Key highlights:

- The Shanghai Gold Price Benchmark PM (SHAUPM) in RMB rose by 0.5% in August while the LBMA Gold Price AM in USD saw a 2.6% fall

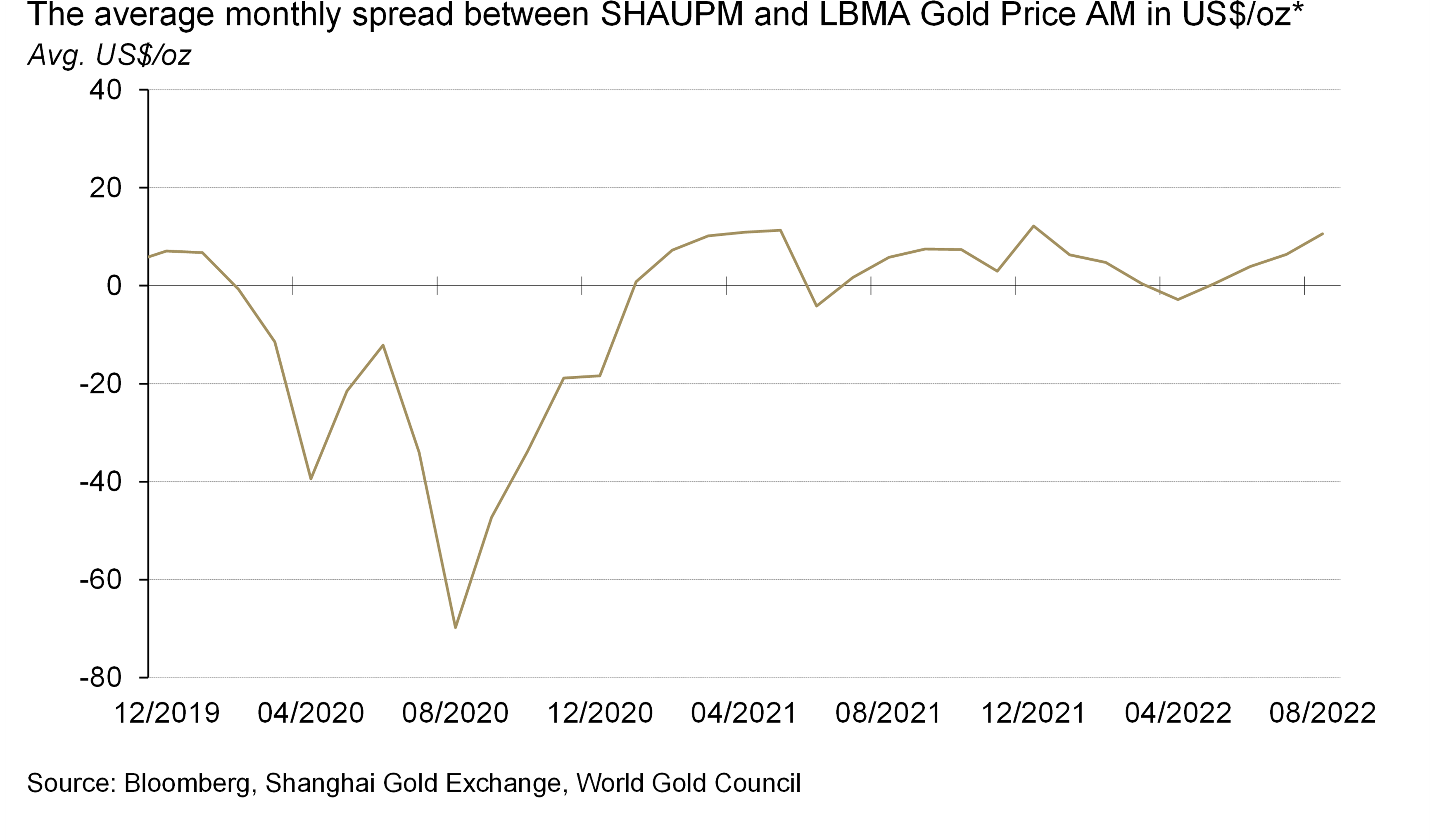

- The average Shanghai-London gold price spread climbed further in the month, driven by stronger demand1

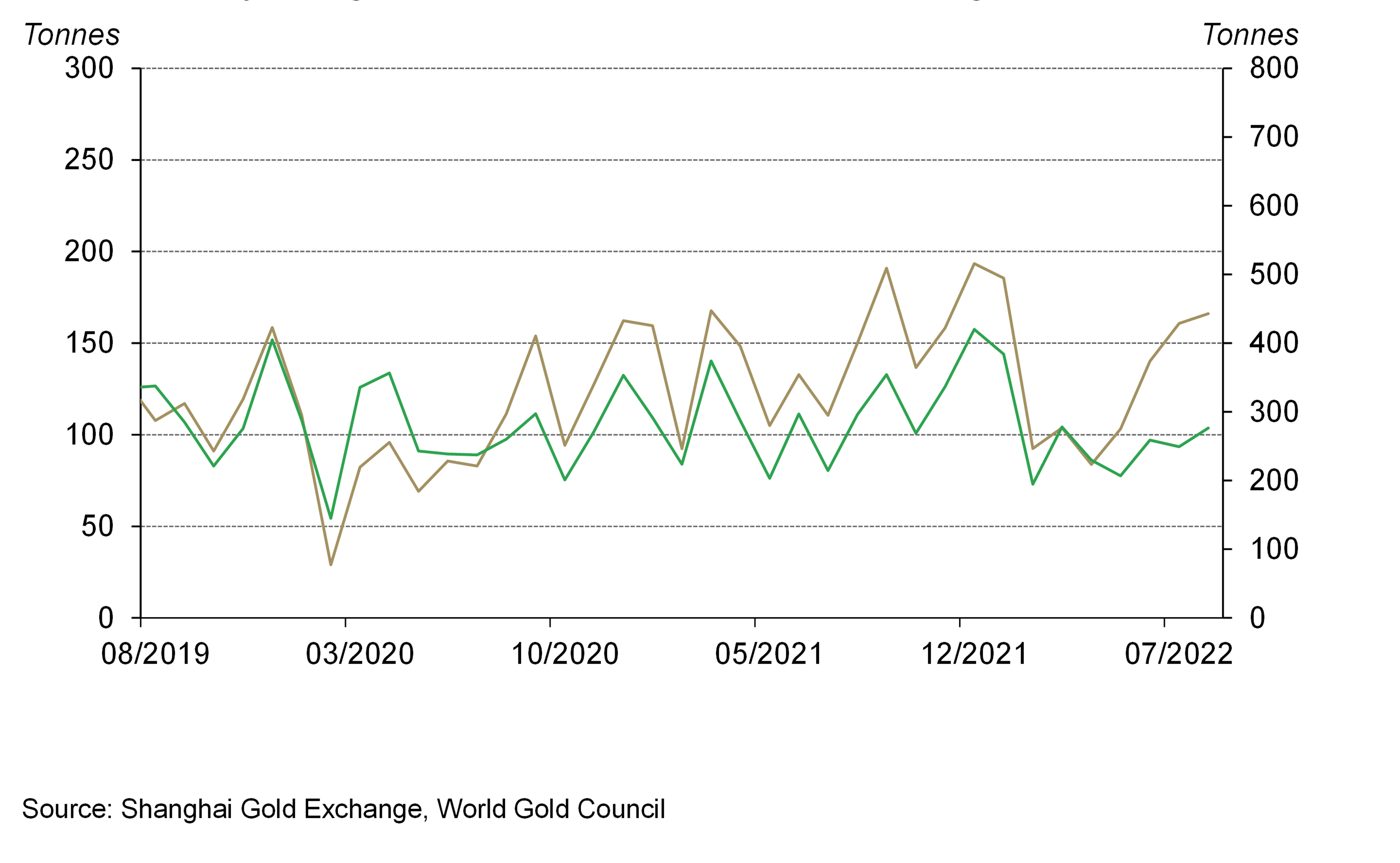

- Seasonal strength and robust consumption supported gold withdrawals from the Shanghai Gold Exchange (SGE) in August, witnessing both m-o-m and y-o-y rises.

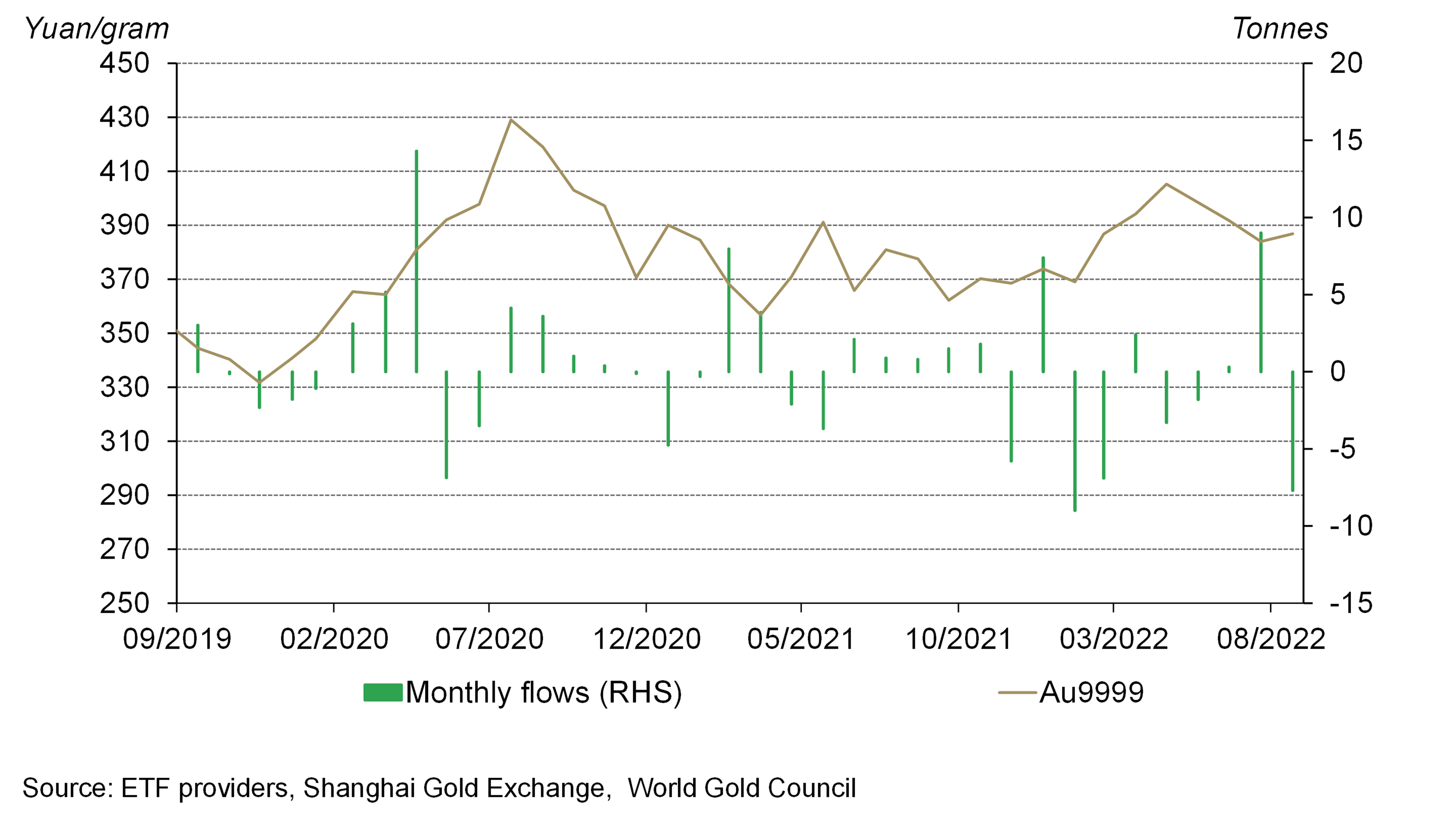

- Total assets under management of Chinese gold ETFs stood at 58.3t (US$3.3bn, RMB22.6bn) at the end of August, a 7.7t (US$485mn, RMB2.8bn) outflow over the month.2

Looking ahead:

- In late August more and more cities were implementing soft or partial lockdowns to contain recent COVID-19 case resurgences;3 this could weigh on local gold consumption in the near term

- The annual Shenzhen Jewellery Fair – scheduled for early September – was postponed due to a pandemic outbreak, dialling down business activities in China’s main gold manufacturing hub.4 The pandemic has also impacted the exhibitions that manufacturers usually hold during September and prevented clients’ trips to Shenzhen. This could also potentially weigh on wholesale gold demand.

Local gold price premium continued to rise

Regional gold performances diverged in August. While the US Fed’s hawkish stance in monetary tightening and softer inflation expectations weighed on the USD gold price, the SHAUPM in RMB saw a marginal increase. This was primarily driven by the RMB’s 2% depreciation against the dollar – thanks to a strong dollar and sluggish economic activities in China.

Stronger gold consumption in China – see below for more – may also have contributed to the local gold price’s outperformance relative to its USD peer. Consequently, the Shanghai-London gold price spread continued to rise in August. The spread reached US$10.6/oz on average in the month, US$4.2/oz higher m-o-m and US$4.8/oz higher y-o-y.