India gold market update: Record high prices, accompanied by investment interest

19 February, 2025

Highlights

- Domestic prices track international highs, but demand pressure results in deeper discounts from local dealers

- Price surge dims jewellery demand, while investment interest lingers

- Gold ETFs see unprecedented inflows in January

- The Reserve Bank of India (RBI) resumed its gold buying in January, after a December pause, adding 2.8t to its reserves

- Gold imports hit their six-month low in January

- The Union Budget maintained the import duty on gold at 6%, while reducing the customs tariff on gold jewellery from 25% to 20%.

Looking ahead

- Gold investment interest is expected to remain strong, even as jewellery demand faces pressure from record-high prices. The financial year-end dynamics, which include statutory payments and tax-saving investments, may curtail discretionary spending, further weighing down demand. However, price stability could be a mitigating factor for jewellery demand, which could see an improvement in the new fiscal year starting in April.

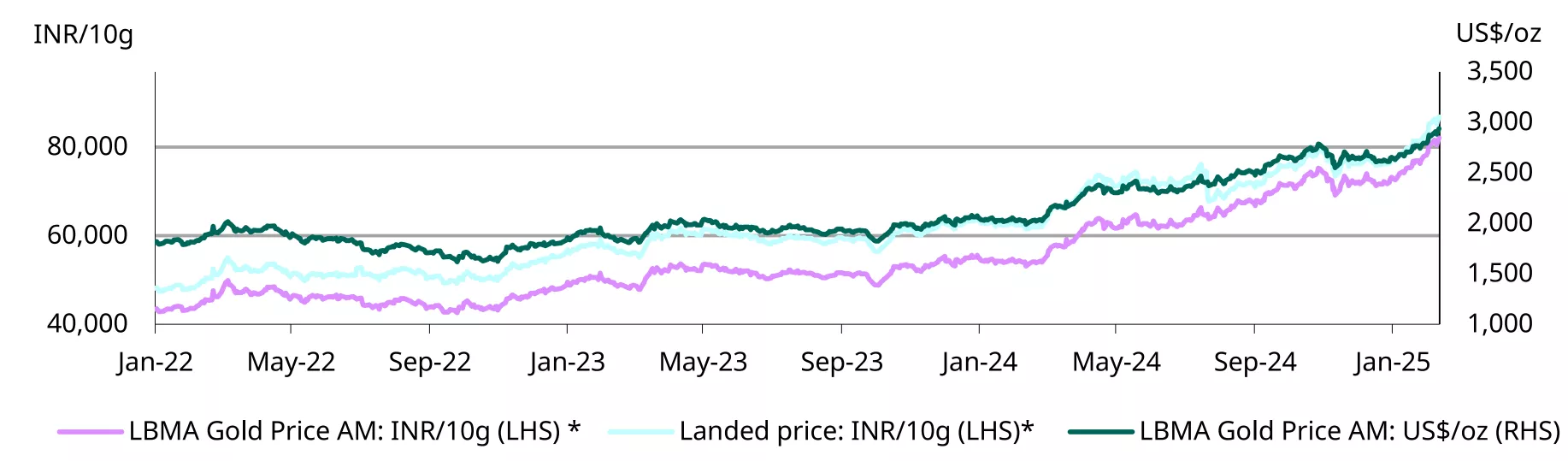

Gold achieves a new peak

Heading into 2025, gold has not only reversed the price moderation seen in November-December (a decline of 6%), but it has also repeatedly hit new -record highs. So far in 2025,1 the LBMA gold price AM in USD has surged by US$286/oz or 10% to US$2,938/oz. Domestic prices have been rising in parallel with international prices, rising by 14% to a record INR86,831/10g,2 with the higher gains attributed to the weakness in the INR against the USD (1.1% depreciation y-t-d). Our analysis indicates that the upward climb in gold prices can be attributed to a combination of geopolitical risks, growing concerns about inflation, and increased investment flows.

Chart 1: Gold breaks previous records

LBMA Price AM and domestic landed price by month, US$ and INR*

*Based on the LBMA Gold Price AM in USD expressed in local currency as of 14 February 2025. Landed price includes import tariff and tax.

Source: Bloomberg, World Gold Council.

Union Budget 2025-26: key highlights pertaining to gold

- One of the key takeaways from the Union budget presented on 1 February for gold is that the import duty hasn’t been changed. In the run-up to the budget there were worries that the government might hike the duty due to the rise in gold imports after it reduced the duty by 9% back in July 2024

- On the other hand, the government cut the customs tariff on gold jewellery from 25% to 20%. This is likely done as part of the overall rationalisation of tariffs across commodities. However, since jewellery imports aren’t that significant and are limited to high-end jewellery (and of low caratage), this cut in duty is unlikely to have much impact on domestic jewellery production

- It was also announced that new tariff lines will be introduced under the HSN codes3 for precious metal from 1 May to distinguish imports of precious metals in various forms. The new tariff lines will differentiate gold imports in bar form from other types. This is done to address the disruptions caused by imports of gold in forms such as platinum alloy and gold paste. From May, the tariff rates can differ based on the new classification

- The government has also decided not to issue any sovereign gold bonds as part of its market borrowing programme. This could work in favour of gold ETFs, as investors looking for gold-related financial products may turn to ETFs instead.

Price surge takes shine out of jewellery demand, maintains investment interest

The rally in gold prices to repeated new all-time highs since the start of the year has weighed heavily on the retail demand for gold jewellery. Uncertainty about announcements in the Union Budget also influenced buying activity.

Anecdotal reports indicate that demand dropped sharply in January and the weakness persisted into February, despite the end of the inauspicious period in the Hindu calendar (15 Dec - 15 Jan) and the usual-post Union Budget pick-up in demand. Wedding-related purchases too have been subdued, suggesting that many consumers had front loaded their purchases when prices dipped in November. Rather than making fresh purchases, many buyers are opting to exchange old gold for new jewellery. Additionally, as gold prices surged past previous thresholds, many consumers are also taking the opportunity to sell old gold and lock in profits.

This slowdown in jewellery demand has left retailers reluctant to restock, as they face challenges in meeting payment terms with manufacturers. This has created a liquidity crunch within the industry. The subdued demand environment was reflected in the widening spread between domestic and international prices. Since December, domestic gold prices3 have been trading at a discount to international prices, with the gap widening from an average US$3/oz in December to US$23/oz.4

Notwithstanding the depressed jewellery demand, investment demand interest (for bars and coins) has stayed the course with investors anticipating further price increases.

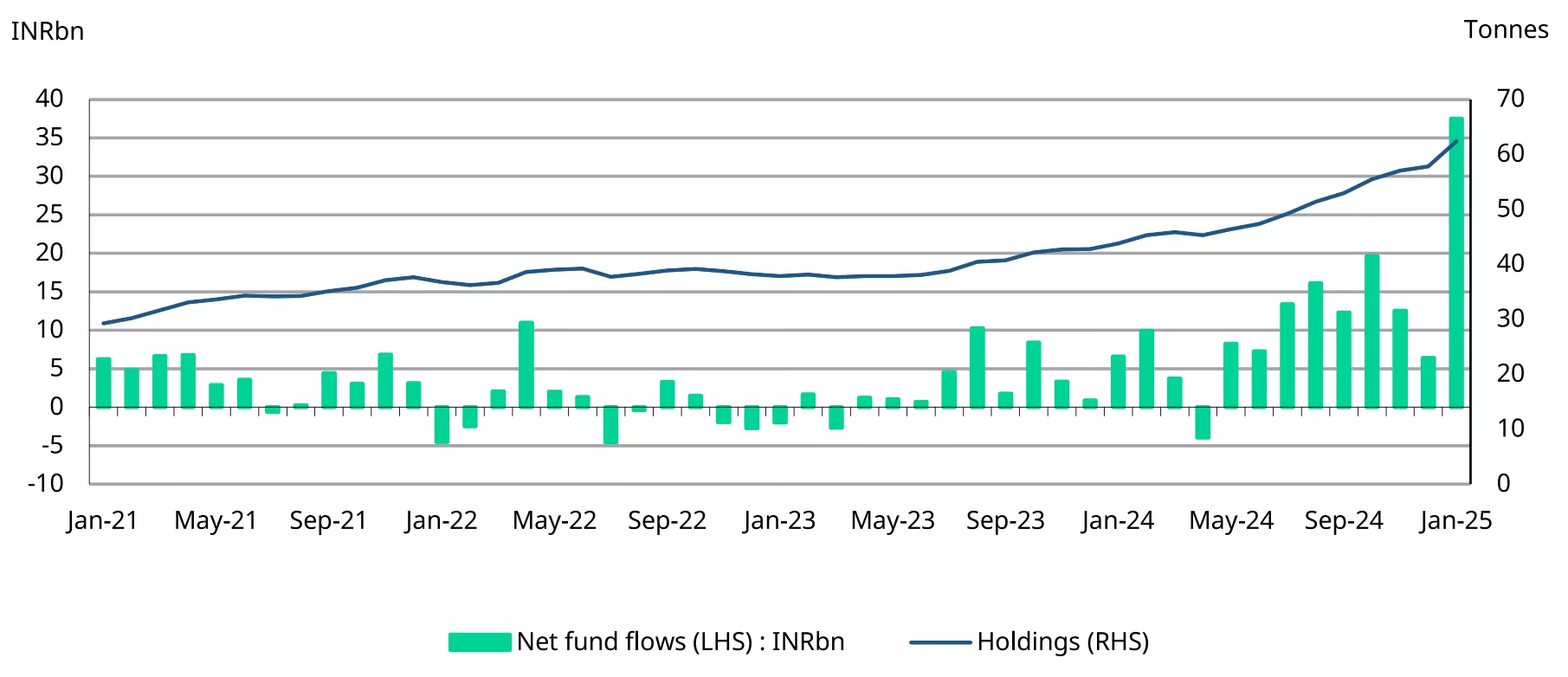

Record inflows into gold ETFs

2025 began with strong interest in Indian gold ETFs, marked by unprecedented inflows in January. According to the Association of Mutual Funds in India (AMFI), gold ETFs recorded net inflows of INR37.5bn(~US$435mn) in January, significantly higher than the average inflows of INR9.4bn(~US$112mn) over the previous 12 months. The cumulative assets under management (AUM) of gold ETFs grew to INR51.8bn(~US$6bn), an 15% m/m increase and 4.6t were added to the overall holdings, taking the collective holdings to 62.4t. These figures are close to our initial estimates, which were based on information available at the time.5

Anecdotal reports suggest that the strong inflows in January can be attributed to investors redirecting free cash flow towards gold ETFs for diversification amid ongoing global and domestic economic and policy uncertainty. The sustained weakness in the domestic equity markets has also been driving flows into gold ETFs, with investors pulling back from equities in favour of the safe-haven appeal of gold.

In February, a new product was launched, bringing the total number of gold ETFs in India to 19,6 highlighting the strong momentum in this space.

Chart 2: Inflows soar

Monthly gold ETF fund flows in INRbn, and total holdings in tonnes*

*As of end January 2025.

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

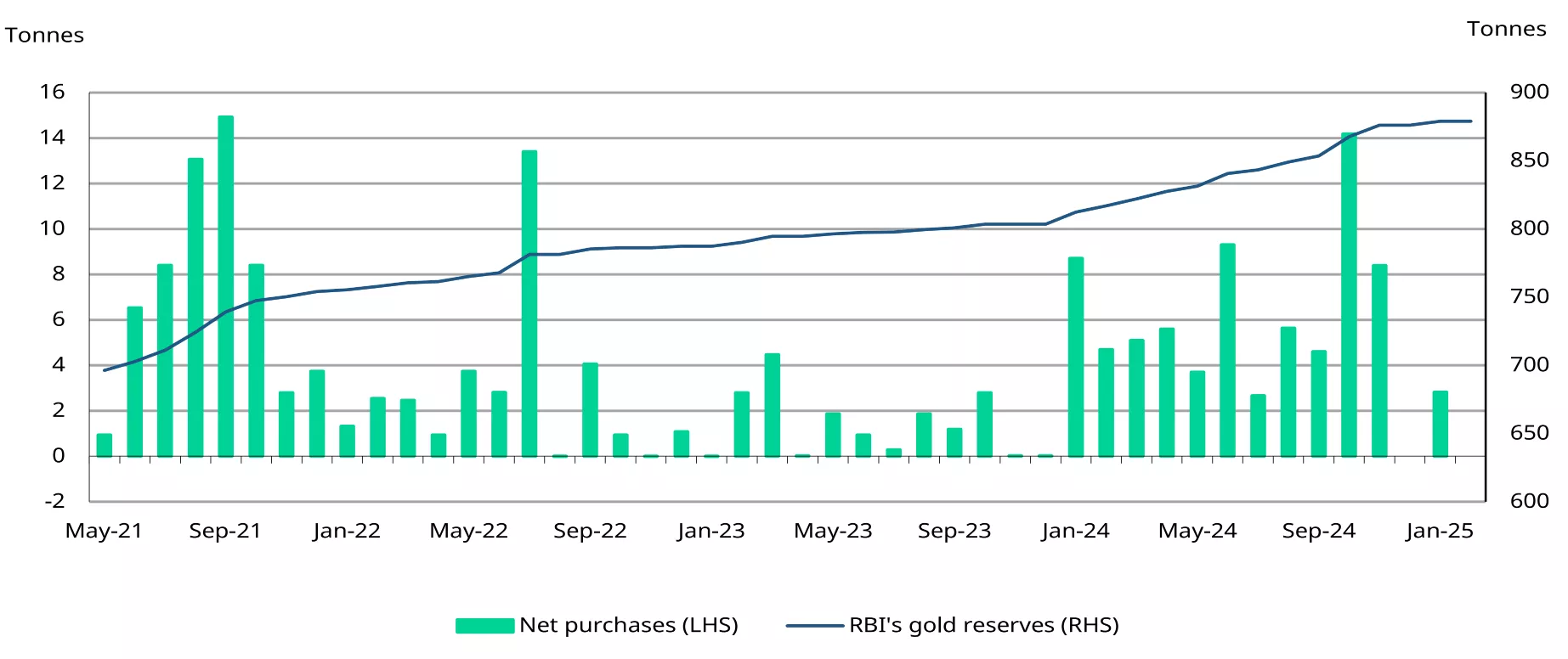

Gold buying resumes at the RBI after a brief pause

The RBI resumed its gold purchases in January, after pausing in December following 11 consecutive months of buying. The central bank added 2.8t of gold to its gold holding during the month, taking its total gold reserves to a new high of 879t. This renewed buying suggests that the RBI is likely to continue with its gold accumulation, following a significant purchase of 72.6t in 2024, making it the third largest buyer of gold among global central banks that year.

Not only is the RBI building its gold reserves, the share of gold in its forex reserves has been steadily climbing from 7.7% in January 2024 to 11.31% by early February 2025.7 This increase reflects the RBI’s efforts to diversify its forex reserves, alongside a decline in its holding of foreign currency assets (from 88.5% to 85.2%).

Chart 3: RBI’s gold holdings rise

RBI’s net purchases and reserves, in tonnes*

*Data as of 7 February 2025.

Source: RBI, World Gold Council

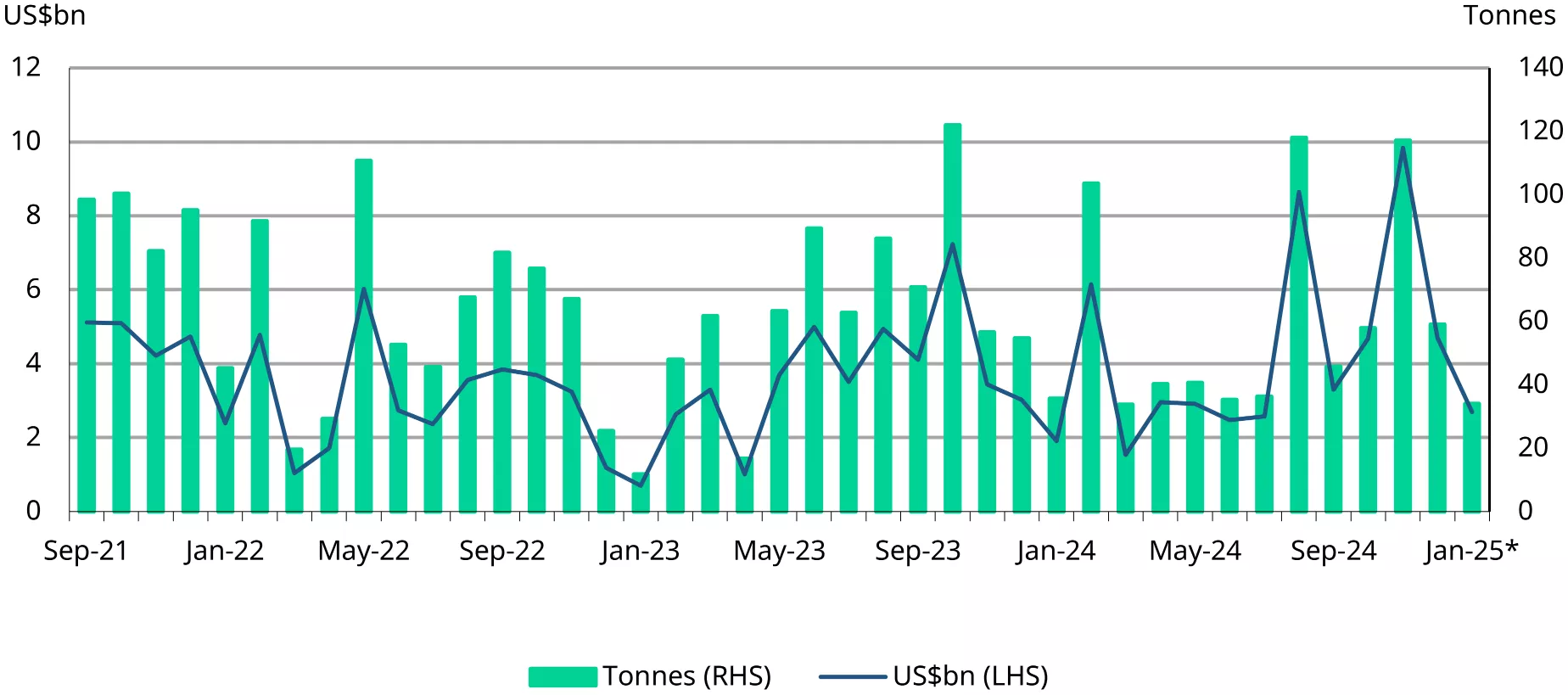

Gold imports slow in January

Gold imports in January saw a noteworthy drop owing to high prices leading the pull-back in demand. Anecdotal market reports suggest that manufacturers did not pick-up imports, reflecting the depressed demand environment. January's imports were the lowest since July 2024. According to Ministry of Commerce data, the gold import bill for the month totalled $2.68bn, a 43% decrease compared to December. However, it was approximately 40% higher than January of the previous year. We estimate that the volume of imports in January ranged between 30t-35t.

Chart 4: Gold imports cool from peak

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1As of 14 February, 2025.

2Based on the landed price of gold (international prices adjusted for import taxes and exchange rate) as of 14 February, 2025.

3HSN (Harmonized System of Nomenclature) code is a system used to classify goods in international trade and is accepted globally.

4Domestic gold prices refer to the landed prices, which are the international prices adjusted for import taxes and exchange rate.

5 As of 14 February, 2025.

6The daily AUM and NAV data published by AMFI covers 15 of the country’s 18 gold ETFs.

7As of 14 February, 2025.

8As of 7 February, 2025.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.

Information obtained from ICRA Analytics Limited

All information obtained from ICRA Analytics Limited in this document has been obtained by ICRA Analytics Limited from sources believed by it to be accurate and reliable. Although reasonable care has been taken to ensure that the information herein is true, such information is provided ‘as is’ without any warranty of any kind, and ICRA Analytics Limited in particular, make no representation or warranty, express or implied, as to the accuracy, timeliness or completeness of any such information. All information obtained from ICRA Analytics Limited contained herein must be construed solely as statements of opinion, and ICRA Analytics Limited shall not be liable for any losses incurred by users from any use of this document or its contents in any manner. Opinions expressed in this document are not the opinions of ICRA Analytics Limited’s holding company, ICRA Limited (ICRA), and should not be construed as any indication of credit rating or grading of ICRA for any instruments that have been issued or are to be issued by any entity.