Asset allocation implications in today’s chaotic world

1 October, 2024

- Geopolitical risks have been elevated in recent years

- Spikes in geopolitical risk usually lead to equity market sell offs

- Gold has been a proven safe-haven asset during geopolitical crises, delivering robust returns during these events.

Frequent tail events

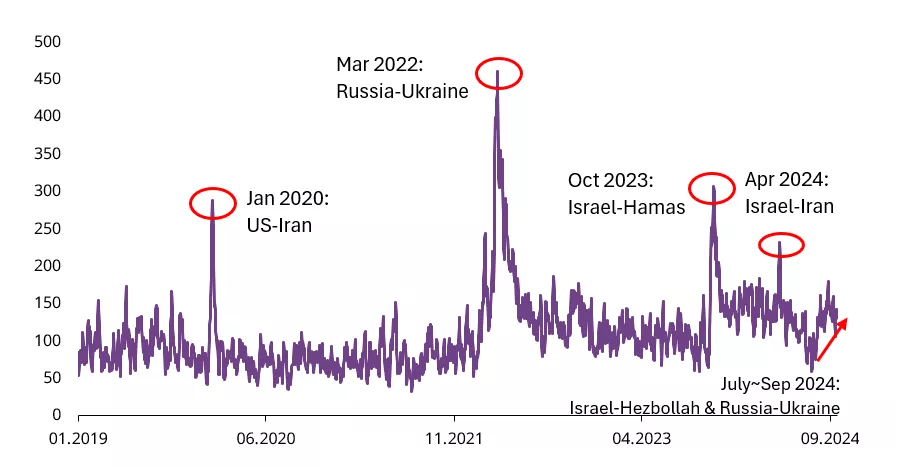

Geopolitical risks spiked again recently (Chart 1). Ukraine's cross-border attack in early August, followed by Russia's largest air assault since the war began, has escalated the conflict. Meanwhile, the assassination of a Hamas political leader and subsequent retaliatory actions from Iran and Hezbollah have sharply increased geopolitical tensions in the Middle East.1 And most recently, waves of explosions in Lebanon and Israel’s declaration of “a new phase of war” have raised fresh geopolitical concerns in the region.2

Chart 1: A period of heightened risks

Five-day moving averages of the Geopolitical Risk Index (GPR)*

*As of 20 September 2024. Source: matteoiacoviello.com, Bloomberg, World Gold Council

The GPR Index indicates increasingly frequent periods when geopolitical risk is elevated – periods that have been particularly challenging for investors over the past three years. So far in 2024 the GPR Index has recorded 15 spikes – days when the Index surged by more than 100% – on the back of tensions in the Russia-Ukraine war and developments in the Middle East. This follows 31 spikes in 2023, 20 spikes in 2022 and 41 spikes in 2021.

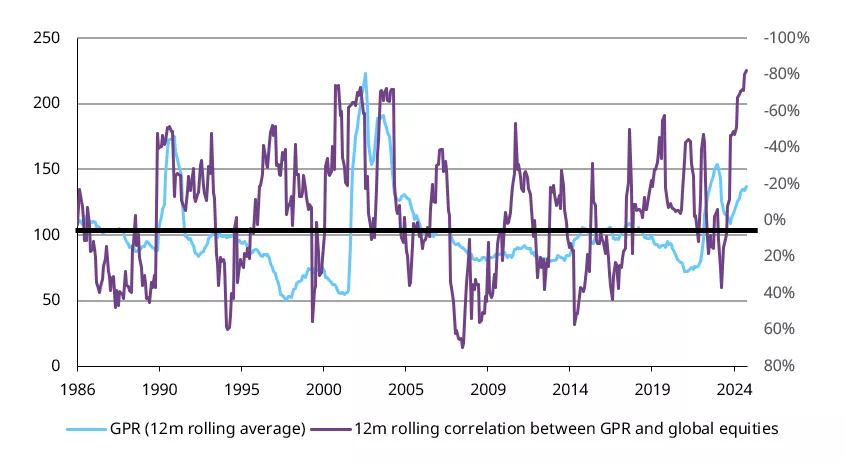

Historical data tells us that when geopolitical risks stay elevated (typically above 100), global equities suffer – evidenced by the negative correlation between the GPR Index and global equity returns (Chart 2). Currently, the correlation between GPR and VIX is marching towards a record high.

Chart 2: Rising geopolitical risk leads to equity market selloffs

Rolling average GPR index and correlation with the VIX*

*Based on 12m rolling average of the GPR index and correlation between average monthly changes in the GPR Index and the MSCI World Index. As of August 2024. Source: matteoiacoviello.com, Bloomberg, World Gold Council

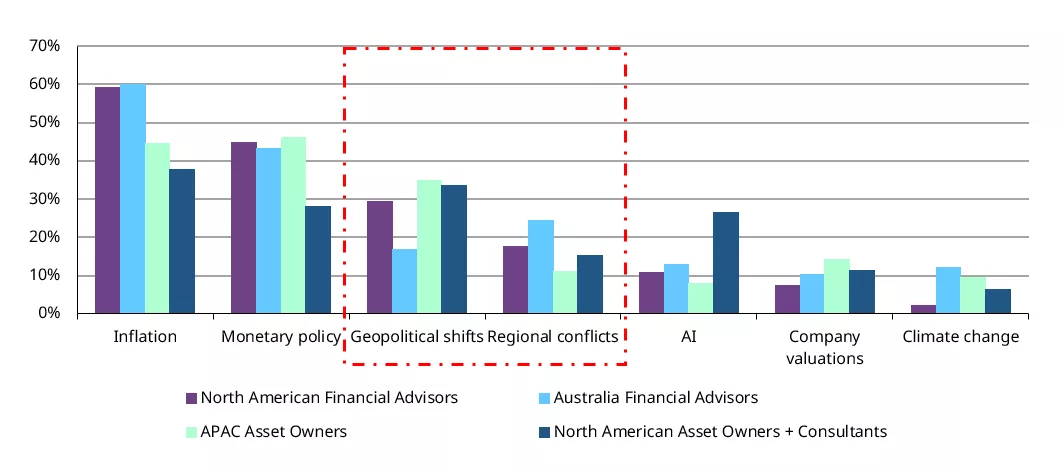

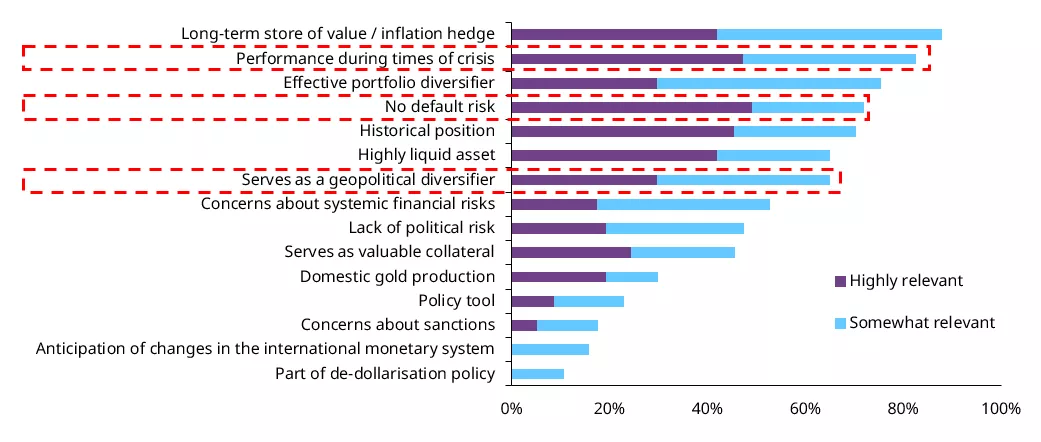

In fact, geopolitical risks have been front of mind for institutional investors for some time. Based on results from a survey we commissioned last year, geopolitical shifts and regional conflicts are identified by global investors – including Australian financial advisors – as the third and fourth biggest trends affecting their investment decisions (Chart 3).3 And geopolitical instability is one of the top concerns of global central banks when it comes to reserve management.

Chart 3: Geopolitical risks: one of the top concerns for global investors*

Q: Which of the following are the top two global trends affecting investments right now?

Asset allocation implications

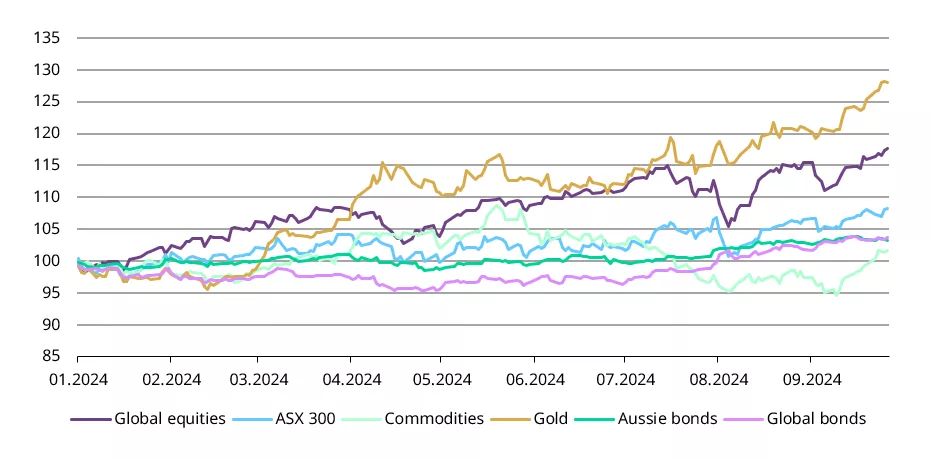

How have major assets fared so far this year? Gold has outperformed to date, surging by 28% (Chart 4). Global equities have delivered robust results too – while US stocks rocketed by 20%, the ASX 300 witnessed an 8% increase, mainly driven by factors such as the prospect of lower global interest rates ahead. But taking a closer look, when geopolitical risks spiked during April and August, equities fell back – impacted by multiple factors including surging geopolitical tensions – and gold rose higher.

Chart 4: Gold has held up during geopolitical risk spikes so far this year

Performance of indexed assets to date in 2024*

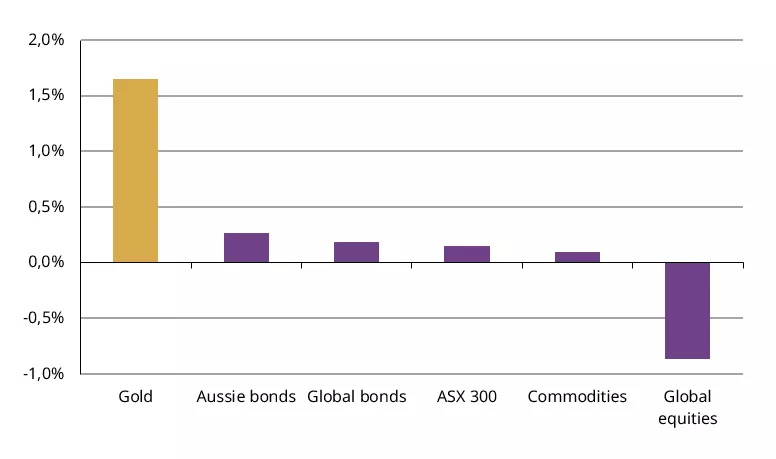

In almost every week during which the GPR index soared by over 100%, gold saw positive returns. Gold averaged a weekly return of 1.6% during these spikes while global equities declined, on average, by 0.8% (Chart 5).

Chart 5: Gold, a consistent outperformer during geopolitical crises

Performance of various assets during geopolitical risk spikes*

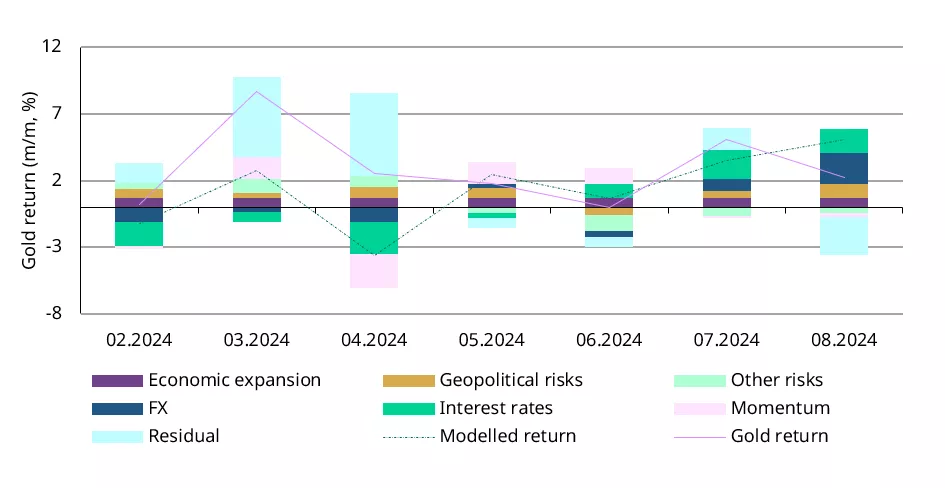

As our previous analysis demonstrates, geopolitical risks are a statistically significant variable that drives gold’s performance (Chart 6). Our monthly Gold Return Attribution Model (GRAM) shows that geopolitical risks have contributed 4.3% of gold’s return to date this year. Furthermore, our research shows that every 100-unit increase in the GPR Index corresponds to a 2.5% rise in the gold price.

Chart 6: Geopolitical risks have been a consistent contributor to gold’s return in 2024

Monthly GRAM results*

*Data to 31 August 2024. For more information, see: Gold Return Attribution Model | World Gold Council. Results shown here are based on analysis covering an estimation period from June 2019 to August 2024. We have reduced the estimated window to five year

Gold as an effective geopolitical risk hedge

Creating a resilient portfolio is a topic constantly explored by investors. We believe one of the keys to building this resilience is to prepare for “unknown unknowns”. While scenarios such as global economic growth can be deduced from economic data clues, geopolitical risks tend to be sudden and unpredictable. And these geopolitical tensions often lead to financial market turmoil, damaging investor portfolios.

When we examine how various assets respond to sudden geopolitical risk spikes, gold’s robust performance during such events becomes clear. We conclude that gold is an ideal hedge against unpredictable geopolitical shocks. This is further evidenced in our 2024 Central Bank Gold Survey, which revealed that geopolitical risk was a key driver that spurred on central banks in their recent record-breaking gold purchases (Chart 7).

Chart 7: Geopolitical risk-related concerns are driving the gold purchase decisions of global central banks

We believe that gold's key attributes – its safe-haven nature, its ability to generate long-term returns (especially now that a global easing cycle has begun), and its low correlation with risk assets – will continue to represent immense value to investors who seek to build a resilient portfolio in today’s world.

Footnotes

1For more, see: What happened in Iran and what we know about assassination of Ismail Haniyeh | CNN

2For more, see: Second wave of explosions hits Lebanon a day after pager attack | AP News

3The World Gold Council and State Street Global Advisors commissioned ZoomRX (formerly Vivisum) to survey 75 North American Asset owners, 50 North American consultants, 400 North American Financial Advisors, 250 Australian Financial Advisors and 75 Asia Pacific Asset Owners. Fieldwork was conducted between 20 October and 18 December 2023.