Summary

- The Shanghai Gold Benchmark PM (SHAUPM) in renminbi (RMB) continued to rise in March – albeit marginally – while the LBMA Gold Price AM in USD saw a gentle decline1

- China’s economy showed signs of a potential recovery last month as the COVID-19 outbreak seemed to be effectively contained2

- Gold’s investment demand in China kept elevating, sending Au(T+D)’s trading volumes in March to another all-time high and adding another 4.6t in Chinese gold-backed ETFs’ holdings

- Au9999’s trading volumes – usually seen as a proxy for physical gold demand in general – and gold withdrawals from Shanghai Gold Exchange (SGE) both saw notable rebounds in March as most Chinese companies resumed operations3

- In March, significantly higher gold demand and disruptions in gold-supply chains worldwide due to intensified coronavirus outbreak, combined still soft Chinese consumer demand, resulted in the widest local RMB gold price’s discount in history4

- The People’s Bank of China (PBoC) kept its gold reserves unchanged at 1,948t in March, accounting for 3.3% of total reserves.

In March, the SHAUPM rose by 1.4% while LBMA Gold Price AM fell slightly as the RMB weakened relative to the USD. Although new COVID-19 infections in China remained near zero in March, concerns for the pandemic’s aftermath on the domestic economy linger. The Shanghai Stock Composite Index and Wind Chinese Commodity Index dropped by 4.5% and 6.8% respectively last month. Meanwhile, as COVID-19 spreads globally, governments and central banks initiated various supportive fiscal and monetary stimulus to cushion its impacts on their economies, lowering holding gold’s opportunity cost.

Both RMB and USD gold price volatility soared to multi-year highs in March. As we noted in our recent Investment Update: Gold prices swing as markets sell off, many investors sold liquid and return-generating assets such as gold last month, in order to meet capital requirements when risk assets sold off sharply around the globe.

China’s economy is gradually recovering as new infections kept declining.5 According to the Ministry of Industry and Information Technology, around 99% of large-scale enterprises and over 76% of small- and medium-sized companies had restarted work as of 30th March.6 Consequently, both China’s manufacturing and service PMIs rebounded from February’s 15-year low in March. China’s gradual resumption to work can also be observed in the rising power demand since early March.

Au(T+D)’s trading volumes in March set a new record, reaching 3,935t. Au(T+D)’s trading volumes in March averaged US$9bn per day, its highest ever level. Safe-haven demand amid sell-offs in Chinese stock and commodity markets following COVID-19 outbreak globally was the main contributor fueling the rocketing Au(T+D)’s trading volumes.

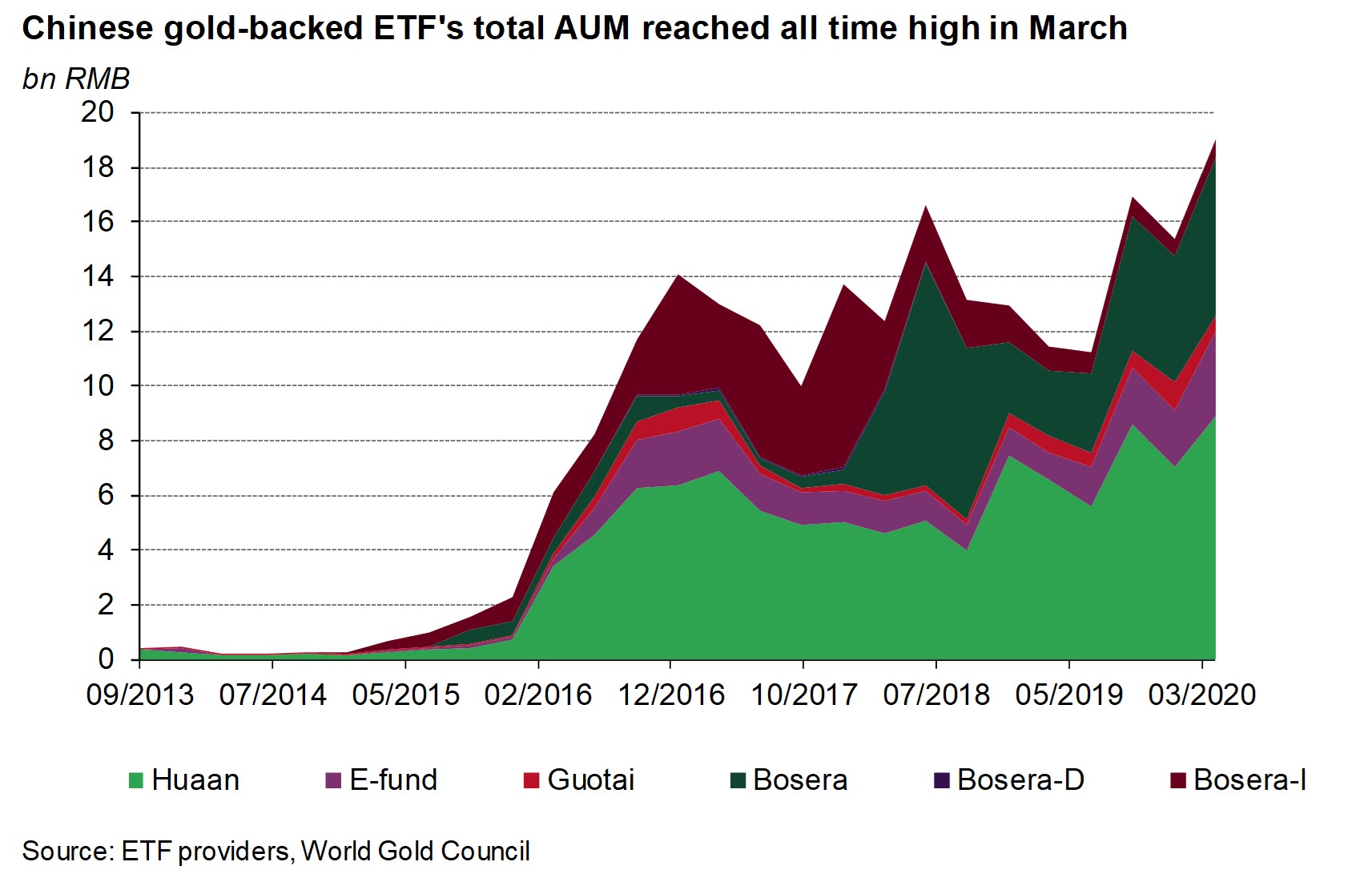

Chinese gold-backed ETF holdings stood at 51.3t as of March, up by 4.6t in the month.7 Concerns for China’s economic growth and weaknesses in risk assets following the COVID-19 outbreak in January supported growth in Chinese investors’ strategic allocation to gold ETFs. As a result, Chinese gold-backed ETFs’ holdings increased by around 8t in the first quarter of 2020.

Chinese gold ETFs’ asset under management (AUM) recorded another all-time high. The highest quarter average local gold price since the SGE’s establishment and the rising safe-haven demand drove Chinese gold-backed ETFs’ AUM to 19bn RMB, or US$2.7bn as of March, the highest ever.

With the nation emerging from the COVID-19 outbreak, China’s physical gold demand rebounded gradually in March:

- Au9999’s trading volumes totaled 335t last month. Despite being 39% lower y-o-y, the contract’s trading activities rose by more than 130% on a m-o-m basis8

- Gold withdrawals from the SGE went up to 82t, a 53t increase from the previous month, but still below its 2019’s average.

As I mentioned in my previous blog post, gold consumption in China in March may have been supported by various stimulus measures. These measures include re-opening malls across the country, e-vouchers from the government to boost leisure consumption, jewellery retailers’ efforts in online sales, and promotion and discounts on almost all gold products by these retailers.9

In March, the SHAUPM was US$11/oz cheaper than LBMA Gold Price AM on average, the largest discount since the SGE’s establishment. With the COVID-19 global outbreak intensifying in March, gold coin sales in the US surged as risk assets’ sell offs fueled investors’ safe-haven demand.10 The pandemic has also led to gold supply disruptions outside China including suspensions in gold miners and refiners’ operations as well as difficulties in gold transportations due to cancelled flights.11 These factors resulted in a premium for gold outside China. Coupled with still tepid demand and slowly recovering supply in China, Chinese local gold price’s discount widened significantly in the month.

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, it was Au9999 vs LBMA Gold Price AM.

There was no change in the PBoC’s gold reserve in March. According to State Ministry of Foreign Exchange, the PBoC’s foreign reserves stood at US$3,061bn as of March, a US$46bn decrease m-o-m due to global financial markets’ disruptions caused by the COVID-19 outbreak. In the meantime, the PBoC’s gold reserve has remained at 1,948t (3.3% of total reserves) since September 2019.