Gold has rarely been out of the headlines in recent months, having outperformed most other global assets and repeatedly reached record highs. According to our research, North American professional investors are reaping the rewards.1

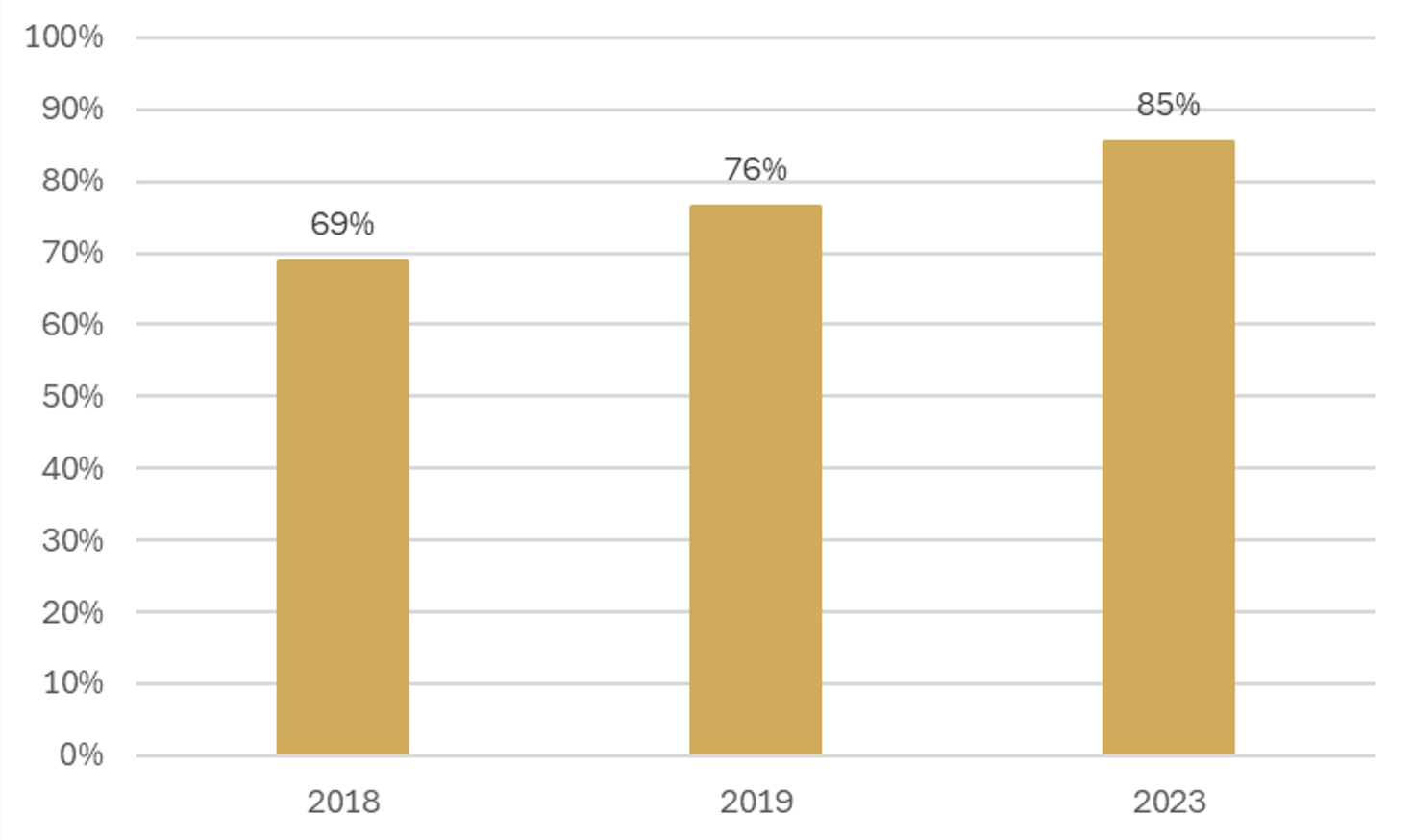

We recently commissioned a survey of 525 North American professional investors – a mix of large institutions, consultants and financial advisors – the results from which confirmed a growing trend of gold ownership among this audience. A staggering 85% reported an allocation to some type of gold investment, up from 69% in 2018 and 76% in 2019 (Chart 1).

Chart 1: Gold ownership among North American professional investors has risen steadily since 2018

% of respondents with a gold allocation

At face value this may seem a surprisingly high percentage. And delving deeper into the data reveals that just over a quarter of respondents hold only very small (<1% AUM) gold allocations. But it was particularly interesting to see that more than half held at least 1% of AUM in gold, with 24% having an allocation of 3% or more.

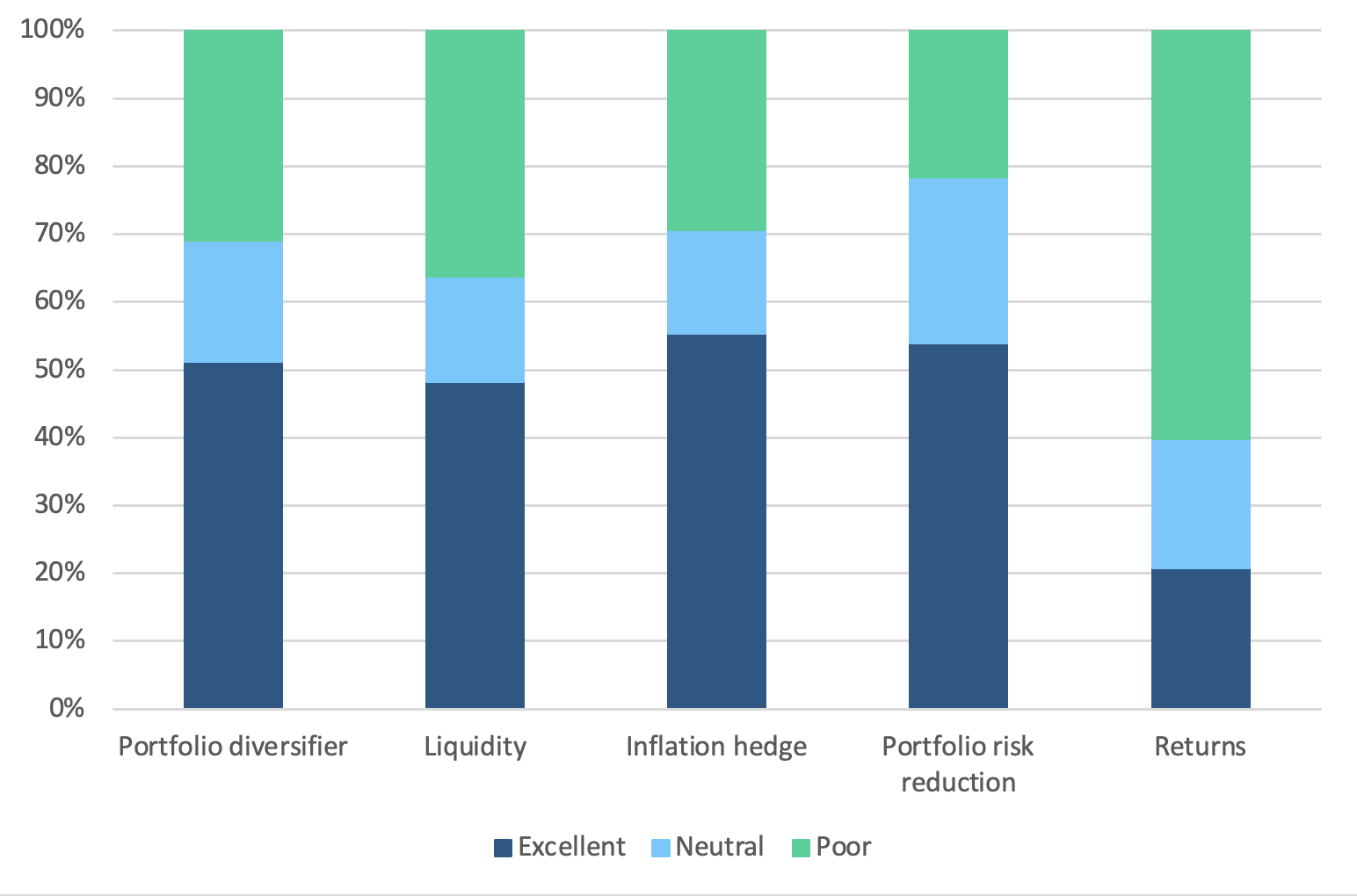

These investors have perceptions around gold that are comfortingly familiar to us and confirm that gold’s core attributes are, on the whole, well recognised. The majority of respondents view gold as an excellent portfolio diversifier and inflation hedge, and agree that it reduces portfolio risk (Chart 2). Among the most compelling reasons that might encourage the respondents to invest in or increase allocations to gold were its track record in portfolio diversification and its role as a proven dollar- and inflation-hedge.2

Chart 2: Gold’s core benefits are well recognised, with the exception of its long-term returns

% of respondents agreeing with various statements regarding gold’s investment characteristics

While most of these investors seem to be holding gold for its portfolio protection, they appear to be less aware of its impressive long-term performance. 60% of respondents believe that gold tends to deliver less than sparkling long-term returns compared with other asset classes. This, despite it having outperformed US equities over the last 25 years with its 8% average annual return.3

Gold’s stellar recent performance will have been an unexpected boon to such investors, although perhaps less of a surprise to the 21% who agree that gold generates ‘excellent’ comparative long-term returns.

Gold’s liquidity profile is also less well recognised, with just under half of our sample agreeing that gold is a liquid asset. Unsurprisingly, this view is stronger among non-owners: almost a quarter of respondents with no gold holdings cited liquidity as a barrier to investing in gold. And only a quarter of non-owners said they view gold as a liquid asset, compared with 52% of those who do own it. If this group can be made aware of gold’s profile as a highly liquid asset, they could perhaps be encouraged to invest and benefit from its enviable performance.

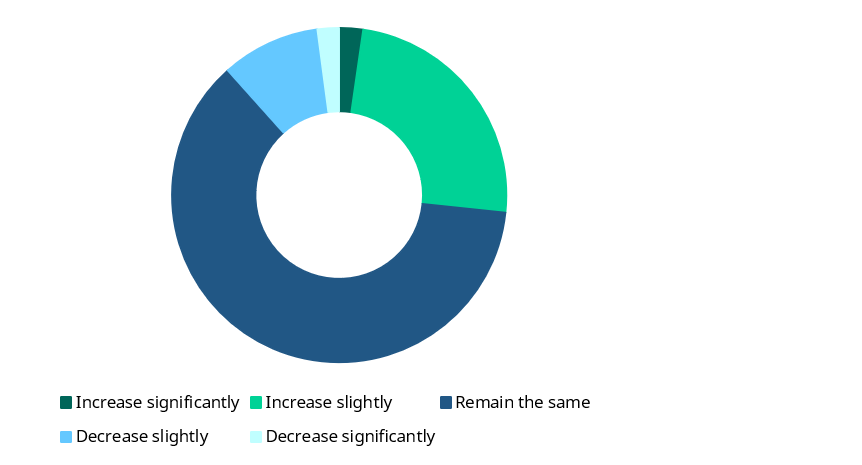

Chart 3: Overall gold allocations will be steady-to-higher over the next 12-18 months

% of respondents selecting each option

Gold’s role as a ‘proven diversifier, especially in periods of financial turmoil and economic uncertainty’ was the most commonly cited reason for increasing gold allocations – 46% of the sample chose it as one of their top three motivations.4 Today’s backdrop of heightened global uncertainty, geopolitical tension and sky-high equity valuations could help explain why most North American investors are planning to either maintain or increase their gold allocations. Over one-quarter of respondents said they were planning to increase their allocations in the next 12 to 18 months – more than double the number who said they were planning to reduce them (Chart 3).

Unsurprisingly, respondents who currently have gold allocations hold some differing views from those who do not. Institutions that don’t own gold are more likely to say that one of their top three barriers to investing is that ‘Other large institutions are not investing in gold’. This is clearly a misconception: our survey shows that 79% of North American asset owners and consultants have a gold position.5 If our data can dispel such a myth, it could help these investors overcome this barrier to investing and encourage greater participation in the gold market.

At the aggregate level, North American investors seem likely to increase their allocations to gold over the year ahead. We recently flagged that gold is historically under-owned in the US, signalling the potential for headroom and supporting a positive outlook for gold ownership.

The survey has given us a bounty of useful insights into the views and behaviours of global professional investors. This is just a sneak peek – we’ll share more as we dive deeper into the data. Stay tuned…

Footnotes

The World Gold Council and State Street Global Advisors commissioned ZoomRX (formerly Vivisum) to survey 75 North American Asset owners, 50 North American consultants, 400 North American Financial Advisors, 250 Australian Financial Advisors and 75 Asia Pacific Asset Owners. Fieldwork was conducted between 20 Oct and 18 Dec 2023.

Respondents selected from a list of statements to answer the question: ‘What do you think are the three most compelling reasons that you might invest in gold or increase your existing investments in gold?’

LBMA Gold Price PM (US$) vs MSCI Daily TR Gross USA index (US$)

The other top reasons chosen were: ‘Gold has stood the test of time as a safe and proven store of value’ (33%); ‘Our clients express a desire to invest in gold’ (31%), and ‘Gold is a proven hedge against a weakening dollar’ (30%).

The 79% ownership figure excludes Financial Advisors. Including Financial advisors, ownership is 85%.