Summary

- The domestic gold price increased by 1.2% during July, ending the month at Rs51,301/10g1

- Retail demand remained tepid as the wedding season ended and rural demand was muted. Wholesale demand saw decent activity as jewellers replenished stocks ahead of the India International Jewellery Show (IIJS)2

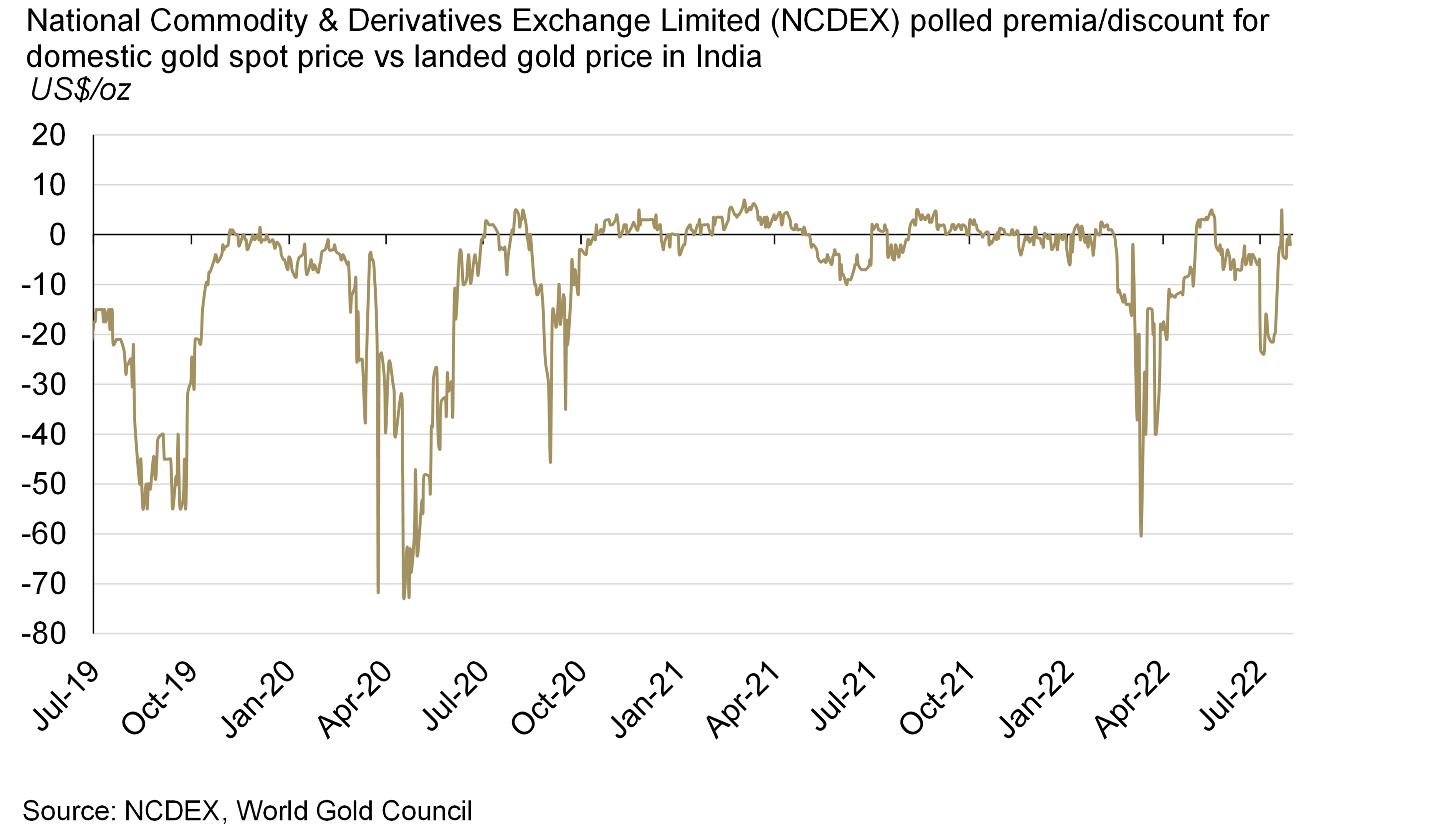

- The local price discount narrowed from US$23-24/oz to US$1-2/oz over the course of the month supported by wholesale demand

- Official imports declined to 42.5t in July, 41% lower y-o-y due to weak retail demand

- Indian gold ETFs witnessed a net outflow of 0.9t in July as investors likely booked profits amid a sharp correction in the domestic gold price and expectations of further price weakness

- The Reserve Bank of India (RBI) added 13.4t of gold in July, increasing its total gold reserves to 783.1t.

Looking ahead

- Retail demand is gradually picking up, supported by festivals during the month and ahead of the wedding season3

- Official imports are expected to pick up during August on the back of improved retail demand.

The local discount narrowed during the month due to healthy wholesale demand

The international gold price declined in July by 3.5% to US$1,753/oz, led by softer US inflation expectations and dollar strength.4 The depreciating local currency resulted in a stronger INR gold performance (+1.2%) compared to USD performance.

With healthy wholesale demand the local discount in the market narrowed to US$1-2/oz by the end of the month compared to a discount of US$23-24/oz at month start (Chart 1).5 As wholesale demand from manufacturers waned, the local market went back into a discount of US$9-10/oz during the first week of August.

Chart 1: The local discount narrowed by the end of the month with healthy wholesale demand

Retail demand remained tepid and imports were muted

Retail demand remained tepid in July due to three reasons: rural demand softens while sowing is in progress, the wedding season has drawn to a close, and import duty on gold has risen. However, retail demand saw a marginal improvement during the third week of the month due to a correction in the domestic gold price, although consumers held back in expectation of a further price decline. Wholesale demand saw decent activity as jewellers replenished stocks ahead of the India International Jewellery Show (IIJS) which coincided with a correction in the domestic gold price. 6 Against this broad backdrop, official imports remained muted in July: Indian official imports were 42.5t; 4% lower m-o-m and 41% lower y-o-y (Chart 2). Y-t-d official imports in 2022 remain 35% lower compared to 2021 import levels due to weak retail demand in Q1 2022 and the recent hike in gold’s customs duty.

Chart 2: Indian gold official imports remained muted in July 2022

Conversations with industry contacts reveal that retail demand in August is gradually picking up ahead of the upcoming wedding season. Retail demand should also be supported by festivals during the month and official imports are expected to surpass the soft imports during June and July.

The sentiment at India International Jewellery Show (IIJS) was buoyant

India’s largest B2B show was held in Mumbai between 4 and 8 August. Conversations with key manufacturers highlighted their healthy order books from retailers ahead of the key wedding and festival season. With lower import levels in June and July retailers have started to replenish their stocks and IIJS serves as a good platform to place orders. Manufacturers also reported good retailer demand for plain and light-weight gold jewellery. In the last few years rose gold has also started to attract young millennials due to its lower price point (rose gold is 18k), more on-trend designs and the choice of light-weight pieces (Figure 1).

Indian International Bullion Exchange (IIBX) launched in GIFT City

The India International Bullion Exchange (IIBX) at GIFT City, India's only international finance services centre underpinned by a truly state-of-the-art infrastructure, was inaugurated on 29 July by India's Prime Minister, Narendra Modi, in the presence of the Finance Minister, industry regulators and other senior bureaucrats (Figure 2). IIIBX should, over time, enable Indian jewellers to buy directly from overseas suppliers, promote responsible sourcing and strengthen the Indian market.

Indian gold ETFs witnessed highest outflows since January 2022

Indian gold ETFs witnessed net outflows during the month (0.9t) as investors booked profits amid a sharp correction in the domestic gold price and expectation of further price weakness. These outflows softened total gold ETF holdings to 38.2t by the end of July (Chart 3). Despite the July net outflows, India has managed to squeak out y-t-d inflows of around 0.6t.

Chart 3: Indian gold ETFs saw highest outflows since January

The RBI added 13.4t to its gold reserves

The RBI added 13.4t to its gold reserves in July – the highest level since September 2021, at which time it added 18.7t. This took total gold reserves to 781.3t (7.6% of total reserves) by the end of the month (Chart 4). 8 So far, the RBI has added 27.1t to its gold reserves during the year.

Chart 4: RBI's gold purchases touched 10-month high in July

Monsoon gained momentum during the month but kharif crop sowing remained weak

After the weak monsoon during June, rainfall totals improved in July ending 8% above the long period average (LPA) by the end of the month (Chart 5). But monsoon rainfall remains deficient across the East and Northeast regions (particularly among the paddy fields of Bihar, West Bengal and Uttar Pradesh). 9 With deficient rainfall in these states sowing of paddy is 13% lower y-o-y, with overall kharif crop sowing down by 3%. If the distribution of monsoon rainfall remains uneven, reduced kharif crop production could lead to higher food inflation and lower incomes for rural communities.

Chart 5: The monsoon gained strength in July