China’s gold market in August: expect the expected light

12 September, 2024

Key highlights:

- The LBMA Gold Price AM in USD rose by 4.3% in August while the Shanghai Gold Benchmark PM (SHAUPM) in RMB climbed 1.7% – limited by the appreciating RMB against the dollar and weak local demand

- Gold withdrawals from the Shanghai Gold Exchange (SGE) amounted to 102t in August, 17% higher m/m yet a 37% fall y/y. While approaching industry events and the early October sales peak led to a m/m seasonal rebound, the prevailing weakness in gold consumption kept weighing on wholesale gold demand

- August saw the first monthly outflow from Chinese gold ETFs since November 2023, totalling RMB2bn ( -US$292mn) driven by potential profit-taking activities amid the rangebound local gold price being near the record high. Their total assets under management (AUM) fell slightly by 3% to RMB51bn (US$7.3bn) and collective holdings reduced by 3.6t to 90t

- In contrast, volumes of gold futures at the Shanghai Futures Exchange (SHFE) rose further amid the positive gold price performance, averaging 227t in August, the highest since April.

Looking ahead

- While a sluggish economic backdrop and the rangebound and record-level gold price may continue to limit gold consumption in coming months, further seasonal improvement in wholesale demand – strong or weak depending on retailers’ expectations –can be expected amid more active stock replenishment from the upstream for the early October National Day Holiday sales boost

- Meanwhile, efforts from policymakers to boost household confidence are also potential tailwinds to shore up gold jewellery consumption in the longer term

- On the other hand, investment demand for gold remains largely dependent on the gold price – continued rangebound moves may keep momentum-seeking investors on the sidelines.

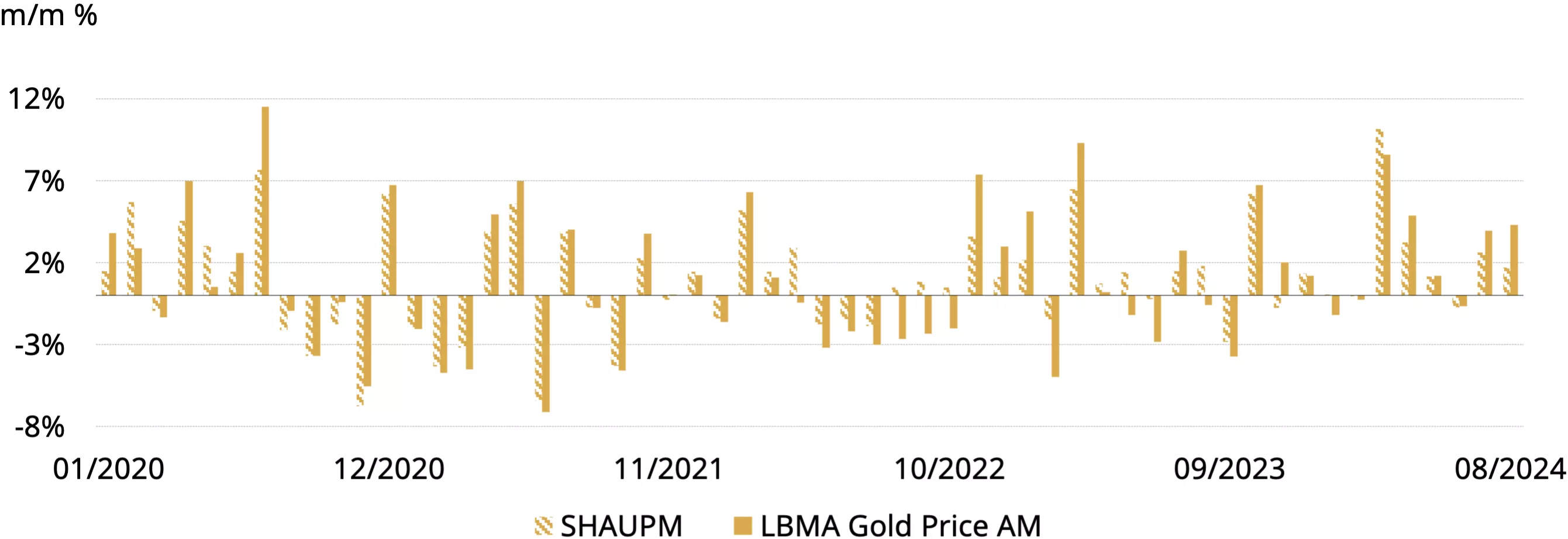

Gold continued to rise in August (Chart 1). Intensifying expectation for the Fed’s rate cut in September brought down US Treasury yields and the dollar, and therefore the opportunity costs of holding gold, which was supportive for the gold price. Rising geopolitical risks during the month provided additional boosts.

The gold price in RMB has witnessed a smaller monthly increase than its USD peer. The continued appreciation in RMB against the dollar as well as tepid demand in the country have limited gains in the local Chinese gold price.

Chart 1: Gold extended its strength in August

Monthly changes of SHAUPM and LBMA Gold Price AM*

*Note: We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices please visit Shanghai Gold Exchange.

Source: Bloomberg, Shanghai Gold Exchange, World Gold Council

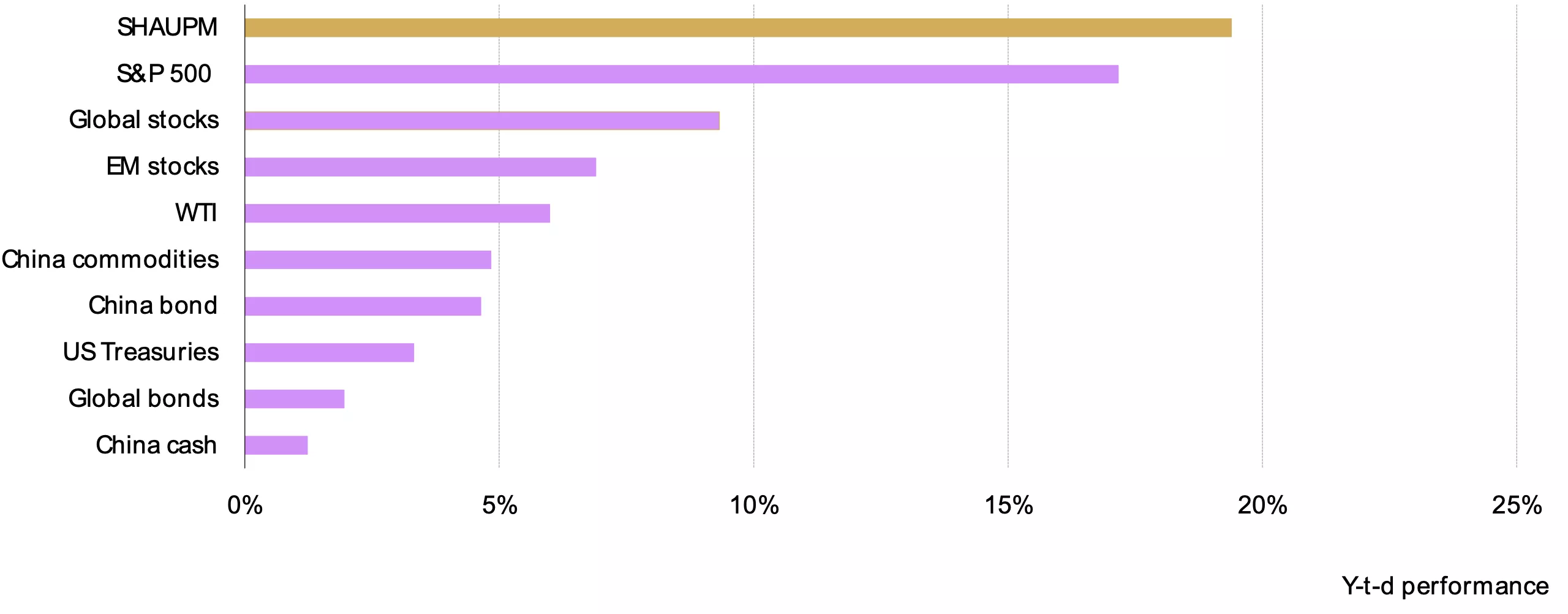

Another strong month took the RMB gold price’s y-t-d return to just over 18%, higher than most domestic and global assets (Chart 2).

Chart 2: Gold has outperformed major assets so far in 2024*

*As of 30 August 2024; all calculations in RMB. Based on the SHAUPM, S&P500 Index, WTI Crude Oil, Bloomberg US Treasury Aggregate, CSI China Money Market Fund Index, Wind China Commodity Index, Bloomberg China Bond Aggregate, Shanghai Shenzhen 300 Stock Index, and the ChiNext Stock Index.

Source: Bloomberg, Shanghai Gold Exchange, World Gold Council

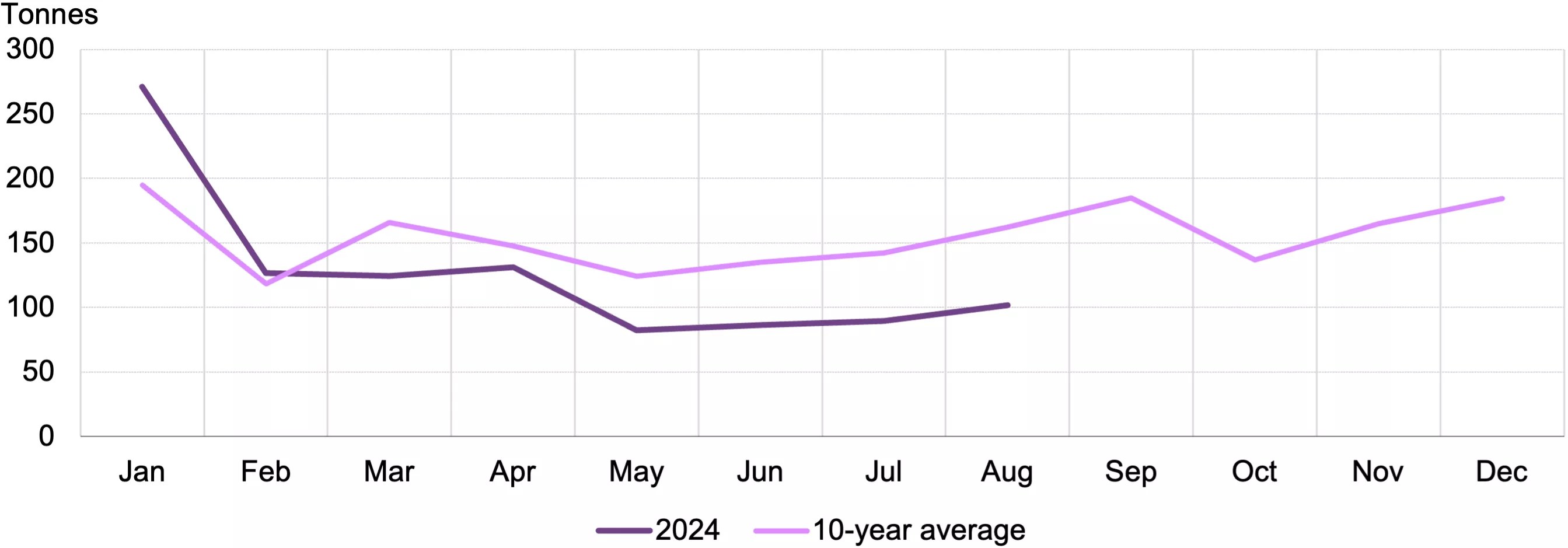

Despite a seasonal m/m rise, wholesale gold demand stayed weak in August (Chart 3). During the month, 102t of gold left the SGE, 14% higher m/m. Wholesale gold demand tends to pick up in August following a seasonally tepid Q2: stock replenishment for various gold jewellery fairs in September and the early October National Day Holiday sales boost usually lift gold withdrawals in August and September.

But on a y/y basis, there was a 37% drop in August’s gold withdrawals. And they remain well below the 10-year average of 162t. Continued economic uncertainties and the record level local gold price maintained pressure on gold jewellery consumption. In addition, the rangebound price overall may also have reduced investor appetite for gold. The overall demand weakness has been reflected in the sharp fall in the local gold premium: in August, the Shanghai-London gold price spread turned to a discount of US$0.6/oz on average, the first time since April 2022.

Chart 3: August saw a weak seasonal m/m rebound

Gold withdrawals from the SGE in 2024 and the 10-year average*

*10-year average based on data between 2014 and 2023.

Source: Shanghai Gold Exchange, World Gold Council

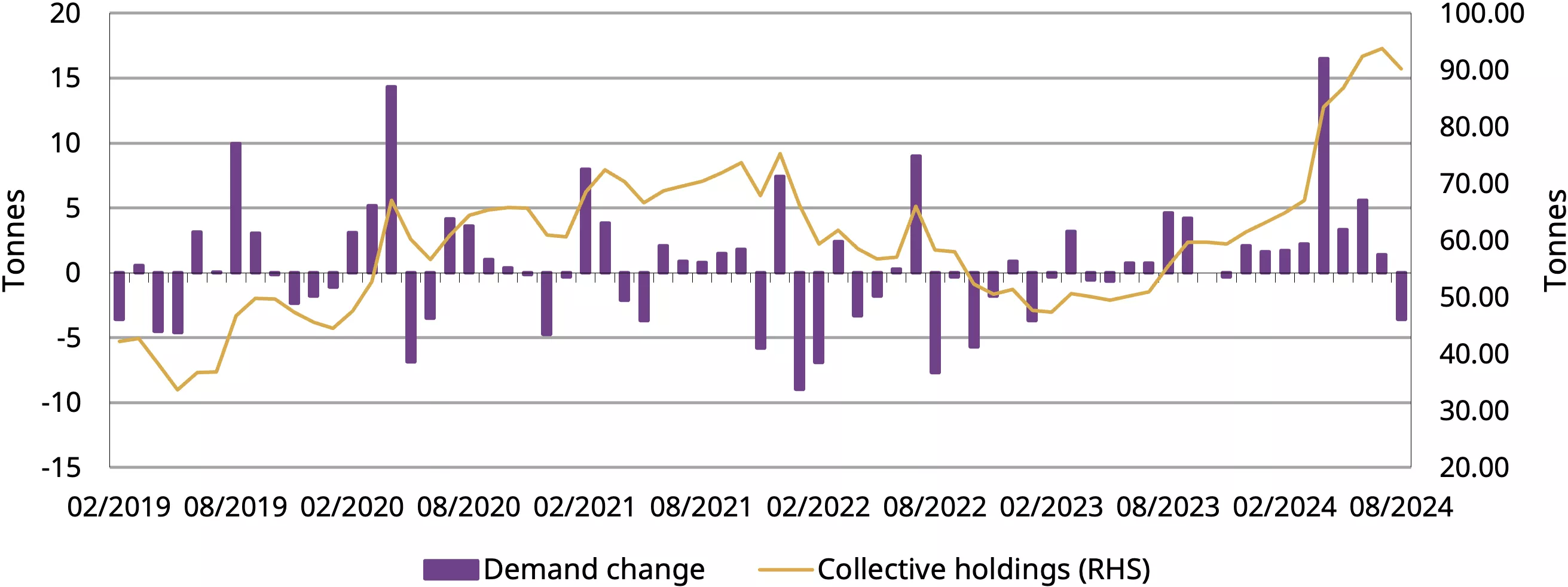

Gold ETF demand weakened last month. Chinese gold ETFs saw outflows of RMB2bn (-US$292mn, -3.6t) in August, putting a stop to their eight-month inflow streak (Chart 4). Despite the August outflow, the total AUM and collective holdings stayed near their record highs at RMB51bn (US$7.3bn) and 90t. Recently a strengthening local currency has limited the RMB gold price’s upside potential, resulting in rangebound movements near the record high – which is identified by some investors as a chance to take profits.

Chart 4: Chinese gold ETFs saw their first outflow in nine months

Chinese gold ETF AUM and holdings*

Source: ETF providers, Shanghai Gold Exchange, World Gold Council

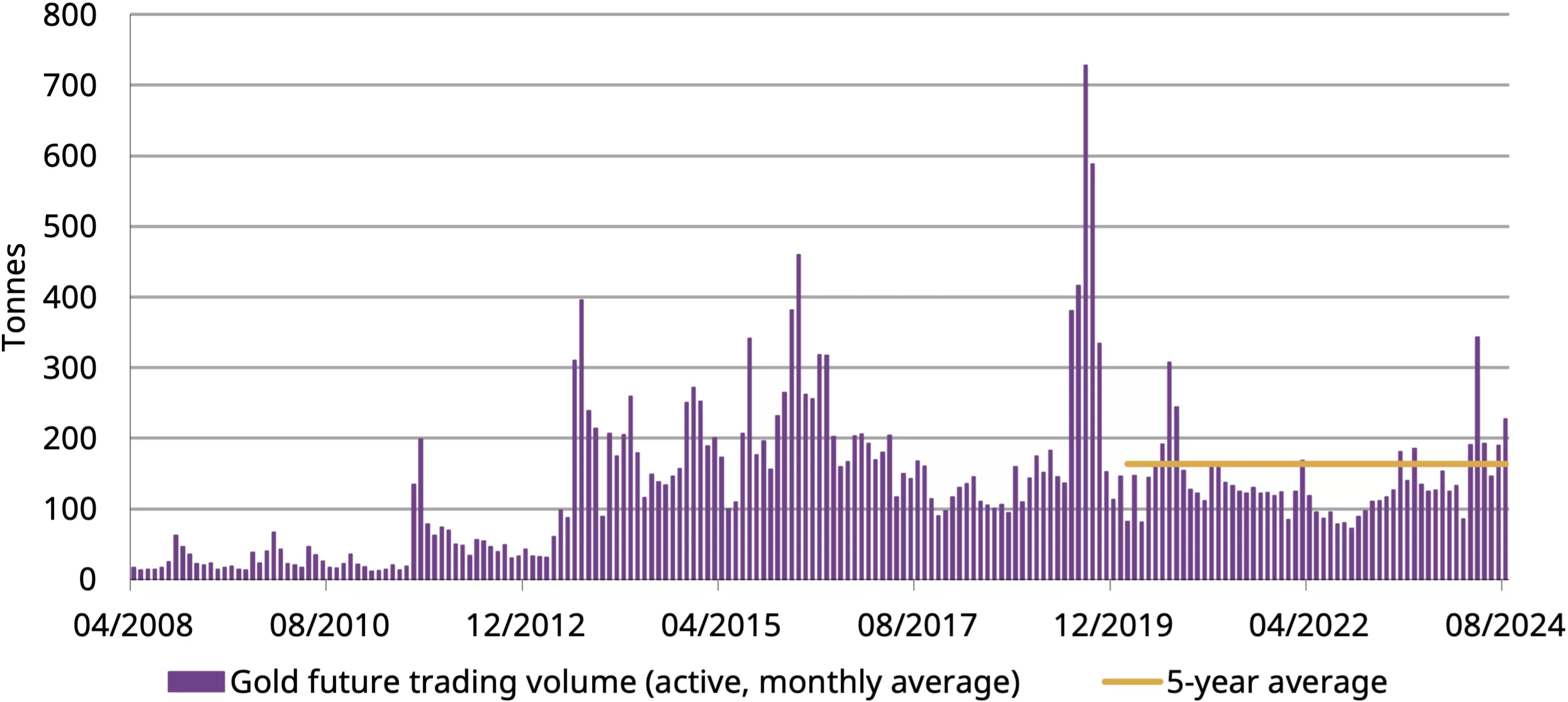

In contrast to ETF demand, trading volume of the SHFE’s gold futures kept climbing. In August, the average daily volume of the active gold futures contract reached 227t, a 20% m/m rise and well above the five-year average of 163t (Chart 5). Positive sentiment among traders amid the local gold price strength earlier in the month may have provided support.

Chart 5: Trading volumes at the SHFE continued to climb

Monthly and five-year average trading volumes in the active gold futures contract*

*Based on the average daily trading volumes (by month) of the active gold futures contract.

Source: Shanghai Futures Exchange, World Gold Council

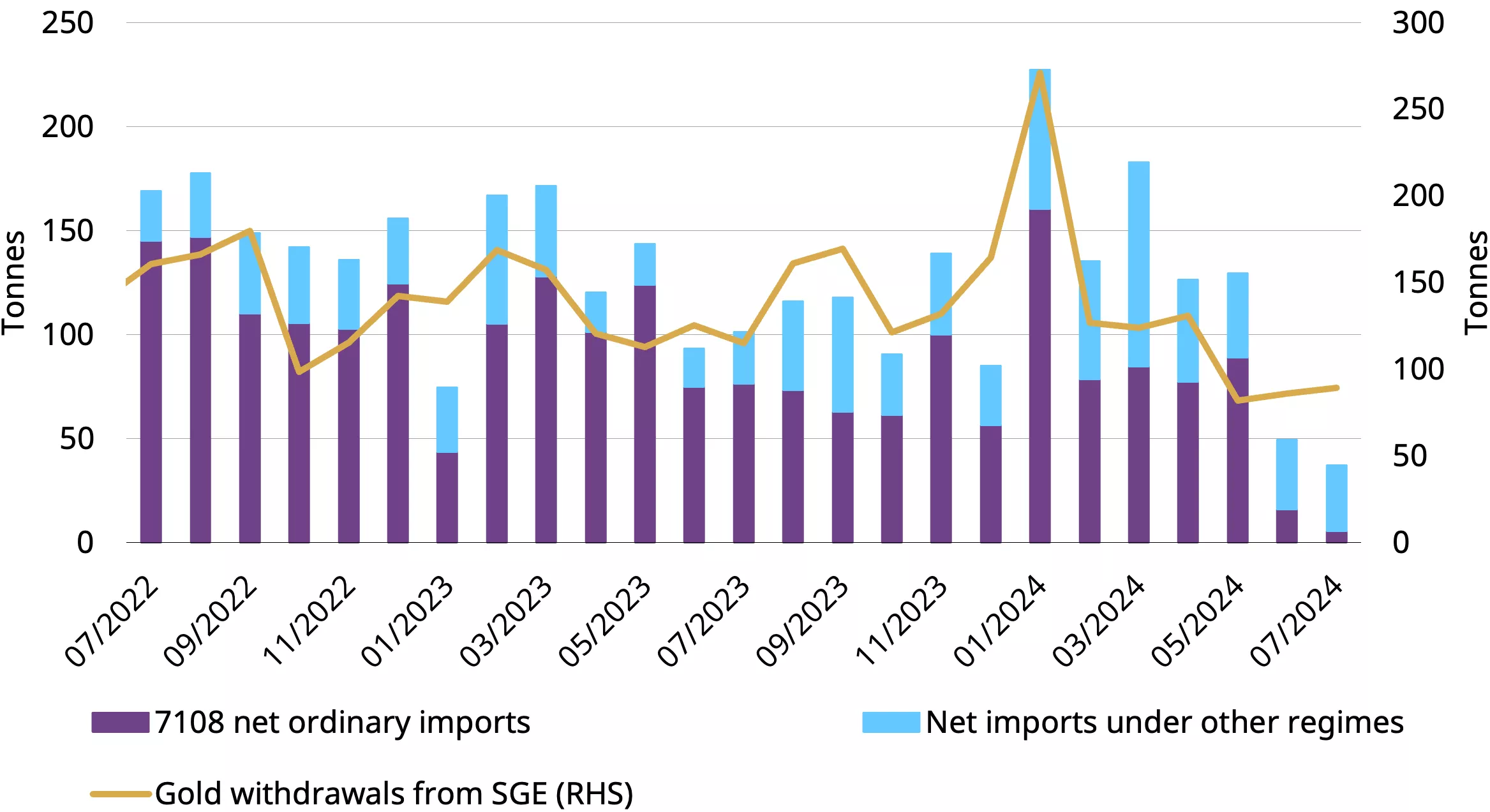

Gold imports remained sluggish in July, according to the latest data from China Customs (Chart 6). China imported 45t of gold in July, a 24% fall m/m and a 58% slump y/y. And netting out exports, imports were 37t, the lowest monthly total since May 2022.1 Recent tepid demand has weakened local manufacturers’ and wholesalers’ expectations of gold consumption in coming months, weighing on imports. Meanwhile, the plunging local gold price premium – which turned into discounts after mid-July – added further pressure on imports.

Chart 6: Gold imports declined further*

*Based on all imports under HS code 7108 reported by China Customs and excluding exports.

Source: China Customs, World Gold Council

China’s official gold holdings stayed at 2,264t by the end of August, unchanged for four consecutive months. Currently, gold accounts for 5% of the nation’s total foreign exchange reserves. And so far in 2024, China’s reported gold purchases have remained at 29t y-t-d, accumulated between January and April. For more information on central bank gold purchases, please visit: Central Banks Gold Reserves by Country | World Gold Council

Footnotes

1Including all imports under all import regimes under HS code 7108.