Summary

- The domestic gold price diverged from the international gold price: the MCX Gold Spot price rose marginally by 0.2% compared to a 2% decline in the LBMA Gold Price AM in USD

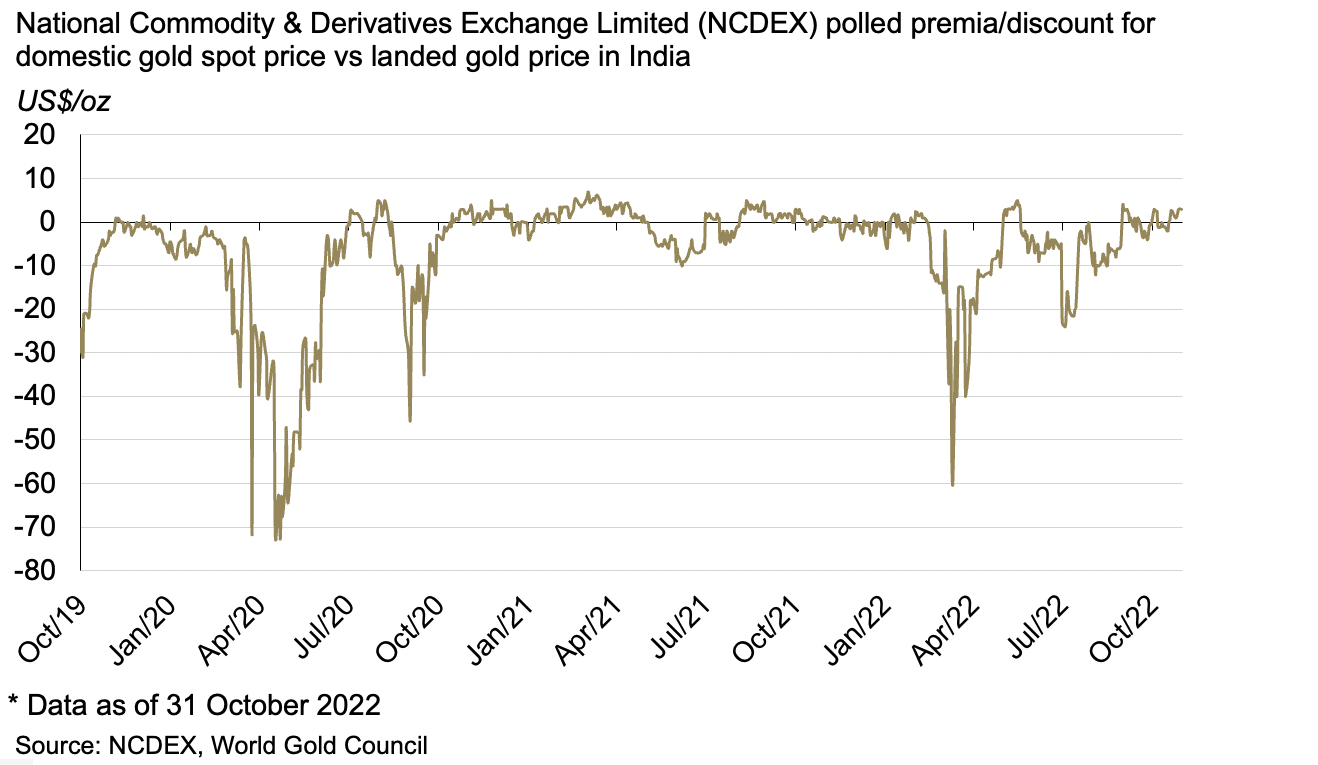

- Healthy retail demand in October drove a local price premium for the majority of the month

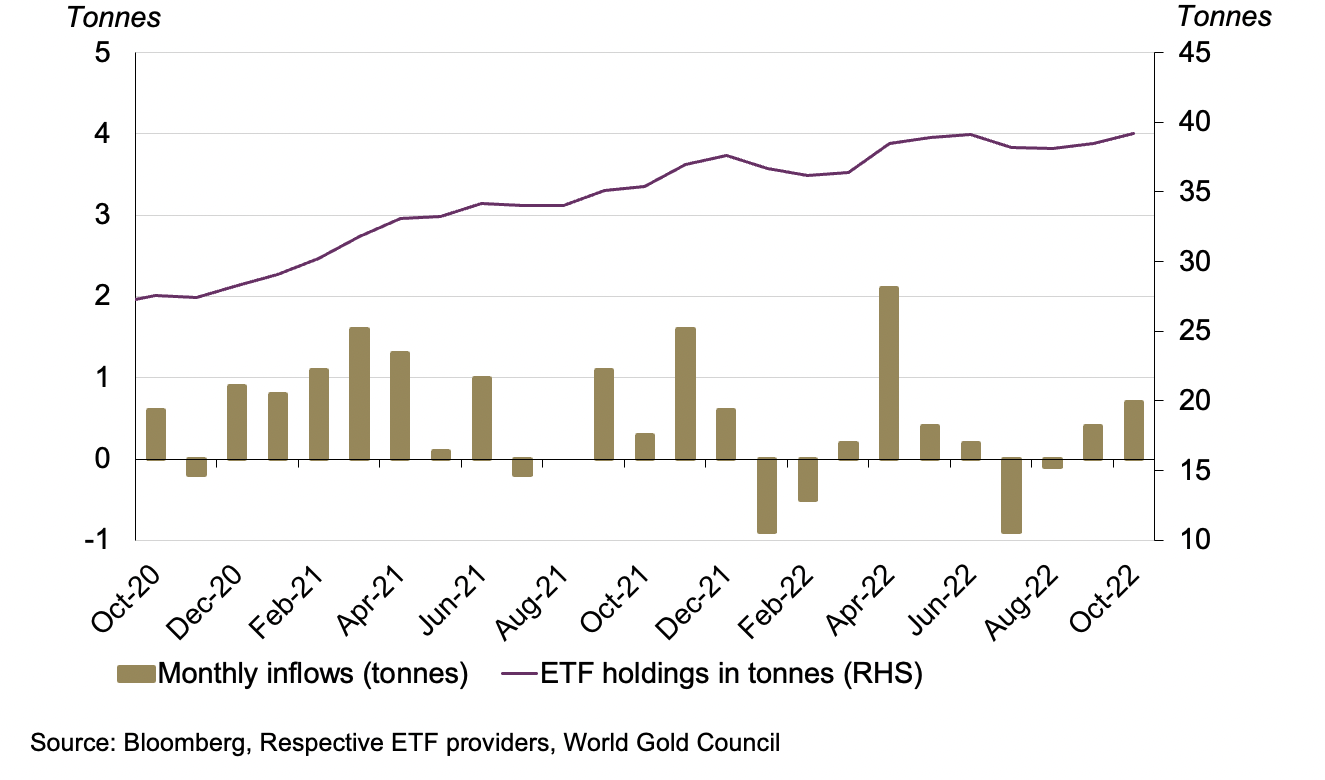

- Indian gold ETFs witnessed a marginal net inflow of 0.7t in October, as the correction in the domestic gold price ahead of Dhanteras likely lured investors into gold

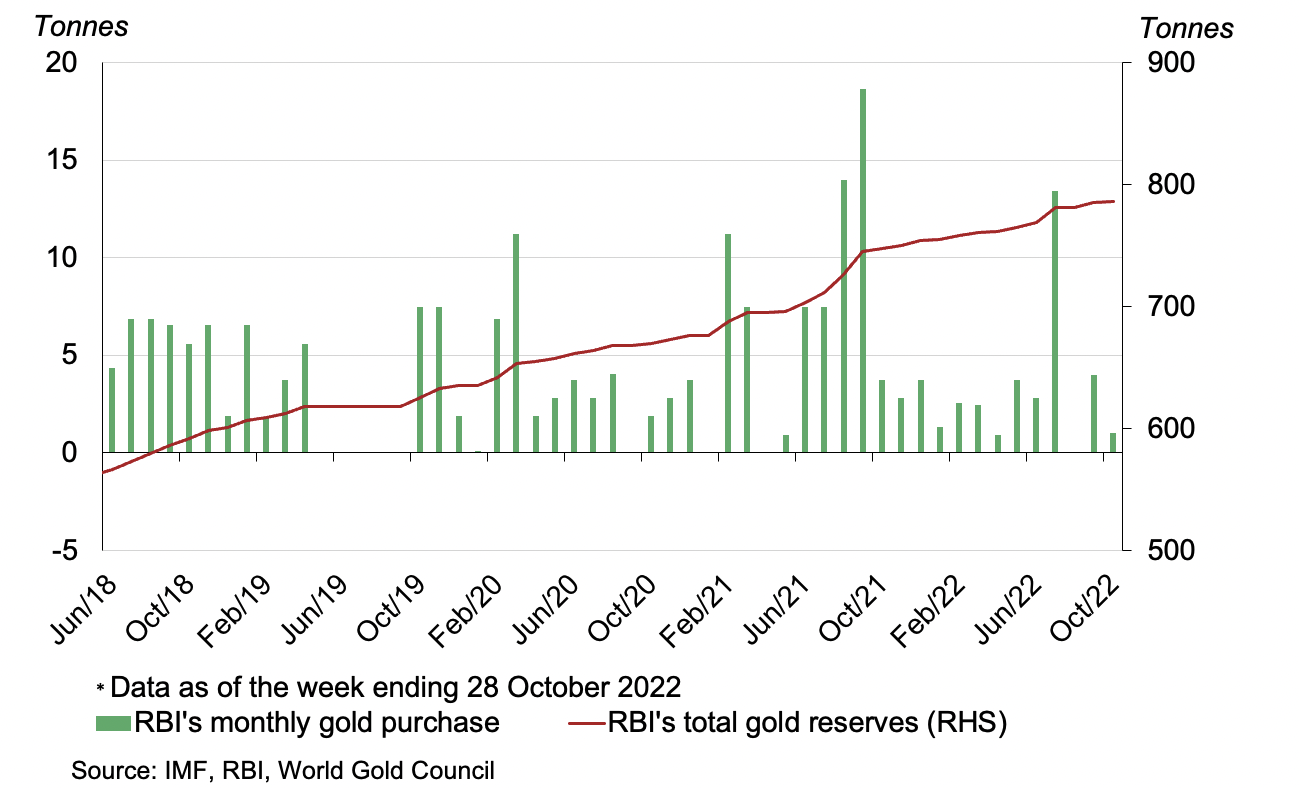

- The Reserve Bank of India (RBI) added 1t of gold to its reserves in October, lifting its total gold reserves to 786.3t.1

Looking ahead

- Retail demand is expected to remain healthy in the months ahead, supported by the ongoing wedding season.

- Urban demand may benefit from improving consumer sentiment and an expectation of a lower inflation trajectory.

- Rural demand may, however, face headwinds due to the poor kharif foodgrain output after uneven and erratic rainfall.2

The local market remained in premium for most of the month

The international gold price declined by 2% in October to US$1,639/oz, impacted by higher yields and dollar strength.3 Gold’s performance was relatively strong in local currency terms (+0.2%% m-o-m) as the INR depreciated against the USD.

The arrival of festivals and the wedding season, fortuitously coinciding with a price pullback, proved to be positive for Indian retail demand. This pushed the local market back into a premium for most of the month. The wholesale demand for bullion also picked up due to a correction in the customs tariff, which was revised downwards to US$533/10g from 1 October – it had previously been US$549/10g – resulting in lower bullion import costs. With this pick up in demand the local market touched a premium of US$3/oz by the end of the month (Chart 1).4

Chart 1: Strong retail demand kept the local market in premia for the majority of the month

Retail demand remained strong during October

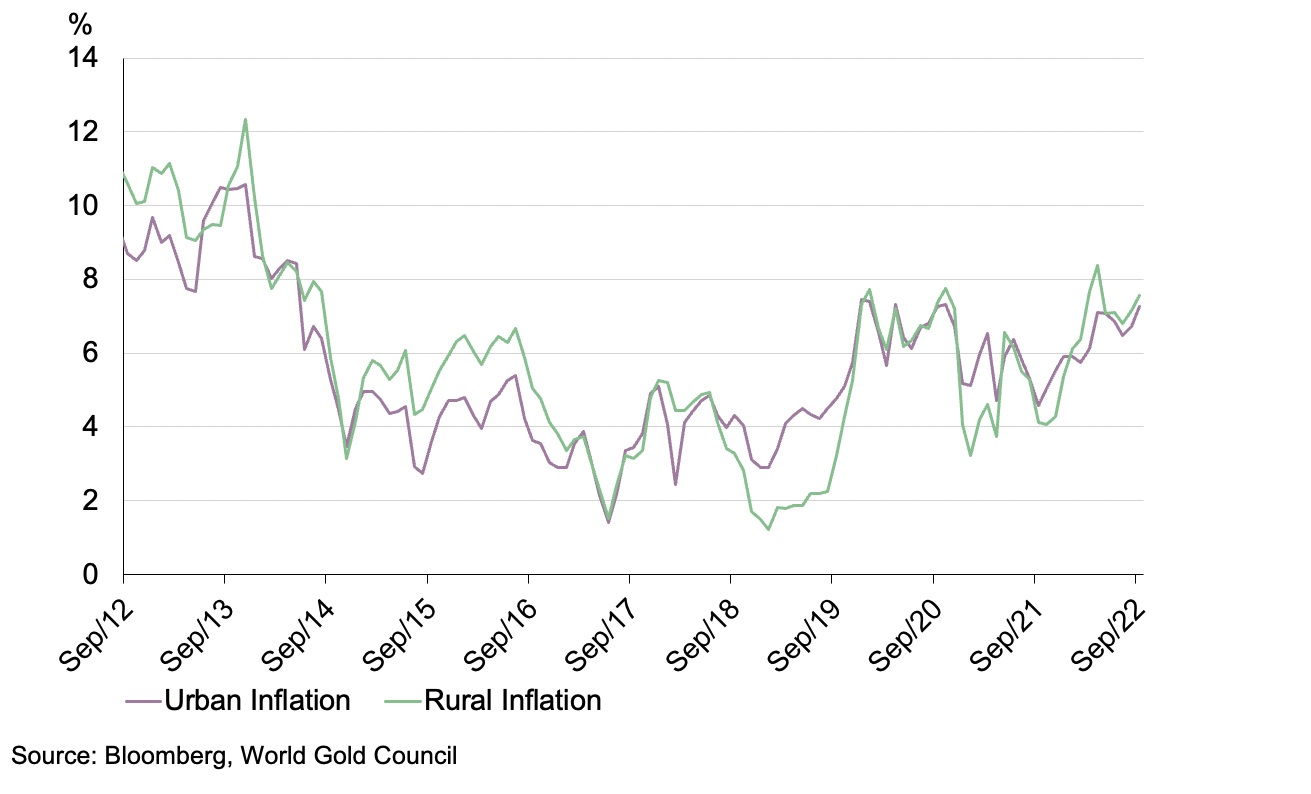

October retail demand remained strong with the onset of festivals and weddings. The festivals of Dussehra and Dhanteras sparked fresh demand for physical gold towards the end of the month. Dhanteras was celebrated on two days this year (22 and 23 October) and with a stable gold price before this date, demand received a boost from sales of jewellery (for weddings and everyday wear) as well as bar and coin purchases. Dhanteras purchases received support from the recovery in urban sentiment, although rural demand was impacted due to a 4% higher y-o-y domestic gold price and relatively high levels of inflation compared to urban areas (Chart 2). Based on our interactions with the trade, demand during the lead-up to Dhanteras was ~10-15% higher y-o-y in volume terms, indicative of the strong sentiment this year, particularly when we consider that last year’s festival demand was also robust.

Chart 2: Higher inflation hit spending of rural consumers

Indian gold ETFs witnessed net inflows in October for the second consecutive month

With a timely correction of 4% in the domestic gold price just ahead of Dhanteras, investors were likely lured towards gold ETFs, resulting in a net inflow of 0.7t during the month.5 This lifted total gold holdings to 39.2t by the end of September (Chart 3). Overall, Indian gold ETFs have seen small but meaningful net inflows of 1.6t y-t-d.

Chart 3: Indian gold ETFs saw net inflows for a second consecutive month in October

The RBI’s gold purchases slowed in October

After making 4t of gold purchases in September, the RBI added just 1t to its gold reserves in October – according to the latest available data. Its total gold reserves now stand at 786.3t (Chart 4).6 Gold as a percentage of total reserves has risen during the year due to intervention in the FX market by the RBI in an attempt to defend the INR, causing FX reserves to slump by US$102bn to their current level of US$531bn.7

Chart 4: RBI added 1t to its gold reserves in October

Looking ahead

Retail demand is expected to remain healthy in the months ahead supported by the ongoing wedding season. Gold demand is expected to receive a push and pull from urban and rural purchases. Urban demand may benefit from improving consumer confidence and an expectation that inflation will take a lower trajectory due to easing input costs. But rural demand could face headwinds due to lower foodgrain production. Monsoon rainfall has been deficient across the East and Northeast regions and the loss to standing crops due to this unseasonal rainfall is expected to lead to 11% lower y-o-y rice production.

Considering the strong start to Q4 and the interplay between urban and rural demand in the months ahead, we expect overall retail demand to remain above pre-pandemic levels in the quarter, although possibly below that of 2021, at which time there was a huge boost from pent-up demand post 2020-2021 lockdowns (Chart 5).

Chart 5: Retail demand in Q4 2022 may not match the strong levels of previous year

Footnotes

Data as of the week ending 28 October 2022.

Kharif crops are monsoon crops that are cultivated and harvested during the monsoon season which lasts from June to November.

Based on the LBMA Gold Price AM (US$) on 31 October 2022.

The premium/discount data is based on the gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

The domestic gold price corrected by 4% to Rs49,818/10g by 21 October from a high of Rs 51,635/10g on 6 October.

Central bank data is taken from IMF-IFS: IFS up until September and weekly statistics from the RBI for October. October’s purchases are up to the week ending 28 October. Please refer to our latest central bank statistics: https://www.gold.org/goldhub/data/gold-reserves-by-country

RBI’s gold reserves as a percentage of total reserves increased to 7.7% in October from 6.9% in December 2021. The FX reserves of US$538bn are based on data for the week ending 28 October 2022.