Key highlights:

Wholesale gold demand saw the strongest January ever (271t) - boosted by stock replenishment ahead of the Chinese New Year.1

Chinese gold ETFs attracted RMB827mn (US$113mn), lifting their total AUM to an all-time high.

The PBoC reported the 15th consecutive gold purchase in January, adding 10t to their gold reserves and lifting the total to 2,245t.

2024 new year holiday gold consumption could see strong y/y growth.

Looking ahead:

- With the Spring Festival ahead, local gold demand tends to be supported by seasonal buying booms. And the 2024 CNY holiday gold consumption could see strong y/y growth as the previous year’s festival sales boost was dented by COVID-19 infections. But wholesale gold demand may lower as replenishing activities cool after January.

- Meanwhile, weaknesses in local assets including equities and properties may continue to drive investors to physical gold investment, further boosting gold demand at the beginning of the lunar new year of the dragon.

The Chinese gold price benefited from a weaker RMB

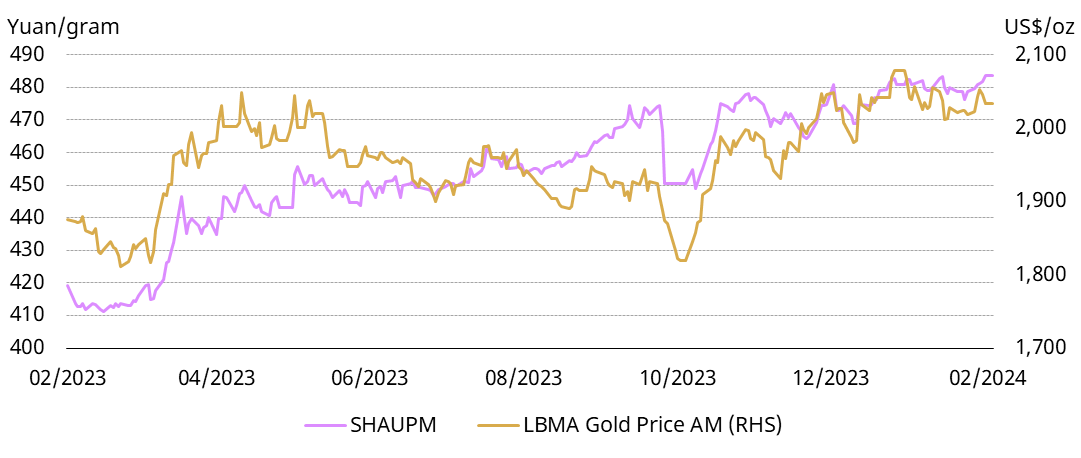

Unlike its USD peer, the local gold price in RMB remained stable in January (Chart 1). During the month, the LBMA Gold Price AM in USD saw a 1.2% fall, while the SHAUPM rose slightly by 0.1%, primarily due to the 1% depreciation in RMB against the dollar.

Chart 1: The RMB gold price outperformed its USD peer in January

Daily closes of SHAUPM and LBMA Gold Price AM*

And while the Chinese gold price’s performance during January lagged behind some investments including global stocks, it outperformed Chinese equities and commodities. This should remind local investors of the benefit of diversifying their portfolios with gold, which has low correlations with Chinese assets.

Chart 2: Among major assets, gold in RMB was steady

Major asset performances in January 2024*

2024 saw the highest January gold withdrawals ever

Gold withdrawals from the SGE totalled 271t last month, a 95% jump when compared to the low base in 2023 amid fewer working days, and a 65% m/m surge. As we previously mentioned, active restocking ahead of the traditional sales boom around the CNY holiday drove January’s wholesale gold demand materially higher. And January is usually the strongest month for gold withdrawals as the CNY holiday generally occurs in late January or early February. We believe a stable local gold price provided additional support.

In general, the industry’s brisk replenishment reflected its positive outlook on gold demand around the CNY holiday, which mainly stemmed from:

Chart 3: Gold withdrawals recorded the strongest January ever*

Local premium rebounded

The Chinese gold price premium averaged US$47/oz (2.2%) in January, US$9/oz higher m/m (Chart 4). With local gold demand rocketing ahead of the CNY holiday and imports in recent months lowering, tightening supply and demand conditions lifted the local gold price premium higher.

Chart 4: The local gold price premium rebounded amid stronger demand

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz and %*

Chinese gold ETFs’ AUM rose to a record high

Chinese gold ETFs attracted RMB827mn (US$113mn) in January, pushing their total AUM to RMB30bn (US$4bn), the highest ever (Chart 5). And their holdings rose 1.6t to 63t by the end of the month. Rising safe-haven demand drove investors to gold amid the seventh consecutive monthly decline in local equities and a weakening RMB.

Chart 5: Chinese gold ETF AUM rose to an all-time high

Monthly fund flows and Chinese gold ETF holdings

The PBoC’s gold reserves rose 15 months in a row

China’s central bank announced a 10t gold purchase in January, pushing their total gold reserves to 2,245t (Chart 6). The PBoC has been announcing non-stop gold reserve since November 2022. And during this 15-month period, the PBoC’s reported gold purchases piled up to 297t.

The central bank’s gold buying spree, combined with weak performances of Chinese assets such as equities and properties, has sparked retail investors’ interests in gold. It also contributed to a surge in local gold investment demand during 2023 and could continue to support the sector’s growth.

Chart 6: The PBoC’s gold purchasing streak extended to 15 months

Footnotes

The 2024 Chinese New Year’s holiday occurs between 10 and 17 February. It is also known as the Spring Festival.

For more, see: 龙年贺岁金饰热销,黄金消费进入旺季!国潮风金饰受年轻人青睐|黄金_新浪财经_新浪网 (sina.com.cn)