Summary

- The domestic gold price ended 3.8% higher in July at Rs48,250/10g1

- Retail demand was mixed: moderate strength in the first half of the month was followed by a softening of demand in the second half due to an absence of wedding dates

- Official imports rebounded with easing of lockdown restrictions and the local market flipped back to discount as demand softened from mid-July onwards

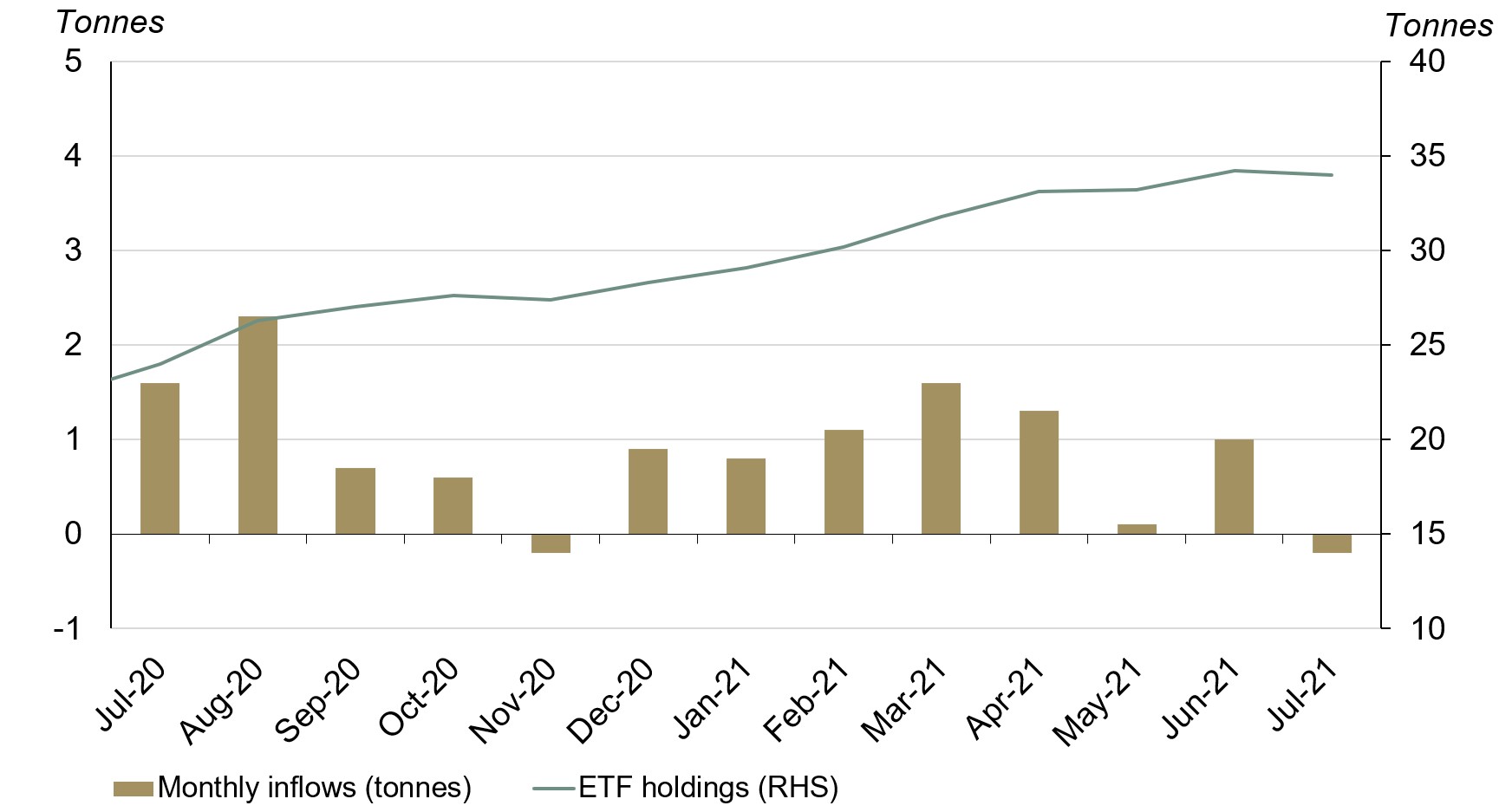

- Optimism regarding prospects for economic recovery, bolstered by an increase in the vaccination rate, led to minor outflows from Indian gold ETFs during the month. Total holdings reached 34t by the end of July; a net outflow of 0.2t (Rs0.6 bn; US$8.3mn)

- The Reserve Bank of India (RBI) added 5.6t of gold in July, increasing its total gold reserves to 711.2t

- Cumulative rainfall between June and July was 1% below the long-period average (LPA). Kharif sowing remained 4.7% lower than last year but 7% higher than the five-year average up to the end of July.

Gold prices rallied in July

The fall in the US 10-year bond yield, along with momentum, lifted the USD gold price. The US 10-year bond yield contracted by 25bps during the month to end at 1.22%. During the month the LBMA Gold Price AM in USD and MCX Gold Spot in INR rose by 4% and 3.8% respectively (Chart 1).2

Chart 1: Gold prices rallied in the month

Domestic gold price in rupees vs LBMA Gold Price AM in US dollars

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Economic indicators showed continued signs of recovery

With the increased reach of the vaccination programme and the release of pent-up demand following the easing of lockdown restrictions, several economic indicators showed continued signs of recovery during the month. The high-frequency indicators of trade and demand, such as E-Way bill, fuel demand, automobile sales and labour participation rate, witnessed m-o-m growth in July.3 In the light of this sustained recovery in demand, rating agency CRISIL upgraded its credit outlook for India from cautiously optimistic to positive.

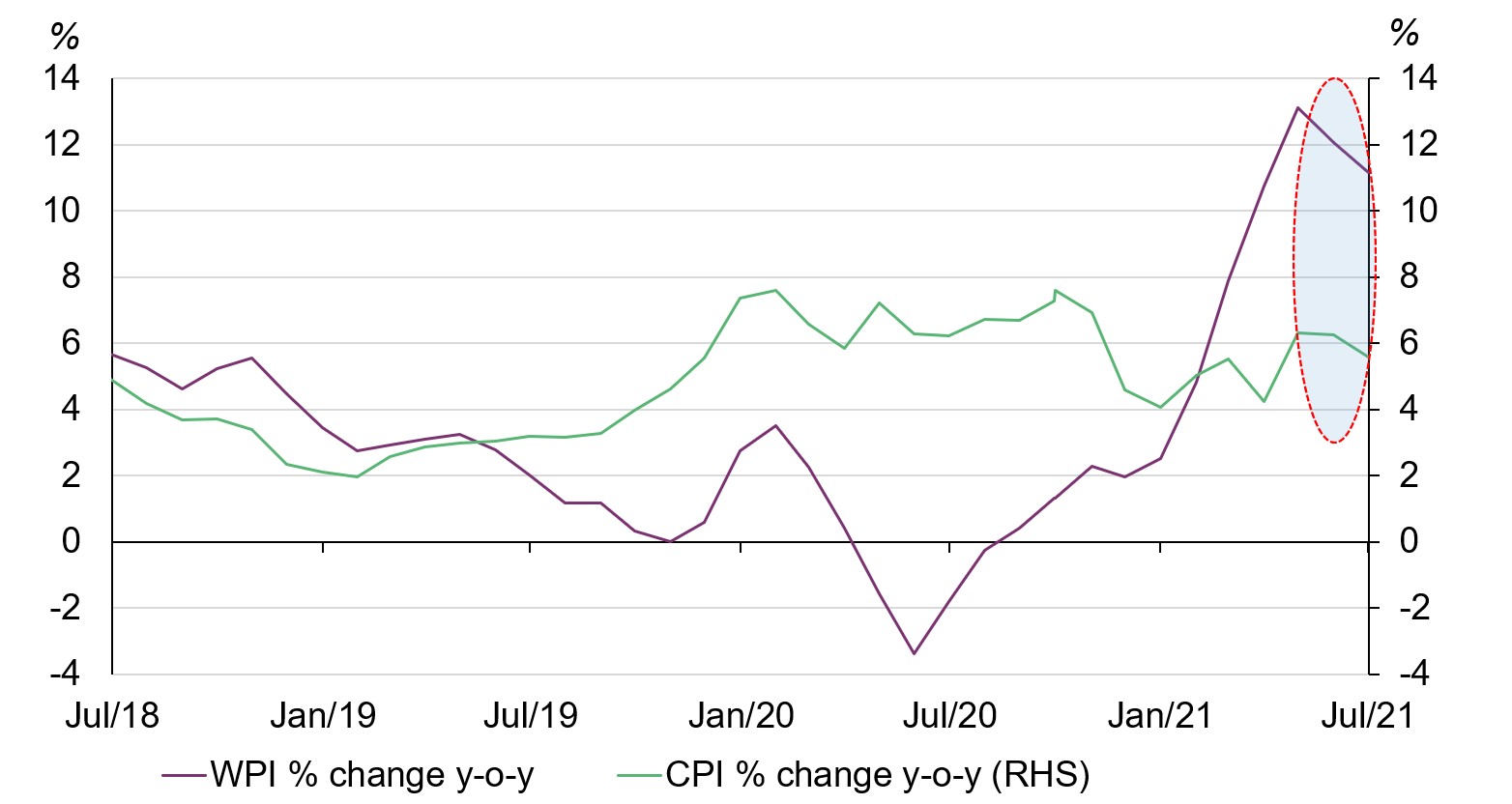

Wholesale and retail inflation eased further in the month

In July, India’s y-o-y wholesale inflation (WPI) and retail inflation (CPI) eased to 11.16% and 5.59% respectively (from 12.07% and 6.26% respectively in June), due to moderation in food prices. Continuing double-digit WPI inflation and the possibility of it spilling over into CPI inflation remains a concern. Considering this, the RBI increased the CPI inflation forecast for FY 2021-22 from 5.1% to 5.7%.4

Chart 2: India's wholesale price and retail inflation eased further in July

India's WPI % change y-o-y vs CPI % change y-o-y

Source: Bloomberg, World Gold Council

Retail demand was mixed during the month

Anecdotal evidence suggests that gold demand remained relatively strong in the first half of the month, predominantly for wedding purchases. Large organised retailers with a national presence reported a stronger recovery in demand from metros, which had been badly impacted during the first wave of the pandemic last year. However, demand softened gradually from mid-July onwards with the absence of further wedding dates in the month and the onset of Aadi month in Tamilnadu.5

Retail demand is expected to remain healthy in August with a 2.4% correction in the domestic gold price on 9 August. Festivals such as Raksha Bandhan and Onam may provide a further boost to retail demand.6

Indian official imports rebounded in July

Retail demand improved as states eased lockdown restrictions and the economy reopened; as a result official import rebounded. Indian official gold imports totalled 72.3t in July 2021 – more than double the 29.7t from July 2020 and more than triple the 15.8t from June 2021 (Chart 3). A total of nine banks, nominated agencies and exporters imported 53.6t of bullion and 18 refineries imported an equivalent 18.7t of fine gold content in the form of gold doré.

From a total of 72.3t in official imports, 31.2t was imported via the Sri City Free Trade Warehousing Zone (FTWZ).7 Six overseas banks were responsible for these imports, with JP Morgan, ANZ, Rand Merchant Bank and Standard Chartered accounting for 93% of the total.

We anticipate that official imports will remain healthy in August. The correction in the gold price during the month has revived retail demand in India and this may create a tailwind for gold imports.

Chart 3: Indian gold official imports were above five-year average

July monthly imports Indian monthly official gold imports from February 2019 - July 2021

Source: Infodrive India, Ministry of Commerce & Industry Govt. of India, World Gold Council

Local market flipped back to discount after demand softened from mid-July

The local market remained in premium of US$1-1.5/oz for the first two weeks of July before the price jump disrupted the recovery in demand and pushed the local market into a discount of US$3-4/oz by month end (Chart 4).8 August’s correction in the gold price caused the local market to return to a premium of US$3-4/oz by the third week of the month amid revival in retail demand.

Chart 4:Domestic market flipped back to discount after demand softened from mid-July

Difference between MCX Gold Spot Price and landed gold price in India derived from LBMA Gold price AM

Source: NCDEX, World Gold Council

Gold ETFs saw marginal outflows after seven months of consecutive inflows

Renewed optimism over the economic recovery and higher rates of vaccination caused investors to pull money out of gold ETFs. Negative returns on domestic gold versus other asset classes may also have prompted outflows during the month.9 Inflows decreased by 0.2t (Rs0.6bn; US$8.3mn) during July taking total gold ETF holdings to 34t (Chart 5).

Chart 5: Indian gold ETF holdings saw marginal outflows in July

Source: Respective ETF providers, Bloomberg, World Gold Council

The RBI added 5.6t to its gold reserves

After purchasing 9.4t of gold in the previous month the RBI purchased an additional 5.6t gold in July, taking its gold reserves to 711.2t or 6.7% of total reserves (Chart 6).10 The RBI has stepped up gold purchases over recent years and has added 34.6t to its gold reserves y-t-d. As per our latest report, central banks are likely to continue buying gold on a net basis in 2021 at a similar or higher rate than in 2020, driven by a continued focus on diversification and risk.

Chart 6: RBI added 5.6t to its gold reserves in July

Source: IMF, RBI, World Gold Council

Monsoon gained strength in July and kharif sowing remained healthy

After a lull, the monsoon gained momentum in mid-July with cumulative rainfall just 1% below the LPA by the end of the month. As the monsoon strengthened, the pace of kharif crop sowing picked up. Although 4.7% lower than 2020, up until the end of July it stands 7% higher than shown in the last five-year average sowing data (Chart 7).11

Chart 7: The sowing of kharif crops at end of July remained healthy compared to the 5 year average sowing data

Source: Department of Agriculture and Farmers Welfare, World Gold Council

Footnotes

Based on MCX Gold Spot price in rupees as of 30 July 2021.

We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

An E-Way bill is an electronic bill for movement of goods and is generated on the E-Way Bill Portal. A GST registered person cannot transport goods in a vehicle without an E-Way bill if the value of goods exceeds Rs50,000.

FY refers to the financial year April to March.

Aadi month started on 17 July and ended on 16 August in 2021. It is considered an inauspicious period for gold purchases by the local community in Tamilnadu.

Onam and Raksha Bandhan is celebrated on 21 and 22 August 2021.

FTWZ offers a distinct advantage as overseas suppliers can import gold into the custom-bonded warehouse of FTWZ without paying customs duty for authorised operations. Imported gold can be stored in FTWZ for a long period – as long as the letter of approval (LOA) is valid – thus reducing the logistics time in supplying to the domestic market as compared to importing from the overseas market.

The premium/discount data is based on gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

Gold returns from Goldhub; for the month ending July, the one-year returns for BSE SENSEX and S&P BSE Government Bonds were 41.4% and 3.3% compared to a negative return of 10% for MCX Gold Spot price.

Central Bank data is taken from IMF-IFS; IFS up until June and weekly statistics from the RBI for July. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics.

Department of Agriculture and Farmers Welfare.