Summary

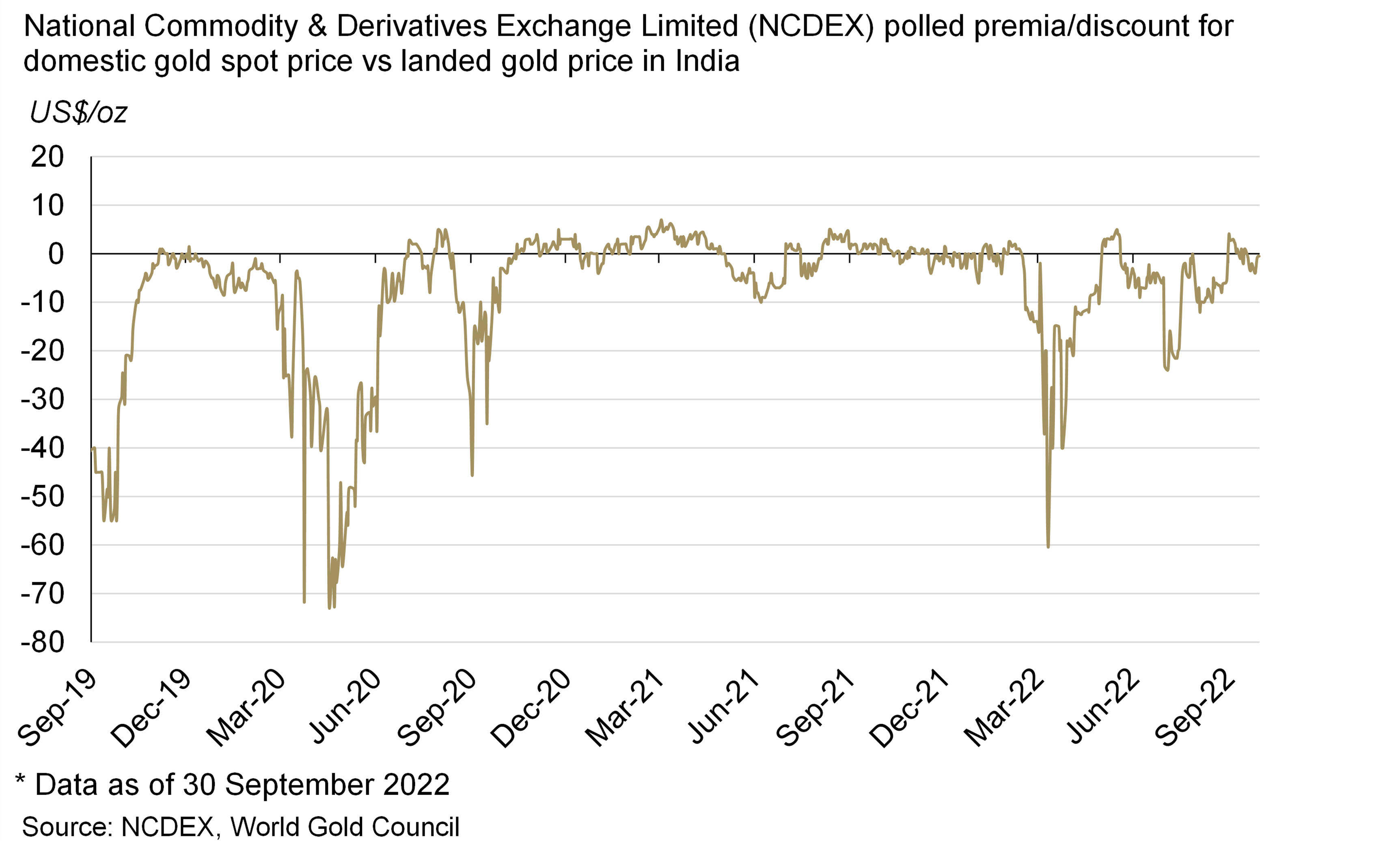

- Healthy retail demand in September drove the local price briefly into premium, but market dynamics generated a discount for much of the month

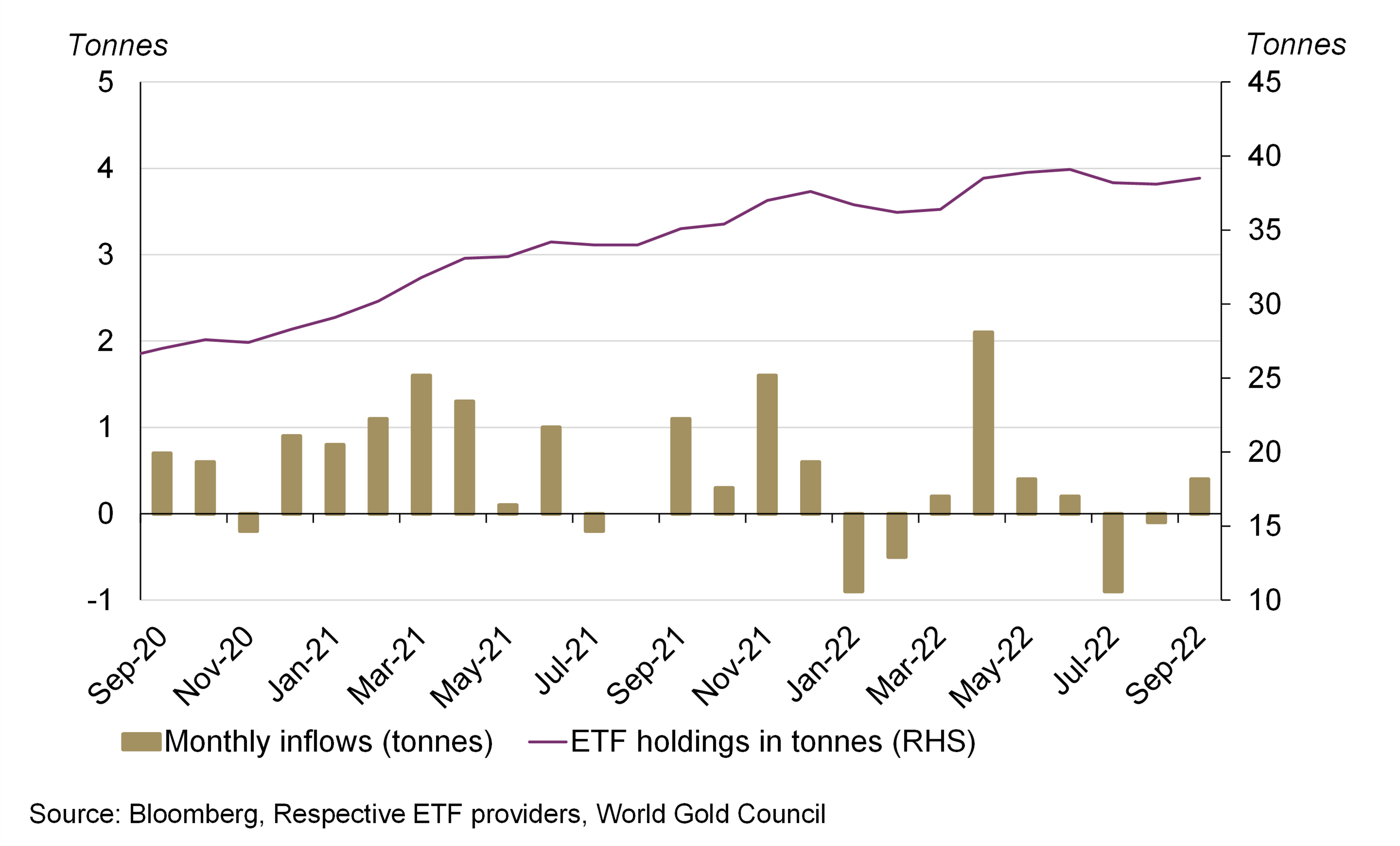

- Indian gold ETFs witnessed a marginal net inflow of 0.4t in September as a domestic gold price correction enticed investors back into gold

- The Reserve Bank of India (RBI) added 1.4t of gold to its reserves in the first three weeks of September, lifting its total gold reserves to 782.7t.1

Looking ahead

- The outlook for gold demand in October remains strong. A lower gold price provided a fillip to gold demand during the last week of September and the momentum has continued

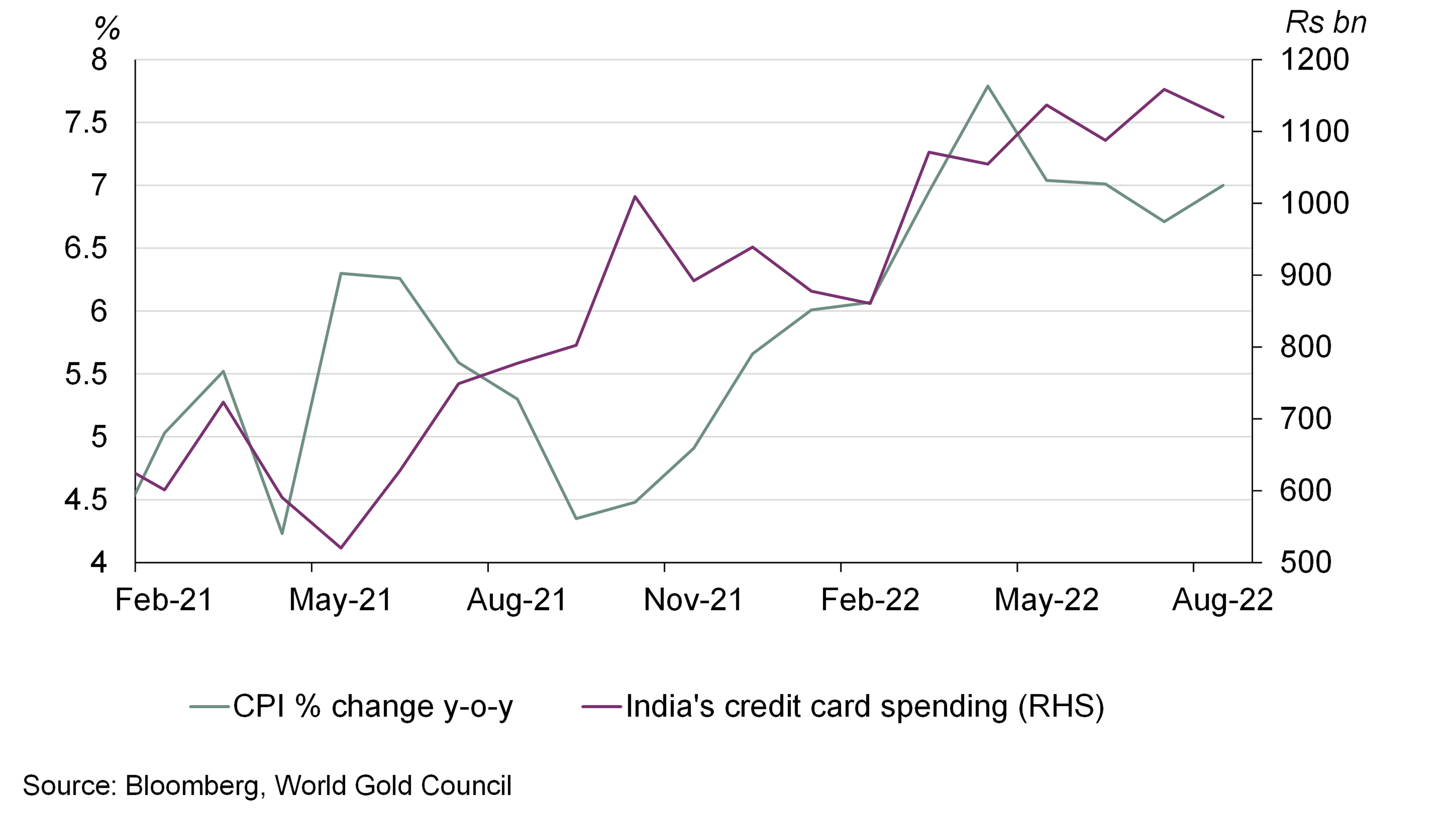

- Elevated retail inflation and a weak rupee (INR) provide a mixed scenario for Indian gold demand.

Retail demand remained healthy during September and outlook remains strong for October

Retail demand got off to a healthy start in September, boosted by a correction in the local gold price and festival-related purchases.2 Demand softened during the inauspicious period of Pitru-Paksha (10 to 25 September) but the lower gold price enticed some consumers to make both spot purchases and advance bookings for upcoming festivals and weddings. And the month ended on a positive note with solid purchases ahead of Navratri.3

Looking ahead, prospects are for another month of strong demand. Our interactions with the trade confirm that momentum has continued in October with consumers making festival and wedding – as well as everyday – purchases.

The local market remained in discount for the majority of the month

The international gold price declined in September by 2.3% to US$1,673/oz, impacted by higher yields and dollar strength.4 Gold’s performance was relatively stronger in local currency terms (-1.8% m-o-m) as the INR depreciated against the USD.

The local gold price pullback proved to be a boost to Indian retail demand, pushing the local market back into a premium of US$2−3/oz during the first week of September – the first time it has been in premium since May 2022. The market, however, dropped back into discount for the rest of the month (Chart 1)5 due to:

- A loophole in custom notification that allowed gold to be imported as platinum alloy with lower duty: Anecdotal evidence suggests that some importers exploited a loophole allowing platinum alloys to be imported at a lower duty.6 Platinum rods with 4% platinum and 96% gold content were declared as platinum alloys, which were subject to 10.75% custom duty instead of the 15% duty on gold bullion. Interaction with trade has revealed that ~27t of gold was imported via this route during September.

This activity, which is against the spirit of the Indian gold market, distorted the local market and kept it in discount for most of the month. The Ministry of Finance through its notification on 3 October has closed the loophole by increasing the custom duty on platinum to 15.4%-higher than the duty on gold at 15%.

- Soft demand during Pitru-Paksha: Retail demand softened with the onset of Pitru-Paksha, which pushed the local market further into a discount during the month.

- Increased unofficial imports after a hike in custom duty: Since the hike in custom duty was introduced on 1 July, an increase in the smuggling of gold into India has helped keep the local market in steady discount. Gold smuggling volumes could increase substantially in 2022 if the custom duty remains at such an elevated level.

Chart 1: The local market remained in discount for majority of the month

The macro backdrop presents a mixed scenario for Indian demand

The current macroeconomic backdrop of elevated retail inflation and a depreciating INR presents a mixed outlook for gold demand in the near term. Retail inflation measured by the consumer price index (CPI) has remained consistently above the RBI’s 6% target since the beginning of the year. And high retail inflation has imposed stress on Indian household savings, resulting in higher credit card spending (Chart 2). Further, INR depreciation to the tune of 8.7% y-t-d has resulted in a 4.5% rise in the domestic gold price (compared to a decrease of 8% in the international gold price).7 And the reduced pace of intervention by the RBI against a widening current account deficit may lead to further INR weakness. Combined, the effect of inflation on household finances and a strong local gold price may impact gold jewellery demand in the near term.

On the positive side, gold is widely considered a hedge against inflation and currency depreciation in India, and retail as well as institutional investors may flock to bar, coin and gold ETFs to protect their wealth.

Chart 2: Credit card spending has increased in India as consumers battle higher inflation

Indian gold ETFs witnessed net inflows in September

With a 1.8% correction in the domestic gold price during September, investors moved back into gold ETFs with a net inflow of 0.4t during the month.8 This lifted total gold holdings to 38.5t by the end of September (Chart 3). Overall, Indian gold ETFs have seen small but meaningful net inflows of 0.9t y-t-d.

Chart 3:Indian gold ETFs saw net inflows in September

The RBI added 1.4t to its gold reserves in September

After making no purchases in August, the RBI added 1.4t to its gold reserves in the first three weeks of September – according to the latest available data. Its total gold reserves now stand at 782.7t (Chart 4). 9 Gold reserves as a percentage of total reserves has grown during the year due to intervention in the FX market by the RBI in an attempt to defend the INR, causing FX reserves to slump by US$96bn to their current level of US$553bn. 10

Chart4: RBI added 1.4t to its gold reserves in September

Monsoon rainfall was above normal but kharif crop sowing was marginally weaker

The monsoon season ended above the normal range with cumulative rainfall 6% above the long period average (LPA) by the end of September (Chart 5). But the monsoon rainfall remains deficient across the East and Northeast regions (particularly among the paddy fields of Bihar, West Bengal and Uttar Pradesh).11 This has led to the sowing of paddy being 4.7% lower y-o-y, with overall kharif crop sowing down marginally by 0.8%.12 The normal monsoon could lead to higher incomes for the rural community, although higher inflation could remain a headwind for rural savings.

Chart 5: Monsoon rainfall was above normal range in 2022