Surge in ETF inflows supports Q3 gold demand growth

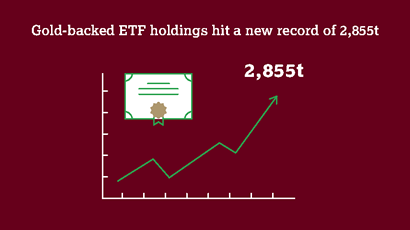

Gold demand grew modestly to 1,107.9t in Q3 thanks to the largest ETF inflows since Q1 2016.

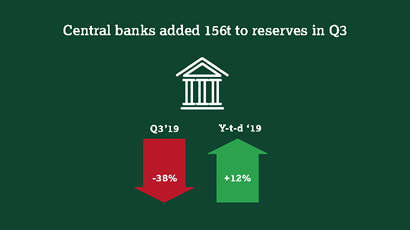

A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3. Although central bank buying remained healthy, it was significantly lower than the record levels of Q3 2018. Jewellery demand (-16%) was hampered by the continued strength in the gold price, which hit new multi-year– and, in some cases, record –highs, as well as by consumer concern over the health of the global economy. Similarly, the decline in bar and coin demand (-50%) in Q3 was driven primarily by the gold price: retail investors took the opportunity to lock in profits rather than making fresh purchases. Technology demand for gold fell 4% as economic challenges remained, but the nascent 5G infrastructure helped to slow the decline in the important electronics sector. With mine production virtually unchanged, a price-related 10% jump in gold recycling boosted gold supply 4% to 1,222t.