When added to a portfolio, gold is known to enhance risk diversification effects because of its consistent low correlation with other traditional assets. Our analysis also found that the diversification effects of gold on an investment portfolio overall are the most compelling rationale for Japanese insurers to make allocations to gold investments.

Gold offers portfolio diversification benefits

20 May, 2024

“We understand that gold brings portfolio diversification benefits due to its low correlation with other assets, and if insurers are to make gold investments, this will likely be the most compelling reason to do so”

Assistant General Manager

Investment Planning Department

Life insurer

However, they are yet to invest in gold as they believe the alternative assets they already hold provide the required portfolio diversification.

“We think that effective portfolio diversification is already in place from hedge funds and REITs, hence [we] do not see the need for gold investments”

General Manager

Investment Planning Department

Life insurer

During our interviews, industry experts told us that because gold does not have cash flows, it does not align with the Asset-Liability Management (ALM) philosophy. They asserted that ALM plays a significant role in their asset management considerations, particularly for life insurers who must fulfil guaranteed crediting rates. Realistically, gold is never intended to be such an asset and its purpose is not to replace any of the assets that provide cash flows. Rather, insurers should view gold as a portfolio's tail risk hedging strategic component. Even so, as Chart 4 illustrates, the diversification merit of allocating even a small proportion of a portfolio to gold, such as 2.5%, is evident by the improvement of the insurers’ overall risk-adjusted returns. Our analysis shows that gold has consistently lowered the overall volatility portfolios: on average, the Sharpe ratio increases by 12% when 2.5% of the portfolio is composed of gold, demonstrating a unique diversification effect unparalleled by any other asset.

As for the new regulation to be implemented in 2025, although the Japan Financial Services Agency (JFSA) has yet to clarify their view on how gold will be treated, they have said that a look-through approach – a calculation based on each of the underlying assets in collective investment undertaking – would be applied in order to gain a firm grasp on any potential risk. Even under the new solvency regulation (ESR), industry experts have expressed the view that regulations will unlikely cause any material impact, even if the risk weight of gold remains comparatively high. Therefore, it seems unlikely that Japanese regulations would be a critical constraint in making gold investments. And our analysis shows that a small allocation to gold can actually help improve a hypothetical Japanese life insurer portfolio’s funding position (Chart 5).

Focus 1: Drivers of gold performance

Multiple insurers have shared their difficulties in how to ascertain the fundamental value of gold given that its price is determined by the equilibrium of market demand and supply. In addition, some insurers have concerns around the elusive time value of gold investments, as the absence of future cash flows makes it challenging to validate its present value using existing financial asset valuation tools.

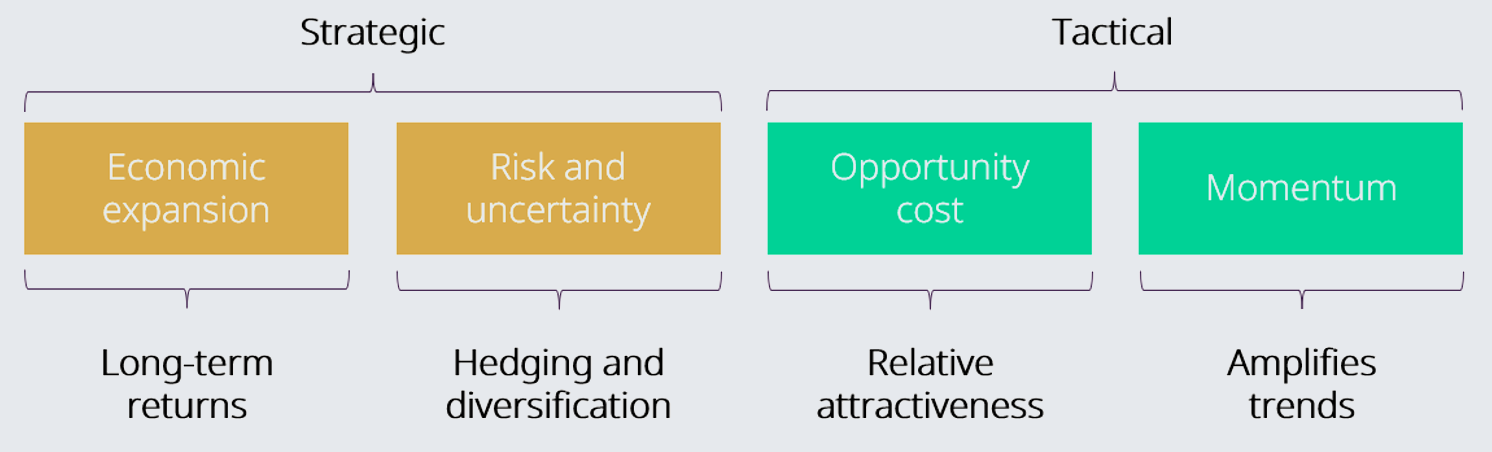

We believe that understanding gold’s valuation is one of the key steps in tackling its operational complexity. The behaviour of gold can be explained by four broad sets of drivers:

- Economic expansion: periods of growth are very supportive of jewellery, technology and long-term savings

- Risk and uncertainty: market downturns often boost investment demand for gold as a safe haven

- Opportunity cost: interest rates and relative currency strength influence investor attitudes towards gold

- Momentum: capital flows, positioning and price trends can ignite or dampen gold’s performance.

There are multiple approaches and tools to understand how gold is valued. Our Gold Value Framework (GVF) is one such tool that can assist insurers in quantifying the long-term expected return and risk of gold with historical data.

“In order to dare to invest in gold, theoretical logic is especially important when setting expected returns. Having deeper theoretical logic will make insurance companies expect the returns of gold with better confidence”

Ex-Manager

Asset Management Department

Life insurer