China's gold market update: Central bank purchases continue in January

18 February, 2025

Highlights

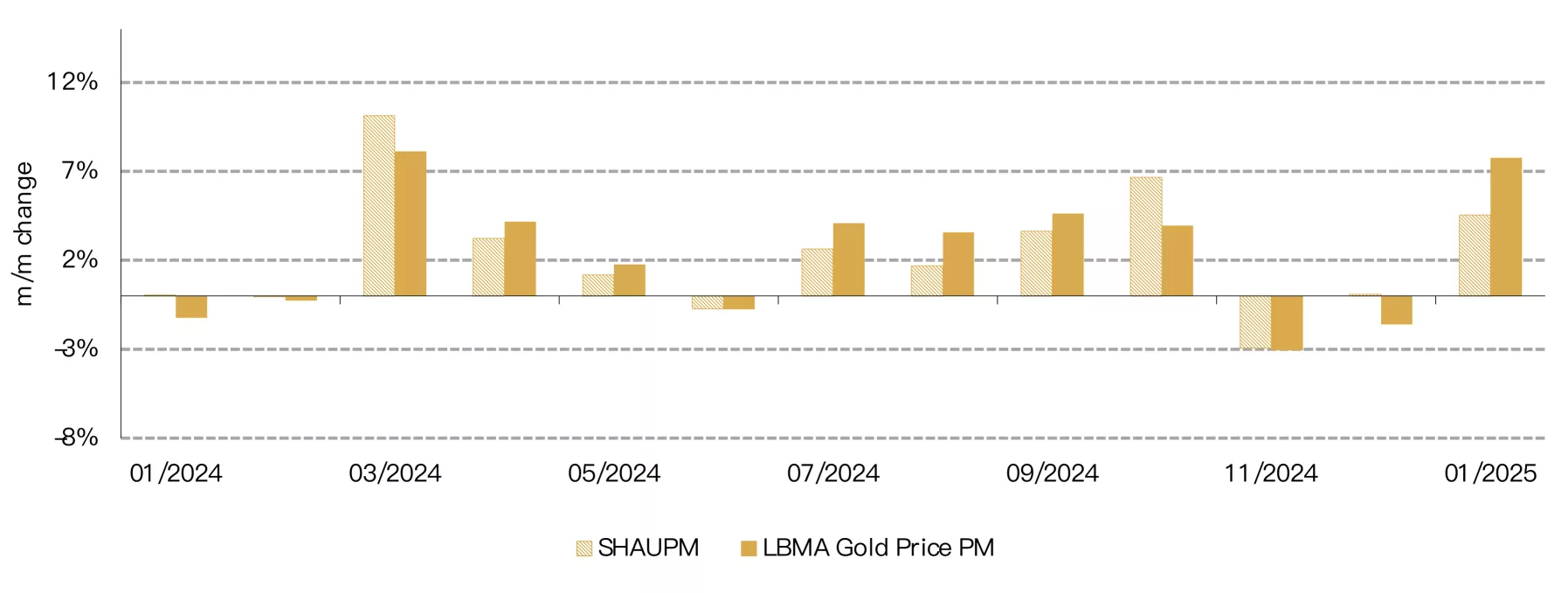

- Gold began 2025 with vigour: the LBMA Gold Price PM and the Shanghai Gold Benchmark Price PM both saw their strongest January in years, rising by 8% and 5% respectively.

- The Shanghai–London gold price spread rose again in January as local wholesale gold demand continues its seasonal improvement: gold withdrawals from the Shanghai Gold Exchange (SGE) increased by 3% m/m to 125t. Yet, total withdrawals remain well below levels seen in past years, highlighting the soaring gold price’s negative impact on gold jewellery’s tonnage demand.

- Chinese gold ETF flows in January flipped negative, shedding RMB2.8bn (US$399mn) and decreasing the total assets under management (AUM) to RMB70bn (US$9.8bn) – but remaining near the record level. Meanwhile, holdings fell 4.7t to 110t.

- The People’s Bank of China (PBoC) reported a further 5t addition to its gold reserves in January; following three consecutive monthly increases, its official gold holdings now stand at 2,285t, 5.9% of total reserves.

Looking ahead

- We anticipate continued strength in bar and coin demand while the soaring gold price may weigh on gold jewellery sales in tonnage terms – although consumer spending may not change much. And in the longer-term, a pilot programme that allows Chinese insurers to buy physical gold should provide additional support for investment demand.

- And judging from the surging attention consumers are paying to gold, there is a possibility that wholesale demand in the near term – driven mainly by investment purchases – may stay stable before it cools as Q2, historically an off-season of gold consumption in China, approaches.

Gold kicked off 2025 with a sizable gain

Gold prices surged during the first month of 2025: the LBMA gold price PM in USD jumped 8% while the SHAUPM in RMB rose 5% (Chart 1). A strengthening local currency and fewer trading days due to the Chinese New Year (CNY) holiday between 28 January and 4 February led to the relative underperformance of the RMB gold price.

Our analysis shows that heightened geopolitical risks – such as the Trump administration’s tariff policies – improving gold ETF inflows and rekindling inflation concerns were main contributors to the record-shattering gold price in January.

Chart 1: Gold starts 2025 on a strong note

Annual returns of the SHAUPM in RMB and the LBMA Gold Price PM in USD*

*As of 31 January 2025.

Source: Bloomberg, World Gold Council

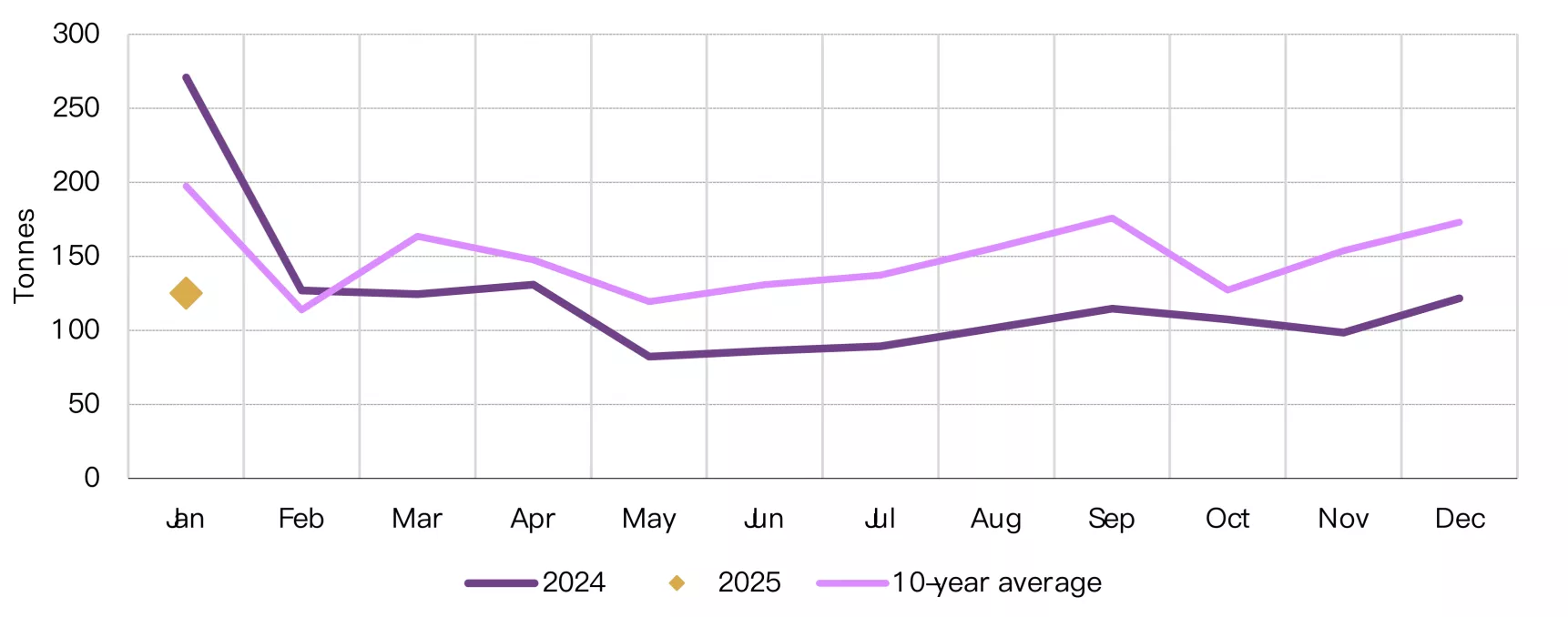

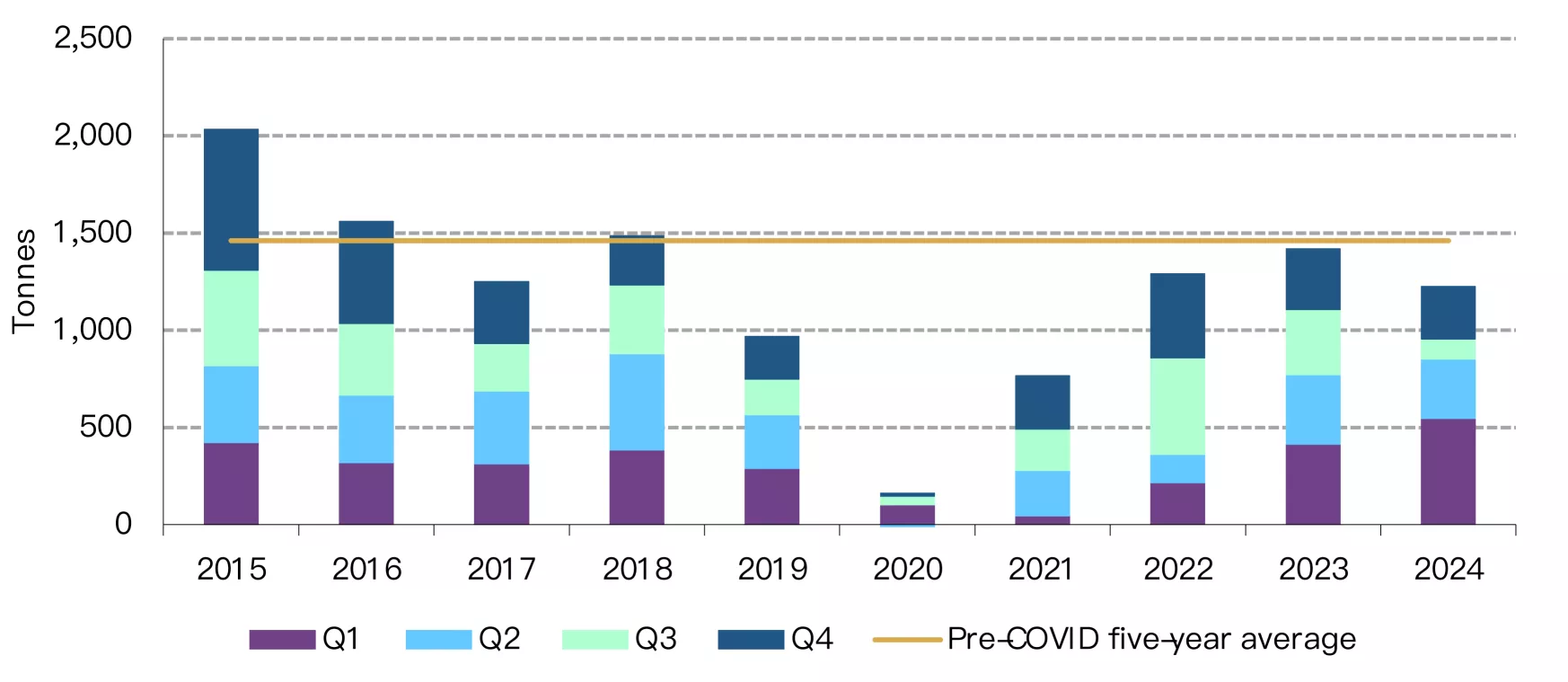

Wholesale demand improved m/m but stayed weak y/y

China’s gold demand improved during the CNY month. On the wholesale side, 125t of gold were shipped out from the SGE, a 3% m/m rise (Chart 2). Seasonal stock replenishment from jewellery retailers, banks and other market participants ahead of the CNY holiday – a traditional peak season for gold consumption in China – was a main contributor.

Chart 2: Seasonal replenishment drives up wholesale demand m/m

Gold withdrawals from the SGE and the Shanghai-London gold price spread*

Source: Shanghai Gold Exchange, World Gold Council

But our pre-holiday field research in Shenzhen, the hub of China’s gold jewellery wholesaling and manufacturing, indicates weaker-than-usual sentiment among gold jewellery retailers. With the gold price soaring and the past year’s demand picture reminding them of potential sustained weaknesses, gold jewellery retailers lowered their expectations for the holiday sales and stocked up less than previous years. And this is also reflected in the 54% y/y decline in January’s wholesale gold demand – but it is important to note that 2024 saw the strongest January in history – and it was 37% below the ten-year average (Chart 3).

Chart 3: Yet the seasonal m/m improvement can’t mask the y/y weakness

Gold withdrawals from the SGE and the 10-year average*

*The 10-year average is based on data between 2014 and 2023.

Source: Shanghai Gold Exchange, World Gold Council

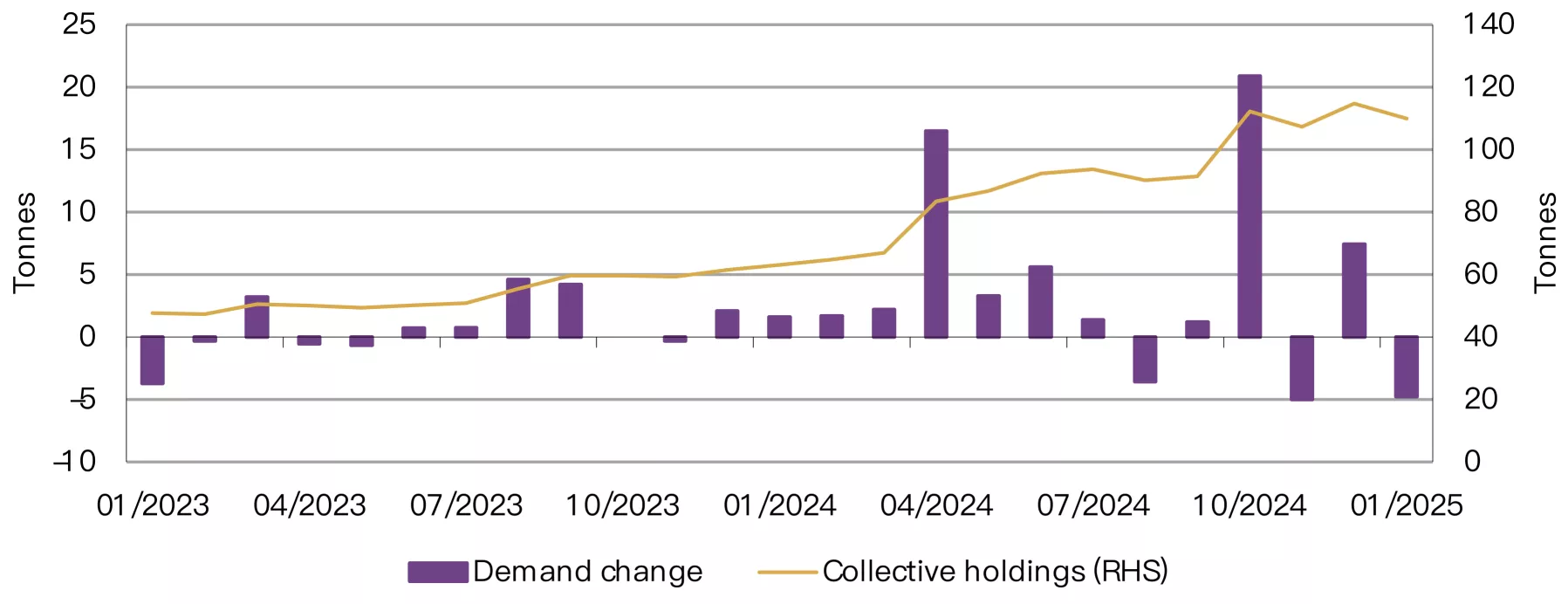

Chinese gold ETF flows flipped negative in January

Chinese gold ETFs lost RMB2.8bn (US$399mn) in January, equivalent to a 4.7t reduction in holdings (Chart 4). After the month’s outflow, their total AUM fell to RMB70bn (US$9.8bn) and collective holdings reached 110t. We believe the outflow can be mainly attributed to profit-taking activities ahead of the CNY holiday to avoid additional volatilities from international markets while the local market is closed.1 Meanwhile, improving investor risk appetite amid the stronger-than-expected Q4 and 2024 GDP data releases in the month may also have led to outflows from gold, the safe-haven asset.2

Chart 4: Chinese gold ETFs saw outflows in January

Collective holdings and monthly changes of Chinese gold ETFs*

*As of 31 January 2025.

Source: Company filings, World Gold Council

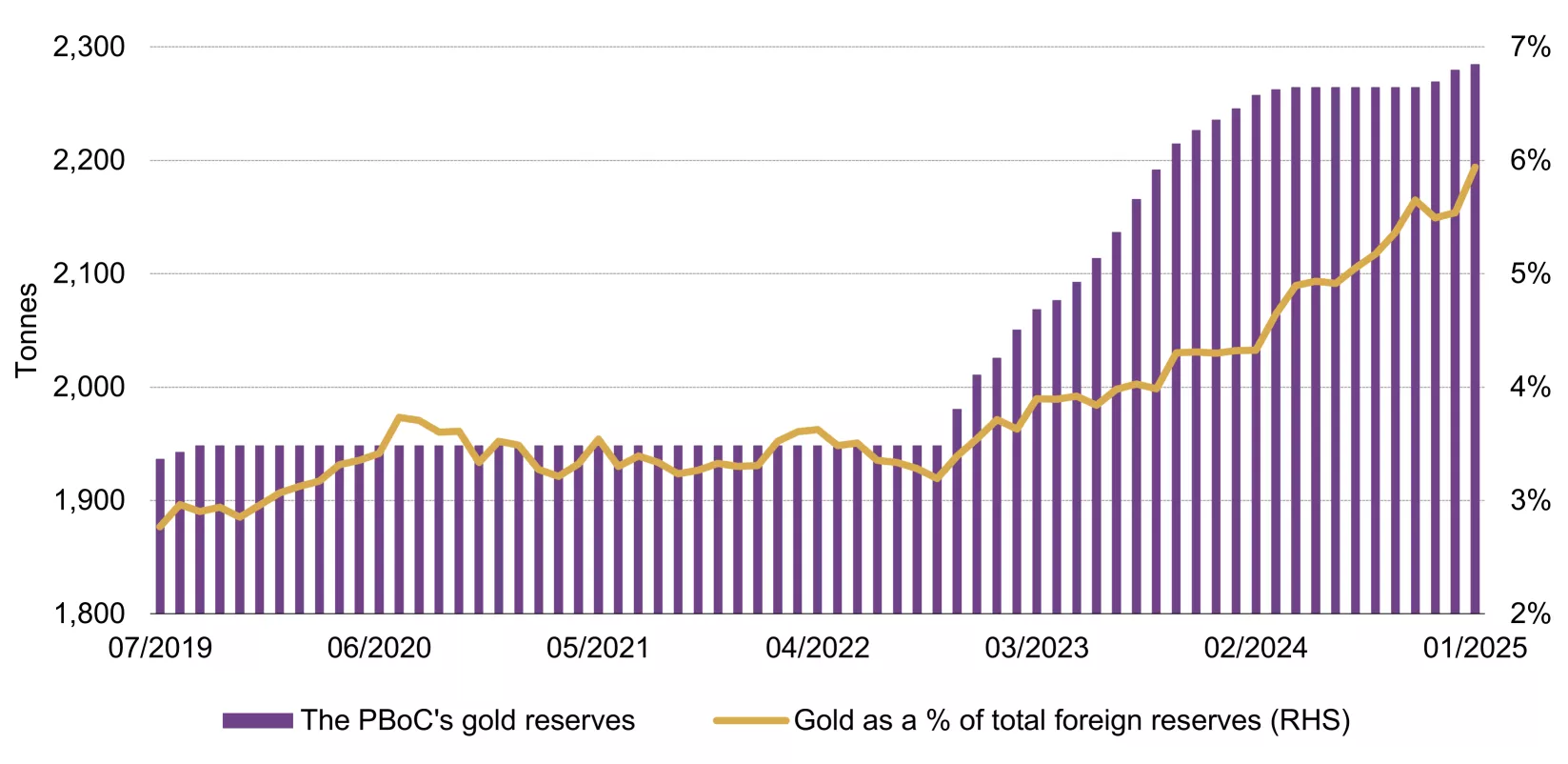

China’s official gold holdings rose three months in a row

The PBoC announced another gold purchase to start 2025: the 5t increase lifted China’s official gold holdings to 2,285t, accounting for 5.9% of total foreign reserves (Chart 5). As noted in our recently published Gold Demand Trends report, China announced a total of 44t gold purchases during 2024 despite its six-month pause in the middle of the year. And we believe the PBoC’s move could have a positive impact on sentiment among local gold investors, as indicated by past anecdotal evidence.

Chart 5: The PBoC reported its third consecutive monthly gold purchase in January

Reported official gold holdings and gold as a percentage of total foreign exchange reserves*

*As of 31 January 2025.

Source: State Administration of Foreign Exchange, World Gold Council

Gold imports ended 2024 with a y/y decline

December saw China import 84t of gold, concluding Q4 with a total of 270t, based on the most recent data from China Customs. While Q4 imports fell 14% y/y, they rose more than 160% q/q – the y/y weakness and q/q seasonal strength are in line with our observation of China’s gold demand during the quarter.

In 2024, China imported 1,225t of gold (Chart 6), a 14% y/y decline and 16% below the pre-COVID five-year average (1,460t). And we saw similar trends in China’s gold consumption in 2024, which fell 10% compared to 2023, leading to the decrease in imports.

Chart 6: Gold imports remain below pre-COVID levels

Gold imports and averages pre-COVID*

*As of 31 December 2024. Pre-COVID average based on imports between 2015 and 2019.

Source: China Customs, World Gold Council

Looking ahead

The CNY holiday between late January and early February showed signs of consumption revival. For instance, box office revenues during the holiday surged to a historical high and consumer spending on dining and travelling both rose compared to the same period in 2024.3

Gold consumption was also booming. Various information indicates that gold jewellery stores were busy during the holiday. Meanwhile, the climbing gold price continued to push consumers to lighter products.4

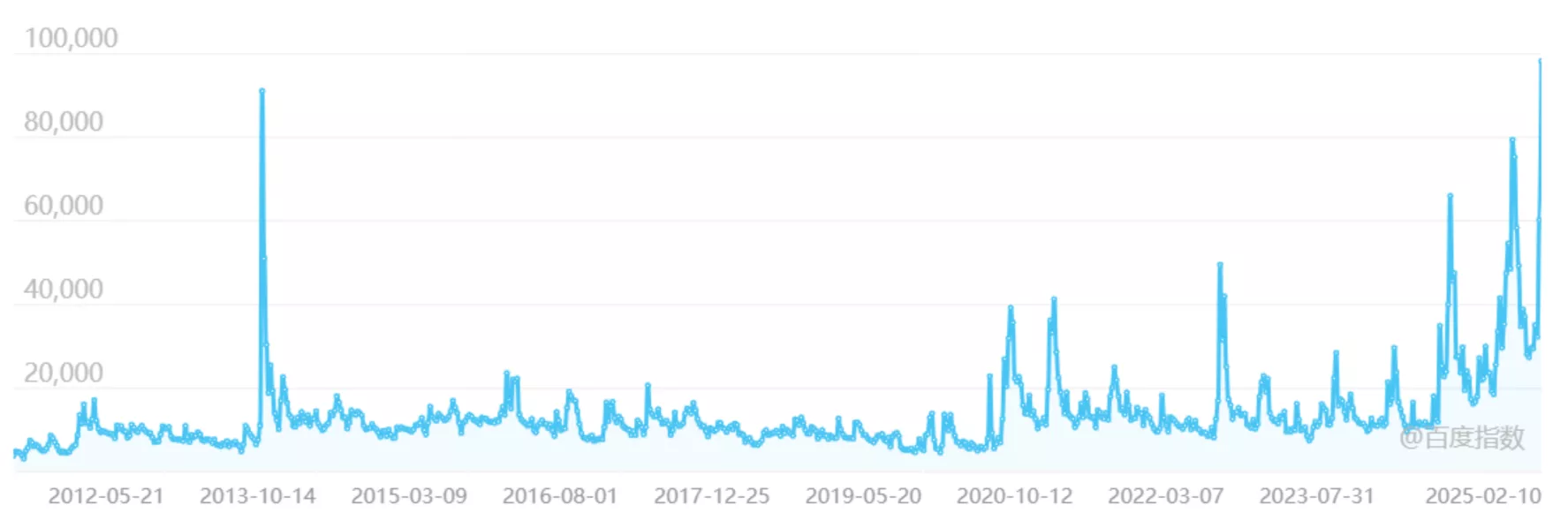

And the investment story is a much stronger one. The strong gold price performance, the central bank’s continued purchasing announcements and the local currency volatilities kept lifting investor attention for gold. Currently, the online searches for gold topped their previous peak seen in 2013 (Chart 7), when gold demand in China surged to the highest in history. Our conversations with market participants indicate that gold bar sales maintained their stunning pace seen in 2024, even leading to inventory shortages for some.

Chart 7: Consumer sentiment towards gold reached a record high

Baidu Search Index of the keyword “Gold”*

*As of 11 February 2025, sourced from 百度指数.

Source: Baidu Index, World Gold Council

We believe the current trend may continue. In tonnage terms, demand for gold jewellery may stay tepid – although value-preserving motives will provide some support – but bar and coin sales should remain hot – and any gold price adjustment could be viewed as a good opportunity to enter. Lastly, we believe a recent announcement of policy changes that allows ten Chinese insurers to buy up to 1% of each company’s total assets in physical gold, as a pilot run, should provide longer-term support for local investment gold demand.5

Footnotes

1Local financial markets were closed due to the CNY holiday between 28 January and 4 February 2025.

2For more, see: China's fourth-quarter GDP grows at 5.4%, beating market expectations | 16 January 2025.

3For more, see: 消费迎来“开门红”!春节期间零售和餐饮同比增长4.1%,以旧换新首批810亿元资金已下达_腾讯新闻 | 8 February 2025.

4For more, see: 2025春节黄金市场热潮:小克重产品爆红,消费者观望情绪升温_金价_变化_央行| 7 February 2025.

5For more, see: China’s Insurance Funds Inject New Vitality into Global and Domestic Gold Markets | World Gold Council | 19 February 2025.