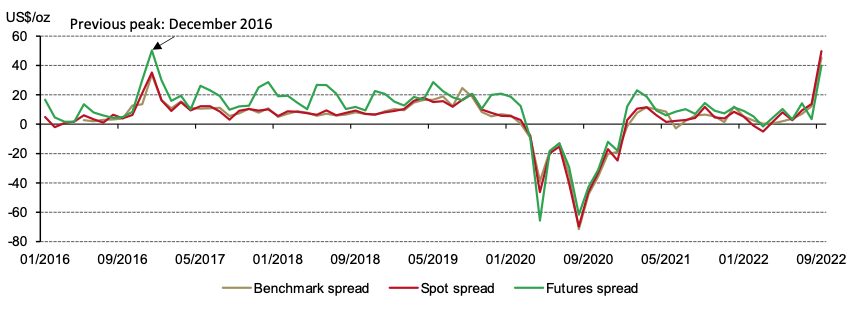

The local Chinese gold price premium has been surging lately: September’s average reached the highest monthly level for nearly six years. Our analysis shows:

- local net gold demand and mean reversion explain 60% of changes in the Shanghai-London gold price spread

- robust wholesale gold demand over recent months has been driving the local gold price premium higher

- while potential strength in China’s wholesale gold demand could continue to support the gold price premium in the coming quarter, mean reversion and COVID-related uncertainties may be major headwinds.

Chart 1: The local gold price premium surged to the highest since December 2016*

Local gold demand has been a key driver of the gold price premium

In addition to import costs, “scarcity” of gold in China, in other words, the level of net domestic supply, is the other major factor influencing the spread: China’s domestic supply is simply not able to meet local demand. Also, due to controls on gold imports into China, the local gold price has been generally higher than its international peer.1 And as the local gold supply often stays relatively stable – 10% volatility over the past decade – gold demand in China – 25% volatility in the past 10 years – contributes more to changes in the spread.2 This was detailed in a past publication.

In fact, our quarterly spread model shows that net demand – calculated by subtracting the previous quarter’s supply from the current quarter’s demand – is a significant factor driving the Shanghai-London gold price spread.3 Another statistically significant factor is mean reversion. Net demand and mean reversion combined explain the lion’s share of the spread changes.

Chart 2: Net demand and mean reversion explain 60% of spread changes*

Momentum has been building for a while

As we have previously noted, wholesale gold demand has been robust over recent months. In September wholesale gold demand – gold withdrawals from the Shanghai Gold Exchange by manufacturers and banks – totalled 180t, a 8% comparing to August and the fifth consecutive m-o-m rise. Manufacturers’ stock replenishment ahead of the National Day Holiday, a traditional gold sales boost during the first week of October, and a stable gold price were supportive factors.

Chart 3: Wholesale gold demand in China has been strengthening since May

Outlook

Gold consumption during the seven-day National Day Holiday sent a mixed signal about Q4 demand strength. While some retailers saw a boost to anticipated sales, those in cities with renewed COVID resurgences and related restrictions were left disappointed.4

And this, to some degree, may continue through the final quarter. On the one hand, seasonality, government stimuli5 and positive consumer sentiment towards gold amid RMB weakness and COVID uncertainties may support future gold consumption.6 But on the other hand, restrictions brought about by the zero-COVID policy could continue to disrupt the local gold market.7

Hence we expect the spread during Q4 will face opposing forces: while mean reversion and demand uncertainties could send the premium lower, aforementioned demand boosts may provide some support.

For detailed analysis, stay tuned for our 2022 Q3 Gold Demand Trends report, which will be published in late October.