The China Gold Market Report 2020 – published at the end of July – provides a comprehensive review of China’s gold market in 2019. This report is a joint effort from the Shanghai Gold Exchange (SGE), Shanghai Futures Exchange (SFE), China Gold Association (CGA), the People’s Bank of China (PBoC) and the World Gold Council. While this report provides valuable insights into key aspects of China’s gold market, it also sheds light on the businesses handled by Chinese commercial banks last year.

In this post we’ll explore the drivers behind the changes in banks’ main retail gold businesses, with a more detailed analysis to follow in the near future.

The most dominant driving force in developing China’s gold market

Chinese commercial banks’ gold businesses have expanded rapidly since the PBoC lifted the ban on retail bullion trading at the end of 2003. The following year, their gold trading volumes at the SGE totaled 235t, accounting for 35% of the SGE’s total gold trading volumes. Fifteen years later, gold trading volumes reached 56,202t in 2019, representing 82% of the SGE’s annual total.

Acting as practitioners in the PBoC’s blueprint for China’s gold market, Chinese commercial banks have largely defined the developments of China’s gold market since 2003. And during this period they introduced an expanded range of products, which can be categorised into:

- Physical gold sales

- Gold trading

- Gold asset management

- Gold derivatives

- Gold financing

- Overseas gold business

Three main retail gold businesses in focus

While other types of Chinese commercial banks’ gold operations are institutional, physical gold sales, account-based gold trading and gold asset management products have been their key retail gold businesses areas.

- Physical gold sales at commercial banks include investment gold bars and coins, cultural and festival physical gold products and gold accumulation plans (GAPs).1

- Account-based gold, or “paper gold”, is the investment product banks offer to retail clients for trading gold in RMB or USD via bookkeeping and market-making by banks. These products allow investors to take physical delivery of the bank’s gold products if requested.

- Gold asset management products issued by banks are usually combinations of derivatives and/or fixed-income products, with gold as the underlying asset. They usually do not involve the delivery of physical products.

Gold businesses of Chinese commercial banks in 2019

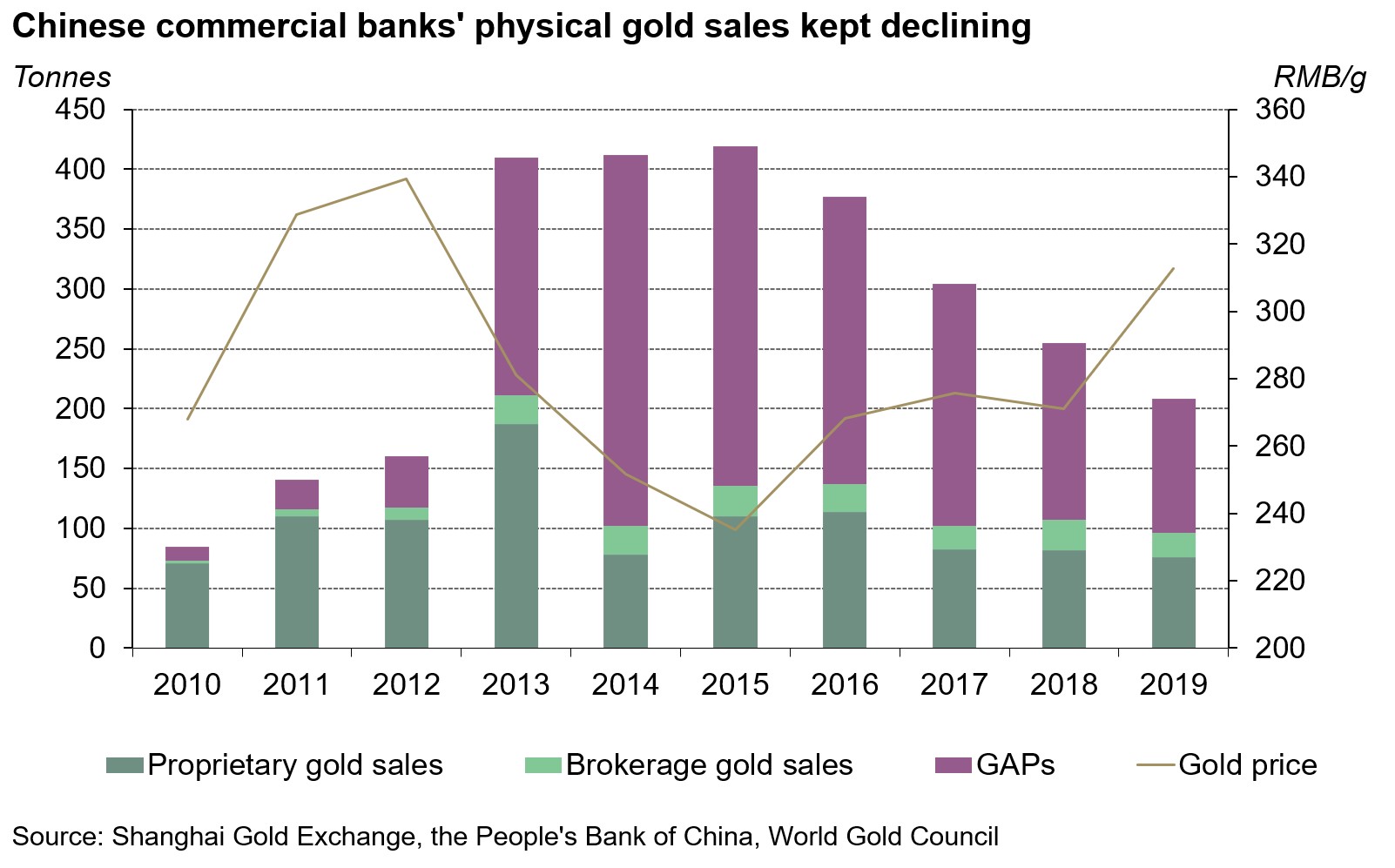

In 2019, Chinese commercial banks recorded their fourth consecutive annual y-o-y decline in their physical gold sales. According to the most recent data provided by the PBoC, physical gold sales totalled 208t in 2019, a fall of 18% y-o-y.

One key factor leading to the downward sales trend over recent years is the growth in China’s retail gold sales channels. The four major listed Chinese jewellers’ points of sales (POS) in mainland China have witnessed a 125% rise during the past ten years.2 By offering intricate designs, these jewellery retailers have attracted many bullion investors and collectors using more active promotion than is adopted by most banks, despite charging higher premiums on their gold products compared to banks. For instance, Lao Feng Xiang – one of the largest Chinese gold jewellery retailers – saw a 43% growth in its gross sales of gold products between 2015 and 2019.

Meanwhile, the Interim Measures on Managing Gold Accumulation Plans (GAP), issued by the PBoC in 2018, had a negative impact on banks’ GAP sales, which had accounted for over 50% of their physical gold sales in 2019. The regulation required all Chinese commercial banks to lift the minimum threshold for GAP investment from RMB100 to one gram of gold: representing more than a 400% jump according to the closing price of Au9999 on 12 August.

*Only listed Chinese jewellery companies with data from 2011 onwards are included. Under this criteria, Chow Tai Fook, Luk Fook, Lao Feng Xiang and Yuyuan Group represent the top four gold jewellers in China.

Furthermore, GAPs are facing an increasing competitive challenge from gold-backed ETFs. The advantage of lower costs and simpler transactions have boosted the popularity of Chinese gold ETFs – the products offer similar features to GAPs but are only a phone tap away. Between 2015 and 2019, total holdings of Chinese gold ETFs surged by 348%, whereas GAPs experienced a 154% plunge.

By contrast, trading volumes of account-based gold rose markedly in 2019: paper gold investors typically focus on shorter-term, more tactical trading strategies than physical gold investors, as these products are more liquid and usually don’t involve physical delivery. Last year, a total of 13 commercial banks in China offered account-based gold trading services. Collectively, their paper gold trading volumes amounted to 3,513t (counting both sides) in 2019, 11% higher than 2018.

As the gold price gathered momentum and volatility rose during the year, short-term gold investors – who do not have access to the SGE and SHFE’s gold contracts – were active in trading paper gold offered by banks. Such enthusiasm can also be observed from the 60% y-o-y surge in the average 2019 daily trading volumes of Au(T+D), a margin-traded gold contract at the SGE.

Gold asset management products continued to rise in 2019. That year, the nominal value of gold asset management products issued by commercial banks was RMB2.5trillion, 32% higher y-o-y. This rising gold price attracted many retail investors and encouraged banks to issue more gold-related structured products to fulfill investor demand for exposure to gold.

Conclusion

Chinese commercial banks remain the most important pillar of support for China’s gold market, accounting for over 80% of the total gold trading volumes at the SGE. While physical gold sales went down in 2019, account-based gold trading volumes and the issuance of gold asset management products continued to rise.

On one hand, physical gold sales from Chinese commercial banks experienced pressure from growing Chinese gold retail channels, changes in regulations and the emergence of Chinese gold ETFs. On the other hand, the rising investment demand for gold benefited commercial banks’ account-based gold trading and gold asset management businesses in 2019. And while “The Interim Measures on Managing Financial Institutions’ Internet Gold Products” and “Notice on Matters Concerning Gold Asset Management Products” eliminated unqualified platforms, commercial banks – qualified to issue gold account trading and asset management products – experienced a boost in these areas.

As the gold price records new record highs this year, investment demand for account-based gold and gold asset management products from Chinese commercial banks could rise further, whereas physical gold sales may continue to weaken, reflecting the demand shift we observed in our Q2 and H1 2020 Gold Demand Trends report.

Footnotes

1 Gold accumulation plans entitle retail clients to accumulate gold bars or other physical forms in regular periods or at their own choice once an account is opened at the bank. Investors can redeem GAPs in cash or in physical delivery. These plans were first introduced to Chinese investors in 2010 by the Industrial and Commercial Bank of China, with support from World Gold Council.

2 In 2019, Chow Tai Seng emerged as the largest listed Chinese jeweller with a total of over 4,000 POS in China. However, it is not included due to its data availability.