Key highlights:

- The LBMA Gold Price AM in USD and the Shanghai Gold Benchmark PM (SHAUPM) in RMB bounced higher, both recording the strongest monthly gains since March

- The industry withdrew 121t of gold from the Shanghai Gold Exchange (SGE) in October, a seasonal fall of 48t compared to September and a 23t y/y rise

- The local gold price premium fell from its record high, possibly driven by weaker gold demand during the month

- Collective holdings in Chinese gold ETFs remained unchanged at 60t, while total assets under management (AUM) rose to RMB28bn (US$4bn) due to a strong local gold price performance

- The People’s Bank of China (PBoC) announced its twelfth consecutive gold purchase, adding 23t to reported gold reserves and lifting the total to 2,215t.

Looking ahead:

- With no major holidays during November the elevated local gold price could weigh on gold consumption and lead to a relatively quiet period towards the end of the year. And uncertainty around the economic recovery could also become a drag on gold demand in the near term.

Gold prices saw notable rises in October

International gold prices experienced sizable rebounds in October (Chart 1). The SHAUPM in RMB rose by 6% and the LBMA Gold Price AM in USD by 7%, the largest monthly increases since March. Based on our analysis, rising safe-haven demand amid the Israeli-Hamas conflict drove the hike in international gold prices, even in the face of higher US Treasury yields.

Chart 1: October saw a notable rebound in gold prices

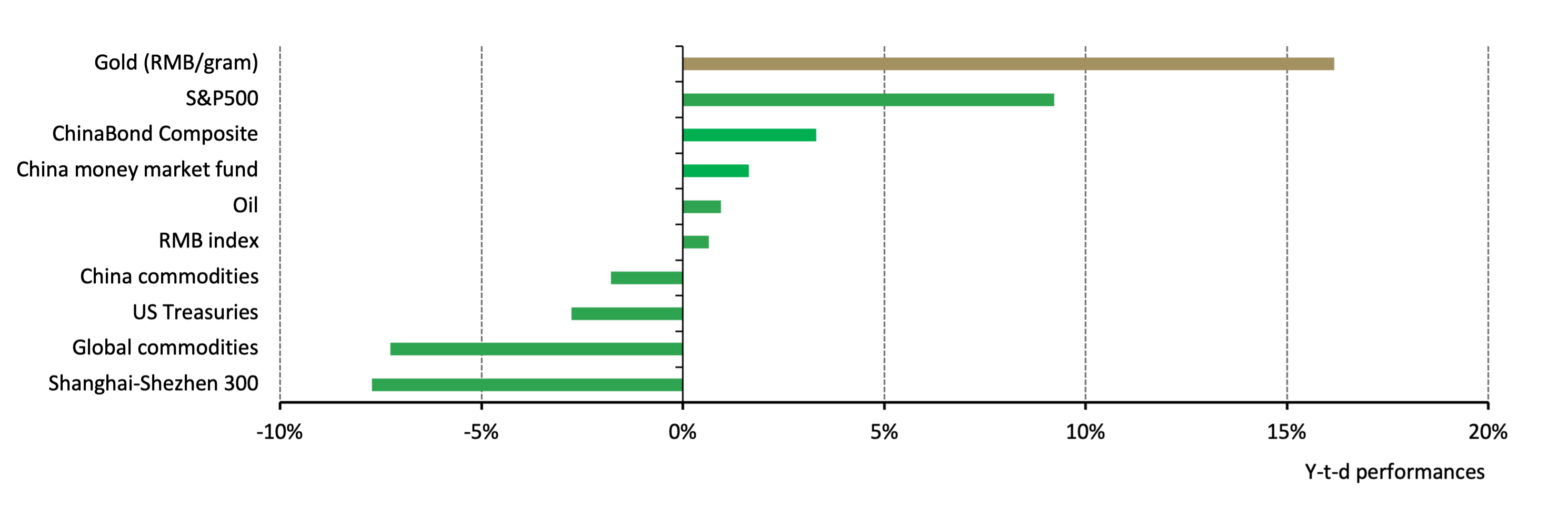

October extended the SHAUPM’s y-t-d gain to 16%, outperforming major assets globally and domestically (Chart 2). The LBMA Gold Price AM in USD has accumulated a 10% rise during the period.

Chart 2: Gold in RMB soared by 16% y-t-d

Major asset performance during the first ten months of 2023*

Wholesale demand fell seasonally

China’s economic recovery unexpectedly faltered in October. China’s official manufacturing PMI dropped below the 50% threshold last month, putting an end to its four-month rebound (Chart 3). The non-manufacturing PMI also declined and the y/y growth in inflation fell to -0.1%, highlighting weakness in domestic demand. Furthermore, exports declined by 6.4% y/y – weaker than the market consensus – putting further pressure on China’s recovery.

Chart 3: Chinese economic activities slowed in October

A total of 121t of gold left the SGE vault in October, a 48t m/m decline (Chart 4). The m/m fall in wholesale gold demand was seasonal. It is usual for the industry to actively replenish before Golden Week early October, a traditional gold product sales boost, and this lowers the need to restock afterwards1. The fact that there were fewer trading days in October also drove the m/m decline. Furthermore, with sales disappointing most jewellers in early October, they have adopted a cautious approach to stock replenishment.

Even so, there was a 23t y/y rise. While this growth was built on a weak October 2022, wholesale demand rose above its five-year average nonetheless, reflecting an improvement in industry sentiment in the first post-COVID year.

Chart 4: Gold withdrawals saw a seasonal m/m fall

Local premium rested from its record high

October’s Shanghai gold price premium over London averaged US$45/oz, or 2%, a sizeable decline from September’s record high of US$75/oz (4%) (Chart 5). We believe a decline in local gold withdrawals helped ease local supply and demand conditions, pulling the premium down. Nonetheless, October’s average premium remained well above its 2022 and pre-pandemic averages, suggesting that net supplies may have stayed at tighter levels than in previous years.

Chart 5: The local gold price premium fell from its record high

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz and %*

Chinese gold ETFs stable in October

Collective holdings in Chinese gold ETFs were virtually unchanged at 60t by the end of October, recording a mild outflow of RMB36mn (US$5mn). However, their total AUM rose by 6% to RMB28bn (US$4bn) thanks to a strong local gold price performance. The sharp fall in the local gold price in early October and the notable rebound later in the month have pushed cautious investors to the side-lines, as they wait for a clear trend.

Chart 6: Chinese gold ETFs stable in October

Monthly fund flows and Chinese gold ETF holdings

The PBoC reported another purchase

The PBoC’s gold reserves rose by 23t in October to 2,215t, extending its buying spree to twelve months (Chart 7). This pushed gold’s share in China’s total foreign exchange reserves to 4.3%, an all-time high. Y-t-d China has reported gold purchases accumulating to 204t. During the twelve-month period since last November China’s gold reserves have increased by 266t.

Chart 7: China’s gold reserves keep increasing

Imports unchanged in September

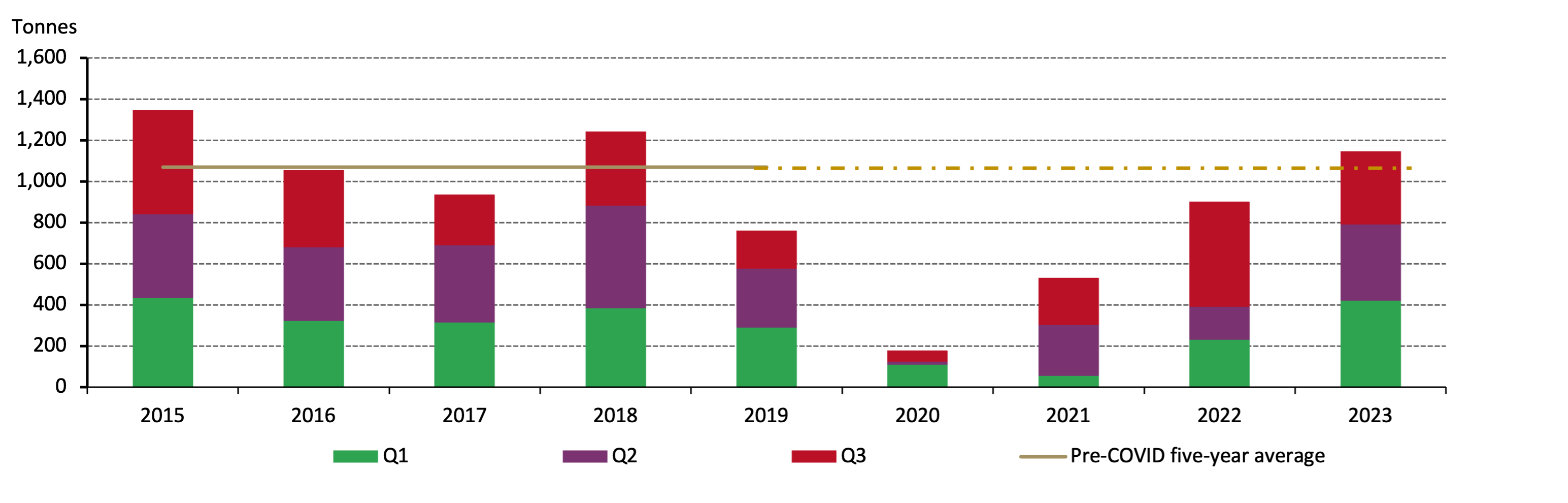

124t of gold was imported into China in September, based on the latest information from China Customs, virtually unchanged from August (123t). During the third quarter China’s gold imports amounted to 354t, 31% lower y/y, primarily due to 2022’s high base.

Between January and September China imported 1,145t gold, 27% higher than 2022, reflecting improved gold demand and the industry’s need to replenish stock during the first post-COVID year.

Chart 8: China’s gold imports continued to rebound in 2023

Footnotes

The 2023 Golden Week (the Mid-Autumn Festival and National Day Holiday) occurred between 29 September and 6 October.