India’s gold market update: Import duty reduction, a catalyst for demand

19 August, 2024

Highlights:

- The reduction of gold’s import duty brought domestic gold prices lower 6% m/m, with y-t-d gains now at 10%1

- The lower import duty has also reportedly boosted consumer demand ahead of the festive season

- In turn, strong demand pushed the domestic gold price to a premium relative to the landed price following five months of discounts

- The Reserve Bank of India (RBI) continued with its consistent but measured approach to buying gold

- Gold ETFs saw substantial inflows in July on the back of adjustments to the treatment of long-term capital gains

- Gold imports also maintained their momentum in July.

Looking ahead:

- The pro-gold policy measures announced in the Union Budget are anticipated to positively impact the domestic gold market, and likely give a fillip to gold demand. We expect the changes to collectively add 50t or more to gold demand in H2 2024.

Import duty cut drives down domestic gold price

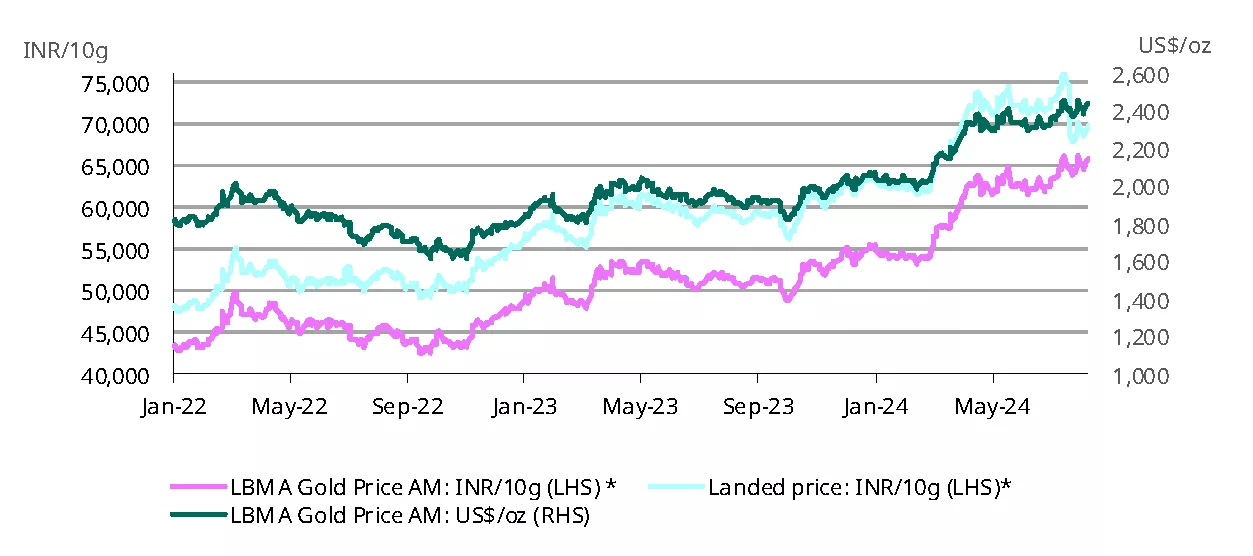

Despite a rise in international gold prices, domestic gold prices have fallen due to a significant 9% reduction in import duty announced in the Union Budget.2 The duty cut has reduced the landed cost of gold, leading to a 6% decrease in the domestic landed price since the cut was implemented.

However, even with this recent decline, domestic gold prices have risen by 10% on a y-t-d basis. This can be attributed to the global price strength (y-t-d gains of 18%) amid strong central bank purchases, elevated geopolitical risks and intensifying expectations of a monetary policy pivot from the US Federal Reserve.

Chart 1: Domestic landed gold price dipped as international prices inched up

LBMA Price AM and domestic landed price by month, US$ and INR*

Import duty cut fuels rise in demand

The significant cut in import duty on gold and the resultant decline in the landed cost of gold have been a shot in the arm for gold demand in the country. Anecdotal reports suggest that there has been strong buying interest from jewellery retailers as well as consumers since the duty reduction. At the recently concluded India International Jewellery Show,3 manufacturers noted that there has been a substantial increase in order bookings from retailers, who are preparing for the festive and wedding season running through December. In some cases, these orders have reached levels not seen in several years. Additionally, the trend of bar and coin buying remains strong, supported by consumers as well as jewellers who are capitalising on supportive gold prices to stock up for future manufacturing.

Our analysis shows that in the past, when the import duty was raised in 2012, it created headwinds for jewellery demand but its effect was even more noticeable in the bar and coin market. Our econometric model (see India’s Gold Market: Reform and growth, pp.128-132) suggests that Indian consumer demand – the sum of jewellery and bar and coin demand – could see an additional 50t or more in the second half of 2024. This is through a combination of an initial boost in consumer appetite given the more attractive price as well as a longer-term effect as local prices aligns more closely with the international price.

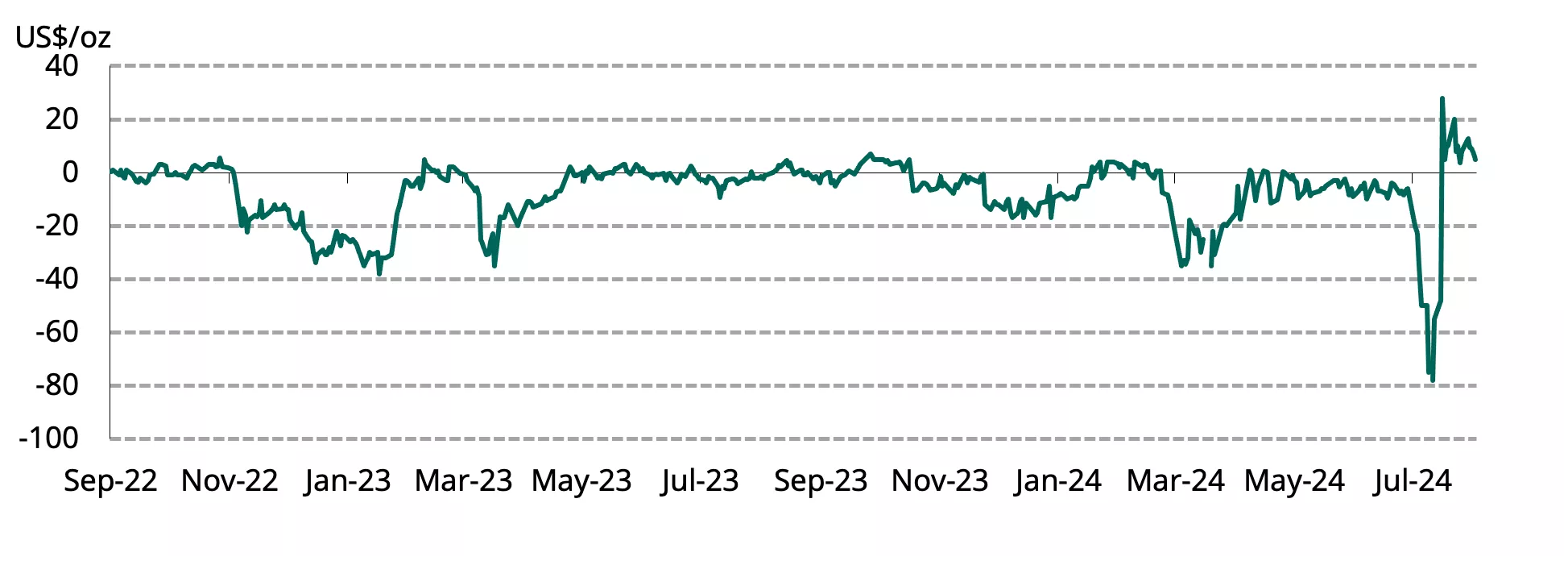

Domestic gold price spread rises from discount to premium

In a notable shift, and as a by-product of positive gold market sentiment, domestic gold prices, which had been trading at a discount for five consecutive months, started trading at a premium4 over international prices almost immediately following the budget announcement. Discounts had widened significantly in July to touch a high of around US$80/oz in the third week of the month. This was largely due to subdued demand amid increased supply of gold in the domestic market procured under the various preferential trade agreements (at lower import duty) and unofficial channels.

According to market reports, wholesalers who had inventory purchased under the old customs duty, began selling gold at a premium to the landed cost to mitigate their losses. This situation was further bolstered by increased consumer demand, which supported the premiums. Recently, however, premiums have moderated from US$28/oz to around US$5/oz.5 This decline can in part be attributed to the rise in international gold prices6 and the potential adjustment in inventory valuations.

Chart 2: Domestic gold prices shift from discount to premium

NCDEX gold premium/discount relative to international price*

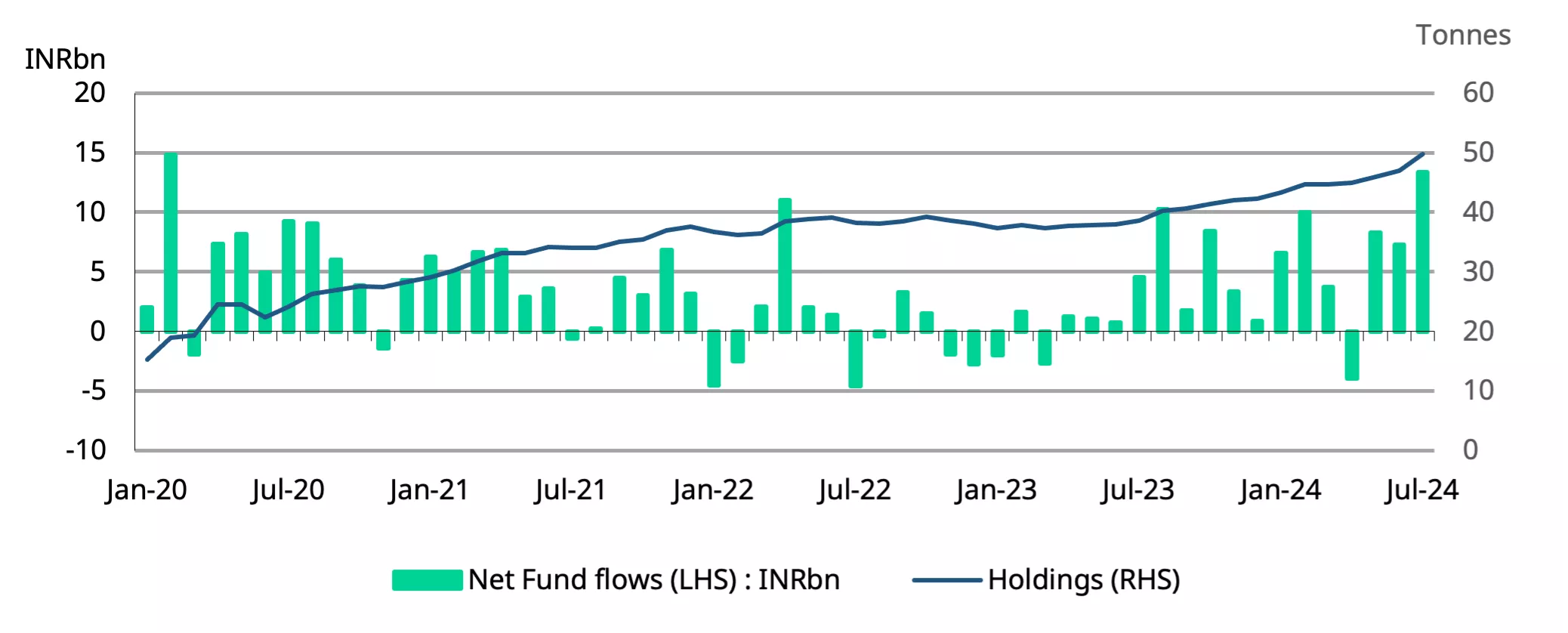

Upsurge in flows of funds into gold ETFs

In July, there was also a notable increase in investments channelled into gold ETFs, consequent to the changes introduced in the Union Budget on 23 July. These announcements included reducing the long-term investment qualifying holding period and lowering the associated tax rate, making the investment landscape for gold ETFs more equitable and attractive. Data from the Association of Mutual Funds (AMFI) shows that net inflows for July amounted to INR13.4bn (~US$160mn),7 making it the highest monthly inflows since February’20 and 84% higher than in June this year. Interestingly, while gross fund inflows nearly doubled m/m from INR7.5bn to INR14.6bn, redemptions also rose from INR0.26bn in June to INR1.28bn.

Despite the increased inflows, the total assets under management (AUM) for Indian gold ETFs as reported by AMFI only grew marginally by 0.3% from the previous month, reaching INR345bn (US$4.1bn). This modest increase can be attributed to the fall in the domestic gold price (~8%)8 following the import duty reduction. So far in 2024,9 net inflows into Indian gold ETFs have totalled INR45bn(US$543mn), according to AMFI data. As of the end of July, the total AUMs have risen by 48% from a year ago, and the collective gold holding of these funds has increased to 49.8t, reflecting a 29% y/y rise. The annual growth in the AUMs of gold ETFs (48%) has outpaced the overall growth of mutual fund AUMs (40%).

The inflows into Indian gold ETFs mirror the global trend of increased flows into gold ETFs. Increased safe-haven demand and higher international gold prices have been fuelling global investor interest in gold ETFs.

Chart 3: Indian gold ETFs see a surge in fund inflows

Monthly gold ETF fund flows in INR bn and total holdings in tonnes*

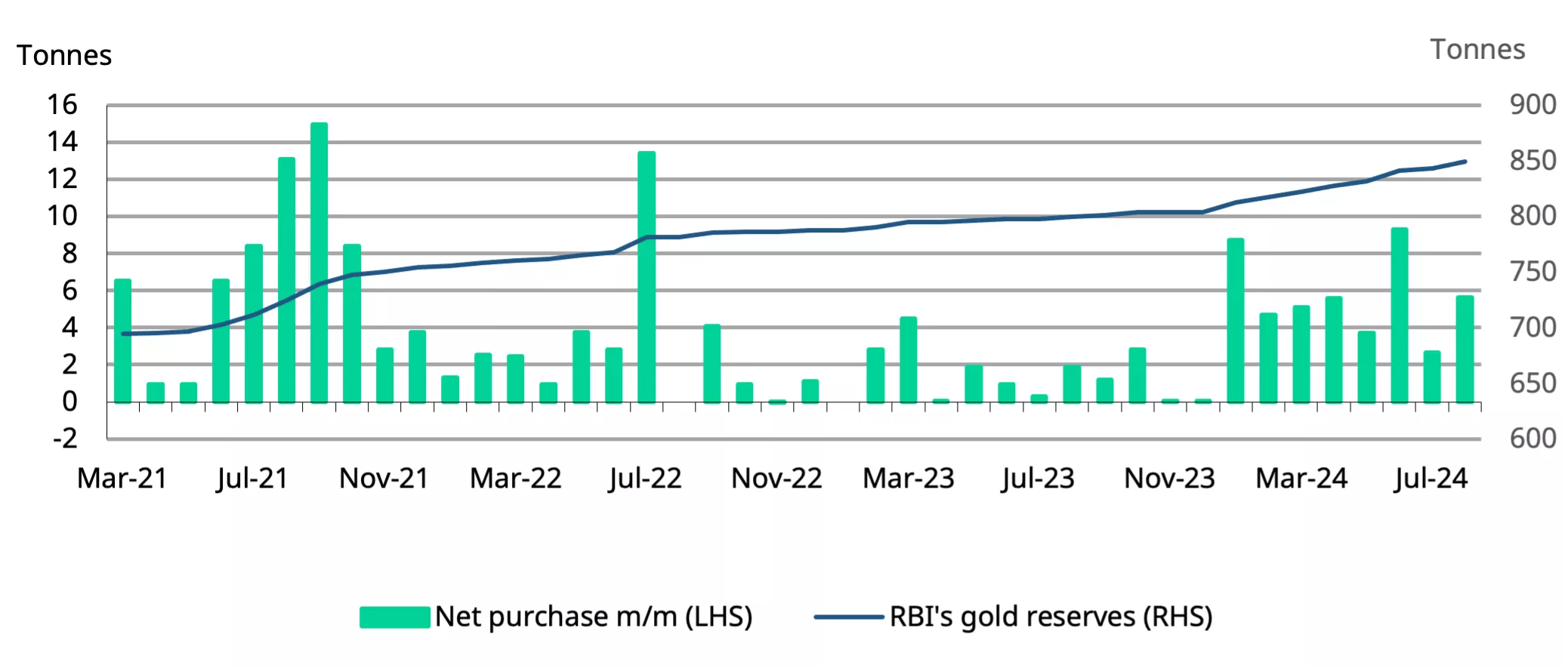

RBI’s persistent but measured gold acquisition

The RBI’s consistent gold purchasing trend since the start of the year continues, although there has been a slowdown in buying following a significant increase in June, when purchases reached 9.3t—the highest monthly total in nearly two years. According to the RBI data and our estimates, the central bank acquired 8.2t of gold in the six weeks to 9 August.10 Year-to-date, the RBI's gold acquisitions have totalled 44.3t, surpassing the total purchases of the past two years.11 The RBI’s gold reserves have now reached a record 849t, representing 8.8% of total foreign reserves, compared to 7.5% a year ago.

The RBI has been a leading gold buyer this year. Its gold purchases are second only to Turkey’s (45t).

Chart 4: Uninterrupted gold acquisition by the RBI

RBI’s monthly net purchases and reserves, tonnes*

Gold imports keep steady

In July, gold imports totalled US$3.1bn, maintaining the stable trend observed over the previous three months. Between April and July, imports averaged US$3.2bn, with volumes ranging between 43 and 47t during this period. The gold import bill for July 2024 was 11% lower than the previous year, and our estimates suggest a 26% decrease in volume terms (around 47t).

Chart 5: Gold imports hold steady

Monthly gold imports, tonnes and US$bn*

Footnotes

1Based on the landed price as of 12 August,2024. Landed cost of gold is the international price adjusted for import tax and exchange rate

2The total customs duty on gold was lowered from 15% to 6% and that on gold doré from 14.35% to 5.35%

3According to the Gems and Jewellery Export Promotion Council (GJEPC), the India International Jewellery Show featured over 2,100 exhibitors and attracted more than 50,000 buyers, including international participants from over 80 countries. It is acclaimed as the world's second-largest B2B gems and jewellery exhibition. GJEPC anticipates that business generation at the show this year to exceed INR1000bn(~US$12bn).

4Premium or discount to international price is calculated as the difference between the landed price of gold (which is the international price adjusted for import taxes and exchange rate) and the domestic selling price.

5Between 23 July and 14 August.

6International gold price have risen by over 2% between 23 July and 13 August

7The AUM and fund flow figures published by AMFI include most but not all inter-scheme investments. As such, provisional fund flow estimates from the World Gold Council may differ from that reported by AMFI.

8The landed gold price dropped by around 8% between 23 and 31 July

9January to July

10See footnote 7.

11RBIs net gold purchase in 2022 was 33t and 16t in 2023