Key highlights:

- Gold prices kicked 2023 off to a strong start. Both the Shanghai Gold Price Benchmark PM (SHAUPM) in RMB (+2%) and the LBMA Gold Price AM in USD (+5%) extended their strength from late 2022

- The Shanghai-London gold price premium experienced a mild rebound, putting a stop to the declining trend since last October. Stronger gold demand during the month was key

- January saw 140t of gold leaving the Shanghai Gold Exchange’s (SGE) vault, the highest withdrawals during a Chinese New Year (CNY) month since 2018

- Chinese gold ETF holdings totalled 48t (US$3bn, RMB$20bn) at the end of January, the lowest since February 20201

- The People’s Bank of China (PBoC) announced a further gold purchase in January, the third consecutive monthly increase. Its total gold reserves rose to 2,025t, 15t higher m-o-m.

Looking ahead:

- With China’s economic activities recovering some vitality during January, a local gold demand rebound may lie ahead. As we mentioned in our Gold Demand Trends, the Chinese government’s prioritisation of consumption stimuli and consumers’ record-level tendency to save could bode well for local gold consumption. Meanwhile, seasonality may also push gold demand higher in Q1.

Gold started 2023 strongly

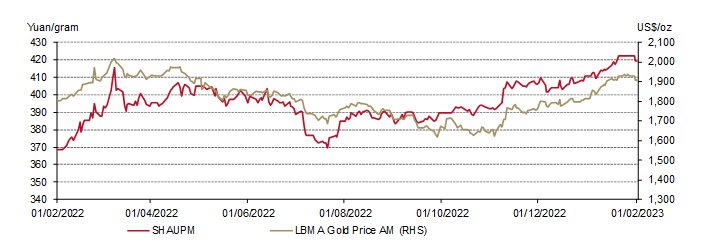

Gold prices kicked 2023 off to a strong start. The SHAUPM in RMB registered a 2% gain in January and the LBMA Gold Price AM in USD rose by 5% (Chart 1). Market participants’ mounting expectations of slower interest rate rises in major markets continued to be a key driver supporting the gold price.

The relative underperformance of the RMB gold price compared to its USD peer was mainly due to local currency strength. In January, the RMB appreciated over 2% against the dollar on a weaker dollar story and optimism over China’s reopening.

Chart 1: The RMB gold price rose by 2% during January 2023

The SHAUPM in Yuan/gram and LBMA Gold Price AM in US$/oz*

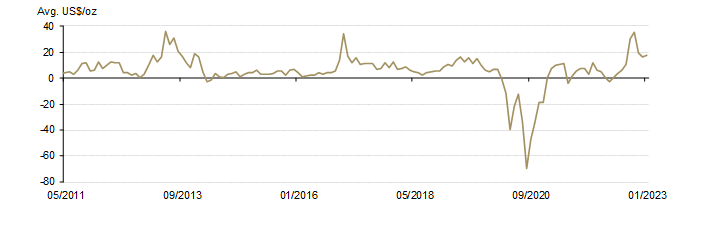

The local gold price premium stabilised in January, registering a mild gain of US$1/oz. A key factor stopping the premium’s fall since late October was a rebound in local gold consumption as detailed below.

Chart 2: The local gold price premium saw a mild rebound in January

The 5-day rolling average spread between SHAUPM and LBMA Gold Price AM in US$/oz*

Fewer working days in January impacted gold withdrawals despite healthy demand

China’s economy is recovering. As the first COVID-19 infection wave peaked during December, Chinese economic activities revived in January. The official general Purchasing Managers’ Index (PMI) jumped to 52.9 last month, from 42.6 in December. And during the 2023 CNY holiday, domestic trips rose 23% y-o-y while cinemas generated a revenue of nearly RMB7bn, the second highest on record.2

Gold consumption also boomed. According to the China Gold Association, during the 15-day period from the CNY day to the Spring Lantern Festival, Chinese gold consumption was up by 18% y-o-y.3 And conversations with industry participants in Shenzhen, the manufacturing hub of China’s gold products, reflected a busy January.4

Gold withdrawals from the SGE totalled 140t last month, a mild m-o-m decline of 2t and 25% lower than January 2022. This was mainly impacted by the occurrence of the 2023 CNY holiday which left gold manufacturers with only 16 trading days in January, the lowest number since 2012. In fact, when compared with previous CNY months, January’s withdrawal total was 12% higher than the 10-year average volume of 124t (Chart 3).

Chart 3: January withdrawals were strong when compared to previous CNY months*

And when adjusted for the impact of trading days, daily withdrawal last month averaged 8.7t. Although it was still 10% lower than a very strong January in 2022, the average withdrawal jumped by 34% m-o-m, extending its strength from previous months as China opened up and the first national COVID infection wave peaked (Chart 4).

Chart 4: Average trading day withdrawal tells a stronger story*

Chinese gold ETFs saw outflows

Chinese gold ETF holdings lost 4t last month, arriving at 48t (US$3bn, RMB$20bn) by the end of January (Chart 5). Following a record annual loss in 2022 and a weak start to 2023, total holdings of Chinese gold ETFs fell to their lowest since February 2020.

Two key factors precipitated January’s outflow. First, the 2% local gold price rise may incentivise profit-taking activities by Chinese gold ETF investors. Second, with the CSI300 stock index booking a sizable gain of 7% and the RMB strengthening, reduced safe-haven demand might also have contributed.

Chart 5: Chinese gold ETF holdings fell to their lowest since February 2020

Monthly tonnage flows and Chinese gold ETF holdings

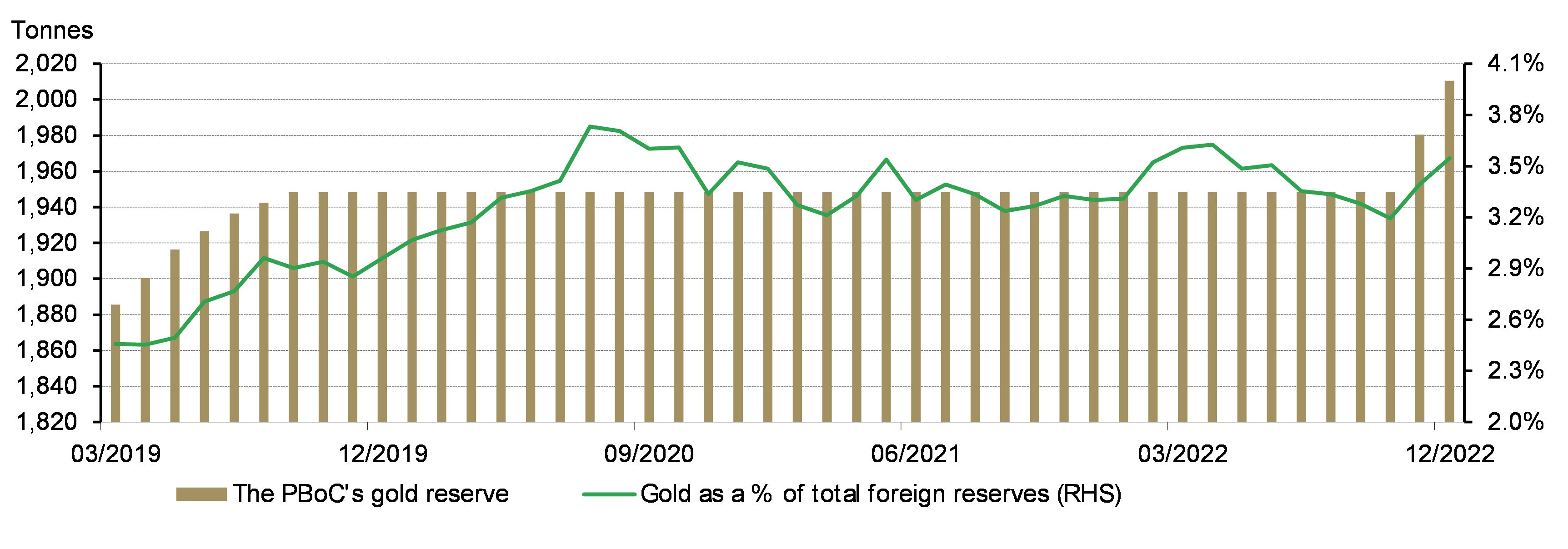

Gold reserves rose further

The PBoC announced another gold reserve rise in January, the third consecutive month. By the end of January, China’s gold reserves reached 2,025t, a 15t rise from its end-2022 level. Currently, gold accounts for 3.7% of China’s total official reserves.

After 38 months of silence, the PboC made its first gold purchase announcement in November. And during the past three months, the PboC’s gold reserves reported increase totalled 77t.

Chart 6: The PBoC announced another gold reserve increase in January

Gold imports rebounded in December

China imported 157t of gold in December, a m-o-m rebound of 18t (Chart 7). With COVID-related border controls softening, international flights saw a notable bounce compared to previous months, making importing activities more convenient. Meanwhile, the still-elevated local gold price premium, albeit sliding from previous peaks, might be another contributor.

This brings the annual total to 1,343t, a 64% y-o-y rise and the highest since 2018. 2022 has been a tale of two halves. On- and- off lockdowns in major cities during the first half suppressed local gold demand and imports. As COVID-controlling measures eased and the local gold price premium rose to a multi-year high, imports during the second half jumped.

Chart 7: China’s gold imports were strong during H2 2022

China’s gold imports under HS7108*

Footnotes