China's gold market update: Seasonal strength in December

15 January, 2025

Highlights

- The LBMA Gold Price AM in USD fell in December while the Shanghai Gold Benchmark Price PM in RMB (SHAUPM) rose, supported by a weakening local currency; both gold prices ended 2024 with their strongest annual performances in more than a decade

- The Shanghai–London gold price spread rose sharply in December as demand improved seasonally; however, gold withdrawals from the Shanghai Gold Exchange (SGE) in 2024 were well below their ten-year average

- December’s inflow and a strong gold price pushed the total assets under management (AUM) of Chinese gold ETFs to a record high of RMB71bn (US$9.7bn), jumping 150% over the year; collective holdings also reached the highest ever

- The People’s Bank of China (PBoC) announced the addition of 10t of gold in December, its second consecutive monthly purchase. This pushed China’s official gold holdings to 2,280t, 5.5% of total foreign exchange reserves and 44t higher than the end-2023 level.

Looking ahead

- We expect a seasonal pick up in gold jewellery consumption due to the peak buying season over the Chinese New Year holiday – from 28 January to 4 February

- Investment buying is likely to continue to draw support from falling government bond yields and a weak local currency –driven by intensifying expectations of more rate cuts to boost the economy and concerns around rising US tariffs.

Gold levels off in December and ends 2024 with a sizable gain

Gold prices diverged in December. The gold price in USD fell by 2% while the SHAUPM in RMB saw a mild gain of 0.1% – due to a 1% depreciation of the local currency against the dollar. In general, rising US Treasury yields and the strengthening dollar – driven by changing expectations of the Fed’s future rate path – outpaced support from rising geopolitical risks, higher inflation expectations and improved market momentum.

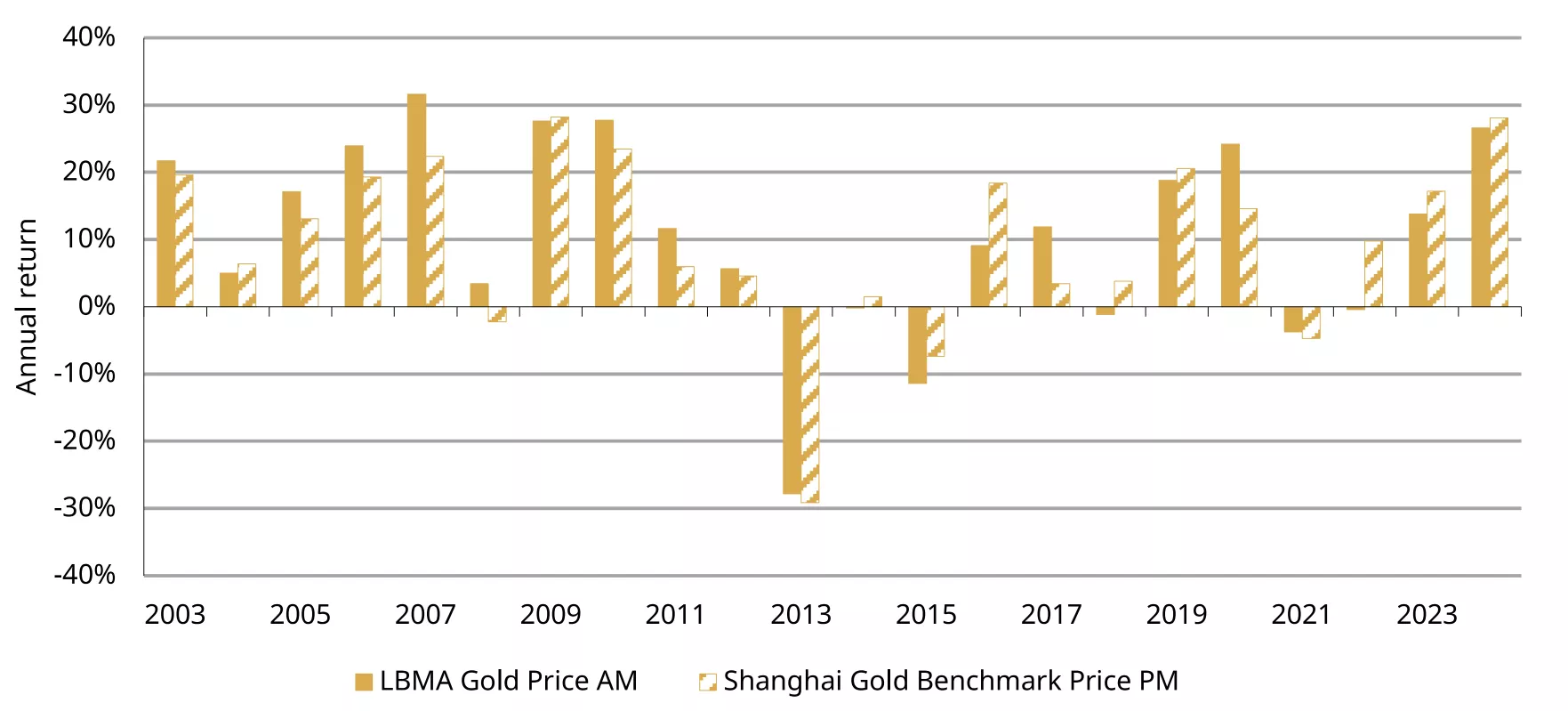

2024 was a strong year for gold (Chart 1): the RMB gold price saw its highest annual return (28%) since 2009 and the gold price in USD experienced its largest gain (+27%) since 2010.1 Spiking geopolitical risks around the globe and continued central bank gold purchases were main drivers of the international gold price. And a weakening Chinese yuan against the dollar, we believe, bolstered the RMB gold price further.

Chart 1: Gold ends 2024 with notable gains after a relatively stable December

Annual returns of the SHAUPM in RMB and the LBMA Gold Price AM in USD*

*As of 31 December 2024. Prior to the launch of the SHAUPM in 2016 we use the price data of Au9999.

Source: Bloomberg, World Gold Council

Wholesale demand subpar in 2024 despite December improvement

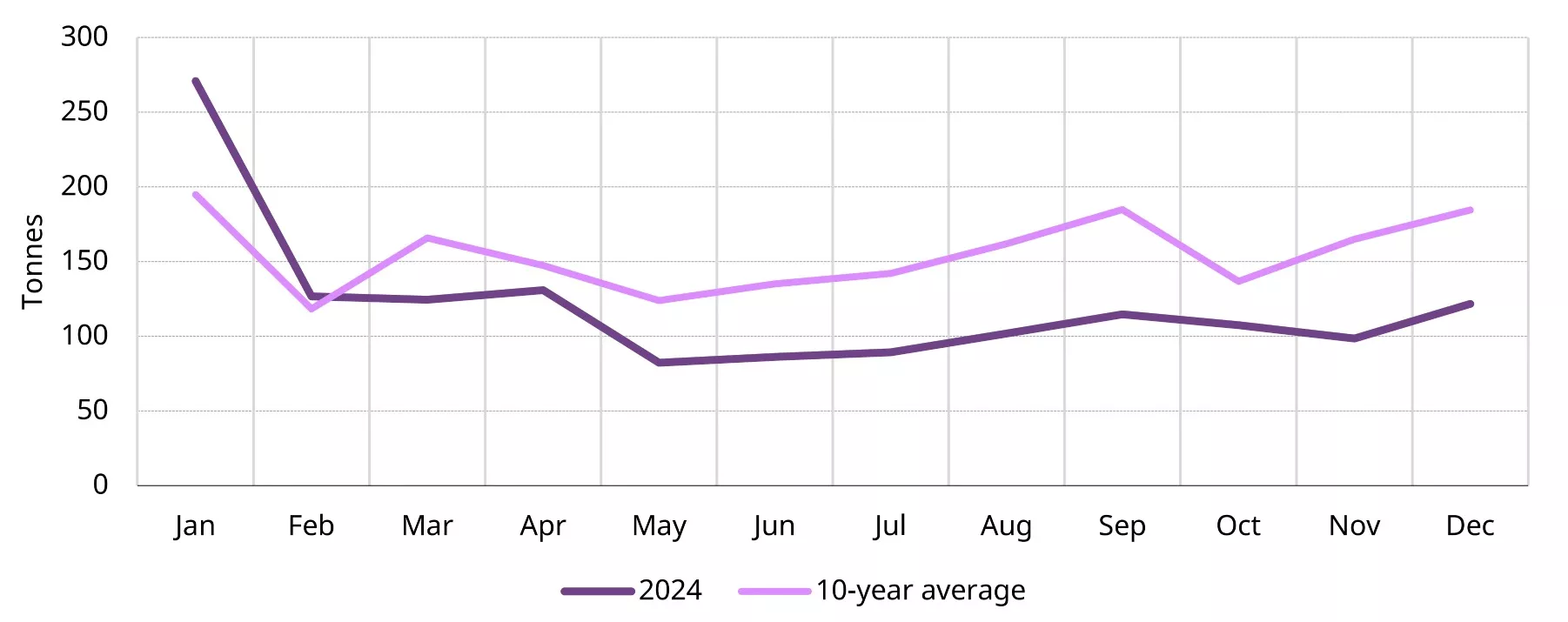

China’s wholesale gold demand improved during the last month of the year (Chart 2). Total gold withdrawals from the SGE rose to 122t in December, up 24% on November. And the Shanghai–London gold price spread turned positive again towards the end of 2024 thanks to improving demand.

This is in line with our observations in Shenzhen, China’s gold jewellery manufacturing hub: wholesalers and manufacturers told us that their showrooms were busier in December as retailers stocked up for the anticipated year-end sales boom. But they also mentioned that while there was a seasonal pick-up m/m, their sales remained below previous years. This is reflected in the 26% y/y fall in total gold withdrawals from the SGE, which were 34% lower than their 10-year average.

Chart 2: Wholesale gold demand rises seasonally yet remains below the long-term average

Gold withdrawals from the SGE and the 10-year average*

*The 10-year average is based on data between 2014 and 2023.

Source: Shanghai Gold Exchange, World Gold Council

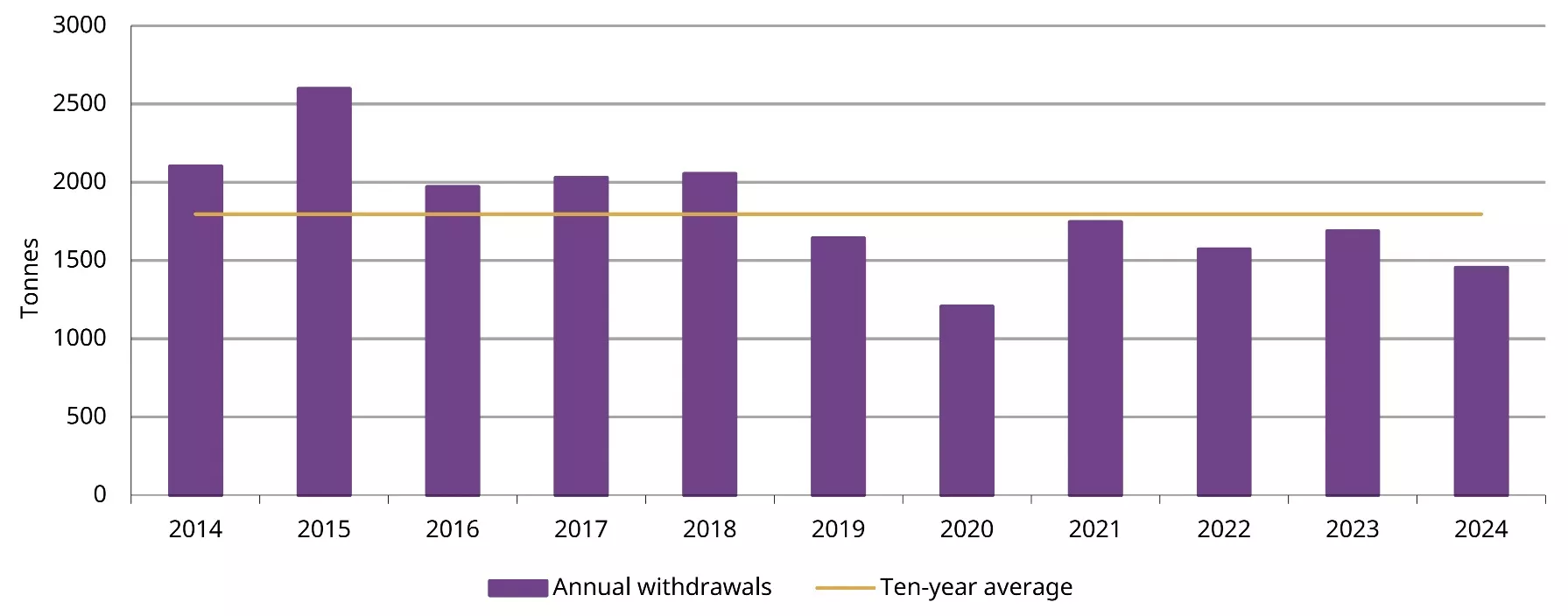

After an impressive start to the year, Chinese gold demand was relatively soft from February onwards. Banks, refiners and jewellery manufacturers withdrew a combined 1,455t of gold from the SGE, 15% less than in 2023 and 22% lower than the 10-year average (Chart 3). This is mainly due to a notable weakness in gold jewellery consumption – the major component of China’s gold demand – as the surging gold price and concerns of an economic slowdown limited affordability for consumers. But the same factors, alongside a weakening currency, proved supportive for investment buying, and this partially countered jewellery’s decline.

Chart 3: Demand weakens in 2024

Annual gold withdrawals from the SGE and the 10-year average*

*The 10-year average is based on data between 2014 and 2023.

Source: Shanghai Gold Exchange, World Gold Council

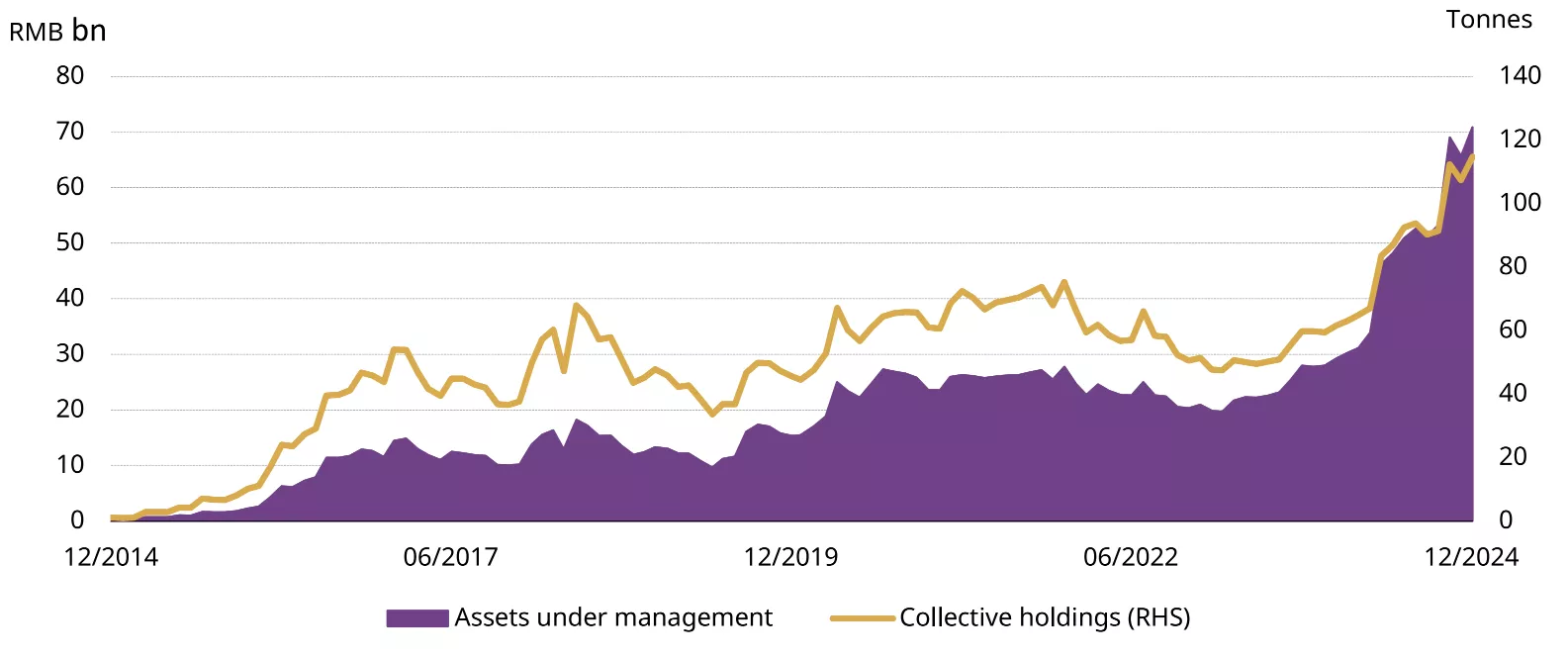

Chinese gold ETF holdings reach another record high

Chinese gold ETFs added RMB4.5bn (US$635mn) in December, pushing the total AUM to RMB71bn (US$9.7bn), the highest on record; holdings also reached a record level of 115t, a 7.5t increase during the month. Although the local equity market experienced another monthly gain, the depreciating RMB and plummeting government bond yields – amid economic uncertainties and intensifying expectations of continued rate cuts – drove investors to gold. The announcement from the PBoC that gold purchases had resumed also likely boosted investor interest.

Investor demand for gold ETFs jumped in 2024, attracting RMB31bn (US$4.4bn), the strongest on record. The total AUM of Chinese gold ETFs surged by 150% during the year, while holdings soared by 87%, or 53t. Three main factors underpinned this robust demand:

- The strong gold price performance which attracted investor attention

- Plunging government bond yields which reflected expectations of continued rate cuts and rising safe-haven demand as the future of China’s economy remains shaky to many

- A weakening local currency which pushed up value-preserving demand.

Chart 4: Chinese gold ETF demand soars in 2024

Total AUM and collective holdings of Chinese gold ETFs*

*As of 31 December 2024.

Source: Company filings, World Gold Council

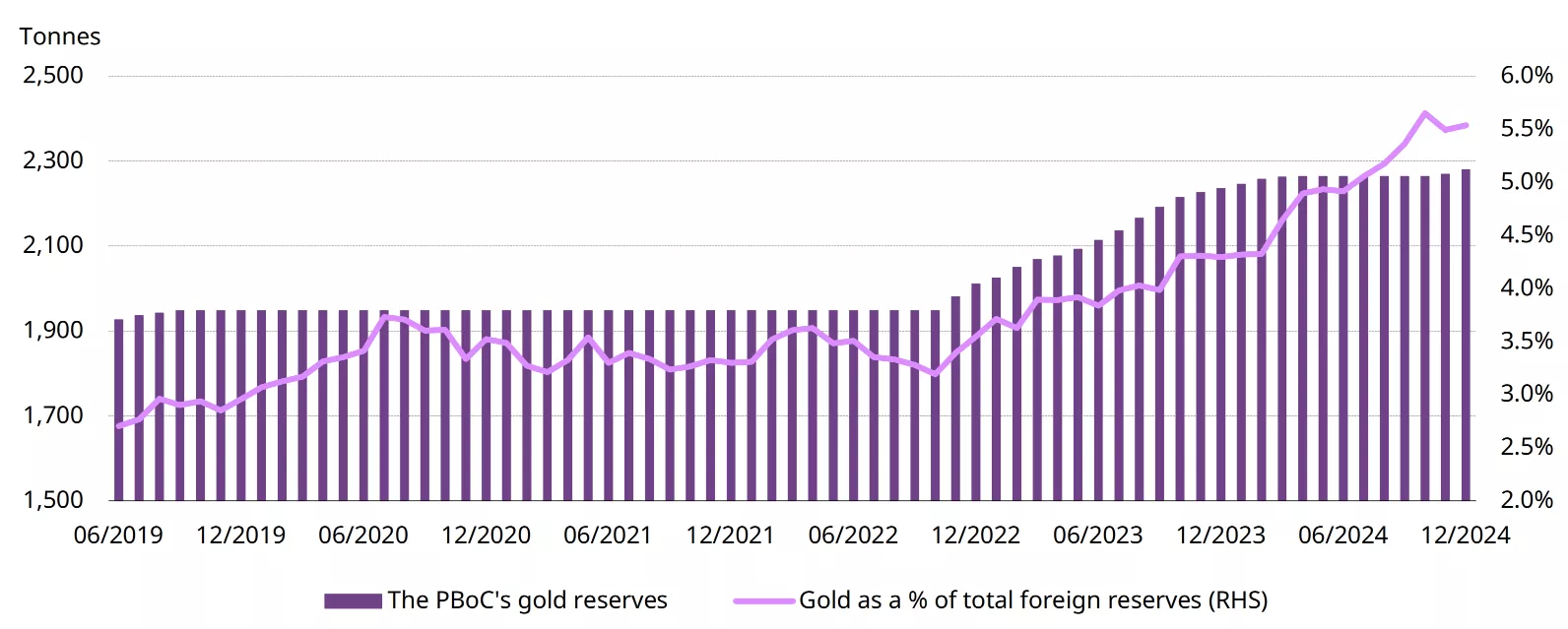

China’s central bank announced gold purchases two months in a row

The PBoC moved again, reporting a 10t gold purchase in December following November’s 5t addition. China’s official gold holdings now stand at 2,280t, accounting for 5.5% of total foreign reserves, a record high.

China’s official gold holding change announcements have been on and off during 2024: after kicking off the year with four consecutive monthly purchases, no activity was reported between May and October. Over the course of the year, China reported 44t of gold purchases, the lowest since 2022 when the central bank resumed its gold buying announcements.

Chart 5: Central bank gold purchases continue in December and end 2024 on a positive note

Reported official gold holdings and gold as a percentage of total foreign exchange reserves*

*As of 31 December 2024.

Source: SAFE, World Gold Council

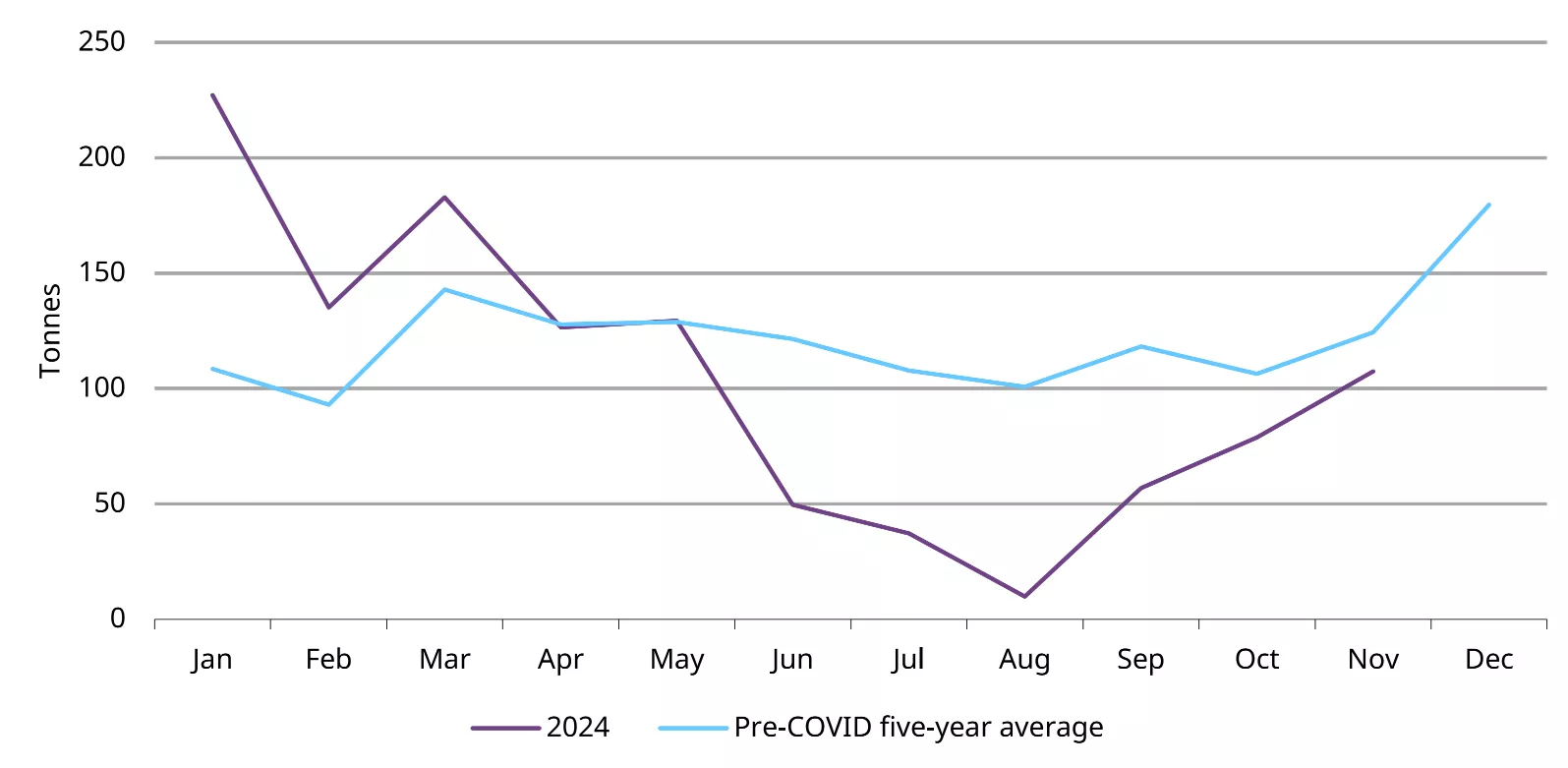

Gold imports on a seasonal rise

Following another m/m rise in October (+39%), November imports increased by a further 36%, totalling 108t (Chart 6). We believe this is seasonal, given China’s gold demand tends to rise ahead of the Chinese New Year holiday in late January or early February. However, due to subpar wholesale gold demand, imports were below their pre-COVID five-year average (124t) and 23% lower y/y.

Chart 6: Imports rebound seasonally yet remain below previous annual averages

Gold imports and averages pre-COVID*

*As of 30 November 2024. Pre-COVID average based on imports between 2015 and 2019.

Source: China Customs, World Gold Council

Footnotes

1The RMB gold price is based on the SHAUPM while the USD gold price refers to LBMA Gold Price AM.