India gold market update: Investment demand shines

19 December, 2024

Highlights

- Jewellery demand weakens post-Diwali, while investment demand for gold bars and coins remains strong

- Indian gold ETFs maintain strong inflows, adding 14.5t year-to-date1

- The Reserve Bank of India’s (RBI) continues its gold accumulation, boosting reserves to 876t

- Initial reports suggest gold imports saw a significant rise in November.

Looking ahead

- Jewellery demand may face short-term pressure due to the upcoming inauspicious period for gold purchases but investment demand is expected to remain supportive.

Gold’s ascent slows amid volatility

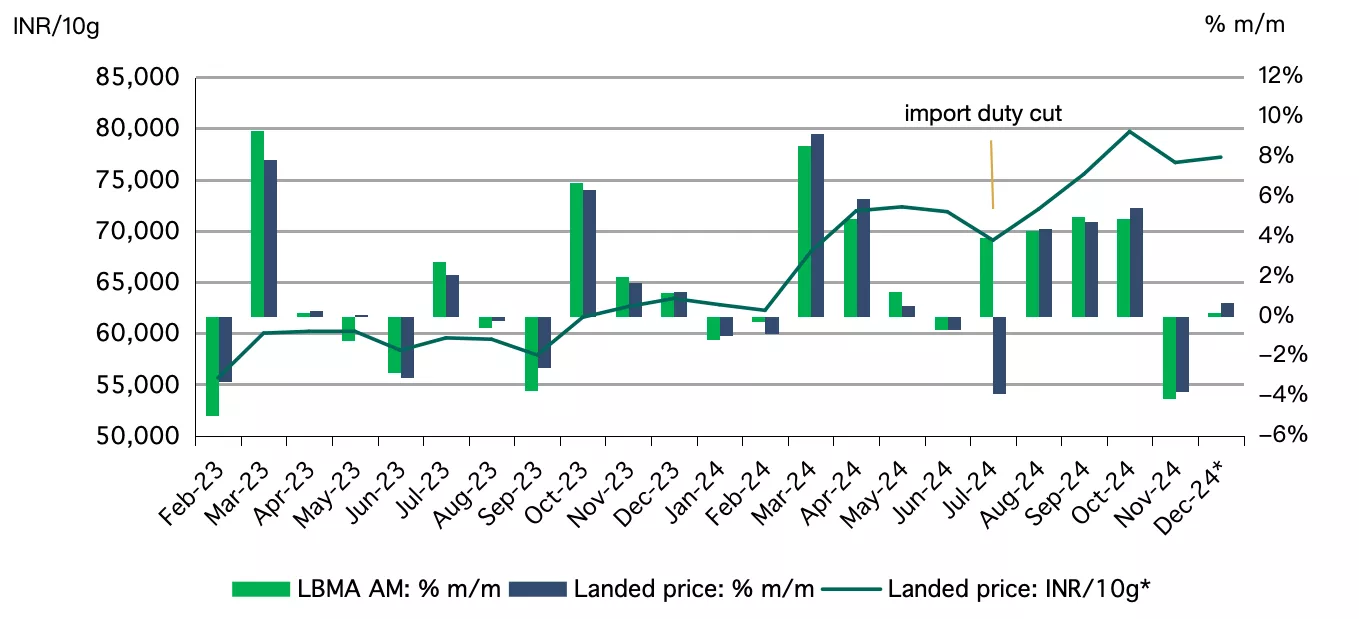

After months of gains and record highs, gold's upward momentum has slowed since early November. Prices have dropped 4% from their October peak to US$2,670/oz2. Rising US Treasury yields, a stronger US dollar, moderating inflation concerns, and a slowdown in market momentum following the US Presidential elections have contributed to the decline. Conversely, persistent and emerging geopolitical risks continue to support prices. In the domestic market, gold prices followed global trends with a more moderate 3% drop from October's peak. This was partly due to a 0.8% fall in the Indian rupee against the dollar. By mid-December, domestic gold was priced at INR 77,185/10g, having fluctuated between INR 73,477 and INR 78,669/10g since late October.

Despite this recent weakness, gold remains one of the top-performing assets of the year, with y-t-d returns of 22% in INR and 29% in USD terms.

Domestic gold prices traded at a premium to international prices for most of November. After trading at a marginal discount (average of US$1.2/oz) for the first 10 days of the month, domestic gold prices moved into a premium, ranging from US$0.5/oz to US$7.5/oz. This shift was likely influenced by a rise in investor demand as gold prices weakened. Since early December, domestic prices have shifted to a discount relative to international prices, with the discount widening to US$7/oz by 13 December, coinciding with the start of the inauspicious gold-buying period in the Hindu calendar.

Chart 1: Gold's momentum eases after recent gains

Monthly LBMA Price AM and domestic landed price* changes and movement

*Based on the LBMA Gold Price AM in USD expressed in local currency as of 13 December 2024. Landed price includes import tariff and tax.

Source: Bloomberg, World Gold Council

Jewellery sales dip, but investment demand continues

Since the peak Diwali buying season, jewellery demand has been lacklustre; gold prices fluctuations have kept consumers on the sidelines despite the onset of the wedding season. But physical investment demand has shown steady growth, with anecdotal reports indicating strong sales of gold bars and coins. The positive sentiment around gold prices and its appeal as an investment asset have likely supported this trend, which is expected to continue.

In the near term, demand could face pressure due to the upcoming inauspicious period for purchasing gold, as per the Hindu calendar, which runs from mid-December to mid-January. Nonetheless, there are expectations of some demand from holiday purchases, particularly from non-resident Indians visiting the country during this period.

Gold ETF demand remains resilient

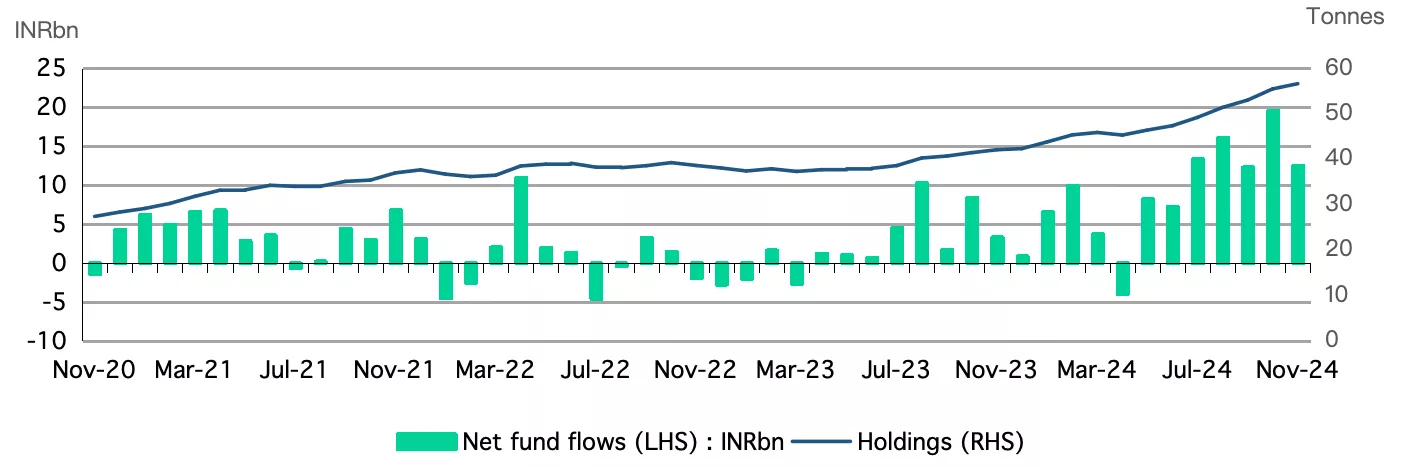

November’s Indian gold ETF inflows, while lower than the record levels seen in October, remained strong and surpassed the average monthly inflow for 2024. The continued positive sentiment towards gold, coupled with volatility in domestic equity markets, likely fuelled these inflows, even as major global markets experienced outflows. According to the Association of Mutual Funds in India (AMFI), gold ETFs saw net inflows of INR12.6bn (~US$149mn) in November, well above this year’s average monthly inflows of INR9.6bn (US$115mn). These healthy inflows are in line with our initial estimate which was based on partial information.3

Total assets under management (AUM) in Indian gold ETFs stood at INR442bn(~US$5.2bn) at the end of November, a 60% y/y growth. Additionally, collective gold holdings in ETFs grew to 56.6t, marking a 35% y/y growth.

The strong inflows into gold ETFs this year underscore heightened investor interest, with inflows recorded in every month except April. Over the first 11 months of 2024, net inflows into gold ETFs amounted to INR106bn(~US$1265mn), a 3.7-fold increase from last year. During this period, 14.5t of gold was added to the cumulative holdings of these funds. Three new gold ETFs were launched in India this year, bringing the total number of physically backed funds available in the local market to 18.

Chart 2: Above average gold ETF inflows in November

Monthly gold ETF fund flows in INRbn, and total holdings in tonnes*

*As of end November 2024.

Source: Company filings, AMFI, CMIE, World Gold Council

RBI piles up more gold

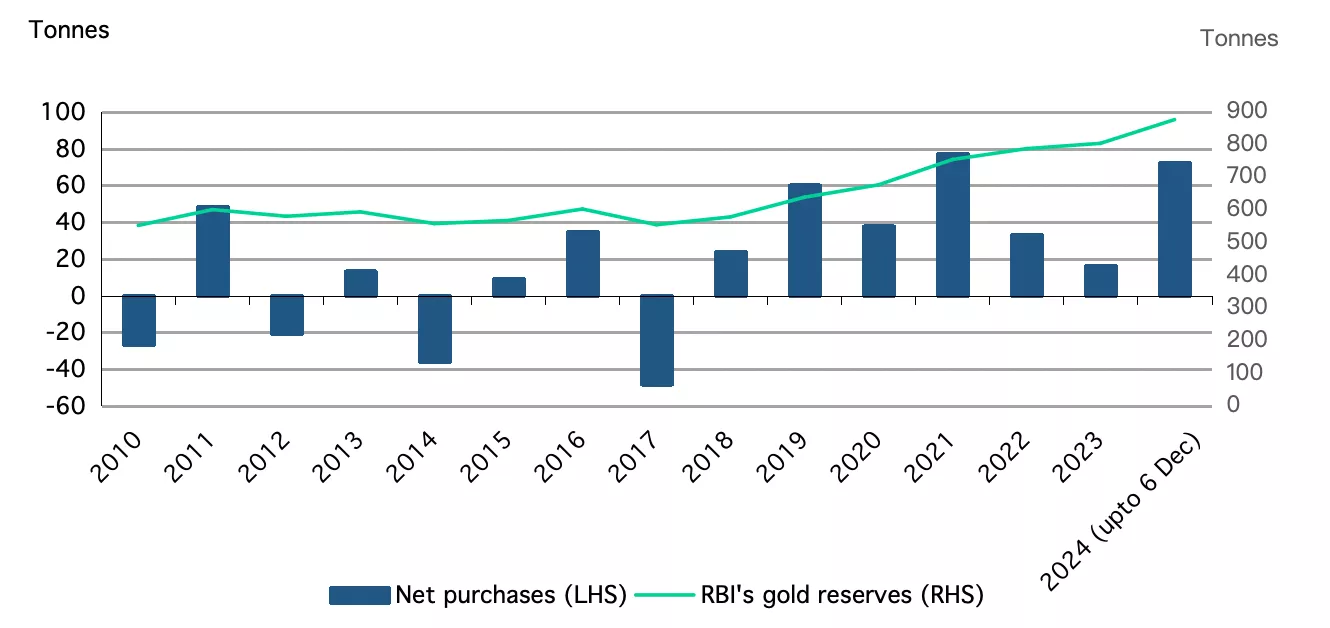

The RBI further added to its gold reserves in November, bringing its total holding to 876t, a 9% increase from the previous year.4 The RBI has been one of the largest gold buyers among central banks this year. According to the banks data5 and our own estimates, 8.4t was added to its gold holdings in November. This marks the 11th consecutive month of gold purchases, with an average monthly acquisition of 6.6t. So far in 2024, the RBI has added 72.6t to its gold reserves significantly outpacing the 16t added in 2023 and the 33t in 2022. Gold now represents 10.2% of the RBI’s forex reserves, up from 7.8% a year ago.

Chart 3: Sizeable addition to RBI’s gold reserves in 2024

RBI’s net purchases and reserves, in tonnes*

*Data as of 6 December 2024.

Source: RBI, World Gold Council

Gold imports hit a record high

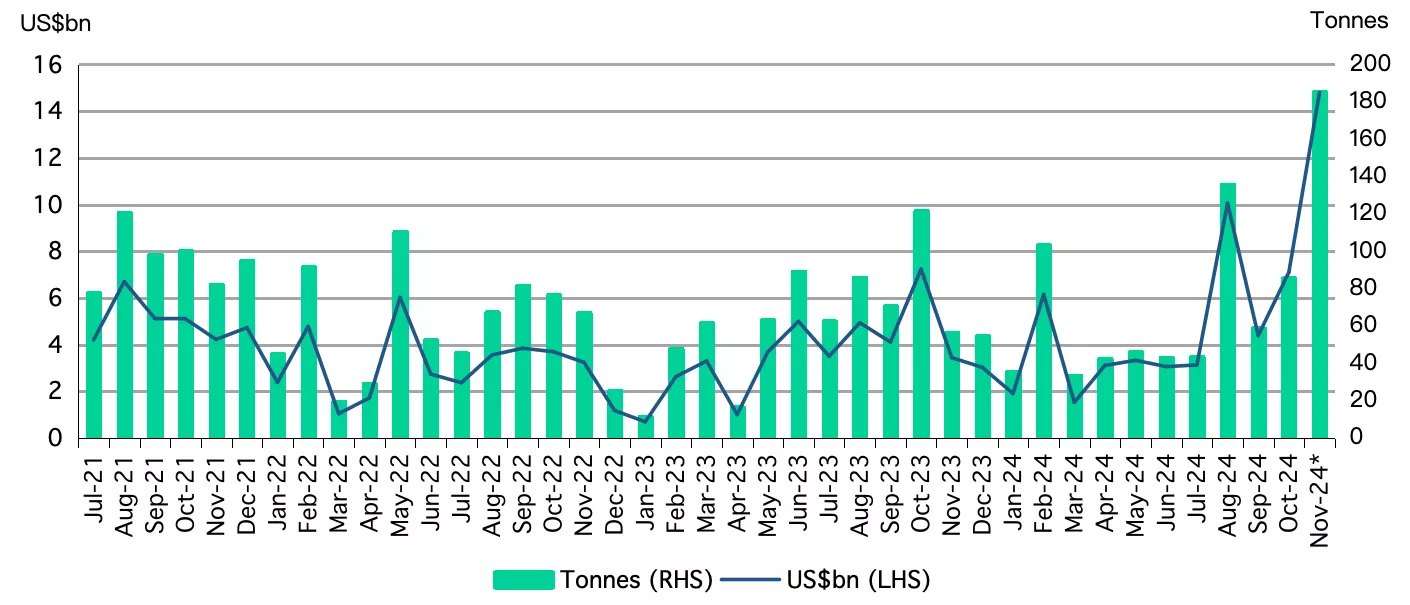

Initial reports suggest that gold imports saw a significant surge in November, reaching record levels. According to data from the Ministry of Commerce, imports in November amounted to US$14.8bn,6 more than double the previous month's total and over four times higher than the same period last year. Our estimates based on this data suggest that the import volume was approximately 170-180t, a substantial increase from October's 86t and the average of 63t over the first 10 months of 2024. Over the first 11 months of 2024 gold imports have risen by 48%, totalling US$59bn (INR4,916bn), with volumes likely exceeding 800t, compared to 689t in the same period of 2023. However, given the sizable figure reported in November, we are having active conversations with local gold industry stakeholders to better understand – if accurate – the drivers of the spike.7

Chart 4: Surge in gold imports

Monthly gold imports; in tonnes and US$bn*

*Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1As of end November 2024

2Based on LBMA Gold Price AM as of 13 December 2024

3The daily AUM and NAV data published by AMFI covers 14 of the country’s18 gold ETFs.

4We have revised our estimate of RBI’s October’24 net gold purchase from 27t to 14t.

5Forex reserve data in the Weekly Statistical Supplement.

6 Ministry of Commerce and Industry: India’s Foreign Trade for the month of November 2024

7 India’s record gold imports said to be due to calculation error, Bloomberg, 18 December 2024