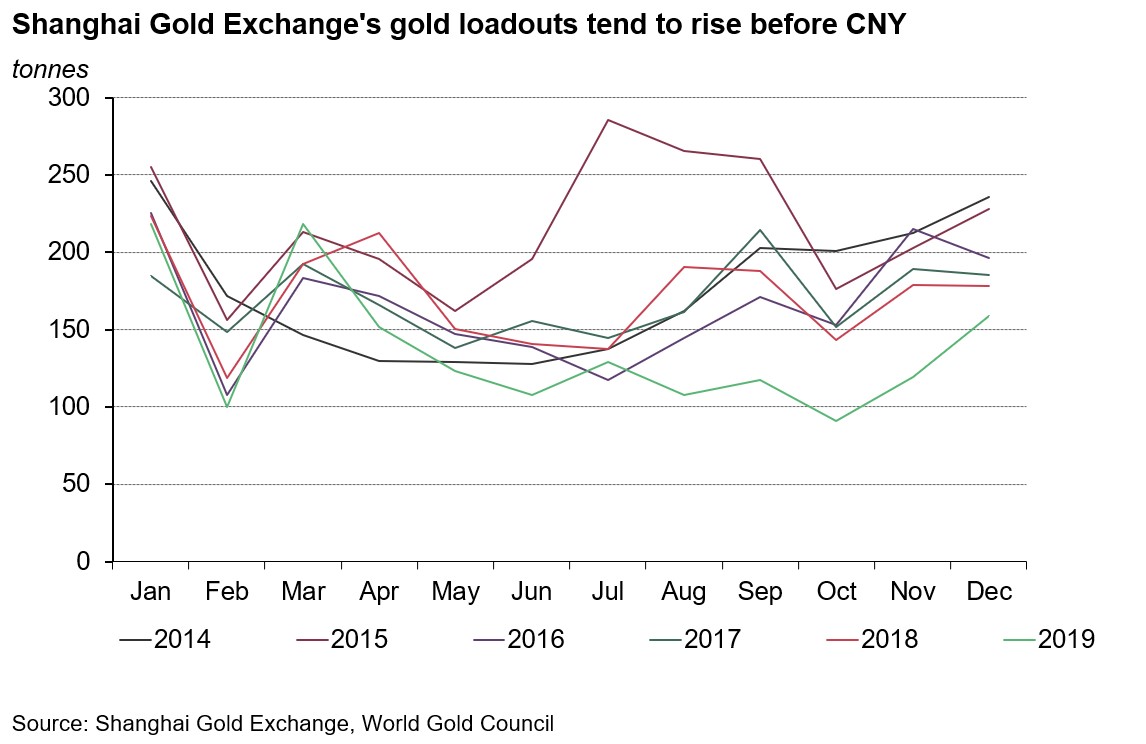

This higher consumption leads to higher gold withdrawals from the Shanghai Gold Exchange (SGE) and imports. Jewellery manufactures and refiners are much busier in November (and sometimes December when there is a late CNY) as retailers and banks often replenish their gold product stocks ahead of Spring Festival. In the past decade, the SGE’s loadouts always started to pick up in November as November’s m-o-m increase averaged 22%. And China’s gold imports in November have been 18% higher than October on average during the past three years, according to China Customs.4

The local gold price premium also rises as Chinese New Year approaches. The logic is simple: higher demand leads to a tighter supply, pushing up local gold price as a result. On average, the local gold premium during the six weeks prior to CNY has been 65% higher than the annual mean during the past ten years.

Note: we used average local premium data from 2010~2019.

Summary

Chinese people have the tradition of stocking up necessities before the CNY as most shops are closed during the holiday. Although categorised as a non-essential item, gold becomes popular prior to the Lunar New Year as it symbolises good luck and Chinese people are generally wealthier at the end of the year.

As such, gold retail stores are always packed before the CNY. December – approximately one month before the CNY – has witnessed the highest retail gold products sales of all months during the past 21 years on average. Gold loadouts, imports and premium are also higher during the period. Primarily, wealth expansion and long-term saving activity for good luck are driving China’s physical gold demand higher prior to the CNY.

In 2019, we have already witnessed higher gold loadouts, imports as well as elevated local gold premium before the CNY. Even though the gold price’s volatility was pushed up amid global political tensions, it had little impact on consumers’ “rigid gold demand” ahead of the CNY, delayed some purchasing decisions a bit at most, according to our trade partners in the jewellery industry. And this could bring vitality to China’s gold demand after suffering from the high gold price and economic downturn in 2019.

Footnotes

1 Online consumer’s comment under mouse-themed products. Sourced from Chow Tai Fook's Taobao T-mall shop's comments section.

2 Chinese lunar new year usually occurs between mid-Jan and early-Feb.

3 The restriction on China’s gold jewellery industry was not lifted until 1908s. And China’s bullion trading was prohibited before 2004.

4 China Customs’ official gold imports data only dates back to Jan 2017.