Highlights:

- Global and domestic gold prices extended their streak of gains; up 12% y-t-d1

- Demand softened after Akshaya Tritiya

- The discount between domestic and international gold prices narrowed

- The RBI has added 30.6t2 to reserves so far this year, taking total gold holdings to a record high of 834.2t

- Positive flows resumed into gold ETFs in May

- Gold imports have seen a consistent increase in May.

Looking ahead:

- We anticipate that jewellery demand will predominantly centre around the festival season starting in the latter half of Q3

- Interest in bars and coins is expected to continue.

Gold corrects from its recent all-time high but maintains yearly upswing

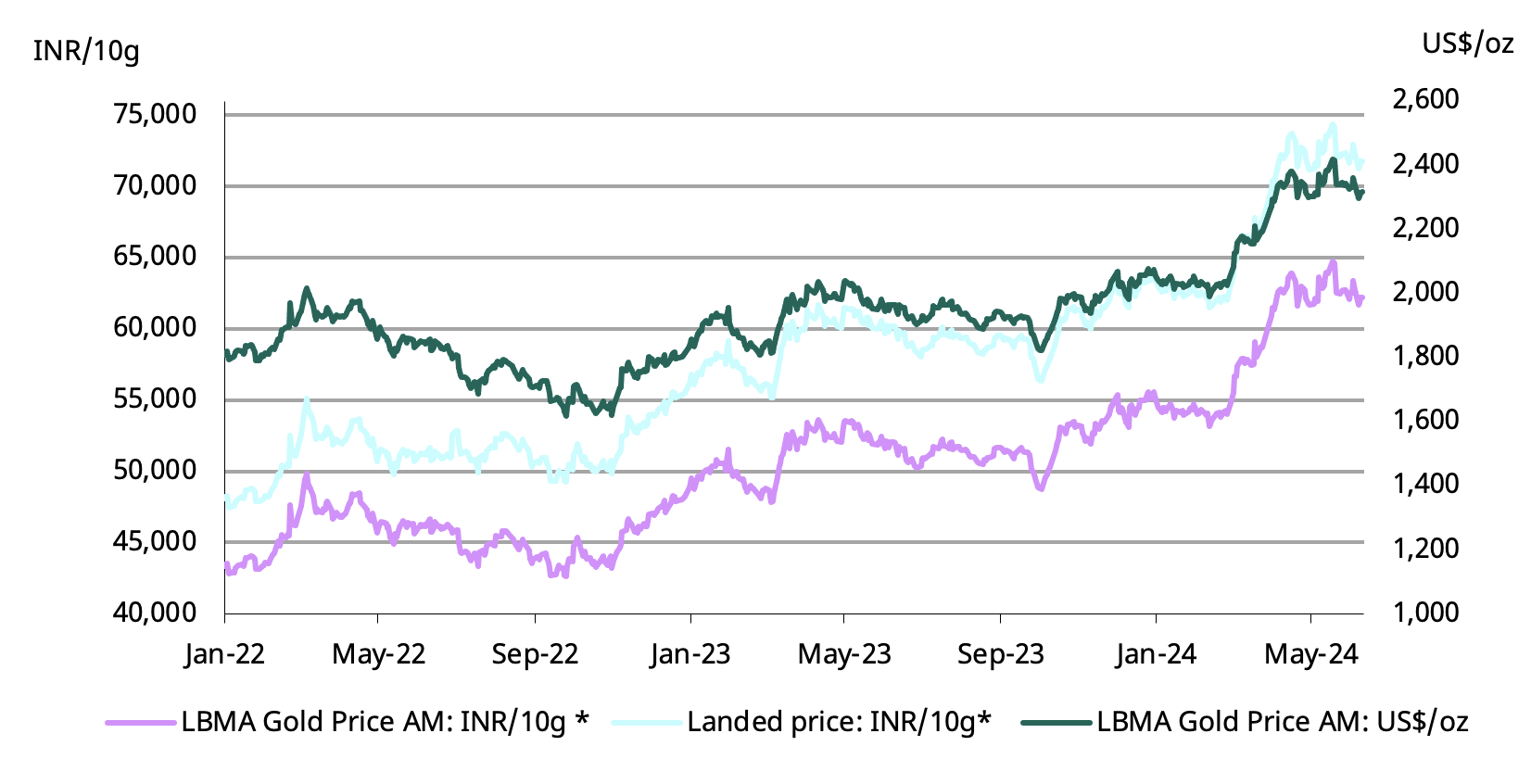

Gold rose to a new all-time high in mid-May before pulling back, likely on profit taking, to close the month at US$2,343/oz.3 This delivered a 1% monthly increase, adding to gains in March (9%) and April (5%). The international price pulled back further in the first half of June (by 1% to US$2,317/oz) following a stronger-than-expected jobs market report in the US and a pause in reported gold purchases by the People’s Bank of China (PBoC). Despite this, gold remains one of the best performing asset classes with a 12% return y-t-d. Indian domestic landed gold prices continue to closely shadow the movement of international gold prices thanks to the relative stability in the USD/INR.

Chart 1: Gold extends gains but takes a breath after recent all-time highs

LBMA Price AM and domestic landed price by month, US$ and INR*

Demand subsides as festival impact wanes

The demand momentum surrounding the Akshaya Tritiya festival (10 May), a traditional auspicious day for gold purchases, proved to be rather short-lived. Market reports suggest that while strong buying exceeded expectations during the festival, gold purchases, particularly jewellery, tapered off afterwards, reminiscent of the lacklustre demand during March and April owing to high price levels. A further price rise to a record high in mid-May also dampened demand during what is the usual low-season for gold, from mid-May to July. But there have been reports of momentum buying during this period, especially of bars and coins, driven by positive consumer sentiment towards gold as an attractive investment amid the recent price surge.

The current trend of subdued jewellery demand is expected to continue over the next few months with a potential uptick anticipated during the onset of the festival season in the latter half of Q3. Conversations with the industry suggest that manufacturers are choosing not to increase their inventories at this time but could build stock as early as August, with activity picking up steam as the quarter progresses.

But investment buying through bars and coins is likely to persist in line with the current trend: from January to March bar and coin demand rose by 19% y/y to 41t.

Modest discounts on gold rates prevail in the domestic market

The discount on the domestic gold price to international price has narrowed from those in March (US$24/oz) and April (US$10/oz) to US$6/oz as of mid-June. This decline in discount – even after Akshaya Tritiya – suggests that gold buying interest continues, in certain quarters, during what is typically a period of low demand.

Chart 2: Domestic gold price discounts reduce

NCDEX gold premium/discount relative to the international price

Indian gold ETFs attract inflows

Inflows into gold ETFs resumed in May, reversing the outflows seen in April; prior to this time there had been twelve consecutive months of uninterrupted inflows. May’s positive trend in fund flows mirrored the broader global trend for the month. Indian gold ETFs saw net inflows amounting to INR8bn,4 indicating a notable turnaround from the INR4bn outflows recorded the previous month and significantly exceeding the preceding 12-month average of INR4bn.

At the end of May total Indian ETF assets under management (AUM) stood at INR317bn (approximately US$4bn), a 37% increase y/y. In addition, collective gold holdings stood at 46t, up 1t m/m and 8t y/y. May also saw a significant uptick in the number of gold ETF folios, rising by 136,772 from the previous month to reach 5.3mn, indicating ongoing investor interest in gold as a financial asset.

Chart 3: Indian gold ETF flows gain momentum

Monthly gold ETF fund flows in INR bn and total holdings in tonnes*

RBI ramps up gold reserves

The RBI’s programme of gold purchases has been consistent so far this year. Based on RBI data and our own estimates, the central bank acquired 3.7t of gold in May and 2.8t in the first week of June,5 bringing its total gold purchases thus far in 2024 to 30.6t. Consequently, the RBI's gold holdings now stand at a new peak of 834.2t, constituting 8.7% of total forex reserves, a level last observed in April 2013.

The RBI has emerged as a significant contributor to global central bank gold purchases this year, following Turkey and China. If the trend of gold buying seen in the first five months of the year continues, the RBI’s annual gold acquisitions could be comparable with the (net) 77.5t bought in 2021. However, the next few months will provide a clearer picture of the bank’s buying trend.

Alongside building its reserves, the RBI has been restructuring the storage of gold over recent years. According to its report on foreign exchange reserves, the central bank has been bringing some of its gold previously held overseas to India.6 This move appears to be motivated by logistical as well as strategic considerations and does not have financial implications, nor does it affect the RBI’s overall gold reserves. Furthermore, the government has granted the RBI an exemption from customs duty on gold imports.7

Chart 4: RBIs gold stock swells

RBI’s monthly net purchases and reserves, tonnes*

Steady uptrend in gold imports

Notwithstanding the high price levels, May maintained the positive trend of the preceding month: gold import values were US$3.3bn, a 7% rise m/m but 10% down y/y (US$3.7bn).

In volume terms, as per our estimates, gold imports in May likely hovered around 45t, higher than the 43t of gold imported in April and notably lower than the 63t imported in May 2023 when prices were 20% lower.

Chart 5: Gold imports continue to rise

Monthly gold imports, tonnes and US$bn*

Footnotes

Based on the LBMA AM Gold Price.

As of 7 June 2024.

Based on the LBMA AM Gold Price. The all-time high (US$2,417/oz) was set by the LBMA Gold Price AM on 21 May 2024.

As per AMFI data.

As of 7 June 2024.

As of 31 March 2024, the RBI held 387.26t with the Bank of England (BoE) and Bank of International Settlements (BIS). In the financial year 2022-23 and 2023-24, 16t and 50t respectively held at BoE and BIS was brought to India.

Extraordinary notification Part II-Section 3-sub-section (i) dated 12 March 24 on https://egazette.gov.in