Gold has all the hallmarks of a keystone German investment

10 October, 2024

Those familiar with Gold Demand Trends – our market-leading quarterly report on global gold demand and supply – will know that gold buying in Germany has seen a pretty dramatic shift over the last couple of years. Just two years ago Germany was the second largest market for retail gold investment: it generated 185t of net bar and coin demand in 2022. That slumped to just 47t in 2023, and in the first half of this year retail investors bought a mere 5t of gold.

But there’s more to this data than meets the eye. For one thing, retail investment demand is measured on a ‘net’ basis. That is to say, it measures the balance of new gold investments versus what investors have sold back from existing holdings. We can’t infer from the data how many people hold gold relative to other investments. And it doesn’t tell us anything about why people may be buying less (and/or selling more).

So we ran some research to find out.

In Q2, we commissioned Toluna to run a 10-minute online survey of more than 3,000 German investors. Such a robust sample gives us a deep insight into the attitudes and motives driving investment behaviour, along with a hefty set of data to sift through. And the findings are encouraging. Spoiler alert: Germans are not falling out of love with gold.

Germany is a gold stronghold…

Gold is a widely held investment in Germany – 37% of German investors have invested in or held gold at some point. And, with 28% current ownership, it’s the third most commonly-owned investment after savings accounts (61%) and stocks/shares (46%).

Over one third of German investors have, at some point, invested in gold

% selecting each option

SQ6: Which of the following have you ever held or invested in?

Base: Total respondents, 3,010.

Source: Toluna, World Gold Council

…where investors have a clear recognition of its key investment characteristics.

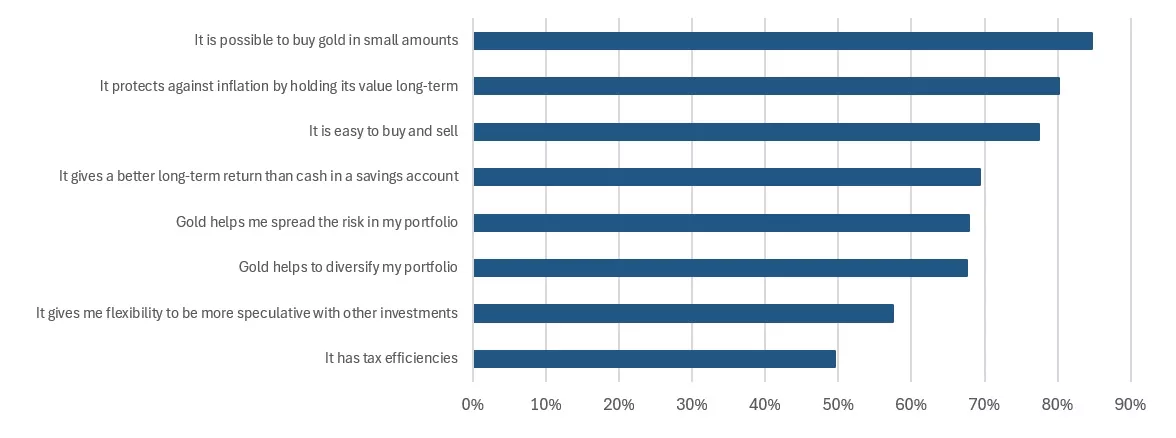

When we look into why Germans are so keen to invest in gold, their reasons for doing so are well aligned with our case for gold as a strategic asset. Aside from the fact that it’s possible to buy gold in small amounts, the top motives for investing are that it protects against inflation, is easy to buy and sell, gives a better long-term return than cash held in a savings account, and helps to spread risk and diversify their portfolio. German investors are, it seems, well versed in gold’s unique investment attributes.

German investors have clear motives for buying gold

% selecting 'Strongly agree' or 'Somewhat agree'

Q8C Please indicate how much you agree or disagree with the following statements for why you invest in gold. 5-point scale: Strongly agree; Somewhat agree; Neither agree nor disagree; Somewhat disagree; Strongly disagree.

Base: Ever invested in gold, 1114, (men 717; women 394).

Source: Toluna, World Gold Council

Gold has provided a safety net for German investors in recent years

So how does this tally with the recent lull in overall levels of gold investment demand in Germany? The country’s gloomy economic landscape has punctured investor confidence: the ZEW Institute’s expectations index plunged to 3.6 in September, from 19.2 the previous month – its lowest in almost a year. And this is reflected in the data around why people in Germany have been selling gold in recent years.

Of the 1,114 respondents who have ever invested in gold, 13% said they had sold either part or all of their gold investment since the beginning of 2023. The top reason for doing so was that they 'wanted to realise gains from the higher price'. But almost a quarter said they sold gold 'to free up funds to make a big purchase' and one fifth sold because 'it was an easy way to get some spare cash'. And notably, 18% of those who have sold gold since the start of 2023 did so because they 'needed the money to supplement my income, due to the higher cost of living'.

Recent gold selling driven by a need to realise gains and access funds

% selecting each option

Q30B - What would you say are the main reasons you sold your gold investment?

Base: Sold since the start of 2023, 147 (men 98, women 49).

Source: Toluna, World Gold Council

But what does the future hold?

Importantly though, this wave of disinvestment does not spell the end of Germany’s love for gold. Most of the recent sellers held onto some of their gold: 65% of those who have sold since the start of 2023 sold only part of their investment. This could reflect the strong belief that 'Keeping cash and physical assets is the safest way to protect one's wealth' (68% selected this as a reason for why they invest in general).

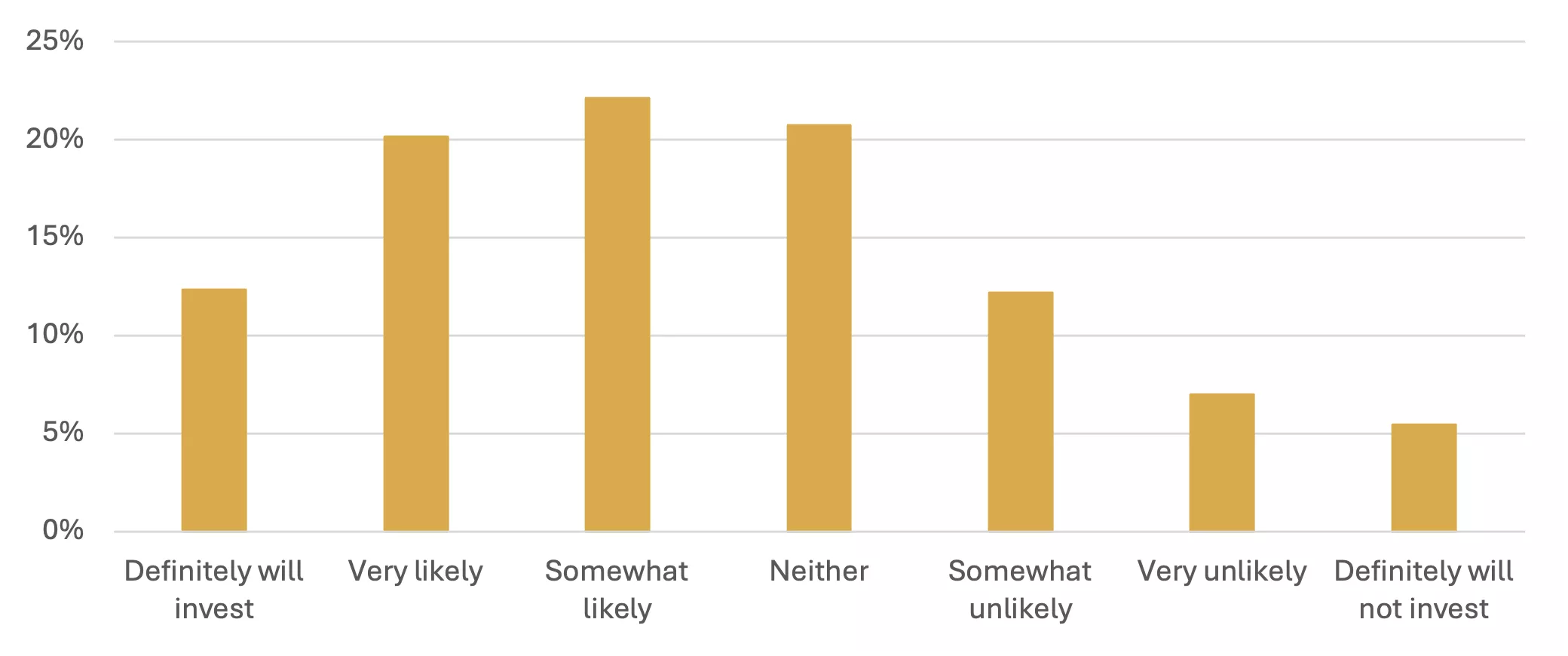

German investors, on balance, say they are likely to invest in gold in the future

% selecting each option

Q11.How likely are you to invest in gold in the future? (7-point scale)

Base: Total respondents, 3010.

Source: Toluna, World Gold Council

More importantly, German gold investors tend to be loyal, repeat buyers. Very few of the 3,010 respondents said they either 'Definitely will not' (5%) or are 'Very unlikely' (7%) to invest in gold in the future. This compares with 12% who 'Definitely will invest' and 20% who are 'Very likely' to; and 25-34 year old men are the most likely to say they will definitely invest in the future. Even those who have sold gold are very open to buying again; notably, none of the 147 respondents who have sold gold since 2023 ruled out a future investment.

Potential future gold returns, geopolitical risks, diversification benefits and falling interest rates are among the top factors that play into this likelihood of making future investments in gold.

The research gives us a sneak peek into the minds of German investors and the way they feel about gold. And, while the last couple of years have been challenging for gold demand in absolute terms, the evidence suggests that the relationship has very solid foundations.